Risk Analytics Market Outlook:

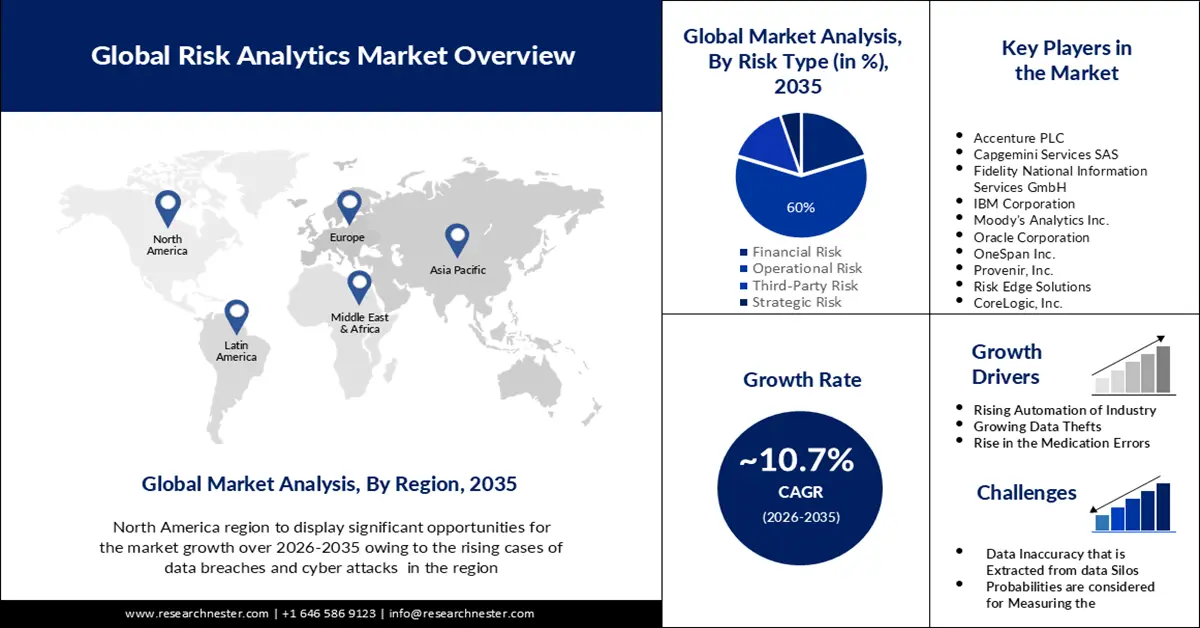

Risk Analytics Market size was over USD 28.23 billion in 2025 and is anticipated to cross USD 78.02 billion by 2035, witnessing more than 10.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of risk analytics is assessed at USD 30.95 billion.

The reason behind the growth is impelled by the rising generation of data. Large volumes of organized and unstructured data are being used more often which has necessitated the use of risk analytics to gain valuable insights, analyze, generate actionable findings, and develop appropriate tactics. According to estimates, every day, the world generates over 2 quintillion bytes of data.

The growing prevalence of black swan events are believed to fuel the market growth. Black swan events are unpredictable owing to their rarity and can result in huge setbacks and consequences therefore, risk managers recognize the need for more rigorous methods such as risk analytics to assist in contingency planning.