Risk Analytics Market Outlook:

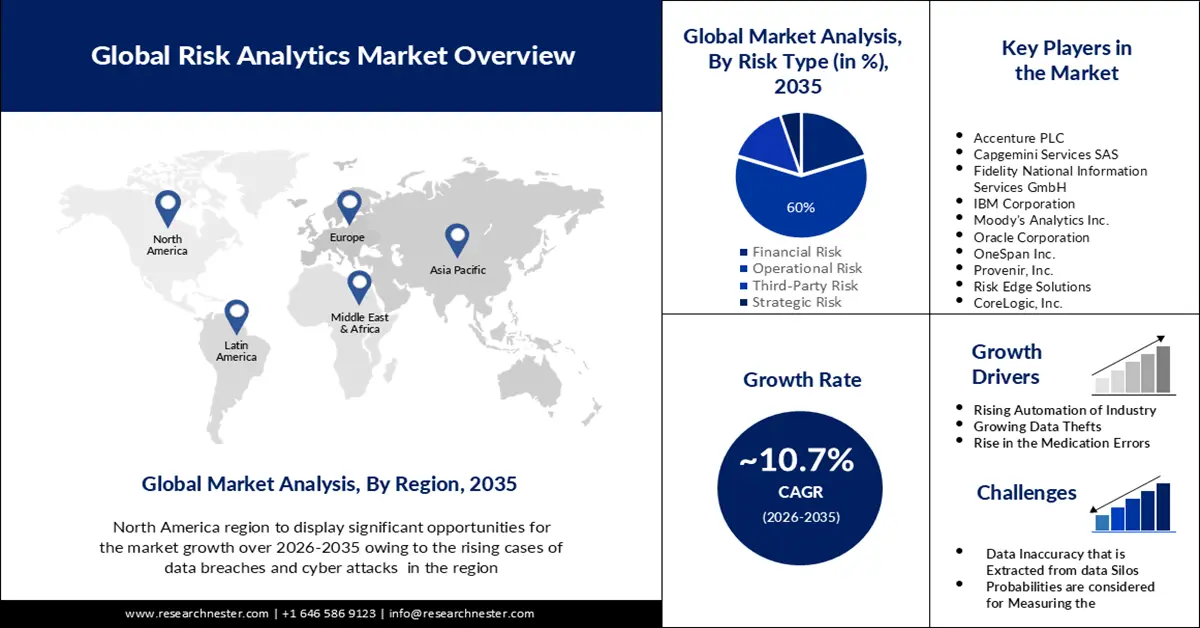

Risk Analytics Market size was over USD 28.23 billion in 2025 and is anticipated to cross USD 78.02 billion by 2035, witnessing more than 10.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of risk analytics is assessed at USD 30.95 billion.

The reason behind the growth is impelled by the rising generation of data. Large volumes of organized and unstructured data are being used more often which has necessitated the use of risk analytics to gain valuable insights, analyze, generate actionable findings, and develop appropriate tactics. According to estimates, every day, the world generates over 2 quintillion bytes of data.

The growing prevalence of black swan events are believed to fuel the market growth. Black swan events are unpredictable owing to their rarity and can result in huge setbacks and consequences therefore, risk managers recognize the need for more rigorous methods such as risk analytics to assist in contingency planning.

Key Risk Analytics Market Insights Summary:

Regional Highlights:

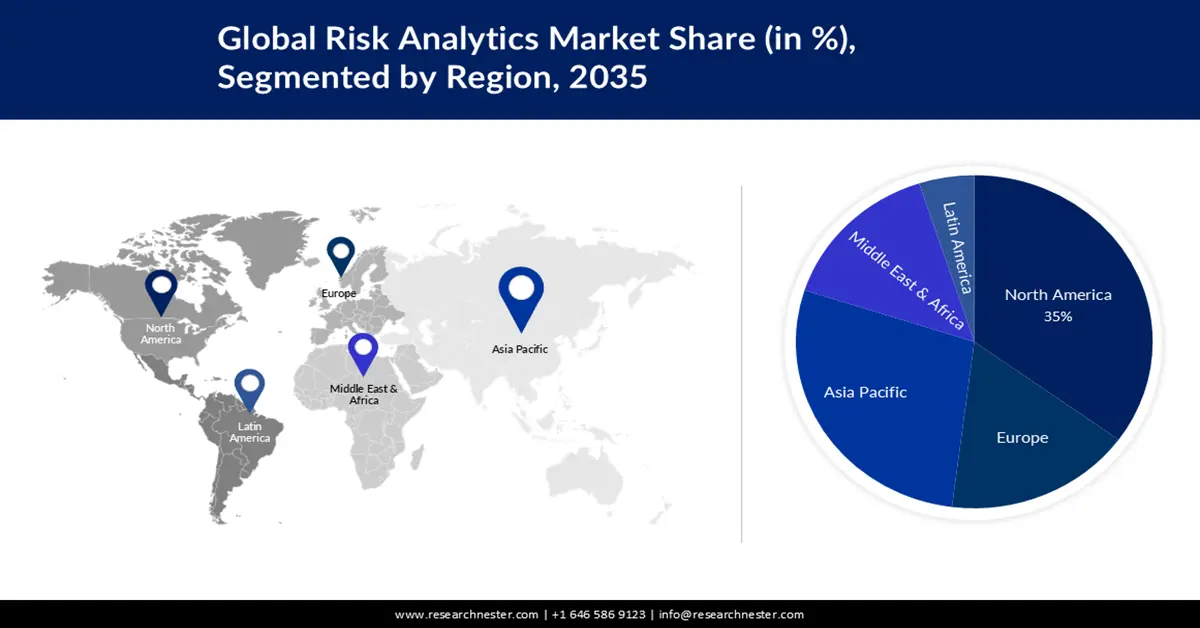

- North America risk analytics market will secure around 35% share by 2035, driven by the growing cases of cyber-attacks in the region.

- Asia Pacific market will hold the second largest share by 2035, driven by the growing risk of patient death from medication errors and the urgent need for risk minimization.

Segment Insights:

- The bfsi segment in the risk analytics market is projected to achieve a 25% share by 2035, driven by the rising amount of compromised data in complex global banking networks.

Key Growth Trends:

- Growing Incidences of the Data Thefts

- Increasing Adoption of Machine Learning

Major Challenges:

- Inaccuracy of Data Extracted from Data Silos

- Difficult to Comply with the Varying Regulation Policies

Key Players: Accenture PLC, Capgemini Services SAS, Fidelity National Information Services GmbH, IBM Corporation, Moody's Analytics Inc., Oracle Corporation, OneSpan Inc., Provenir, Inc., Risk Edge Solutions, and CoreLogic, Inc.

Global Risk Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.23 billion

- 2026 Market Size: USD 30.95 billion

- Projected Market Size: USD 78.02 billion by 2035

- Growth Forecasts: 10.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, India

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 10 September, 2025

Risk Analytics Market Growth Drivers and Challenges:

Growth Drivers

- Growing Incidences of the Data Thefts– In high-risk sectors, risk analytics utilize data to look for control flaws and irregularities that could be indicators of fraud, lowering the chance of data theft. The biggest amount of exposed data records in the world was found in the fourth quarter of 2020, about 125 million data pieces. Moreover, approximately 15 million data records were exposed globally owing to data breaches in the third quarter of 2022. When compared to the previous quarter, this amount had climbed by around 37%.

- Increasing Adoption of Machine Learning- Machine learning approaches are used for analyzing massive volumes of data that can increase the analytical capacities of financial institutions and insurance companies in risk management and compliance. For instance, in 2021, around 76% of organizations chose AI and machine learning (ML) over other IT investments in the world.

Challenges

- Inaccuracy of Data Extracted from Data Silos-Data quality frequently drops as a result of inconsistencies in data that may overlap across silos. Data silos create hurdles to information sharing and collaboration between departments. Moreover, Siloed data is often stored in a separate system and is frequently incompatible with other data sets. Therefore, when data is segregated from the silos, it is difficult for a company to gain an overall understanding of company data.

- Difficult to Comply with the Varying Regulation Policies

- Measurement of Risks on the Basis of Probabilities

Risk Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.7% |

|

Base Year Market Size (2025) |

USD 28.23 billion |

|

Forecast Year Market Size (2035) |

USD 78.02 billion |

|

Regional Scope |

|

Risk Analytics Market Segmentation:

End-user Segment Analysis

The BFSI segment is estimated to hold 25% share of the global risk analytics market during the forecast year owing to the rising amount of compromised data. Global banking networks are extremely complicated, with several moving elements. They connect multiple banks, including regional banks, state banks, and global banks. Networks with cloud and local servers, dedicated terminals at bank and retail locations, consumer and mobile devices, software, ATMs, and other components comprise these interconnected systems. These dispersed networks are more vulnerable to data breaches, compromised cyber security, and other threats.

Moreover, risk analytics enables banks to establish policies in a variety of areas and assists banks in comprehending the possible influence of market and external forces. From January 2018 to June 2022, financial breaches accounted for around 153 million exposed records. Moreover, 2021 was the most severe year for financial data violations, with a 12% rise over 2020, jumping from 233 to 260 breaches in the United States.

Risk Type Segment Analysis

Risk analytics market from the operational risk segment is set to garner a notable share shortly. Rising problems occur owing to human errors. People's operational risk can be produced by a variety of circumstances, including human error, bad decision-making, or hostile intent. The human mistake was responsible for more than half of all data breaches reported to Australia's Information Commissioner under the new legislation. There are various other reasons the company can face operational risks, such as cyber-attacks, human errors, outsourcing, talent retention, automation implementation, data analytics, and others.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Risk Type |

|

|

Deployment |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Risk Analytics Market Regional Analysis:

North American Market Insights

Risk analytics market in North America is predicted to account for the largest share of 35% by 2035 impelled by the growing cases of cyber-attacks. For instance, in 2021, over 30,000 US businesses were hit by a widespread attack on Microsoft Exchange email servers, one of the worlds largest email servers and it was one of the largest cyberattacks in US history. The hackers used four separate zero-day vulnerabilities to obtain unauthorized access to emails from small enterprises to municipal governments. This may increase the demand for risk analytics in the region as this method helps in identifying, analyzing, evaluating, and concentrating on the resources that are likely to create loss.

APAC Market Insights

The APAC risk analytics market is estimated to be the second largest, during the forecast timeframe led by growing risk of patient death owing to medication errors. Pharmaceutical errors are responsible for around 7,000 deaths per year. Drug errors and drug-related difficulties in India are primarily caused by inappropriate medication use. Moreover, the rate of adverse medication events was as high as 82 per 1,000 prescriptions in the country, while national statistics show that up to 5 million medical errors occur each year. Therefore, there is an urgent need to improve risk minimization and medication error prevention in the region which may create a huge demand for risk analytics.

Risk Analytics Market Players:

- Accenture PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Capgemini Services SAS

- Fidelity National Information Services GmbH

- IBM Corporation

- Moody's Analytics Inc.

- Oracle Corporation

- OneSpan Inc.

- CoreLogic, Inc.

- Provenir, Inc.

- Risk Edge Solutions

Recent Developments

- CoreLogic announced the launch of Climate Risk Analytics for assisting government agencies and corporations in measuring, modeling, and reducing the physical hazards of climate change to the real estate market, originally until 2050. The platform is based on Google’s cloud and long-term infrastructure.

- Moody’s Analytics announced the introduction of risk analytics platform in China, Risk Compass, it is used to analyses the market and find out the opportunities for managing the risk.

- Report ID: 4844

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Risk Analytics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.