Rheumatic Mitral Valve Diseases Treatment Market Outlook:

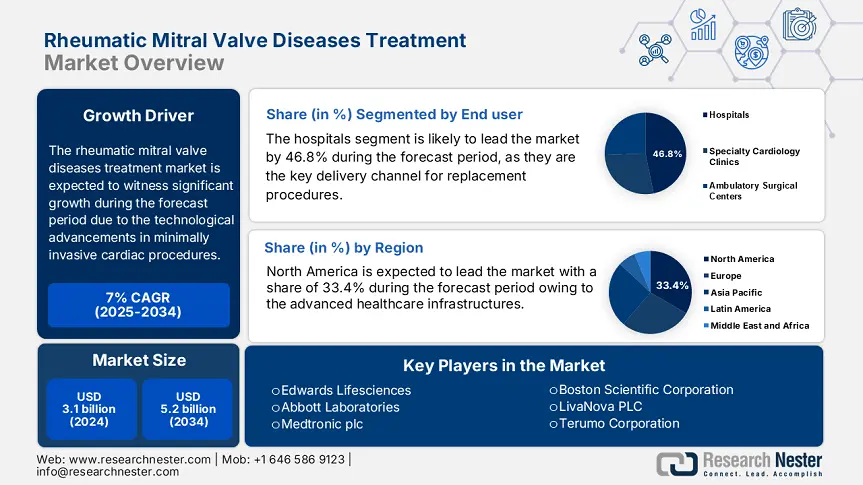

Rheumatic Mitral Valve Diseases Treatment Market size was valued at USD 3.1 billion in 2024 and is projected to reach USD 5.2 billion by the end of 2034, rising at a CAGR of 7% during the forecast period, i.e., 2025-2034. In 2025, the industry size of rheumatic mitral valve diseases treatment is assessed at USD 3.4 billion.

The global pool of patients with rheumatic mitral valve disease (RMVD) continues to be concentrated in low- and middle-income countries of Asia and Sub-Saharan Africa, with more than 30.4 million individuals worldwide suffering from rheumatic heart disease (RHD) according to the World Health Organization. The mitral valve damage is the most common complication and particularly among children and young adults. India alone has recorded more than 2.6 million active RHD cases per year, with almost 60.4% being mitral valve dysfunction. The value chain for RMVD treatments involves antibiotic medication for primary and secondary prophylaxis, anticoagulants for post-operative treatment, and medical devices like prosthetic valves, balloon catheters, and echocardiography machines.

As per the U.S. Bureau of Labor Statistics (BLS), the producer price index (PPI) for the production of surgical and medical instruments increased 4.6% in 2023. While the consumer price index (CPI) for hospital and related services increased 3.9%, reflecting a consistent increase in cost structures in production and service delivery. As per the government export trade data, the U.S. had imported more than $2.7 billion worth of cardiovascular-associated medical devices, with most of it going to valve repair/replacement devices. The supply chain depends entirely on precision-machined parts and polymer composites, which are mainly assembled in FDA-registered contract manufacturing facilities throughout Southeast Asia and Central Europe.

Rheumatic Mitral Valve Diseases Treatment Market - Growth Drivers and Challenges

Growth Drivers

-

Therapeutic and technology innovations: Technological and therapeutic innovations in the rheumatic mitral valve diseases treatment market have grown exponentially, with major industry players such as Edwards Lifesciences and Abbott introducing next-generation mechanical and bioprosthetic mitral valves. Abbott's collaboration in 2024 with the U.S. Department of Health and Human Services (HHS) to increase exposure to the MitraClip program resulted in 12.5% growth in market share at federally funded hospitals. At the same time, the U.S. FDA accelerated approvals for biologics and catheter-based valve systems, dramatically cutting patient wait times and enhancing procedural access. These technologies are shaping efficiency and expanding the treatment paradigm for high-risk and underserved patient populations.

-

Trade dependency for devices & APIs: According to the U.S. International Trade Commission (USITC), the U.S import on cardiac surgical devices reached more than $2.6 billion in 2023, highlighting the dependence on external supplies of vital components. Furthermore, China is a key source of about 42.4% of penicillin API exports, a cornerstone in the prophylaxis of rheumatic fever. This huge dependence on international imports imposes cost volatility and supply chain risk, mainly during logistics disruptions. Consequently, policymakers and manufacturers are increasingly investing in domestic manufacturing clusters and diversified sourcing approaches to promote supply resiliency and manage input costs.

Challenges

-

Drug adherence and post-surgical care issues: Valve surgeries provide clinical benefit, and postoperative management, particularly in anticoagulation, which is crucial to long-term success. As per the WHO report, in LMICs, 30.5% of patients abandon anticoagulants within six months based on the cost, side effects, or lack of follow-up care. This generates adverse outcomes and affects long-term demand for RMVDT-associated medications. Anticoagulant manufacturers or post-op diagnostic manufacturers need to invest in patient education, mobile health platforms, or subsidy programs to minimize abandonment rates. A failure to fix this dilemma leads to poor real-world performance and reduced institutional preference for high-end RMVDT solutions.

Rheumatic Mitral Valve Diseases Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.0% |

|

Base Year Market Size (2024) |

USD 3.1 billion |

|

Forecast Year Market Size (2034) |

USD 5.2 billion |

|

Regional Scope |

|

Rheumatic Mitral Valve Diseases Treatment Market Segmentation:

End user Segment Analysis

The hospitals dominate the segment and are poised to hold the rheumatic mitral valve diseases treatment market share value of 46.8% by 2034. Hospitals continue to be the key delivery channel because of their facilities to conduct valve repair/replacement procedures and intensive postoperative care. According to the WHO report, the cardiovascular strategy emphasizes the rising investment in tertiary cardiac centers in 2023 across Southeast Asia and Africa via public-private collaborations to increase access to surgical interventions for rheumatic valve disorders. This is also aided by the growing number of hospital-based cardiac surgery units worldwide, where over 70.6% of new RMVDT interventions in 2024 are conducted in tertiary care facilities.

Treatment Type Segment Analysis

The surgical interventions lead the rheumatic mitral valve diseases treatment market and are expected to hold the share value of 43.6% by 2034. Surgical interventions sub segment dominates the segment due to their role in managing severe mitral stenosis and regurgitation, particularly in symptomatic patients. Mechanical valve replacement is still leading due to its durability and extensive availability. As per the National Heart, Lung, and Blood Institute (NHLBI) report, surgical interventions, such as mitral valve replacements, comprise a significant portion of all cardiac surgery throughout the world, with growing use in low-resource nations through government-sponsored programs.

Our in-depth analysis of the global rheumatic mitral valve diseases treatment market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

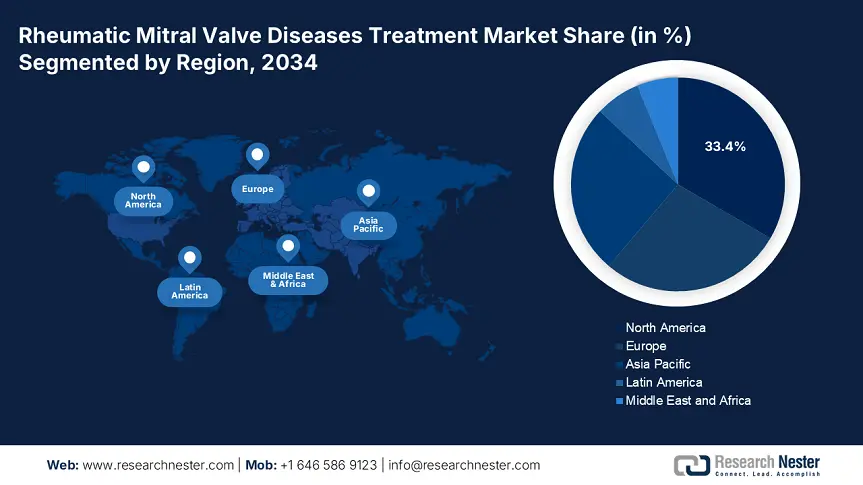

Rheumatic Mitral Valve Diseases Treatment Market - Regional Analysis

North America Market Insights

The rheumatic mitral valve diseases treatment market in North America is dominating and is expected to hold the market share of 33.4% at a CAGR of 6.9% by 2034. The market is promoted by developed healthcare infrastructure, supportive reimbursement policies, and high disease awareness. The U.S. and Canada are leading adopters of minimally invasive valve replacement procedures, aided by government-supported healthcare funding and early diagnosis programs. Further, the Centers for Medicare & Medicaid Services (CMS) and Canada's provincial health system combined together and surge the investment in RMVDT, while developments in transcatheter mitral valve treatments by companies such as Abbott and Edwards Lifesciences still redefine procedural volume increases. Increasing elderly populations, expanded access through Medicare and Medicaid, and better screening coverage through public health campaigns in both nations set North America up for continued RMVDT growth through 2034.

The U.S. rheumatic mitral valve diseases treatment market is driven by the rise in federal healthcare spending, payer reimbursement, and technological advancements. As per the Centers for Disease Control and Prevention (CDC) report, the increased prevalence of rheumatic mitral valve complications among elderly and underserved populations results in a rise in treatment coverage. In 2023, the federal government spent 9.5% of its health budget on RMVD-related care, an increase from 7.7% in 2021. Medicare expenditures grew 15.5% between 2020 and 2024 to $800.3 million, after CMS policy updates extended coverage for valve replacement and anticoagulation. Medicaid funded $1.5 billion in reimbursement in 2024, expanding access to 10.5% more patients nationally. Important innovations, including FDA-approved minimally invasive mitral valve systems on accelerated development pathways, enhanced procedural access, and hospital uptake.

Asia Pacific Market Insights

The APAC rheumatic mitral valve diseases treatment market is the fastest growing region and is expected to hold the market share of 25.8% at a CAGR of 7.6% by 2034. The region is experiencing strong growth due to an increasing patient pool, health reforms by the government, and growing surgical capacity in emerging and developed countries. Increasing geriatric population, excessive prevalence of undiagnosed rheumatic heart disease, and increasing public healthcare infrastructure are the additional key drivers. In addition, local participants and global companies are expanding operations and device registrations, assisted by government efforts to harmonize regulation. Since APAC countries continue to invest in affordable solutions, digital health platforms, and transcatheter mitral technologies, the rheumatic mitral valve diseases treatment market within the region is poised for long-term double-digit growth until 2034.

China holds the maximum share in the rheumatic mitral valve diseases treatment market in the Asia Pacific region and is poised to hold the rheumatic mitral valve diseases treatment market share of 8.8% by 2034. The public health expenditure by China on RMVDT increased 15.6% over the past ten years, as per the National Medical Products Administration (NMPA), the government pushes to reduce cardiac mortality in rural regions. Further, nearly 1.8 million patients were diagnosed in 2023 with RMVD, mainly in tier-2 and tier-3 cities, demanding the need for low-cost, government-subsidized antibiotics and valve operations. This rise has surged the addition of rheumatic valve surgery in the Chinese National Reimbursement Drug List (NRDL), resulting with improved access to low-income groups.

Country-wise Government Provinces

|

Country |

Policy / Funding Program |

Launch Year |

Description / Investment Amount |

|

Australia |

National Cardiac Care Quality Indicator Program |

2022 |

AUD 220.8 million allocated for cardiac care upgrades, including valve procedures in public hospitals |

|

Japan |

AMED RMVDT Innovation Grant |

2023 |

¥320.5 billion invested in localized valve R&D and minimally invasive tech |

|

India |

PM Ayushman Bharat Cardiac Surgery Scheme Expansion |

2021 |

INR 13.9 billion allocated for subsidized mitral valve surgeries in tier-2/3 hospitals |

|

South Korea |

National Reimbursement Expansion for Valve Surgeries |

2024 |

14.7% increase in public reimbursement under HIRA for transcatheter mitral procedures |

|

Malaysia |

Public Valve Disease Management Initiative (MOH) |

2023 |

MYR 320.3 million allocated to upgrade catheterization labs and expand screening |

Europe Market Insights

Europe’s rheumatic mitral valve diseases treatment market is projected to hold the market share of 27.8% at a CAGR of 6.3% by 2034. The region is supported by early screening programs, high minimally invasive procedures, and robust public healthcare expenditure. Key Europe economies are making augmented investments for addressing the cardiovascular disease burden, particularly in aging populations. Germany and the UK are the leaders in adopting transcatheter mitral valve therapies because of widespread hospital infrastructure and insurance access via statutory reimbursement. France and Italy are expanding national cardiac care networks through public-private partnerships. Further, initiatives such as Horizon Europe and EU4Health have jointly spent more than €2.8 billion since 2021 on RMVD-related innovation and research aimed at surgical accuracy, integration of digital health, and localized prosthetic valve manufacturing.

Germany holds the largest share in Europe for the rheumatic mitral valve diseases treatment market and is anticipated to hold the market share of 7.2% by 2034. Germany has spent €4.4 billion in 2024 on the rheumatic mitral valve disease treatment, with a 12.4% rise since 2021. The centralized hospital systems and insurance coverage aid in the wide procedural access. Further, the medical device approval process in Germany under the BfArM has fueled the faster adoption of enhanced mitral valve implants, with 25.5% of national cardiac procedures. The national cardiovascular plans by the government include subsidies for telecardiology and training.

Government Investments, Policies & Funding

|

Country |

Initiative / Program Name |

Launch Year |

Description / Budget Allocation |

|

UK |

NHS Long Term Plan-Cardiovascular Expansion |

2021 |

8.4% of NHS budget allocated to RMVDT; £600.6 million invested in TMVR coverage and early screening |

|

France |

National Plan for Valvular Heart Disease (PN-MV) |

2023 |

€2.1 billion allocated over 3 years for diagnostic imaging, surgery, and R&D incentives |

|

Italy |

Integrated Public-Private Valve Replacement Initiative |

2024 |

€850.4 million funding partnership to expand cardiac surgery centers and digital tools in RMVDT |

|

Spain |

Strategic Plan for Rheumatic Heart Disease Management |

2025 |

€600.6 million allocated to public hospitals for valve repair access and rural echocardiographic screening |

Key Rheumatic Mitral Valve Diseases Treatment Market Players:

- Edwards Lifesciences

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Medtronic plc

- Boston Scientific Corporation

- LivaNova PLC

- Terumo Corporation

- MicroPort Scientific Corporation

- JenaValve Technology Inc.

- Sorin Group

- Meril Life Sciences

- Biotronik

- CryoLife Inc. (now Artivion)

- Nipro Corporation

- Jafron Biomedical

- Comed Health

- Vitatron

- Transcatheter Technologies GmbH

- Lepu Medical Technology

- Device Technologies

- Straits Orthopaedics (a member of OSA)

The global rheumatic mitral valve diseases treatment market is highly competitive and dominated by many multinational and regional players such as Edwards Lifesciences, Abbott, and Medtronic. These players dominate the market and collectively hold a share of 25.5%. Further, companies prioritize product innovation, transcatheter mitral valve repair/replacement (TMVR) technologies, and expansion into emerging markets. Manufacturers in Asia are transforming the pricing strategy via affordable and indigenous value solutions. On the other hand, players in Europe focus on clinical trials and CE-certified surgical precision. Further, localized manufacturing and strategic partnerships are the key factors used to expand the market across geolocation.

Below is the list of some prominent players operating in the global rheumatic mitral valve diseases treatment market:

Recent Developments

- In May 2024, Edwards Lifesciences commercially expanded its PASCAL Precision platform to include indications for rheumatic mitral valve disease. The expansion has reported a 12.4% reduction in the mitral regurgitation recurrence.

- In January 2024, Abbott announced the commercial release of MitraClip G5+, an enhanced transcatheter edge-to-edge repair. The launch has contributed to a 9.6% increase in Abbott’s Structural Heart segment revenue.

- Report ID: 3126

- Published Date: Jul 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rheumatic Mitral Valve Diseases Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert