Small Cell 5G Network Market Outlook:

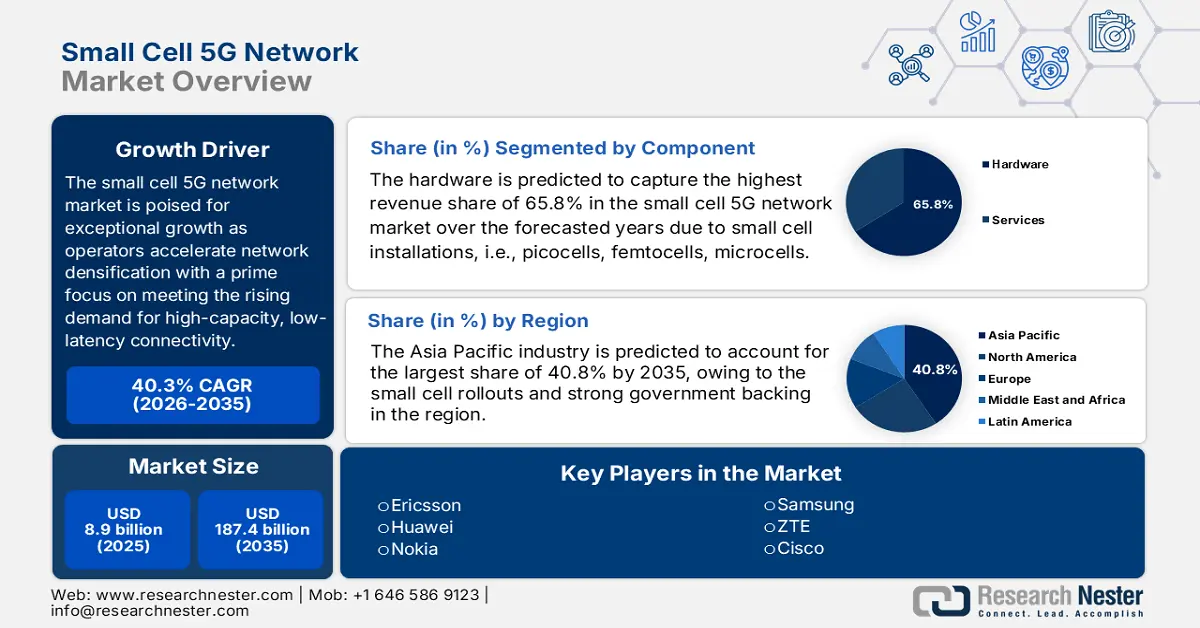

Small Cell 5G Network Market size was valued at USD 8.9 billion in 2025 and is projected to reach USD 187.4 billion by the end of 2035, rising at a CAGR of 40.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of small cell 5G network is assessed at USD 12.4 billion.

The market is poised for exceptional growth as operators accelerate network densification with a prime focus on meeting the rising demand for high-capacity, low-latency connectivity. Simultaneously, 5G adoption has been expanding across consumer, enterprise, and industrial segments, and small cells have become highly essential for addressing coverage gaps, particularly in terms of indoors and in dense urban environments. As per the November 2023 reports, the 5G fund for rural America allocates around USD 9 billion over a span of ten years from the universal service fund to expand 5G coverage in underserved areas. In addition, policymakers are considering increasing funding and supporting emerging technologies such as open RAN to broaden vendor participation and lower deployment costs, hence presenting a positive small cell 5G network market outlook.

Furthermore, significant funding grants from governments and private entities also present encouraging opportunities for new entrants and software-centric solutions, thereby expanding competitive dynamics in the market. In this context Ministry of Communications in March 2025 revealed that the Government of India has taken notable steps to boost 5G connectivity, especially in remote and underserved areas, through initiatives that were funded by the Digital Bharat Nidhi. It also highlighted the key measures, which include spectrum auctions, AGR and financial reforms, SACFA clearance simplification, RoW streamlining, and time-bound permissions for small cell installations. Moreover, since October 2022, 4.69 lakh 5G BTSs have been deployed across the nation, wherein 2.95 lakh were added in 2023-24, covering 99.6% of districts. Hence, these efforts create strong growth potential for small cell 5G networks, facilitating faster deployments as well as improved coverage.

Key Small Cell 5G Network Market Insights Summary:

Regional Insights:

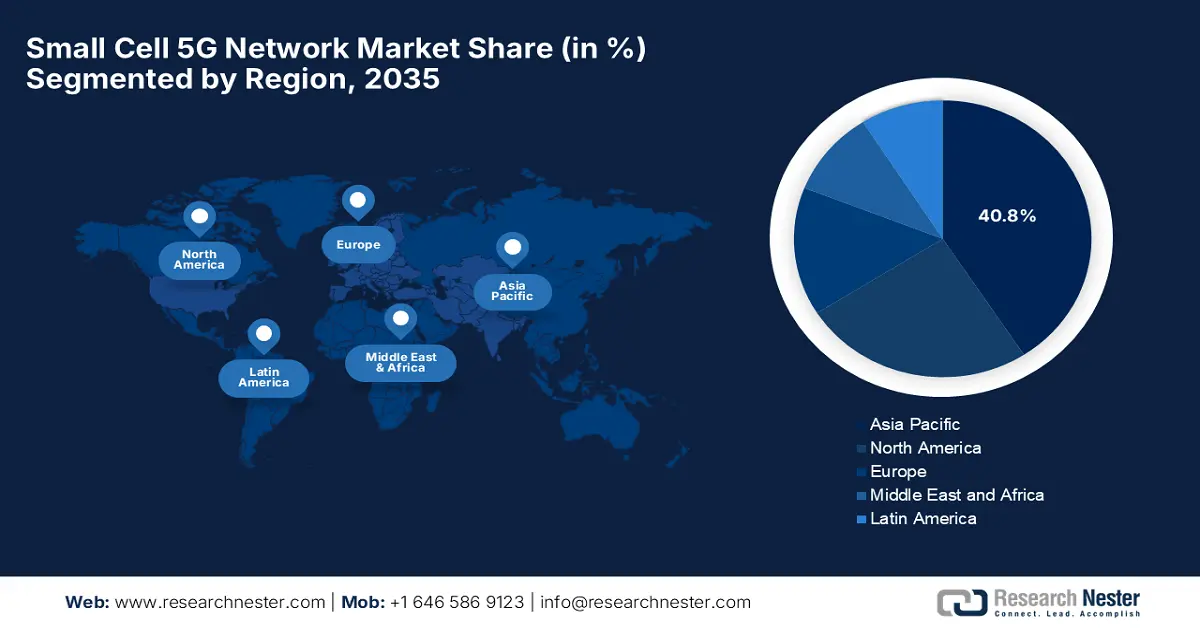

- Asia Pacific is projected to command a 40.8% share by 2035 in the small cell 5g network market, supported by accelerated small cell rollouts and strong government backing.

- North America is expected to remain a central contributor through 2035, strengthened by dense urban deployments and rising demand for ultra-fast connectivity.

Segment Insights:

- The hardware segment is estimated to secure a 65.8% revenue share by 2035 in the small cell 5g network market, underpinned by the essential role of picocells, femtocells, and microcells in densifying urban and enterprise 5G coverage.

- The non-standalone segment is set to expand at a notable pace during 2026–2035, favored for its cost-effective integration with existing legacy network infrastructure.

Key Growth Trends:

- Expansion and adoption of 5G networks

- Surge in mobile data traffic & smartphone use

Major Challenges:

- Site acquisition & permitting

- Power & backhaul

Key Players: Huawei (China), Nokia (Finland), Samsung (South Korea), ZTE (China), Cisco (U.S.), NEC (Japan), CommScope (U.S.), Airspan Networks (U.S.), ip.access (United Kingdom), Corning (U.S.), Fujitsu (Japan), Comba Telecom (Hong Kong), Contela (South Korea), Baicells Technologies (U.S.).

Global Small Cell 5G Network Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.9 billion

- 2026 Market Size: USD 12.4 billion

- Projected Market Size: USD 187.4 billion by 2035

- Growth Forecasts: 40.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 2 January, 2026

Small Cell 5G Network Market - Growth Drivers and Challenges

Growth Drivers

- Expansion and adoption of 5G networks: The worldwide deployment of 5G infrastructure is the most important driving factor for the upliftment of the

small cell 5G networkmarket. Operators across the globe have rolled out 5G services to meet demand for faster connectivity and enhanced mobile broadband, in which small cells become essential to extend coverage. In April 2025, GCI Communication Corp has partnered with Ericsson to deploy and operate a new dual-mode 5G Core network across Alaska that supports the transition from 5G non-standalone to standalone services. Ericsson also mentioned that it will manage GCI’s existing 3G, 4G, and 5G core networks through its intelligent operations center, by leveraging AI and predictive operations to enhance network efficiency and customer experience. In addition, the partnership also establishes a framework to accelerate the deployment of future core functionalities by allowing GCI to focus on strategic initiatives. - Surge in mobile data traffic & smartphone use: The exponential increase in mobile data usage due to a rise in video streaming, cloud services, social media, and other bandwidth-intensive applications is pushing network operators to densify networks. In this context, the Telecom Regulatory Authority of India in July 2025 stated that the 5G data traffic is increasing substantially, for which 5G is contributing a growing share of total wireless data usage as its subscriber base expands and usage shifts toward high‑data applications. Further, it documented that overall, out of 1,200.80 million of total telephone subscribers, the wireless (Mobile+5G FWA) telephone subscribers are 1,163.76 million, reflecting greater consumer demand on next-generation networks, hence pressuring networks to densify with small cells, contributing to the small cell 5G network market expansion.

- Cybersecurity standards: This is the fundamental growth driver for the expansion of the small cell 5G network market. Cybersecurity is now a core requirement for telecom infrastructure, wherein specialized 5G security guidance helps operators structure risk-based defenses, reducing cyber risk and building trust in small cell deployments. In August 2024, NIST reported that its National Cybersecurity Center of Excellence (NCCoE) has launched the applying 5G cybersecurity and privacy capabilities white paper series to guide technology, cybersecurity, and privacy managers in assessing and mitigating risks in 5G networks. It also stated that the series provides recommended practices, implementation guidance, and research findings, all tested on commercial-grade 5G equipment. Furthermore, the first papers focus on introducing the series and protecting subscriber identifiers with a subscription concealed identifier, thereby offering enhanced security and privacy for 5G users, hence increasing adoption in this field.

Challenges

- Site acquisition & permitting: This is the major bottleneck hindering the expansion of the market over the years ahead. The operators in this field need to secure approvals for poles, street furniture, rooftops, and other urban assets, which involves navigating complex municipal regulations, zoning laws, and aesthetic requirements. Simultaneously, negotiations with multiple stakeholders, which include city authorities, property owners, and utility companies, are slowing down progress in this sector. This delays in permitting increase project timelines and costs, especially in terms of dense urban areas where high site density is required. Furthermore, the aspect of inconsistent regulatory processes across regions makes network planning challenging for operators who are aiming to meet 5G coverage and capacity targets.

- Power & backhaul: Ensuring reliable power and low-latency backhaul is essential, but at the same time, it is challenging for small cell 5G networks. Most of the sites, such as streetlights or urban furniture, were not designed to support power-intensive electronics, complicating installations and thereby limiting adoption in the small cell 5G network market. In addition to backhaul connectivity, whether fiber or microwave, it must deliver ultra-low latency to support 5G performance, but dense urban areas can make routing and deployment even more difficult. Infrastructure limitations, access permissions, and environmental constraints further complicate network integration, whereas without consistent power and high-capacity backhaul, small cells cannot deliver the promised coverage, throughput, or reliability.

Small Cell 5G Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

40.3% |

|

Base Year Market Size (2025) |

USD 8.9 billion |

|

Forecast Year Market Size (2035) |

USD 187.4 billion |

|

Regional Scope |

|

Small Cell 5G Network Market Segmentation:

Component Segment Analysis

The hardware is predicted to capture the highest revenue share of 65.8% in the small cell 5G network market over the forecasted years. The segment’s dominance is mainly due to small cell installations, i.e., picocells, femtocells, microcells, that are fundamental physical infrastructure required for densifying 5G coverage in urban and enterprise locations. In January 2025, Verizon Business announced that it had been selected by the U.S. Air Force to deploy 5G and 4G LTE network enhancements across 35 Air Force bases in the U.S. These upgrades include small cells, new macro builds, and C-Band carrier additions to improve network speed, bandwidth, and latency for personnel and surrounding communities. This deployment is part of Verizon’s ongoing involvement in the Air Force’s Offer to Lease program, expanding 5G coverage, hence denoting a wider segment scope.

Network Model Segment Analysis

In the small cell 5G network market, the non-standalone is anticipated to grow at a considerable rate over the discussed timeframe, owing to the early rollouts across all nations. This is also deployed along with the existing legacy network infrastructure, benefiting from its cost-effectiveness. In this regard, Nokia and Bharti Airtel in July 2024 announced that they successfully completed India’s first 5G non-standalone cloud RAN trial, which marks a key milestone in Airtel’s network evolution. The trial utilized 3.5 GHz for 5G and 2100 MHz for 4G, performing data calls with commercial devices over Airtel’s live network and achieving throughput exceeding 1.2 Gbps. Also, Nokia’s cloud RAN solution leveraged virtualized, distributed, and centralized units on x86 hardware with L1 acceleration, enabling efficient power usage and performance across a hybrid RAN environment. Hence, this trial demonstrates the benefits of scalable, agile, and automated network deployment, supporting Airtel’s goal of delivering high-quality, future-ready 5G services.

Deployment Mode Segment Analysis

By the end of 2035, the indoor sub-segment based on deployment mode is anticipated to grow at a considerable rate and showcase lucrative growth opportunities in the market. The growth of the subtype is efficiently propelled by the demand for consistent indoor 5G coverage in offices, malls, airports, and homes. These indoor small cells help fill coverage holes where macro cells are comparatively less effective. In addition, this expansion is positively influenced by the rising adoption of smart buildings, IoT devices, and enterprise applications that require reliable high-speed connectivity. Indoor small cells also enable low-latency services and high-capacity networks in dense urban environments. Moreover, enterprises and public venues are making continued investments in indoor 5G infrastructure to support digital transformation initiatives, which in turn results, vendors focusing on energy-efficient small cell solutions to meet this growing indoor demand.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Network Model |

|

|

Deployment Mode |

|

|

Network Architecture |

|

|

Frequency Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Small Cell 5G Network Market - Regional Analysis

APAC Market Insights

Asia Pacific is predicted to dominate the global small cell 5G network market with a share of 40.8% by the end of the forecast period. The small cell rollouts and strong government backing are the key factors fueling the region’s leadership in this field. In this regard, SoftBank, Ericsson, and Qualcomm Technologies in December 2025 reported that they conducted a field trial of 5G and 5G advanced technologies, which include L4S, on SoftBank’s 5G standalone commercial network in Tokyo. This trial focused on low-latency XR content streaming on smart glasses, achieving approximately 90% reduction in wireless link latency and stable, continuous communication. The collaboration demonstrated the effectiveness of network slicing, configured uplink grants, and rate-controlled scheduling to optimize high-performance 5G services for real-time applications, hence positively impacting market growth.

China is augmenting its leadership in the global leader in the market, which is leading in terms of small cell 5G deployments, owing to the presence of suitable government policies and an emerging telecom landscape. The country is also focused on integrating small cells with existing macro networks, with a prime focus on uninterrupted high-speed coverage in urban centers. In September 2025, Huawei announced that it was named the sole leader in the global data’s small cell data: competitive landscape assessment, which is excelling in both outdoor, residential, and enterprise small cell solutions. Its LampSite, Easy Macro, and BookRRU products are offering high integration, multi-band support, and scalability, setting industry benchmarks. Furthermore, as operators focusing on indoor coverage and mobile AI services, Huawei’s small cell innovations are driving China’s 5G-A network expansion and ecosystem growth, hence contributing to overall market growth.

India is considered to be one of the most prominent players in the small cell 5G network market, which is efficiently shaped by the need to overcome infrastructure challenges in densely populated regions. Operators in the country are experimenting with innovative deployment models to provide reliable connectivity in congested cities. In 2022, Sanmina and Reliance Jio announced that they formed a joint venture in the country to manufacture high-tech infrastructure hardware, which includes 5G equipment, under the Make in India initiative. The firm also mentioned that this venture leverages Sanmina’s global manufacturing expertise and Reliance’s local market leadership to expand domestic production and support both national as well as international demand. Furthermore, this collaboration strengthens India’s 5G ecosystem by enabling the local supply of small cell and telecom hardware for urban and enterprise network deployments.

North America Market Insights

North America is identified to be the central player in the market, which is primarily fueled by the high density of urban areas and heightened demand for ultra-fast connectivity. Telecom operators in this region are focused mainly on deploying small cells to enhance network coverage and capacity in congested cities. Simultaneously, strategic collaborations between infrastructure providers and mobile network operators are efficiently driving innovation in network planning, wherein the regulatory bodies are easing the process of spectrum allocation to facilitate 5G rollout. Moreover, the rising investments in edge computing and AI-enabled network optimization to improve user experience are also bolstering market progression over the years ahead. Furthermore, North America’s leading role in technological innovation is attracting global partnerships, accelerating 5G commercialization, and small cell adoption.

The U.S. is solidifying its position over the regional small cell 5G network market, propelled by private-sector investments and government incentives, which are aimed at modernizing telecommunications infrastructure. Market players in the country are strongly emphasizing advanced technologies such as massive MIMO and edge computing to optimize network performance. In June 2024, Verizon announced that it had deployed 20 new small cells and upgraded capacity at multiple existing sites, enhancing network performance for residents, tourists, and businesses, thereby expanding 5G coverage in Myrtle Beach and Hilton Head, SC. The firm also notes that these upgrades support high-demand applications, which include mobile usage, remote work, 5G home internet, and ultra-fast wireless business connectivity. Furthermore, this deployment highlights the role of small cells in densifying networks, improving coverage, and enabling advanced services in urban and resort areas of the U.S.

National Statistics on Small Cell and 5G Infrastructure Expansion

|

Statistic (U.S.) |

Value (Year) |

Description |

|

Small cells and DAS in service |

156,787 units (end-2023) |

Small cells + DAS are being reported across the U.S. to fill coverage gaps and densify networks |

|

Increase from 2022 |

142,057 - 156,787 |

Growth in small cell and DAS deployments year-on-year in the U.S |

|

Outdoor small cells (estimate) |

202,100 units (end-2023) |

An estimated outdoor small cell count supporting over 466,850 small cell nodes |

Source: FCC

Canada is witnessing increased adoption of small cell 5G technology, which in turn is influenced by its vast geography and the need to improve rural and suburban connectivity. Network operators are deploying small cells to bridge coverage gaps and provide seamless service to underserved regions, benefiting the country’s market growth. In June 2025, Ericsson announced that it had launched the Ottawa-developed indoor fusion 8828 5G solution, which is a compact indoor small cell system especially designed to enhance 5G coverage for small and medium-sized businesses such as retail stores, cafes, and cinemas. Bell Canada is the first operator to implement this technology, which improves network reliability, speed, and enterprise connectivity across indoor locations. In addition, this deployment highlights the growing adoption of localized small cell solutions in the country to support advanced 5G services and digital transformation for businesses.

Europe Market Insights

Emphasis on sustainable and energy-efficient small cell 5G networks to align with environmental targets is the key factor positioning Europe as the predominant leader in the small cell 5G network market. Growth in this region is also driven by the integration of small cells into urban planning initiatives and public infrastructure projects. Prominent countries are collaborating on standardized deployment frameworks to accelerate adoption in this field. In this regard European Commission in December 2025 stated that as of 2023, Europe had installed 44,180 small cells, with 5G small cells reaching 6,205 units, which marks an 850% increase when compared to 2022. This rapid deployment highlights the growing role of small cells in urban areas to improve 5G capacity, reduce latency, and enhance spectrum efficiency. Furthermore, it also states that despite this growth, the region still lags behind other regions in terms of high-quality 5G network densification and performance, encouraging players to invest in innovative small cell solutions.

Germany has a strong scope to capitalize on the regional small cell 5G network market due to the rising deployment of small cells in industrial zones to support Industry 4.0 initiatives. The country is also prioritizing the use of small cells to enhance connectivity for automation, smart manufacturing, and logistics networks. In this regard, Boldyn Networks in December 2025 announced the expansion of its presence in Germany through the integration of Munich-based smart mobile labs, in turn allowing the company to support high-profile private 5G network deployments for organizations such as Deutsche Bahn AG, the University of Kaiserslautern, and SWR. Moreover, the company now operates more than 60 private 5G network sites in the country, offering its private 5G as a service to simplify deployment and management for industrial as well as mission-critical environments. Hence, this milestone positions Boldyn as a key player in Germany’s private network sector, thereby supporting digital transformation across various sectors.

In the U.K., the small cell 5G network market is primarily driven by the urban redevelopment projects and smart city programs. Simultaneously, the regulatory support for street furniture and public infrastructure installations is also easing the deployment process and promoting innovation in network architecture. In November 2024, Virgin Media O2 reported that it had become the first operator in the country to deploy 5G standalone small cells, starting in Birmingham city centre, thereby enhancing mobile capacity in high-traffic areas. It also stated that the compact cells, which were installed on existing street furniture, deliver faster speeds, lower latency, and improved connectivity for customers across more than 300 towns and cities. In addition to this rollout, using MIMO technology is part of Virgin Media O2’s ongoing network upgrade strategy to meet rising data demand and provide reliable, high-performance 5G service, hence indicating a positive market outlook.

Key Small Cell 5G Network Market Players:

- Ericsson (Sweden)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huawei (China)

- Nokia (Finland)

- Samsung (South Korea)

- ZTE (China)

- Cisco (U.S.)

- NEC (Japan)

- CommScope (U.S.)

- Airspan Networks (U.S.)

- ip.access (United Kingdom)

- Corning (U.S.)

- Fujitsu (Japan)

- Comba Telecom (Hong Kong)

- Contela (South Korea)

- Baicells Technologies (U.S.)

- Ericsson is a leader in telecommunications infrastructure, which is specializing in 5G small cell solutions such as the radio dot system for indoor coverage and DAS, DRS deployments. The firm is focused mainly on energy-efficient, scalable, and AI-enabled solutions, targeting both enterprise and neutral host networks. In addition, Ericsson also leverages strong R&D, operator partnerships, and an international footprint that enables it to maintain leadership in 5G densification projects across urban and industrial environments.

- Huawei is the dominant player in global 5G infrastructure, which is offering a small cell portfolio for indoor and outdoor deployment. The company’s products combine massive MIMO, cloud RAN, and intelligent management systems with a prime focus on improving coverage, capacity, and energy efficiency. Furthermore, Huawei makes investments in R&D and collaborates with operators worldwide to implement both public and private 5G networks.

- Nokia provides 5G small cells, which include the AirScale radio access and small cell solutions, focusing on indoor coverage, urban densification, and enterprise networks. The company integrates AI-based network management and Cloud RAN to enhance efficiency, reliability, and scalability. In addition, Nokia’s strategic initiatives revolve around partnerships with major operators, energy-efficient technologies, and support for multi-band and multi-technology networks.

- Samsung is one of the most popular brand names in this field, which is providing end-to-end 5G small cell solutions, including compact indoor units, massive MIMO radios, and integrated network management platforms. The company is focused on flexible deployment, low-latency performance, and AI-assisted optimization, targeting enterprise, metro, and campus networks. Samsung is also concentrating on continued innovations and energy-efficient designs, which is positioning it as a strong contender in competitive small cell deployments across both urban and industrial environments.

- ZTE is yet another central player in this market, which offers a wide range of small cell solutions for 5G, especially designed to provide enhanced coverage, capacity, and energy efficiency. Besides, the company integrates advanced RAN and massive MIMO technologies with AI-based network management tools to optimize performance. In addition, ZTE’s strategic initiatives include global operator collaborations, cost-effective deployment models, and support for private and neutral host networks.

Below is the list of some prominent players operating in the global market:

The small cell 5G network market hosts both large telecom infrastructure giants along with specialized radio access vendors who are competing in terms of innovation, scale, and deployment versatility. Key pioneers such as Ericsson, Huawei, Nokia, and Samsung leverage extensive R&D and global operator contracts to drive small cell densification and indoor coverage solutions. In this context, HPE Aruba Networking in June 2024 announced that it has launched enterprise private 5G, which is an integrated solution with 4G, 5G small cells, core network, and cloud-native management, simplifying deployment and management of private cellular networks for enterprises. The launch mainly targets large campuses, industrial sites, and service providers, and delivers reliable indoor, outdoor coverage, AI-based data capabilities, and integration with Wi-Fi networks. Hence, such instances position HPE as a key player in the market, enabling rapid, cost-effective private 5G deployments across all nations.

Corporate Landscape of the Small Cell 5G Network Market:

Recent Developments

- In November 2025, Nokia announced that it had extended its partnership with Telefónica Germany through a five-year agreement to modernize RAN and accelerate 5G expansion by 2030. The deal includes Nokia’s AirScale RAN portfolio, including small cell solutions, massive MIMO radios, and cloud RAN to improve coverage, indoor connectivity, and efficiency.

- In June 2025, Ericsson reported that it was ranked the overall leader among small cell vendors in the 2025 ABI Research DAS/DRS report, leading in both innovation and implementation. The recognition highlights its radio dot system and indoor small cell solutions that deliver scalable, energy-efficient 5G coverage.

- Report ID: 2885

- Published Date: Jan 02, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Small Cell 5G Network Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.