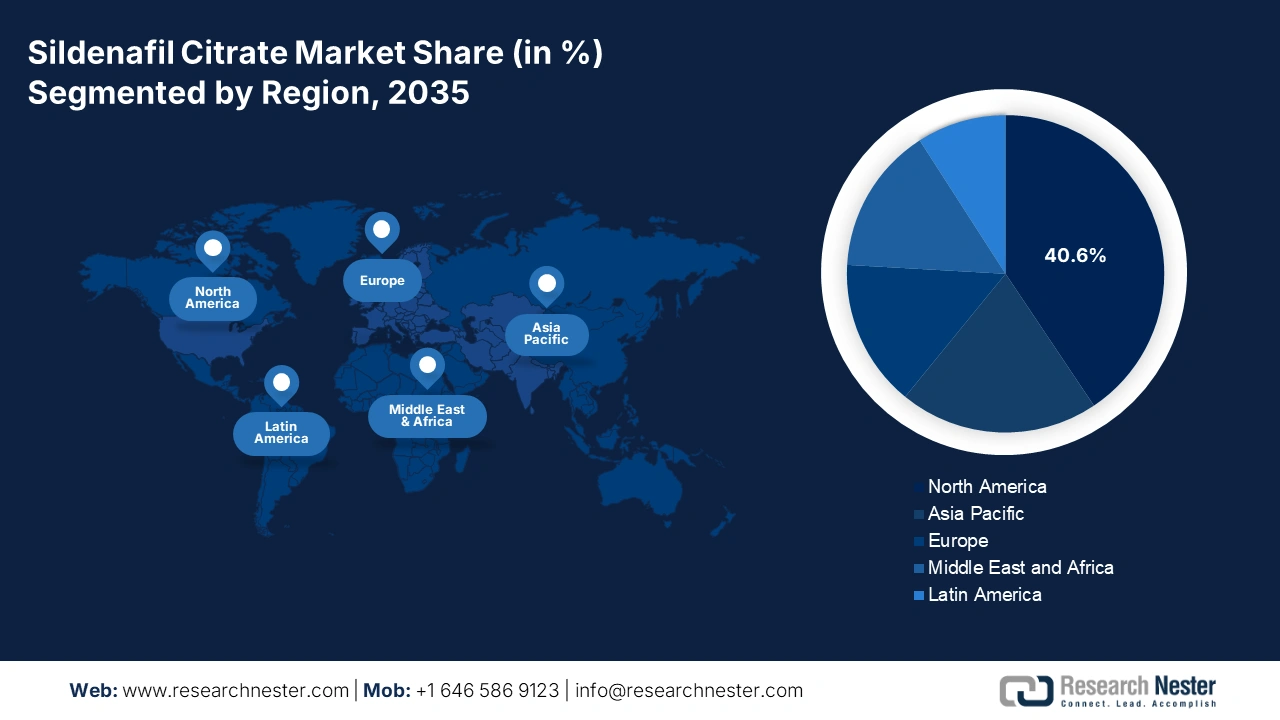

Sildenafil Citrate Market - Regional Analysis

North America Market Insights

North America is a key player in the sildenafil citrate market, projected to register a significant share of 40.6% in 2035. The region benefits from a substantial consumer base, insurance coverage offered by public healthcare systems such as Medicare and Medicaid, and the bolster accessibility of over-the-counter drugs. In this regard, the Medicare expenditure for therapeutics associated with erectile dysfunctions increased from 2020 to 2024 reflecting government support. Besides, the U.S. FDA approved generic sildenafil, which has significantly driven affordability, thereby readily blistering the region’s growth.

The U.S. sildenafil citrate market is expanding rapidly and is driven by a large base of erectile dysfunction patients and pulmonary arterial hypertension usage. Low-cost generics lead due to affordability and availability. Medicare Part D covered 3,500 medications in 2021 at a gross outlay of USD 216 billion on top-selling items, according to the July 2023 KFF study. Sildenafil citrate gains in this context, using Medicare coverage trends to increase prescription availability and strengthen its market base.

The Canada sildenafil citrate market is unfolding significant growth opportunities with a surge in OTC sales, as reported by Health Canada. Besides, the public health systems of Ontario are readily enhancing their expenditures for erectile dysfunction treatments. CIHA states that the generic version of sildenafil accounts for a significant proportion of prescriptions in Canada due to its affordability. The CMA data in 2025 has provided evidence that the total healthcare expenditure reached CAD 344 billion in 2023, with 12.1% of GDP, which is reflecting sustained federal and provincial investment and, indirectly, aid access to ED treatments.

Information on Drug Manufacturer-Approved Sales in Canada

|

DIN |

DIN name |

Active Ingredient(s) |

Strength |

Dosage Form |

Route of Administration |

|

02406152 |

SILDENAFIL |

SILDENAFIL (SILDENAFIL CITRATE) |

50 MG |

TABLET |

ORAL |

|

02406160 |

SILDENAFIL |

SILDENAFIL (SILDENAFIL CITRATE) |

100 MG |

TABLET |

ORAL |

Source: Government of Canada August 2021

APAC Market Insights

Asia Pacific’s sildenafil citrate market is witnessing the fastest growth with a considerable share by 2035, owing to the expansion of e-pharmacy, rising awareness of erectile dysfunction diagnosis, and affordability of generics. Besides, the business in the sector is fueled by the presence of a large consumer base, government healthcare expenditure, and domestic pharmaceutical firms. Countries such as India, China, Japan, and South Korea significantly contribute to the APAC market with their evolutionary prosperity.

India is a leader in the sildenafil citrate market by holding a significant share in the Asia Pacific region, fueled by factors such as affordable generics offering market penetration. Besides, the patient pool report in the JAPI study in May 2024 is 31.7%. Governing bodies in the country are offering their support with funding initiatives and expanding healthcare access. Local pharmaceutical manufacturing is on the rise, further driving business in the sector. Further, the government spending on specific drugs is not always transparent, the National Health Policy emphasizes reducing out-of-pocket expenditure, influencing the preference for generics.

China is the biggest potential sildenafil citrate market and is driven by a massive population base and rising healthcare spending. The NMPA regulates a market with many domestic generic producers. The China Health Statistics Yearbook indicates a rising prevalence of chronic diseases that contribute to ED, driving patient numbers. The Frontiers article in January 2025 provides evidence that the prevalence of ED among men aged 40 to 70 is projected to be around 26%. Government expenditure is concentrated on priority drugs, yet despite the availability of sildenafil being universal, considerable demand is fulfilled through out-of-pocket expenditure, with the private sector dominating distribution and sales.

Europe Market Insights

The sildenafil citrate market in Europe is driven by strict regulatory control by the European Medicines Agency (EMA) and diverse reimbursement strategies among member states. The European Commission's push for a stronger European Health Union improves the healthcare access, on the other hand the national budgets remains as the decisive factor for market access and growth. The main trends are a strong cost-containment focus, which leads to the penetration of generics, and the centralization of procurement in certain countries to secure lower prices.

Germany is the largest shareholder in the sildenafil citrate market in Europe. Its size is attributed to the growing population and robust health insurance system, which provides broad coverage. The Federal Joint Committee (G-BA) determines reimbursement, and while patients have access, the system emphasizes off-patent generics. The German Medical Association guidelines influences the prescribing habits. Further, the market growth is tempered by reference pricing policies that makes the reimbursement level aligned with the low-cost alternatives, compelling manufacturers to compete aggressively on price.

The demand for sildenafil citrate in the UK sildenafil citrate market is consistent due to an aging male population. Expenditure is controlled by the National Health Service (NHS) through rigorous generic prescribing and competitive tendering. The NHS has announced that 81% of drugs in primary care are prescribed generically. Although no specific budget percentages for sildenafil are ever disaggregated publicly, NHS Business Services Authority figures indicate stable expenditure on erectile dysfunction drugs, indicating a policy of cost-effectiveness. The Medicines and Healthcare products Regulatory Agency (MHRA) approves both generic and branded forms, but the market is predominantly generic, which maintains public payer costs low.