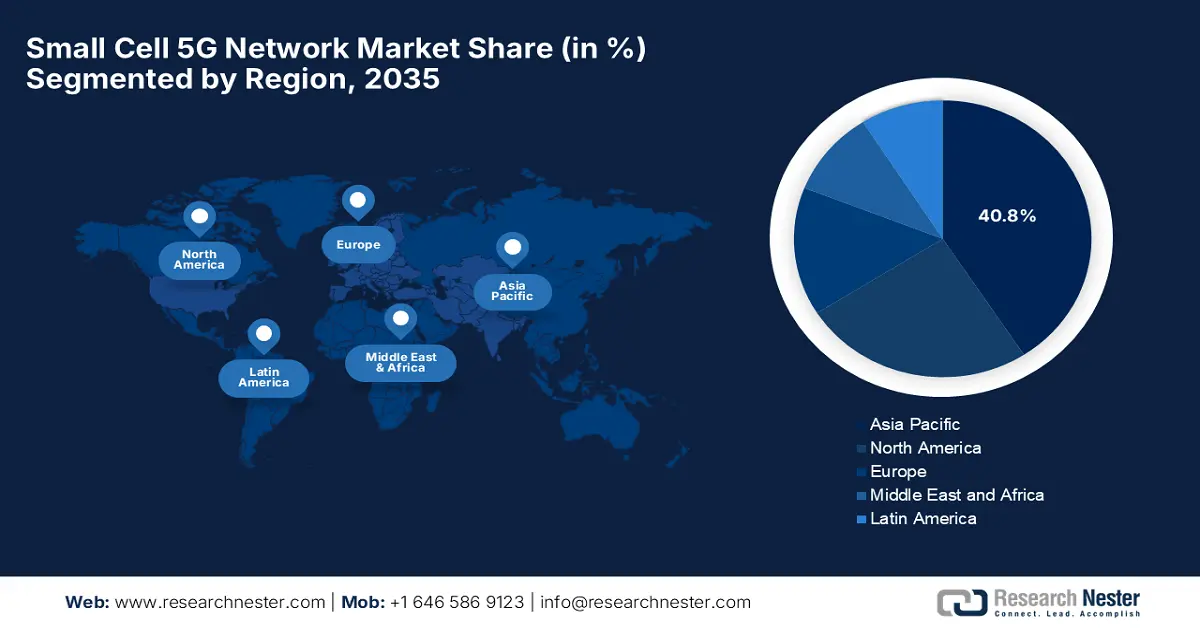

Small Cell 5G Network Market - Regional Analysis

APAC Market Insights

Asia Pacific is predicted to dominate the global small cell 5G network market with a share of 40.8% by the end of the forecast period. The small cell rollouts and strong government backing are the key factors fueling the region’s leadership in this field. In this regard, SoftBank, Ericsson, and Qualcomm Technologies in December 2025 reported that they conducted a field trial of 5G and 5G advanced technologies, which include L4S, on SoftBank’s 5G standalone commercial network in Tokyo. This trial focused on low-latency XR content streaming on smart glasses, achieving approximately 90% reduction in wireless link latency and stable, continuous communication. The collaboration demonstrated the effectiveness of network slicing, configured uplink grants, and rate-controlled scheduling to optimize high-performance 5G services for real-time applications, hence positively impacting market growth.

China is augmenting its leadership in the global leader in the market, which is leading in terms of small cell 5G deployments, owing to the presence of suitable government policies and an emerging telecom landscape. The country is also focused on integrating small cells with existing macro networks, with a prime focus on uninterrupted high-speed coverage in urban centers. In September 2025, Huawei announced that it was named the sole leader in the global data’s small cell data: competitive landscape assessment, which is excelling in both outdoor, residential, and enterprise small cell solutions. Its LampSite, Easy Macro, and BookRRU products are offering high integration, multi-band support, and scalability, setting industry benchmarks. Furthermore, as operators focusing on indoor coverage and mobile AI services, Huawei’s small cell innovations are driving China’s 5G-A network expansion and ecosystem growth, hence contributing to overall market growth.

India is considered to be one of the most prominent players in the small cell 5G network market, which is efficiently shaped by the need to overcome infrastructure challenges in densely populated regions. Operators in the country are experimenting with innovative deployment models to provide reliable connectivity in congested cities. In 2022, Sanmina and Reliance Jio announced that they formed a joint venture in the country to manufacture high-tech infrastructure hardware, which includes 5G equipment, under the Make in India initiative. The firm also mentioned that this venture leverages Sanmina’s global manufacturing expertise and Reliance’s local market leadership to expand domestic production and support both national as well as international demand. Furthermore, this collaboration strengthens India’s 5G ecosystem by enabling the local supply of small cell and telecom hardware for urban and enterprise network deployments.

North America Market Insights

North America is identified to be the central player in the market, which is primarily fueled by the high density of urban areas and heightened demand for ultra-fast connectivity. Telecom operators in this region are focused mainly on deploying small cells to enhance network coverage and capacity in congested cities. Simultaneously, strategic collaborations between infrastructure providers and mobile network operators are efficiently driving innovation in network planning, wherein the regulatory bodies are easing the process of spectrum allocation to facilitate 5G rollout. Moreover, the rising investments in edge computing and AI-enabled network optimization to improve user experience are also bolstering market progression over the years ahead. Furthermore, North America’s leading role in technological innovation is attracting global partnerships, accelerating 5G commercialization, and small cell adoption.

The U.S. is solidifying its position over the regional small cell 5G network market, propelled by private-sector investments and government incentives, which are aimed at modernizing telecommunications infrastructure. Market players in the country are strongly emphasizing advanced technologies such as massive MIMO and edge computing to optimize network performance. In June 2024, Verizon announced that it had deployed 20 new small cells and upgraded capacity at multiple existing sites, enhancing network performance for residents, tourists, and businesses, thereby expanding 5G coverage in Myrtle Beach and Hilton Head, SC. The firm also notes that these upgrades support high-demand applications, which include mobile usage, remote work, 5G home internet, and ultra-fast wireless business connectivity. Furthermore, this deployment highlights the role of small cells in densifying networks, improving coverage, and enabling advanced services in urban and resort areas of the U.S.

National Statistics on Small Cell and 5G Infrastructure Expansion

|

Statistic (U.S.) |

Value (Year) |

Description |

|

Small cells and DAS in service |

156,787 units (end-2023) |

Small cells + DAS are being reported across the U.S. to fill coverage gaps and densify networks |

|

Increase from 2022 |

142,057 - 156,787 |

Growth in small cell and DAS deployments year-on-year in the U.S |

|

Outdoor small cells (estimate) |

202,100 units (end-2023) |

An estimated outdoor small cell count supporting over 466,850 small cell nodes |

Source: FCC

Canada is witnessing increased adoption of small cell 5G technology, which in turn is influenced by its vast geography and the need to improve rural and suburban connectivity. Network operators are deploying small cells to bridge coverage gaps and provide seamless service to underserved regions, benefiting the country’s market growth. In June 2025, Ericsson announced that it had launched the Ottawa-developed indoor fusion 8828 5G solution, which is a compact indoor small cell system especially designed to enhance 5G coverage for small and medium-sized businesses such as retail stores, cafes, and cinemas. Bell Canada is the first operator to implement this technology, which improves network reliability, speed, and enterprise connectivity across indoor locations. In addition, this deployment highlights the growing adoption of localized small cell solutions in the country to support advanced 5G services and digital transformation for businesses.

Europe Market Insights

Emphasis on sustainable and energy-efficient small cell 5G networks to align with environmental targets is the key factor positioning Europe as the predominant leader in the small cell 5G network market. Growth in this region is also driven by the integration of small cells into urban planning initiatives and public infrastructure projects. Prominent countries are collaborating on standardized deployment frameworks to accelerate adoption in this field. In this regard European Commission in December 2025 stated that as of 2023, Europe had installed 44,180 small cells, with 5G small cells reaching 6,205 units, which marks an 850% increase when compared to 2022. This rapid deployment highlights the growing role of small cells in urban areas to improve 5G capacity, reduce latency, and enhance spectrum efficiency. Furthermore, it also states that despite this growth, the region still lags behind other regions in terms of high-quality 5G network densification and performance, encouraging players to invest in innovative small cell solutions.

Germany has a strong scope to capitalize on the regional small cell 5G network market due to the rising deployment of small cells in industrial zones to support Industry 4.0 initiatives. The country is also prioritizing the use of small cells to enhance connectivity for automation, smart manufacturing, and logistics networks. In this regard, Boldyn Networks in December 2025 announced the expansion of its presence in Germany through the integration of Munich-based smart mobile labs, in turn allowing the company to support high-profile private 5G network deployments for organizations such as Deutsche Bahn AG, the University of Kaiserslautern, and SWR. Moreover, the company now operates more than 60 private 5G network sites in the country, offering its private 5G as a service to simplify deployment and management for industrial as well as mission-critical environments. Hence, this milestone positions Boldyn as a key player in Germany’s private network sector, thereby supporting digital transformation across various sectors.

In the U.K., the small cell 5G network market is primarily driven by the urban redevelopment projects and smart city programs. Simultaneously, the regulatory support for street furniture and public infrastructure installations is also easing the deployment process and promoting innovation in network architecture. In November 2024, Virgin Media O2 reported that it had become the first operator in the country to deploy 5G standalone small cells, starting in Birmingham city centre, thereby enhancing mobile capacity in high-traffic areas. It also stated that the compact cells, which were installed on existing street furniture, deliver faster speeds, lower latency, and improved connectivity for customers across more than 300 towns and cities. In addition to this rollout, using MIMO technology is part of Virgin Media O2’s ongoing network upgrade strategy to meet rising data demand and provide reliable, high-performance 5G service, hence indicating a positive market outlook.