Robotic-Assisted Hip Replacement Market Outlook:

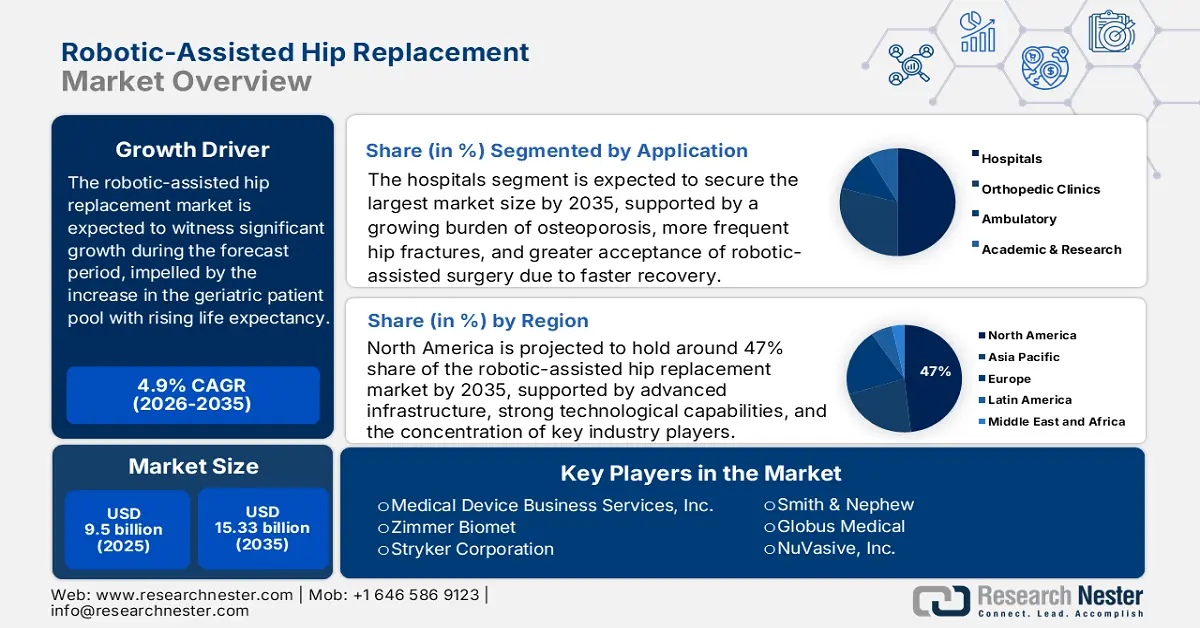

Robotic-Assisted Hip Replacement Market size was over USD 9.5 billion in 2025 and is anticipated to cross USD 15.33 billion by 2035, witnessing more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of robotic-assisted hip replacement is assessed at USD 9.92 billion.

The increasing demand for hip replacement surgeries owing to growing prevalence of osteoarthritis is anticipated to attribute to the growth of the market. As per Agency for Health Research and Quality, each year higher than 4 million total hip replacements are done in the U.S. Osteoarthritis is one of the major factors for hip replacement surgery which is also very frequent among geriatric population. The number of adults aged 50 or above with osteoporosis raised from 9.4% in 2007-2008 to 12.6% in 2017-2018. As people get older, hip replacements become more common. As a result of hip wear and tear, prosthetic replacement of the ball and socket joint may be the only option. Hence robotic technology is estimated to be used to aid in performing this process. Other factors causing hip joint damage are rheumatoid, hip fracture, and more.

Further, increasing adoption of automation in the medical sector is considered to boost the growth of global robotic-assisted hip replacement market trends. The goal of using automation in surgery is to make up for mistakes made by humans. There are several variables that affect patient safety in medicine, and surgery in particular. The majority of medical mistakes are caused by human failings, such as incomplete knowledge, bad judgement, a lack of dexterity, weariness, and inattentiveness. Hence the demand for robotic-assisted hip replacement is estimated to increase. Also, a growing number of hip replacement issues, and rising damage to cartilage owing to age or sedentary lifestyle practices are estimated to rise the market growth. Additionally, the demand for robotic-assisted hip replacement is expected to increase as a result of adequate health insurance and changes to the health reimbursement laws for robotic-assisted hip replacement surgeries.

Key Robotic-Assisted Hip Replacement Market Insights Summary:

Regional Highlights:

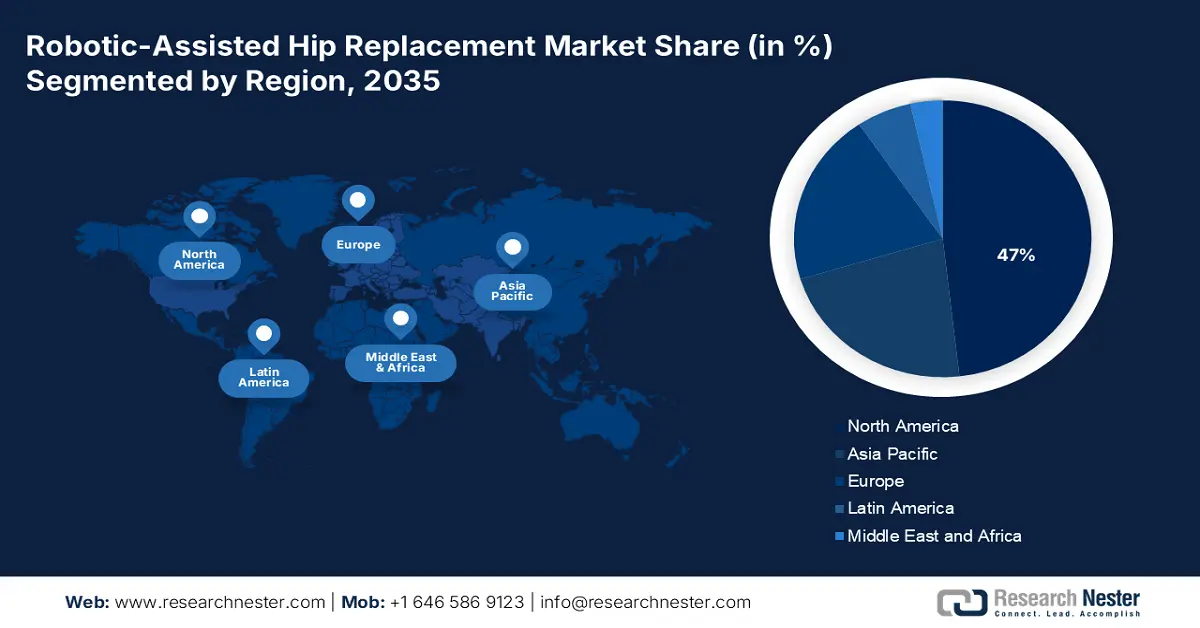

- By 2035, North America is anticipated to secure a 47% share in the robotic-assisted hip replacement market, impelled by highly developed infrastructure, an advanced technology base, and the presence of major market players.

Segment Insights:

- By 2035, the hospitals segment in the robotic-assisted hip replacement market is expected to capture the largest market size, propelled by the rising incidence of osteoporosis, increasing hip fractures, and higher adoption due to reduced recovery time.

- Over 2026-2035, the semi-active segment is anticipated to command the largest market share, supported by its dynamic interaction capabilities such as haptic feedback and advanced three-dimensional anatomical mapping.

Key Growth Trends:

- Increase in Geriatric Patient Pool with Rising Life Expectancy Across the World

- High Demand for Hip Replacement Surgical Procedures with Increasing Awareness of Replacement Procedures

Major Challenges:

- High Cost of Surgical Robots

- Less Affordable in Low Income Regions

Key Players: Medtronic plc, Medical DeviceBusiness Services, Inc., Zimmer Biomet, Stryker Corporation, Smith & Nephew, Globus Medical, NuVasive, Inc., Limacorporate S.p.A., Asensus Surgical US, Inc, Titan Surgical LLC.

Global Robotic-Assisted Hip Replacement Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.5 billion

- 2026 Market Size: USD 9.92 billion

- Projected Market Size: USD 15.33 billion by 2035

- Growth Forecasts: 4.9%

Key Regional Dynamics:

- Largest Region: North America (47% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Canada, Germany, United Kingdom, China

- Emerging Countries: India, Brazil, South Korea, Mexico, Singapore

Last updated on : 21 November, 2025

Robotic-Assisted Hip Replacement Market - Growth Drivers and Challenges

Growth Drivers

- Increase in Geriatric Patient Pool with Rising Life Expectancy Across the World – Increased life expectancy and declining fertility are expected to be the reason for the growing geriatric population. As per the 2021 U.S Census Bureau, the United States has 15% of the nation’s population i.e., over 50 million adults aged 65 and above. Older people are more prone to bone-related diseases, especially, osteoporosis and osteoarthritis. Moreover, the rising geriatric population is bound to demand more frequent surgeries to treat such diseases. This is estimated to boost market growth.

- High Demand for Hip Replacement Surgical Procedures with Increasing Awareness of Replacement Procedures – It is observed that the total hip arthroplasty is estimated to increase by 30% in 2020, 72% in 2025, 120% in 2030, and 280% in 2040.

- Surge in Personal Disposable Income Across the World Among Developing Countries – Personal disposable income increased by USD 1.18 billion in 2020 and 80% of it i.e., USD 957 billion is from fiscal stimulus.

- Lack of Surgeons and Physicians to Perform Safely and Efficiently – The U.S has a shortage of about 12o,000 physicians and 30,200 surgical specialists in 12 years based on the report of the Association of American Medical Colleges (AMMC).

- Government Investments in Healthcare and Hospital Infrastructure to Improve Healthcare Facilities – Hospital infrastructure investment in America is a direct investment in American jobs and communities, where in 2019 about 5 million jobs and USD 1 trillion in goods and services are purchased from small businesses supporting over 15 million jobs.

Challenges

- High Cost of Surgical Robots - The robotic machinery is very expensive and requires a skilled professional to handle that is hindering market growth. Since least number of surgeons are able to access these procedures the preference for conventional methods would remain constant or grow. Also, the workflow process and final surgical outcome are best achieved with the right training and expertise. However, the cost involved in training is also high which further boost the overall cost of the system, hence hindering the market.

- Less Affordable in Low-Income Regions

- Lack of favorable reimbursement policies

Robotic-Assisted Hip Replacement Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 9.5 billion |

|

Forecast Year Market Size (2035) |

USD 15.33 billion |

|

Regional Scope |

|

Robotic-Assisted Hip Replacement Market Segmentation:

Application Segment Analysis

The global robotic-assisted hip replacement market is segmented and analyzed for demand and supply into application which is further is segmented into hospitals, orthopedic clinics, ambulatory and academic, and research. Out of these, the hospitals segment is expected to hold the largest market size by the end of 2035 on the back of the high incidence of osteoporosis, rising number of hip fractures, and increasing road accidents during the forecast period. Worldwide, about 200 million women suffer from osteoporosis. It is estimated that the incidence of hip fracture would increase by 310% and 240% in men and women respectively. Additionally, since the recovery time is reduced owing to the robotic-assisted hip replacement, the hospital staying duration is also reduced. Hence large number of hospitals are expected to adopt this system in large scale.

Type Segment Analysis

The global robotic-assisted hip replacement market is also segmented and analyzed for demand and supply by type into passive, semi-active, and active. Out of which the semi-active segment is anticipated to hold the largest market share over the forecast period. The growth of this segment can be attributed to this system having more dynamic interactions. One instance of a semi-active system is haptic feedback, which gives the surgeon tactile feedback and aids in defining particular limits (i.e., for surgical resection or safety). To build a three-dimensional image of the patient's anatomy, landmarks are specified either before surgery or during it. The 3-dimensional field is then generated by computer software with defined bounds. Through a number of feedback mechanisms, the surgeon is made aware of these limitations. Also, numerous semi-active systems offer vibratory tactile feedback, but they may also include visual and audio feedback.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Robotic-Assisted Hip Replacement Market - Regional Analysis

North America Market Insights

North America industry is anticipated to hold largest revenue share of 47% by 2035, impelled by highly developed infrastructure, presence of an advanced technology base, and growing market giants.. Highly developed infrastructure, the presence of an advanced technology base, and growing market giants during the forecast period are some of the factors estimated to boost the growth of the market in this region. Additionally, the growing incidence of osteoporosis and osteoarthritis, shortage of surgical specialists, and increasing sports and road injuries are major factors aiding in the market growth in the North America region. More than 2 million football injuries took place in the U.S in 2021. However, hip replacement is never considered as first option, despite owing to various benefits provided by robotic technology, and development of technologies, athletes are finding it efficient to undergo surgery.

Robotic-Assisted Hip Replacement Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medical Device Business Services, Inc.

- Zimmer Biomet

- Stryker Corporation

- Smith & Nephew

- Globus Medical

- NuVasive, Inc.

- Limacorporate S.p.A.

- Asensus Surgical US, Inc

- Titan Surgical LLC

Recent Developments

-

Stryker revealed the release of Mako Total Hip 4.0, a smart robotic system to improve the user experience with CT-based 3D modeling and new planning features along with approach-specific and region-based pelvic registration.

-

DePuy Synthes announced that Australian orthopedic surgeons would be the world’s first to access the next generation of robotics.

- Report ID: 4244

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.