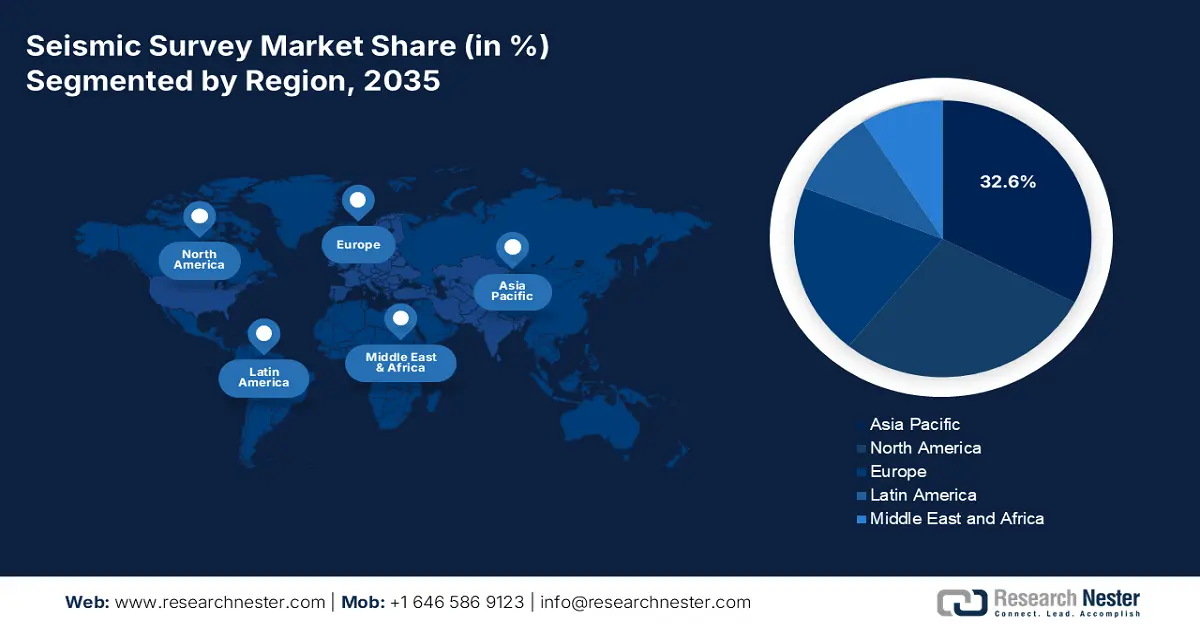

Seismic Survey Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the seismic survey market is anticipated to garner the highest share of 32.6% by the end of 2035. The market’s upliftment in the region is effectively attributed to underground and geothermal infrastructure, an increase in scaling subsurface services for CCS, brownfield optimization, and deepwater exploration, particularly in South China Sea, Australia. According to an article published by NLM in April 2023, with an approximate 12-year overall volume transport of deepwater into the South China Sea (SCS), there has been a significant linear 9% upward trend. This has led to long-lasting modifications in satellite-based ocean bottom pressure within the region. Besides, the SCS is a marginal sea with an in-depth basin of more than 1 × 106 km2, which is connected to the Pacific Ocean through Luzon Strait, an extremely deep passage with a still in-depth of an estimated 2,400 meters.

China in the seismic survey market is growing significantly, owing to the aspects of upscaling CCS monitoring for industrial clusters, redevelopment of mature basins, and sustained offshore exploration. As per an article published by the State Council in December 2022, the country’s offshore crude production has demonstrated an almost 7% year-on-year (YoY) growth as of 2022. This has resulted in an estimated 58.6 million metric tons, and also accounts for over 50% of the country’s overall crude increment. Besides, the offshore natural gas production has exceeded 21.6 billion cubic meters, denoting an 8.6% YoY rise, and making nearly 13% of the country’s gas increment. Moreover, China’s offshore oil production has increased by 60 million tons as of 2023, along with a rise in the offshore natural gas production, accounting for more than 23 billion cubic meters, thereby making it suitable for bolstering the market.

India in the seismic survey market is also growing due to the upstream intensification to diminish import reliance, onshore fields redevelopment, and the widened utilization of geophysics in infrastructure, geothermal, and CCS. As stated in an article published by the PIB Government in December 2025, ports are considered a significant constituent of the infrastructure industry, accounting for almost 95% of external trade by volume. Between 2024 and 2025, the country’s major ports readily handled 855 million tons of cargo, denoting a rise from 581 million tons in the past 10 years. Besides, the Maritime Amrit Kaal Vision 2047 is a long-term vision and a standard approach for green ports, providing an investment of almost ₹80 lakh crore. This has been embarked on for green shipping initiatives, shipbuilding, inland waterways, coastal shipping, and ports, thus denoting an optimistic outlook for the overall market’s expansion in the country.

Europe Market Insights

Europe in the seismic survey market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by infrastructure geophysics, growth in geothermal, subsurface appraisal for CCS, and the mature offshore redevelopment in the North Sea, comprising Norway and the UK. According to an article published by Wind Europe in January 2024, the region witnessed a record 4.2 GW of the newest offshore wind farms, denoting a 40% increase from 2022. Based on this, there has been the provision of €30 billion in investments, which is expected to cover 9 GW that is poised to be developed in the upcoming years. Additionally, in 2023, the region has been successful in developing 4.2 GW of offshore, which is 1.7 GW more than in 2022. Besides, the UK, France, and the Netherlands also installed the latest capacity, including the 1.5 GW Hollandse Kust Zuid project, thereby driving the market’s demand and development.

The UK in the seismic survey market is gaining increased traction due to the presence of large-scale CCS clusters that readily depend on seismic for baseline monitoring and characterization, along with basin redevelopment. As per an article published by the Renewable Institute Organization in 2025, Ofgem has ensured the approval of a generous investment by allocating an initial £8.9 billion. This has been significantly directed towards upscaling Britain’s high-voltage electricity network, as well as an additional £1.3 billion on standby. This particular draft settlement has formed the first stage of an approximately £80 billion programme, with the intention of enhancing grid capacity and successfully shielding households from the volatile global gas market. However, this investment almost quadrupled the present expenditure levels for supporting 80 transmission projects and activities globally, which is positively impacting the market’s exposure.

Norway in the seismic survey market is also developing, owing to an extension in the CCS deployment that has leveraged saline aquifers and depleted fields, frontier exploration, and offshore redevelopment. As stated in the September 2025 IRENA Organization data report, the electricity generation trend in the country majorly depends on renewable and wind, combinedly accounting for 1475 in 2022 and 155% in 2023. Besides, the capacity utilization of different sources in the country accounts for 41% fossil fuels, 46% hydro or marine, 9% solar, 31% wind, and 36% bioenergy. Moreover, as per an article published by Sustainable Energy Technologies and Assessments in December 2022, the thermal energy extraction depends upon utilizing ground source heat pump systems, which is approximately 3 TWh, and is expected to reach 8 TWh by the end of 2030. Additionally, the increased focus on energy supply through different sources is also responsible for uplifting the seismic survey market in the country.

Total Energy Supply of Sources in Norway (2022)

|

Components |

Non-Renewable |

Renewable |

|

Total Energy Supply |

500,329 TJ |

571,242 TJ |

|

Growth |

-18.4% |

8.5% |

|

Primary Energy Trade |

||

|

Imports |

483,564 TJ |

|

|

Exports |

8,428,360 TJ |

|

|

Net Trade |

7,944,796 TJ |

|

|

Supply Imports |

45% |

|

|

Production Exports |

93% |

|

|

Energy Self-Sufficiency |

846% |

|

Source: IRENA Organization

North America Market Insights

North America in the seismic survey market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by the growing subsurface characterization for carbon capture and storage (CCS), shale development, and the continued offshore Gulf of Mexico activity. According to a data report published by the Congressional Budget Office in December 2023, the region comprises 15 CCS infrastructure, particularly operating in the U.S., and these have the capacity to capture almost 22 million metric tons of carbon dioxide annually. This also accounts for 0.4% of the U.S.’s overall yearly carbon dioxide emissions. Besides, in terms of federal financial support, regional lawmakers allocated USD 5.3 billion for conducting research and related programs for CCS, thereby making it suitable for boosting the seismic survey market’s growth.

The seismic survey market in the U.S. is gaining increased exposure due to an increase in the demand for CCS centers, geothermal reservoirs, and hydrogen storage facilities, the presence of several funding programs by the government, manufacturing initiatives, and industrial decarbonization. As per an article published by the IEA Organization in 2025, the country announced crucial opportunities for bolstering carbon capture, utilization and storage (CCUS) project development, which comprises USD 1.7 billion for carbon capture demonstration. This also caters to the USD 1.2 billion for direct air capture (DAC) facilities, operating under the Infrastructure Investment and Jobs Act. Moreover, the sources' identification of carbon emissions in the country is also a driving factor for fueling the market’s demand, along with its continuous growth.

Carbon Dioxide Emissions in the U.S. From Different Sources (2023)

|

Source Type |

Emission (Million Metric Tons) |

|

Electric Power |

1,541 (62.1%) |

|

Industrial Energy |

776 (31.2%) |

|

Ethanol Production |

45 (1.8%) |

|

Iron and Steel Making |

42 (1.7%) |

|

Cement Production |

41 (1.7%) |

|

Natural Gas Processing |

26 (1.1%) |

|

Ammonia Production |

12 (0.5%) |

Source: Congressional Budget Office

The seismic survey market in Canada is also growing, owing to exploration in the oil and gas sector, CCS, mining and infrastructure, along with sustainability and governmental programs. As stated in an article published by the Government of Canada in August 2025, the country’s clean energy gross domestic product (GDP) is expected to reach USD 107 billion, readily driven by USD 58 billion in yearly investments by the end of 2030, and ensuring the provision of over 600,000 employment opportunities. Besides, an additional clean electricity generating capacity, ranging between 140 GW and 190 GW, is predicted to be required by the end of 2050. Furthermore, Ontario’s Aboriginal Loan Guarantee Program has ensured a consortium of 24 Indigenous groups to gain an equity stake in the Wataynikaneyap Transmission Project, which is readily supported by the federal government in the form of a USD 1.6 billion investment, thus proliferating the seismic survey market’s growth.