Slimicides Market Outlook:

Slimicides Market size was valued at USD 4.18 trillion in 2025 and is expected to reach USD 6.37 trillion by 2035, registering around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of slimicides is evaluated at USD 4.34 trillion.

The growth of the market can be attributed to the increased consumption of paper and paper products. Recently, it was estimated that global consumption of paper totaled 399 million tons in 2020. This figure is projected to rise in the next decade with the consumption value at 466 million tons by 2031. The increasing use of paper for printing, painting, graphics, and signage is estimated to drive market growth in the coming years. According to market research, the growing population of students and increased educational institutes increase the use of paper usage, consequently cruising market growth. The books that are old and have been stored in the library are prone to fungus damage owing to climate change, humidity, and the gaining of paper hence slimicides are very useful to preserve those books. Upanishats, old manuscripts, and literature books must be stored and protected from damage, and slimicides play an essential part in that process.

Slimicides, also known as anti-slime agents, are antimicrobial chemical agents used for eliminating microorganisms that produce slime, algae, bacteria, slime, and fungi. These chemicals are extensively used in the papermaking processes as a large amount of water is recirculated and numerous paper-making chemicals are added during the process for improving the productivity and quality of papers. Thus, the large production of paper for various purposes is estimated to expand the slimicides market size in the forecast period. In 2022, it was anticipated that approximately 300 million tons of paper are produced across the world every year.

Key Slimicides Market Insights Summary:

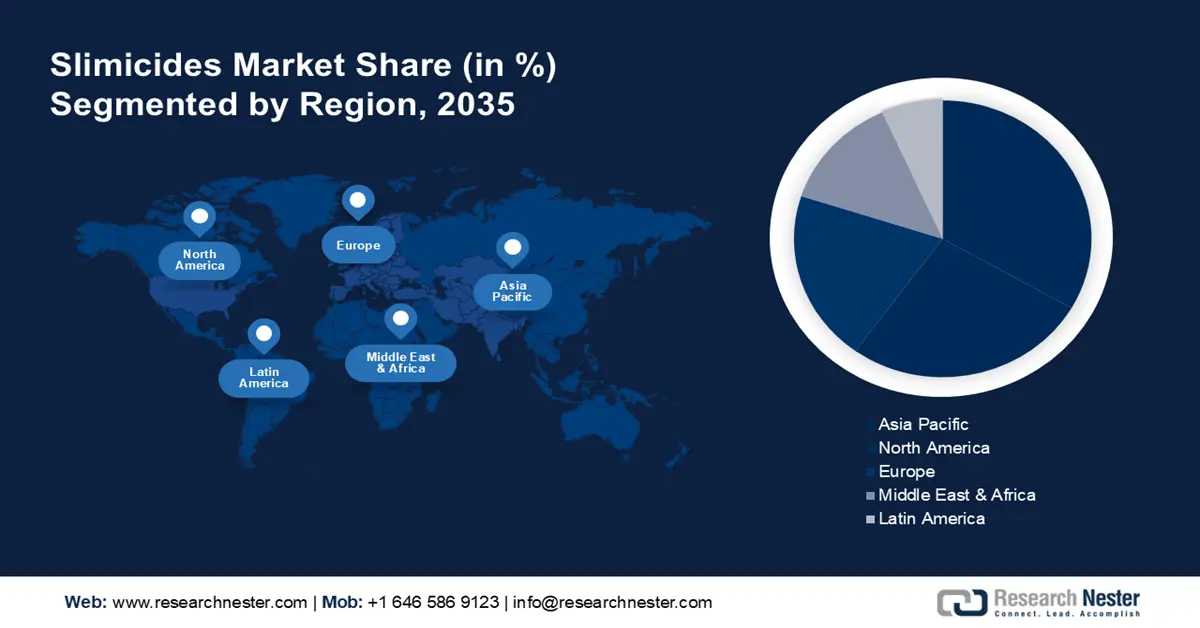

Regional Highlights:

- Asia Pacific is anticipated to secure the largest revenue share by 2035 in the slimicides market during 2026–2035, supported by high regional paper consumption, extensive agricultural land, and strong government investments in oil and gas exploration.

- North America is expected to hold the second-largest market share by 2035, underpinned by rising adoption of paper-based products and substantial oil usage across industries.

Segment Insights:

- The oil extraction industry segment in the slimicides market is projected to attain the leading share by 2035, propelled by the increasing reliance on oil in aviation and expanding marine and shipping activities.

- The paper industry segment is expected to record notable share growth by 2035, fostered by rising global demand for paper-based products.

Key Growth Trends:

- Boom in Online Shopping with Increasing Internet Penetration

- Growth in the Production of Packaging Paper with Rising Adoption of Ec0 Friendly Products

Major Challenges:

- Growing Environmental Concerns Due to the High Production of Water Waste

- Huge Amount of Tree Cutting

Key Players: The Dow Chemical Company, Parchem Fine and Specialty Chemicals, Inc., LANXESS, BASF SE, Lonza Group Ltd., Vink Chemicals GmbH & Co. KG, Albemarle Corporation, Superior Plus, Finor Piplaj Chemical Limited, DuPont de Nemours, Inc.

Global Slimicides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.18 trillion

- 2026 Market Size: USD 4.34 trillion

- Projected Market Size: USD 6.37 trillion by 2035

- Growth Forecasts: 4.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (Largest Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 21 November, 2025

Slimicides Market - Growth Drivers and Challenges

Growth Drivers

- Boom in Online Shopping with Increasing Internet Penetration – The escalation of online shopping has prompted the production of paper for packaging which in turn is estimated to foster the demand for slimicides. According to recent estimates, in 2021, over two billion people bought goods and services online. Further, in 2020, e-retail sales surpassed 4.2 trillion U.S. dollars worldwide.

- Growth in the Production of Packaging Paper with Rising Adoption of Ec0-Friendly Products – The adoption of paper packaging across various industries such as food & beverages, bakery, confectionery, personal care & cosmetics, and others, are expected to boost the demand for papers and slimicides. It was estimated that the global packaging paper and board production value was 256,130 metric tons in 2018, up from 235,500 metric tons in 2016.

- Expansion of the Oil Industry with Increasing Consumption in Many Industries as a Fuel Source – To prevent gas souring, pipeline clogging, and microbial-induced corrosion of equipment and transportation pipes from microbial growth, slimicides are used in the oil industry. Thus, the rising consumption of oil worldwide is anticipated to fuel the demand for the slimicides market. The global oil consumption in 2021 was calculated to be 4.25 billion metric tons, a rise from 4 billion in 2020. Furthermore, it was estimated that the total revenues generated from the oil and gas drilling sector in 2021, were approximately USD 2.1 trillion.

- High Expenditure on Chemical Industry with Rising Use in Textiles and Painting Sector – The capital expenditure on the global chemical industry is projected to be USD 239 billion in 2023. This is a significant rise from USD 220 billion in 2020.

Challenges

- Growing Environmental Concerns Due to the High Production of Water Waste

- Huge Amount of Tree Cutting

- Side effects Imposed by Chemicals - The increasing side effects of chemicals on the health of humans, animals, and marine life is estimated to hamper the market growth in the coming years. The slimicides are made of chemicals such as organic sulfur, Bromium, ammonium compounds, and aldehydes which are harmful when released into the environment.

Slimicides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 4.18 trillion |

|

Forecast Year Market Size (2035) |

USD 6.37 trillion |

|

Regional Scope |

|

Slimicides Market Segmentation:

End-user Segment Analysis

The global slimicides market is segmented and analyzed for demand and supply by end-user into the paper industry, oil extraction industry, and others. Among these, the oil extraction industry is estimated to garner the largest market share as per the market analysis. The increasing use of oil in the aviation sector is estimated to drive market growth. Also, the rapid growth in the shipping industry and marine infrastructure is anticipated to drive market growth in the coming years. As per the estimations for 2022, over 4% of the global oil production was consumed by the shipping industry with the use of over 280 million tons of fossil fuels per annum. The oil extraction industry includes the extraction of huge amounts of fuel every day that are prone to the formation of slime. Fuels such as light oil, aviation biofuel, and gasoline are heavy fuels and are stored in tanks. The water is mixed into the tanks through water breathing or condensation methods. At this water and oil interface microorganisms such as bacteria, molds, fungi, algae, and yeast are generated and form a sludge called slime. The slime floats on the top layer of the oil tanks and flows through the pipes clogging the pipes. The clogged slime prevents the efficient flow of fuels in the excessive process of fuel.

The global slimicides market is also segmented and analyzed for demand and supply by end-user into the paper industry, oil extraction industry, and others. Out of these, the paper industry is attributed to garner the highest revenue by 2035. The presence of paper mills producing papers for consumption is expected to be the primary growth factor for the market. As of 2022, in the United States, the number of active paper mills was counted to be 137. Further, the high employment of people in paper mill businesses is another growth factor. It was estimated that there were approximately 48,600 paper mill employees in the United States in 2022. The increasing application in the paints and coatings industry and metalwork fluids is also increasing the market growth as slimicide is used as a corrosion inhibitor. The rising construction sector and its expenditure across the world are also anticipated to boost the use of paints & coatings which in turn drives the market growth.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Form |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Slimicides Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share by 2035.F The growth of the market can be attributed majorly to the high consumption of paper in the region. China is the largest producing country which produced 117 million tons of paper in 2020. Besides this, the presence of large agricultural lands in the region is expected to bolster the demand for slimicides to kill microorganisms. According to the World Bank, the agricultural land in Asia Pacific was 47.45% in 2018. Further, the constant government support in the regional countries on making huge investments to increase the production and extraction of oil & gas is expected to create strong demand for slimicides. As per the India Brand Equity Foundation, in May 2022, ONGC announced an investment of USD 4 billion from FY22-25 to increase its exploration in India.

North American Market Insights

The North American region is estimated to garner the second-largest market share as per the market analysis. The market growth is attributed to the increase in the use of paper-based products such as paper cups with rising awareness among people of eco-friendly items. The rising number of paper manufacturing companies in North America is also increasing with the support of people towards paper products and packaging industries. The increasing use of oil resources for various industries, as well as the increased use of tissue paper and toilet paper in this region, is expected to drive market growth during the forecast period. As per the reports, in 2021 the United States was estimated to utilize over 18 million barrels of oil per day.

Slimicides Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Parchem Fine and Specialty Chemicals, Inc.

- LANXESS

- BASF SE

- Lonza Group Ltd.

- Vink Chemicals GmbH & Co. KG

- Albemarle Corporation

- Superior Plus

- Finor Piplaj Chemical Limited

- DuPont de Nemours, Inc.

Recent Developments

-

Parchem Fine and Specialty Chemicals, Inc.- has become the official distributor for Yasho Industries of their YAPOX Tolyltriazole and Benzotriazole in the USA. This partnership is expected to provide U.S. customers with a powerhouse of technical knowledge, service, and an advanced supply chain.

-

Lonza Group Ltd announced plans to construct a large-scale commercial drug product fill and finish facility in Stein (CH). The plan is anticipated to provide customers with a complete and integrated end-to-end solution that includes commercial drug product manufacturing for large-scale market supply.

- Report ID: 4294

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Slimicides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.