Motor Neuron Disease Treatment Market Outlook:

Motor Neuron Disease Treatment Market size was over USD 11.02 billion in 2025 and is anticipated to cross USD 19.37 billion by 2035, witnessing more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of motor neuron disease treatment is estimated at USD 11.6 billion.

The growth of the market can majorly be attributed to the growing incidences of persistent sicknesses across the globe, and developing stages of recognition approximately motor neuron sicknesses. The worldwide common occurrence price of amyotrophic lateral sclerosis (ALS), which is a motor neuron disorder, is set 1 in 50,000 humans every year, i.e., about 5,500 to 6,500 new diagnoses each year.

Along with these, growing technological improvements in scientific science, especially in evolved and growing countries is highly anticipated to boost market growth over the projected years. Furthermore, persisted environmental publicity to pollutants in administrative center and home, and excessive intake of narcotic materials also are vital elements that cause motor neuron sicknesses in humans. This in turn is projected to provide sufficient increase possibilities over the projected years. Motor neuron disease (MND) is a rare condition that affects the brain and nerves. It causes weakness that gets worse over time. There is no cure for MND, but there are treatments that can help reduce the impact on your daily life. Some people live with the disease for years. MND is generally believed to be caused by a combination of environmental, lifestyle, and genetic factors. Most cases of MND develop without an apparent cause. About 1 in 10 of the cases is "familial," meaning the condition is hereditary. This is owing to genetic mutations or genetic errors.

Key Motor Neuron Disease Treatment Market Insights Summary:

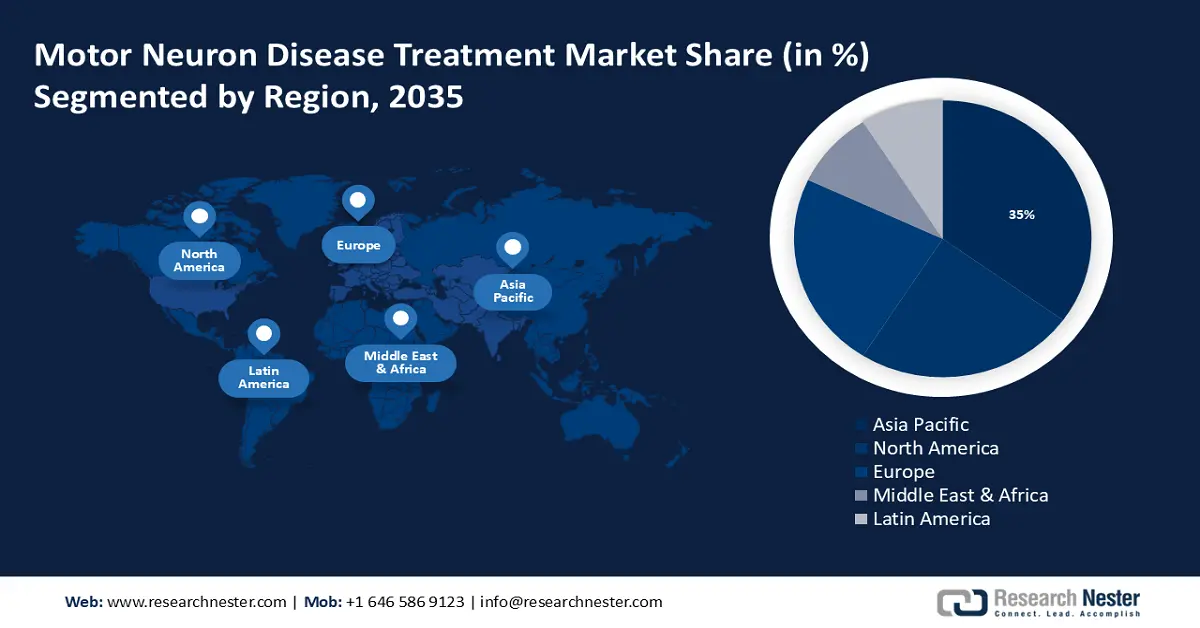

Regional Insights:

- By 2035, the Asia Pacific region is set to command a 35% share in the motor neuron disease treatment market, underpinned by expanding patient volumes and strengthened medical infrastructure.

- By 2035, North America is expected to secure about 24% share, supported by rising healthcare expenditures and extensive reimbursement systems.

Segmental Insights:

- By 2035, the hospitals segment in the motor neuron disease treatment market is projected to secure about 35% share, supported by the rising patient volume requiring specialized motor neuron care.

- The edaravone segment is anticipated to account for nearly 30% share by 2035, bolstered by the increasing incidence of amyotrophic lateral sclerosis (ALS).

Key Growth Trends:

- Spiking Geriatric Population

- Rising Prevalence of Diabetes

Major Challenges:

- High Cost of Motor Neuron Treatment

- Low awareness of treatments among people in low and middle income countries

Key Players: European Technologies Inc., Conscientia Industrial Co., Ltd, CSNpharm, Inc., Aozeal Certified Standards (AOCS), Inc., Finetech Industry Limited, Skyrun Industrial Co., Ltd., Santa Cruz Biotechnology, Inc., Amadis Chemical Company Limited, Mitsubishi Tanabe America, Inc., Aquesituve Therapeutics.

Global Motor Neuron Disease Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.02 billion

- 2026 Market Size: USD 11.6 billion

- Projected Market Size: USD 19.37 billion by 2035

- Growth Forecasts: 5.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 20 November, 2025

Motor Neuron Disease Treatment Market - Growth Drivers and Challenges

Growth Drivers

-

Spiking Geriatric Population – The elderly are one of the most vulnerable patient groups requiring motor neuron disease treatment. Therefore, increasing geriatric population worldwide is regarded as a major factor driving the growth of the market. According to the United Nations Department of Economic and Social Affairs' World Population Aging 2020 report, the number of people aged 65 and over worldwide in the year 2020 is estimated at 727 million. Hence, spiking aged population across the globe is estimated to be an important factor to drive the growth of the global motor neuron disease treatment market.

-

Rising Prevalence of Diabetes – Diabetes, which is a chronic disease, is one of the most prevalent diseases across the globe. Diabetes damages many organs in the body, including the eyes, nerves, brain, kidneys, heart, and blood vessels. Rise in adults with chronic disease and diabetes is expected to increase the demand for motor neuron disease treatment during the forecast period. For instance, in the year 2021 it was noted that more than 530 million adults have diabetes, which is expected to rise to about 640 million by the year 2030. Hence, this is also expected to be a major factor to add to the growth of the global market.

-

Rise in Research Spending – Growth in the global market during the forecast period can be further attributed to increased investment in research and development activities to continuously find more viable solutions for motor neuron disease treatment. Research reports show that global R&D spending has more than tripled in real terms since 2000, rising from about USD 680 billion to more than USD 2.5 trillion in the year 2019.

-

Rising Healthcare Spending – According to the latest spending data, global healthcare spending has increased over the past two decades, effectively doubling from 8.5% in 2000 to USD 8.5 trillion in the year 2019, increasing GDP reached 9.8%. The boom will continue during the forecast period.

-

Growing Incidences of Spinal Cord Injuries – It is expected that patients with chronic illnesses and disabilities, including spinal cord injuries, experience motor neuron diseases more severely, which is anticipated to drive the market growth. It was discovered that between 300,000 and 500,000 people worldwide experience spinal cord injuries every year.

Challenges

- High Cost of Motor Neuron Treatment

- Low awareness of treatments among people in low and middle-income countries

- Lack of reimbursement policies for motor neuron disease treatment in some countries

Motor Neuron Disease Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 11.02 billion |

|

Forecast Year Market Size (2035) |

USD 19.37 billion |

|

Regional Scope |

|

Motor Neuron Disease Treatment Market Segmentation:

End-user Segment Analysis

The global motor neuron disease treatment market is segmented and analyzed for demand and supply by end user into multidisciplinary clinics, hospitals, social work facilities, and others. Out of the four types of applications, the hospitals segment is estimated to gain the largest market share of about 35% in the year 2035. The growth of the segment can be accredited to the large number of patients requiring treatment for motor neuron conditions. The hospitals are also growing rapidly in number, which is estimated to positively influence the segmental growth. For instance, by the year 2022 there was noted to be approximately 6,100 hospitals in the United States. Hospitals provide a wide range of medical care. Physicians, called hospital doctors, typically specialize in internal medicine, pediatrics, or general practice. They have the knowledge to solve common problems and the resources to solve more complex medical problems. Hospitals may also offer specialized care, such as neurology, obstetrics and gynecology, and oncology.

Drug Class Segment Analysis

The global motor neuron disease treatment market is also segmented and analyzed for demand and supply by drug class into riluzole, and edaravone. Amongst these two segments, the edaravone segment is expected to garner a significant share of around 30% in the year 2035. In clinical trials, riluzole appears to prolong life in the early stages of ALS, whereas edaravone only appears to slow the progression of symptoms. According to a JAMA Neurology study published online January 10, 2022, edaravone is well tolerated as an add-on therapy to riluzole, but has additional clinical implications for patients with amyotrophic lateral sclerosis (ALS). Exservan (riluzole) and Radicava (edaravone injection) are used to treat amyotrophic lateral sclerosis (ALS). Exservan and Radicava belong to different drug classes. Exservan is in the benzothiazole class of drugs and Radicava is a central nervous system drug. Increased incidence of amyotrophic lateral sclerosis (ALS) is anticipated to boost the segmental growth. According to a study published in the Centers for Disease Control and Prevention, approximately 15,000 people were diagnosed with ALS in the United States in the year 2019, and the ALS prevalence was 4.9 per 100,000 people in 2015.

Our in-depth analysis of the global market includes the following segments:

|

By End User |

|

|

By Drug Class |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Motor Neuron Disease Treatment Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 35% by 2035, The regional growth can majorly be attributed to the large number of patients and an increase in government support to strengthen the medical infrastructure in the region. The number of beds per 1,000 in China in the year 2017 averaged 4.31, up from 4.02 in the year 2016, according to The World Bank data. In addition, growth of the market in this region is also attributed to the steady increase in the elderly population across the region. Elderly people are prone to motor neuron diseases. The Asia-Pacific population is aging faster than anywhere else is in the world. Sixty percent of the world's total elderly population live in the Asia Pacific region. The region's elderly population is expected to reach 1.3 billion by 2050. Moreover, the government's role in raising awareness regarding the motor neuron diseases is expected to spur market growth in the region.

North American Market Insights

The motor neuron disease treatment in the North America region, amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market in this region can primarily be attributed to the offsetting of the high level of healthcare costs and the availability of reimbursement services from healthcare providers. According to the Centers for Medicare & Medicaid Services, the National Health Expenditure (NHE) was noted to increase by up to 9.7% to about USD 4.1 trillion in the year 2020, which is its 19.7% of the gross domestic product (GDP) of the United States. Moreover, the strong presence of prominent market players is expected to support market growth in the region in the coming years. Amyotrophic lateral sclerosis (ALS) is the most common form of MND. MND occurs when specialized nerve cells in the brain and spinal cord called motor neurons stop working properly and die prematurely. This is called neurodegeneration. Various types of MND cause similar symptoms, and there are three stages: Beginner, Intermediate, Advanced. The disease progresses at different rates and has varying degrees of severity. Motor neuron disease (MND) is a rare condition that affects the brain and nerves. It causes weakness that gets worse over time. There is no cure for MND, but there are treatments that can help reduce the impact on your daily life.

Europe Market Insights

Further, the motor neuron disease treatment in the Europe region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the presence of major key players in the regional market. In Europe, the motor neuron disease treatment market is relatively small due to the low prevalence of the disease. However, there are several companies that are working on developing new treatments for the disease, including biotech companies and pharmaceutical companies. Some of the companies that are involved in the motor neuron disease treatment market in Europe include Biogen, Mitsubishi Tanabe Pharma, and Sanofi. In addition to drug development, there is also ongoing research in Europe aimed at understanding the underlying mechanisms of motor neuron disease and identifying potential targets for future treatments. Clinical trials are also being conducted to test the safety and efficacy of new treatments for the disease. Overall, the motor neuron disease treatment market in Europe is expected to grow over the forecast period as more research is conducted and new treatments are developed.

Motor Neuron Disease Treatment Market Players:

- European Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Conscientia Industrial Co., Ltd

- CSNpharm, Inc.

- Aozeal Certified Standards (AOCS), Inc.

- Finetech Industry Limited

- Skyrun Industrial Co., Ltd.

- Santa Cruz Biotechnology, Inc.

- Amadis Chemical Company Limited

- Mitsubishi Tanabe America, Inc.

- Aquesituve Therapeutics

Recent Developments

-

Mitsubishi Tanabe Pharma America, Inc. announced that EXSERVAN, the first oral film formulation of riluzole, is now available in the United States for the treatment of amyotrophic lateral sclerosis (ALS).

-

Aquestive Therapeutics has granted Zambon Pharma a license to develop and commercialize an investigational oral formulation of riluzole for the treatment of ALS in the European Union.

- Report ID: 3781

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.