Retail Logistics Market Outlook:

Retail Logistics Market size was over USD 337.45 billion in 2025 and is projected to reach USD 1.18 trillion by 2035, growing at around 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of retail logistics is evaluated at USD 377.84 billion.

The rise in e-commerce has significantly shaped the retail logistics landscape. Consumers prefer the convenience of selecting products from extensive catalogs over online retail platforms. This has driven the demand for efficient inventory management, order fulfillment, and last-mile delivery services. According to the 2022 study by the World Trade Organization, the global commerce volume and value have increased at an average rate of 4% and 6% respectively from 1995-2022. Furthermore, the demand for quick-service delivery has implored companies to build sophisticated warehouse and logistics infrastructure. The establishment of micro-fulfilling centers is facilitating retailers to stay competitive in the rapidly evolving e-commerce sector.

Key Retail Logistics Market Insights Summary:

Regional Highlights:

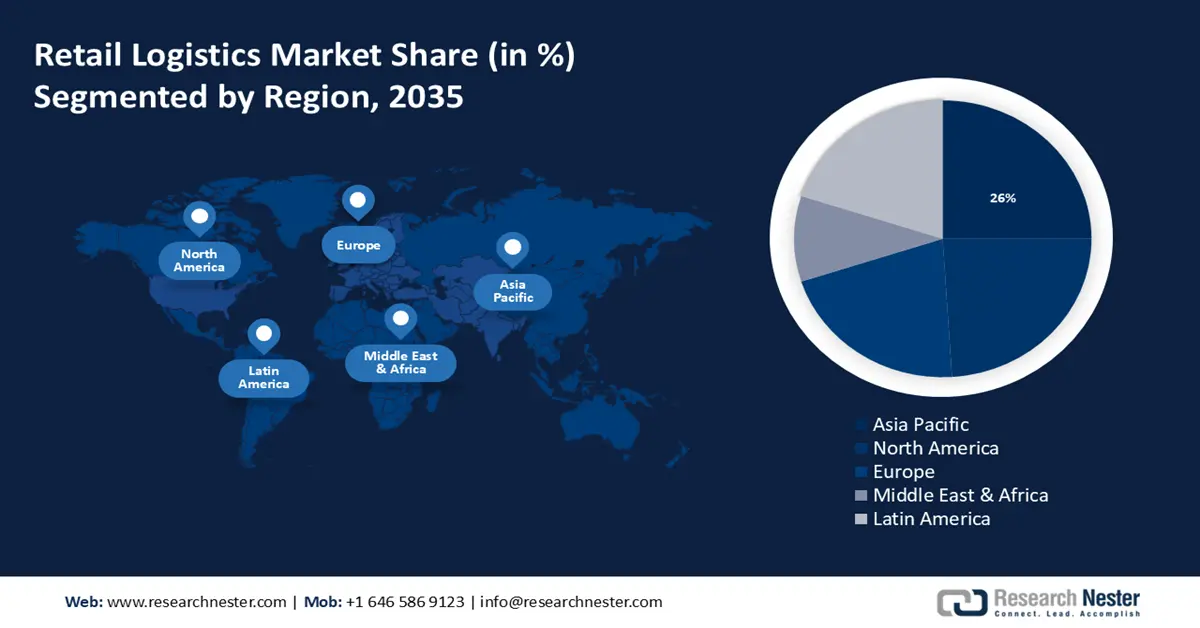

- The Asia Pacific retail logistics market achieves a 26% share by 2035, driven by rising e-commerce penetration and growing retail businesses in countries like China and India.

- The North America market will register significant growth during the forecast timeline, driven by rising disposable income and booming food and beverage logistics sector.

Segment Insights:

- The roadways segment in the retail logistics market is anticipated to see substantial growth till 2035, attributed to rising demand for long-distance transport and improvements in road infrastructure.

- The supply chain solutions segment in the retail logistics market is expected to secure a 34.60% share by 2035, fueled by benefits such as timely delivery, omnichannel optimization, and effective returns handling.

Key Growth Trends:

- Growing advancement in AI & big data analytics

- Adoption of sustainable multimodal transportation

Major Challenges:

- Growing supply chain disruptions

- Fluctuations in the price of logistics transportation

Key Players: DHL Supply Chain, XPO Logistics, Inc., United Parcel Service, Inc. (UPS), FedEx Corporation, Kuehne+Nagel International AG, C.H. Robinson Worldwide, Inc., DB Schenker, Nippon Express Co., Ltd., Ryder System, Inc., CEVA Logistics.

Global Retail Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 337.45 billion

- 2026 Market Size: USD 377.84 billion

- Projected Market Size: USD 1.18 trillion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (26% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Indonesia, Thailand, Malaysia

Last updated on : 17 September, 2025

Retail Logistics Market Growth Drivers and Challenges:

Growth Drivers

- Growing advancement in AI & big data analytics - The integration of AI and big data analytics in the industry has fostered the automated real-time assessment of traffic patterns, goods transportation capabilities, consumer preferences, and delivery schedules. These technologies enable merchants to cut down on operation costs. Companies such as Oracle, Koerber, Manhattan Associates, and Blue Yonder, are leveraging AI-powered Software-as-a-Services (SaaS) to offer efficient supply chain execution systems. In March 2024, Walmart Commerce Technologies introduced Route Optimization SaaS software solution that provides local fulfillment including pickup, shipping, and delivery.

Machine learning (ML) facilitates predictive analysis of upcoming product demand, calculates lead time, and ensures informed decision-making in a fast-paced retail logistics environment. AWS Supply Chain, Microsoft Supply Chain Platform, Google Cloud Vertex, and IBM Watson are some of the available ML-based supply chain management (SCM) tools in the market. These tools help retailers optimize their net working capital deployment, and develop better customer experiences. Consequently, the retail logistics market is expected to experience an upswing over the forecast year. - Adoption of sustainable multimodal transportation - The utilization of multimodal transportation such as road, rail, water, and air, simplifies customs processes, reduces carbon emissions, and lowers cargo processing time. As per 2023 research, multimodal transportation is predicted to reduce carbon emissions by about 29% in contrast to single-mode transportation.

Big-box retailers are broadening their transportation channels to lower their carbon footprint. For instance, in March 2023, IKEA partnered with KLOG, to create a long-distance block train intended for the Poland-Spain-Poland corridor. This eliminated the need for 4,500 trucks and lowered CO2 emissions by 5,100 tons per year. Hence, the trend of multimodal transport systems is growing in retail logistics to achieve the target of net zero. - Rise in disposable income among the middle-class population - With the improving standard of living, the expenditure on discretionary purchases including home furnishings, clothing, electronics, and luxury items has increased. The rising middle-class population in developing countries provides a tailwind for the trading sector. According to the National Institutes of Health (NIH), the number of middle-class households in China increased from 270 to 490 million from 2013 to 2019. Thus, growing buying capabilities is fostering market expansion.

Challenges

- Growing supply chain disruptions - The market is anticipated to be hindered by operational inefficiency in logistics. A successful supply chain is constructed and operated by optimizing resources, lowering inventory, facilitating greater cooperation and interaction between external and internal stakeholders, and speeding product cycle time.

Achieving enough operational efficiency can be difficult in retail supply chains since they lack transparency across key business units. Furthermore, the suppliers must use the newest business resource planning software in place of traditional spreadsheets. As a result, it is anticipated that supply chain interruptions will restrict market expansion. - Fluctuations in the price of logistics transportation - As the fuel prices keep fluctuating, it affects the overall logistics expenses. Thus, managing this kind of expense is a crucial concern for logistics businesses, as it will negatively impact the demand for retail logistics.

Retail Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 337.45 billion |

|

Forecast Year Market Size (2035) |

USD 1.18 trillion |

|

Regional Scope |

|

Retail Logistics Market Segmentation:

Solution Segment Analysis

Supply chain solutions segment is set to capture over 34.6% retail logistics market share by 2035. The segment's substantial expansion is primarily due to its beneficial characteristics, such as timely delivery, omnichannel operations optimization, uncompromised product handling, and effective handling of client returns.

Furthermore, the growing adoption of cloud is also evaluated to boost segment expansion. Research Nester reported that in 2021, close to 39% of supply chain companies adopted the cloud in 2021 across the globe, whereas about 85% were strategizing to deploy the cloud in the coming five years.

Mode of Transportation Segment Analysis

By 2035, roadways segment is anticipated to dominate over 50.1% retail logistics market share. This segment's rapid growth is attributed to the rising need for long-distance road transport. In addition, several government initiatives are aiding the development of the condition of national and international highways. For instance, the U.S. Federal Highway Administration in November 2021, implemented the Infrastructure Investment and Jobs Act (IIJA). Consequently, this is estimated to improve road connectivity, which is additionally projected to improve logistics.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Solution |

|

|

Mode of Transport |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Retail Logistics Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 26% by 2035. The market in this region is also projected to account for the highest revenue share of 25.9% during the forecast period owing to the penetration of e-commerce in China, India, and South Korea.

Additionally, the China market for retail logistics is poised to gather the highest growth over the projected period. This market growth is set to be influenced by the growth of several retail businesses in this region.

Furthermore, the market in India is also predicted to rise on account of the growing exportation of goods through waterways.

Moreover, the Japan market for retail logistics is set to see notable growth in the market from 2024 to 2035. This is driven by increasing spending on advanced technologies.

North American Market Insights

The North America market for retail logistics is also poised to have significant growth in its revenue during the forecast timeline. The growth of the market in this region is set to be dominated by rising disposable income, followed by an improving standard of living. According to the U.S. Bureau of Economic Analysis, the discretional income in the United States increased in March to approximately USD 20882 billion from over USD 20718 billion in February of 2024.

Additionally, the U.S. market for retail logistics is also set to rise in the upcoming years. The major factor driving market expansion in this nation is the surging food & beverage sector.

Moreover, with the rising penetration of unmanned vehicle drones the market in Canada is predicted to influence the market expansion over the forecast timeframe.

Retail Logistics Market Players:

- Schenker AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- A.P. Moller - Maersk

- APL Logistics Ltd

- C.H. Robinson Worldwide, Inc.

- DHL International GmbH

- DSV

- CJ Logistics Corporation

- United Parcel Service of America, Inc.

- XP, Inc.

The retail logistics market’s key players are launching various services in the market to satisfy the customer's needs. Moreover, they are collaborating with major companies who are professionals in the field of technology to enhance their services. Some of the key players include:

Recent Developments

- December 21, 2023: Schenker AG India has signed an MoU with Container Corporation of India (CONCOR) to work together on EXIM and domestic business, with a focus on sustainability.

- January 11, 2024: IBM Corporation announced its partnership with SAP to create technologies for assisting clients in the consumer-packaged goods and retail industries to optimize their supply chain, finance operations, sales, and services with generative AI.

- April 1, 2019: Panasonic Corporation and JDA Software, Inc. signed a partnership between JDA Japan and Panasonic to broaden sales of the companies' collaborative solutions in Japan's manufacturing, logistics, and retail industries.

- Report ID: 6257

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Retail Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.