Smart Pneumatics Market Outlook:

Smart Pneumatics Market size was over USD 4.73 billion in 2025 and is projected to reach USD 7.85 billion by 2035, witnessing around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart pneumatics is evaluated at USD 4.95 billion.

Manufacturing companies are widely adopting energy-efficient solutions to mitigate their energy consumption rates and expenses. Smart pneumatics are emerging as effective energy-efficient solutions for such companies owing to their better control and monitoring capabilities. Smart pneumatics systems support automation processes, reduce downtime, and improve overall productivity, making them highly valuable in modern manufacturing environments where precision and efficiency is crucial.

The digital shift in the manufacturing sector is positively influencing the demand for smart pneumatics worldwide. According to the U.S. Bureau of Labor Statistics, published by the Federal Reserve Bank of St. Louis, estimates that the Producer Price Index (PPI) of the total manufacturing industries was calculated at 249.364 in 2024. The growing adoption of Industry 4.0 practices and advancements in automation are pushing the demand for smart pneumatics in the manufacturing industry. Several studies reveal that more than 60% of organizations have adopted automation for business operations.

Key Smart Pneumatics Market Insights Summary:

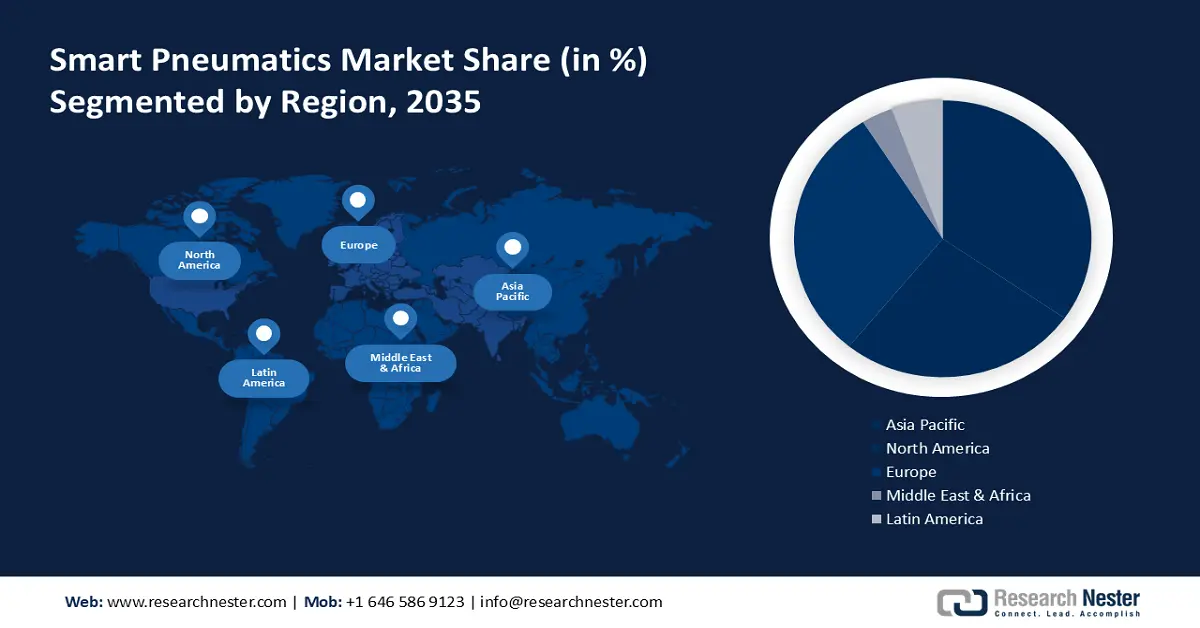

Regional Highlights:

- Asia Pacific smart pneumatics market holds the largest share by 2035, driven by rising industrial activities and vehicle ownerships.

Segment Insights:

- The smart pneumatic actuators segment in the smart pneumatics market is anticipated to experience substantial growth till 2035, driven by increasing automation focus and IoT-enabled analytics in industrial applications.

- The automotive segment in the smart pneumatics market is expected to see moderate growth till 2035, influenced by growing vehicle production and demand for smart brake and suspension systems.

Key Growth Trends:

- Deployment of next-gen sensors and control systems

- Compact pneumatic systems to exhibit increasing demand

Major Challenges:

- High costs

- Complexity and compatibility issues

Key Players: Emerson Electric Co., Festo AG & Co. KG, Parker Hannifin Corporation, SMC Corporation, Norgren (IMI Precision Engineering), Bimba Manufacturing (IMI plc), Aventics GmbH (Emerson), Rotork plc, Camozzi Automation S.p.A., Metal Work Pneumatic.

Global Smart Pneumatics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.73 billion

- 2026 Market Size: USD 4.95 billion

- Projected Market Size: USD 7.85 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, China, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Smart Pneumatics Market Growth Drivers and Challenges:

Growth Drivers

-

Deployment of next-gen sensors and control systems: The integration of smart sensors and control systems is driving greater precision, flexibility, and efficiency in pneumatic systems. Modern pneumatic systems are enabled with high-accuracy pressure sensors that continuously monitor air pressure within the systems. Smart pneumatic systems are expected to exhibit increasing adoption in several end use organizations, including automotive, manufacturing, and food & beverages in the coming years, owing to their real-time monitoring, accurate feedback, and adaptive control.

- Compact pneumatic systems to exhibit increasing demand: The miniaturization trend is driving the demand for compact pneumatic systems where space is premium such as in assembly lines and robotics for precise movements in confined spaces. Aerospace and electronics are prime end use industries, which are driving the demand for compact pneumatic technologies. Companies manufacturing compact pneumatic systems are set to gain a competitive edge in the coming years as end users seek next-gen solutions that can offer high performance in limited space.

Challenges

-

High costs: Smart pneumatics are manufactured using advanced technologies and components, which increases their overall costs compared to conventional pneumatics. This factor can act as a major obstacle to their adoption particularly in small-scale or budget-constraint organizations.

- Complexity and compatibility issues: The integration of smart pneumatics into existing systems can be a complex process and may lead to the need for expert technicians. The seamless communication between smart components and legacy systems requires core planning and execution or else the complexity can create resistance to adoption. Overall, the installation of smart pneumatic technologies is a complex and expensive process for businesses running on tight budgets.

Smart Pneumatics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 4.73 billion |

|

Forecast Year Market Size (2035) |

USD 7.85 billion |

|

Regional Scope |

|

Smart Pneumatics Market Segmentation:

Type Segment Analysis

Smart pneumatic actuator segment in the smart pneumatics market is poised to grow at over substantial CAGR between 2026 and 2035, owing to their reliability and efficiency characteristics. The end use industries’ increasing focus on automation and Industry 4.0 manufacturing practices is driving the demand for advanced smart pneumatic actuators. Smart pneumatic actuators can be easily integrated with the Internet of Things (IoT) systems, and the data provided by them can be used for analytics and optimization of manufacturing processes. For instance, in January 2021, Curtiss-Wright Corporation launched a new motor support program for Exlar universal actuators. The Exlar FTP and FTX series actuators are finding automation applications in serval industries.

End use Segment Analysis

In smart pneumatics market, automotive segment is set to witness moderate growth rate between 2026 and 2035. since vehicle production worldwide is increasing rapidly. According to the International Organization of Motor Vehicle Manufacturers (OICA), production statistics state 93.5 million of total vehicle production in 2023. Smart pneumatic technologies offer enhanced control and efficiency in various automotive applications including brake and suspension systems. This also results in fuel efficiency and reduced carbon emissions, driving the sales of eco-friendly vehicles.

Our in-depth analysis of the global smart pneumatics market includes the following segments:

|

Component |

|

|

Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Pneumatics Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share by 2035, rising industrial activities, and hike in vehicle ownerships in the region. India, China, Japan, and South Korea are lucrative marketplaces for smart pneumatic system manufacturers. Industries such as food & beverages, chemical, automotive, and agriculture are widely deploying advanced technologies including smart pneumatics to boost their operational efficiency.

Sales of smart pneumatics in China are forecasted to evolve at a CAGR of 3.3% through 2035. China is one of the largest consumers of crude oil across the world owing to the presence of numerous manufacturing plants. For instance, the crude oil production in China reached 4.2 million barrels per day, in 2023. The oil and gas industry operates in hazardous environments where safety is paramount, smart pneumatics aids in monitoring and controlling safety to ensure operational safety in such fields.

In India, supportive government policies are expected to aid various industries in expanding their operational activities. SAMARTH Udyog Bharat 4.0 initiative by the Government of India is set to enhance competitiveness in the capital goods sector. The rising industrial activities in the country are anticipated to directly push the sales of smart pneumatics.

North America Market Insights

North America smart pneumatics market is estimated to offer high-growth opportunities for smart pneumatic manufacturers in the coming years owing to the growing adoption of modern technologies by several businesses. Grants and subsidies offered by respective governments in the region for technological upgrades are encouraging end use companies to invest in advanced pneumatic systems.

The U.S. market is forecasted to expand at a CAGR of 1.5% through 2035. Technological advancements in sensor technology, data analytics, and control systems are driving the demand for smart pneumatics in the country. The expanding automotive sector in Canada is expected to fuel the sales of smart pneumatics in the coming years.

Smart Pneumatics Market Players:

- Parker Hannifin Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Emerson Electric Co.

- Bosch Rexroth

- Chicago Pneumatic

- Rotork

- Festo AG and Co.KG

- Thomson Industries

- Metso

- Bimba Manufacturing Co.

- Cypress EnviroSystems Corp

- Ningbo Smart Pneumatic Co. Ltd

- Stanley Black & Decker, Inc.

- Advanced Pneumatics

- Basso Industry Corp.

- Gardner Denver

- Ham-Let Group

- Hitachi Koki

- Ingersoll Rand Inc.

- Jiffy Air Tool

- Kramer Air Tools Inc.

Key players in the smart pneumatics market are employing several organic and inorganic strategies to earn more. Industry giants are focused on the production of advanced pneumatic systems and for that, they are investing heavily in research and development activities. Strategic collaborations and partnerships with other players and technology companies are also expanding their product folio and market reach.

Some of the key players include:

Recent Developments

- In September 2023, Toyota Material Handling announced the launch of a new line of electric pneumatic forklifts. Pneumatic forklifts with 48V and 80V models are durable and can work in various weather conditions.

- In May 2022, researchers from the Massachusetts Institute of Technology created an innovative design and fabrication tool for soft pneumatic actuators. This technique is estimated to be cost-effective in pneumatic actuator manufacturing.

- In October 2021, Emerson launched a pneumatic valve system with integrated wireless connectivity. This pneumatic valve system is finding applications in sectors such as automotive, food & beverage, packaging, and metal processing.

- Report ID: 6442

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Pneumatics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.