Rare Disease Treatment Market Outlook:

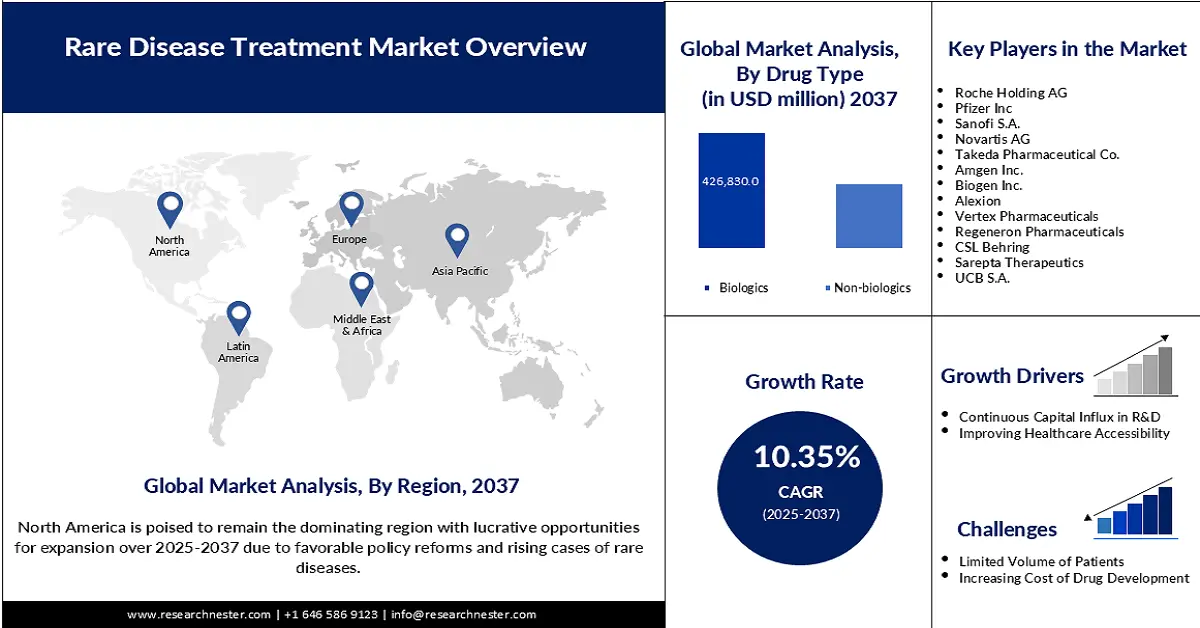

Rare Disease Treatment Market size was USD 232.2 billion in 2024 and is estimated to reach USD 792.8 billion by the end of 2037, expanding at a CAGR of 10.35% during the forecast period, i.e., 2025-2037. In 2025, the industry size of rare disease treatment is assessed at USD 243.1 billion.

The global rare disease treatment market is characterized by a limited yet diverse pool of patients, with more than 300 million people worldwide affected by such ailments in 2024, as reported by the Global Rare Disease Commission (GRDC). In key landscapes, including the U.S., Japan, and Europe, the target demography is quite small, but the cumulative epidemiology continues to grow due to improving diagnostic capacity and heritability of genetic mutations. As a result, approximately 70% of these illnesses appear among children. The wide range of these conditions also fuels demand in this sector, where more than 7,000 types of rare diseases were identified around the globe till 2024, with a potential to exceed 10,000 and 300 new rare genetic disease descriptions being added every year to the principal knowledge bases.

Further, indicating the financial overview of payers’ pricing in the market, the 2022 Institute for Clinical and Economic Review (ICER) unveiled that an annual orphan drug price of USD 100.0 thousand for a limited patient population of 10.0 thousand with these illnesses can earn a USD 1.0 billion yearly revenue. The report further mentioned that the overall cost of treating these conditions per individual often surpasses USD 1.0 million every year, owing to the high pricing of certified orphan drugs and gene & cell therapies. These figures indicate inflation in product and service costs for end-users and consumers, along with the lucrative opportunities from premium-priced pharmaceutical commodities.

Key Rare Disease Treatment Market Insights Summary:

Regional Highlights:

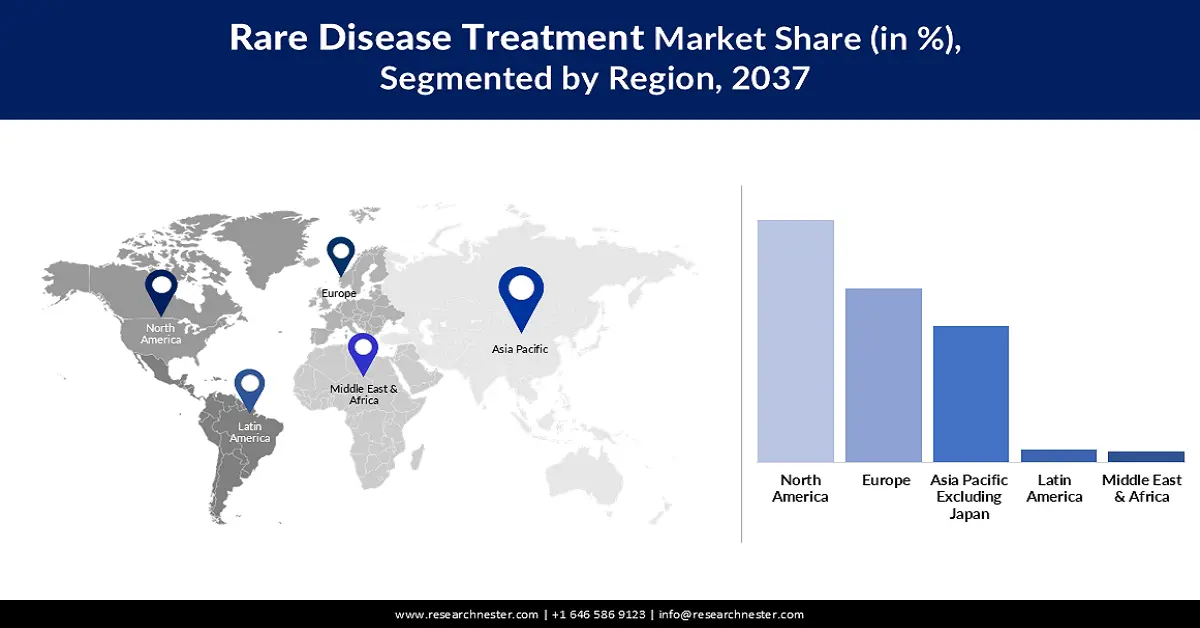

- North America is expected to hold 57.6% share throughout the assessed timeframe, driven by higher rare disease prevalence and supportive government policies.

- Asia Pacific market is projected to register the highest CAGR of 11.5% by 2037, owing to expanding rare disease care capacity and rising healthcare investments.

Segment Insights:

- Biologics segment is projected to account for 53.8% share during the analyzed period, owing to the growing adoption of precision medicine and government-led biosimilar programs.

- Hematologic disorder segment is poised to hold 45.4% revenue share between 2025 and 2037, impelled by high prevalence, mortality rates, and the rising adoption of gene and cell-based therapies.

Key Growth Trends:

- Advances in diagnostics and disease understanding

- Rising investments in R&D and pipeline expansion

Major Challenges:

- Infrastructural and accessibility limitations

- High pricing pressures from payers

Key Players: Roche Holding AG, Novartis AG, Johnson & Johnson, Pfizer Inc., Sanofi S.A., Takeda Pharmaceutical Co., Amgen Inc., Biogen Inc., Alexion, Vertex Pharmaceuticals, Regeneron Pharmaceuticals, CSL Behring, Sarepta Therapeutics, UCB S.A., Ipsen, Chugai Pharmaceutical, Kyowa Kirin, Dr. Reddy’s Laboratories, Samsung Biologics

Global Rare Disease Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 232.2 billion

- 2025 Market Size: USD 243.1 billion

- Projected Market Size: USD 792.8 billion by 2037

- Growth Forecasts: 10.35% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: North America (57.6% Share)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 6 October, 2025

Rare Disease Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Advances in diagnostics and disease understanding: According to a 2025 article from the National Institute of Health (NIH), 80% of distinct rare medical conditions are classified as genetic, where 70% and 3% manifest during childhood and the neonatal period. This displays the important role of the explosive expansion and advances in the genome sequencing industry as a major growth factor in the market. Evidencing the same, in 2022, the NLM published a meta-analysis, highlighting that pooled diagnostic rates from whole-exome sequencing (WES) and whole-genome sequencing (WGS) were higher than conventional methods, accounting for 0.3 and 0.4, respectively, opening new possibilities for previously untreated cases.

Cost Savings from Rapid Genomic Sequencing in Clinical Practice (2022)

|

Country |

Sequencing Method |

Key Outcomes |

|

Australia |

Rapid WES |

USD 408,090 cost-saving from avoided procedures and hospital days |

|

Hong Kong |

Rapid WES |

Reduced 566 hospital days and saved USD 1.03 million |

|

U.S. |

Rapid WGS |

Net cost-saving of USD 128,555 from reduced inpatient days |

Source:NLM

- Rising investments in R&D and pipeline expansion: Both public and private organizations across the globe are heavily investing in extensive research to widen the fields of applications for the existing product portfolios. Every year, more than USD 10 billion is allocated solely to these cohorts worldwide in the rare disease treatment market. On the other hand, the commercial success of innovations induced from these efforts is also marking milestones. Exemplifying the same, the launch of Attruby (acoramidis) for treating transthyretin amyloid cardiomyopathy (ATTR-CM) in November 2024 earned USD 36.7 million in sales for BridgeBio Pharma from the U.S. market alone.

- Increased support from governing authorities: Recent reformation in public and certification governance is assuring future progress and substantial expansion for manufacturers in the market by allocating subsidies, incentives, and fast-tracked approvals. These create a favorable environment for this sector, while preventing financial and brand value losses by saving costs related to time-consuming compliance processes and patent expirations. A notable milestone was achieved in this aspect with the clearance for over 20 gene therapies by the FDA in recent years. For instance, in September 2024, Sanofi gained ODD from the FDA for its Dupixent, treating bullous pemphigoid.

Demographic Patterns in Key Landscapes of the Rare Disease Treatment Market

Overview of Rare Disease (RD) Incidence and Prevalence Across the U.S. (2023)

|

Region/Category |

Estimated Prevalence Rate |

|

Overall U.S. |

1 in every 10 people |

|

Massachusetts |

Affects ~10% of the population |

|

Washington State |

700-800 thousand people acquire RD |

|

Cystic Fibrosis |

0.06% |

|

Ehlers-Danlos Syndrome |

0.15% |

|

Turner Syndrome |

0.02% |

Source: FDA, DOH Washington, and ISPOR

Recent/Ongoing Development projects related to the Rare Disease Treatment Market

Current/Recent/Ongoing Clinical Trials on RD Drugs

|

Drug Name |

Indication |

Sponsor |

Study Phase |

Key Notes |

Timeline |

|

Venglustat |

Gaucher Disease Type 3 |

Sanofi Genzyme |

Phase 3 |

Oral substrate reduction therapy; assessing long-term safety |

Active (Ends 2026) |

|

Hurlerase (vestronidase alfa) |

Mucopolysaccharidosis VII |

Ultragenyx |

Phase 4 |

Enzyme replacement therapy in pediatric patients |

Ongoing since 2023 |

|

Luxturna |

Inherited Retinal Disease |

Spark Therapeutics |

Follow-up/Phase 4 |

Gene therapy for RPE65 mutation-associated retinal dystrophy |

Long-term follow-up ongoing |

|

Elivaldogene autotemcel |

Metachromatic Leukodystrophy |

Orchard Therapeutics |

Phase 3 |

Autologous gene therapy, single infusion |

Active (Completion 2025) |

|

Zynteglo |

Beta-Thalassemia |

Bluebird Bio |

Phase 3/Approved |

Gene therapy, autologous stem cell transduction |

Approved, ongoing studies |

|

Roctavian |

Hemophilia A |

BioMarin |

Phase 3 |

Gene therapy for factor VIII deficiency |

Active (Ends 2026) |

|

Amondys 45 |

Duchenne Muscular Dystrophy |

Sarepta Therapeutics |

Phase 3 |

Exon-skipping antisense oligonucleotide |

Ongoing (2023-2025) |

|

Olipudase alfa |

Acid Sphingomyelinase Deficiency |

Sanofi Genzyme |

Phase 3 |

Enzyme replacement therapy for Niemann-Pick disease |

Recently completed |

|

Libmeldy |

Metachromatic Leukodystrophy |

Orchard Therapeutics |

Phase 2/3 |

Gene therapy; EMA approved, US approval pending |

Ongoing registration |

Source: Clinicaltrials.gov

Challenges

- Infrastructural and accessibility limitations: Several economies, particularly underserved regions, face barriers in availing adequate products and services from the market. Lack of sufficient resources, infrastructure, standardization protocols, and diagnostic capabilities collectively impose gaps in patient access, which ultimately leads to limited adoption in this sector. Underscoring the same issue, the ICER report revealed that 90% of afflicted cases were lacking disease-specific FDA-approved treatment till 2022.

- High pricing pressures from payers: A 2024 NLM study marked Zolgensma for treating spinal muscular atrophy (SMA) as a premium-priced therapeutic due to its USD 2.1 million per-dose cost. As a result, a notable proportion of payers tend to impose strict pricing controls on such high pricing and often exclude these options from their reimbursement coverage plans. It not only makes the rate of affordability and uptake in the rare disease treatment market poorer but also shrinks the scope of profitability for advanced therapy manufacturers.

Rare Disease Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

10.35% |

|

Base Year Market Size (2024) |

USD 232.2 billion |

|

Forecast Year Market Size (2037) |

USD 792.8 billion |

|

Regional Scope |

|

Rare Disease Treatment Market Segmentation:

Drug Type Segment Analysis

The biologics segment is expected to account for the largest share of 53.8% in the market during the analyzed period. The leadership is primarily attributed to the growing popularity of precision medicine in cases of hard-to-treat conditions. Besides, as a part of this category, biosimilars are becoming eligible candidates for government-led programs promoting affordability, making them widely accepted and commercialized assets for this sector. Moreover, the segment’s reputation in being the gold standard for compliance can be exemplified by the FDA’s approval of Bkemv and Soliris as interchangeable biosimilars for rare conditions in May 2024.

Diseases Segment Analysis

The hematologic disorder segment in the market is poised to hold the highest revenue share of 45.4% between 2025 and 2037. High prevalence and mortality rates of these ailments, such as sickle cell, hemophilia, and paroxysmal nocturnal hemoglobinuria, particularly among children, are the major growth factors behind the dominance. According to a Global Burden of Disease (GBD) study, the number of total births of babies and people living with sickle cell disease increased by 13·7% and 41·4% in the world from 2000 to 2021. On the other hand, the clinically proven efficacy of gene and cell-based therapies attracts greater capital allocation to the development of novel drugs for this medical discipline.

Patient Segment Analysis

The pediatric age group is predicted to be the leading patient segment in the market by the end of 2037, while acquiring a share of 67.9%. As per a 2023 publication from the Journal of Pediatric Nursing, 50-75% of all RDs occur among children. Besides, another NLM finding from the same year revealed that age-specific deaths from sickle cell disease accounted for 81,100 among children younger than 5 years from 2000 to 2021, which was higher in comparison to cause-specific mortality. These figures highlight the reason behind the sector’s major activity being concentrated in this segment, solidifying its forefront position in the sector.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Drug Type |

|

|

Diseases |

|

|

Patient |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rare Disease Treatment Market - Regional Analysis

North America Market Insights

North America is expected to dominate the market with a share of 57.6% throughout the assessed timeframe. Higher RD occurrence compared to other Pacific regions is the major growth factor in this landscape. The presence of leading companies and supportive government policies is also a driving asset for the region in this sector. As evidence of such support, a 2024 FDA report highlighted the beneficiaries and positive impact of the Orphan Drug Act on future drug development for rare diseases in the U.S. market. It enables up to USD 3.0 million waiver of the prescription drug user fee and 7 years of extensive market exclusivity for new drugs approved by the FDA.

The rising patient pool in the U.S. necessitates development and manufacturing capacity expansion in the rare disease treatment market. This can be testified by the 2024 FDA report, mentioning that the count of people suffering from RDs reached 30 million in the country. In addition, the U.S. is home to an advanced medical system that offers adequate infrastructure to avail next-generation diagnostic tools and services, thereby fueling the expansion in the region. Moreover, timely product approvals, the emergence of CRISPR-based therapies, and high public awareness in the U.S. are fueling the sector.

Approximately 1 in 12 individuals in Canada is affected by a rare disease, resulting in an urgent need for effective treatments and preventive measures. On the other hand, to combat the access gap, in 2023, the governing body of the country launched the National Strategy for High-Cost Drugs for Rare Diseases that subsidizes medicine purchases, which secures affordability for afflicted patients and profitability for manufacturers at the same time. Moreover, the drugs available in the market account for around one-tenth of pharmaceutical sales in Canada, reflecting the presence of a favorable landscape.

Asia Pacific Market Insights

Asia Pacific market is expected to register the highest CAGR of 11.5% by the end of 2037. Such a pace of growth in this sector is largely attributed to a high focus on expanding the rare disease care capacity and rising public and private healthcare investments. Particularly, in China, India, Vietnam, and Indonesia, the increased tendency to produce maximum biologics volume is fueling the sector remarkably in APAC. Moreover, streamlining clinical trials and updated regulatory pathways are allowing massive commercialization of early therapeutic options to combat mortality from disease progression.

Japan is one of the most popular innovation hubs and a demanding consumer base within the APAC market. The country’s growing emphasis on precision medicine and ambitious goal to overcome its drug loss state is prompting allocation of a robust healthcare budget to this category. The government's efforts to empower this cohort can further be testified by the policies of the Orphan Drug System, which provides 10-year market exclusivity, R&D subsidies covering 50% of clinical trial costs, and a 6-month faster review than standard medicines.

In China, the market is augmenting steadily with the rising number of rare disease cases and the presence of a centralized healthcare system. Besides, the improvements in compliance acquisition processes during the past few years are attracting large-scale investment and greater participation from both domestic and foreign companies in this sector. As evidence, the 2017 regulatory reforms in China attracted more than 50 multinational rare disease drug launches, inspired by the increase in orphan drug approvals in 2022, from 3 annually pre-reform to 30+.

Feasible Opportunities in Key Landscapes

|

Country |

Key Notes |

|

South Korea |

100% reimbursement for 167 designated rare diseases |

|

Japan |

Allocated 4% of the national health budget to intractable disease research |

|

India |

A patient population of 70 million, with only 5% properly diagnosed |

Source: Research Nester Report

Europe Market Insights

The rare disease treatment market in Europe is anticipated to account for a prominent position between 2025 and 2037. The well-structured reimbursement frameworks and regulatory incentives are the primary growth factors in this sector, fueling the region’s consistent expansion. With a 36.0 million RD patient pool, the landscape is also fostering an attractive business environment for the merchandise, as per the 2025 report from the European Parliament. Furthermore, the government efforts benefiting the market include the launch of the European Rare Diseases Research Alliance (ERDERA) in October 2024, funding research in prevention, diagnosis, and treatment of RD with USD 447.3 million until 2031.

In Germany, the market is expected to lead the Europe territory on account of its robust healthcare infrastructure that caters to the rising number of patients. The country also has a large network of specialized centers, including the ACHSE, which supports early diagnosis, treatment and patient care. Moreover, with rising focus on developing advanced drugs and next-generation biologics, the country is expected to expand in this sector at a rapid pace in the coming years.

The rare disease treatment market in France is largely driven by HAS and solidarity‑budget allocation. Nationwide efforts to strengthen the existing healthcare facilities for early intervention and diagnosis are also creating a lucrative surge in this field. In the coming years, the increasing public and private investments in gene and cell therapies are expected to reshape the existing pipelines in the country, while attracting more global investors to engage their resources in this landscape.

Feasible Opportunities for the Market

|

Initiative |

Key Notes |

Timeline |

|

European Reference Networks (ERNs) |

1,619 specialised centres located in 382 hospitals, to tackle rare, low-prevalence and complex diseases and conditions requiring highly specialised healthcare |

2017-2024 |

|

Joint Action on the Integration of Erns into National Healthcare Systems (JARDIN) |

Received USD 17.6 million from the EU4Health programme and USD 4.4 million from the EU Member States to facilitate greater patient access |

2024-2027 |

|

Clinical Patients Management System 2.0 |

The European Commission launched a new IT platform to offer better support to the ERNs, reducing the need for patient travel |

2024 |

Source: European Parliament

Key Rare Disease Treatment Market Players:

- Roche Holding AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Johnson & Johnson

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Co.

- Amgen Inc.

- Biogen Inc.

- Alexion

- Vertex Pharmaceuticals

- Regeneron Pharmaceuticals

- CSL Behring

- Sarepta Therapeutics

- UCB S.A.

- Ipsen

- Chugai Pharmaceutical

- Kyowa Kirin

- Dr. Reddy’s Laboratories

- Samsung Biologics

The global rare disease treatment market is highly consolidated, with several biopharmaceutical giants like Pfizer, Roche, Takeda, and Sanofi controlling a notable share of the market. These companies are highly focused on strengthening their portfolios in this category through the acquisition of orphan drug designations, innovation in gene and cell therapy, and strategic expansion in regional territories to maintain their dominance over the net revenue generation in this sector. On the other hand, several key players from Asia Pacific are debuting via biosimilar pathways and public-private partnerships.

Here is a list of key players operating in the market:

Recent Developments

- In September 2025, Alexion announced that Koselugo (selumetinib) earned a recommendation for approval in the European Union (EU) for the treatment of symptomatic, inoperable plexiform neurofibromas (PN) in adult patients with neurofibromatosis type 1 (NF1).

- In June 2025, CSL Behring received FDA approval for Andembry, the first prophylactic treatment targeting Factor XIIa for hereditary angioedema (HAE), offering once-monthly dosing for patients aged 12 and above. Its novel mechanism, supported by rigorous clinical trials, positions it as a transformative option in the competitive market.

- Report ID: 6667

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rare Disease Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.