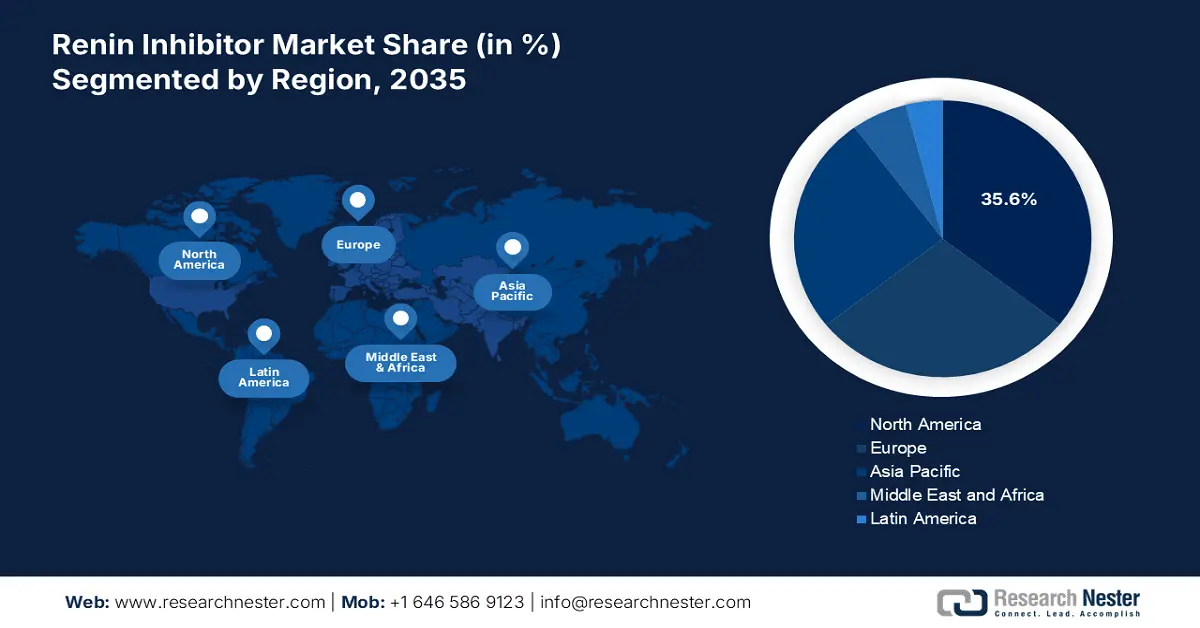

Renin Inhibitor Market - Regional Analysis

North America Market Insights

The renin inhibitor market of North America is the leading region and is projected to acquire a global market share of 35.6% by 2035. Demographic switch in North America results in the growth of an aging population, which has raised the hypertension cases and created demand for renin inhibitors. A significant trend is the shift towards personalized medicine, guided by genetic biomarkers to optimize patient selection for renin inhibitor therapy. Approval of clearance through the Food and Drug Administration led to early adoption of combo therapies in the North American market.

The U.S. market of renin inhibitors dominates in the North America region. The key driver fueling the market is the high burden of cardiovascular disease. As per the Million Hearts report in May 2023, nearly 119.9 million people in the U.S. have hypertension. A trend is the incorporation of real-world evidence (RWE) into regulatory and reimbursement decisions. The allocation of the health budget to the development of renin inhibitors created a market demand growth. Availability of advanced healthcare infrastructure and adoption of telehealth integration are currently in market trends. This resulted in an acceleration in adherence to the use of renin inhibitors through the prescription of tele-healthcare.

In Canada, the renin inhibitor market is shaped by a publicly-funded healthcare system and the Patented Medicine Prices Review Board, which is used to regulate the drug prices. The prevalence of hypertension among people in Canada is 1 in 4, which is considered the major driver fueling the market, as per the NLM study in May 2025. Further, the primary trend is the province-by-province formulary management, where bodies like the pan-Canadian Pharmaceutical Alliance negotiate prices for public coverage. Data from CIHI shows that spending on prescribed drugs continues to rise, increasing pressure for cost-effective therapies.

Prevalence of Hypertension in U.S. and Canada

|

Country |

Estimated Prevalence (%) |

Official Definition Used |

Notes / Trends |

|

U.S. |

Nearly 50% [119.9M adults] |

≥130/80 mm Hg |

Prevalence has increased due to the updated, lower BP threshold |

|

U.S. |

1.56 billion in 2025 |

≥140/90 mm Hg (older standard) |

Prevalence lower with old threshold; increased awareness rates |

|

Canada |

23% from 2023-2024 |

≥140/90 mm Hg |

Recent slight increases, declining control rates among women |

|

Canada |

1 in 4 adults |

≥140/90 mm Hg |

1 in 4 adults, linked to rising obesity and aging population |

|

Canada |

19.5% from 2007–2010 |

≥140/90 mm Hg |

Historically lower prevalence than US and England |

Source: Million Hearts May 2023, NLM August 2013, NLM May 2024, CMA Impact Inc. 2025,

Asia Pacific Market Insights

The APAC is the fastest growing region in the global renin inhibitor market and is poised to accumulate a global market share by 2035. The government investment expanded at a rapid scale to develop the healthcare infrastructure and introduce modernization. This initiated a larger number of government-led screenings, which raised the number of new cases included for hypertension. Accumulation of huge raw material for the production of renin inhibitors made Asia Pacific eligible to deliver the product at an affordable price range. Boom with local manufacturing expanded the market of renin inhibitors in the Asia Pacific.

China holds the largest renin inhibitor market in the Asia Pacific. As per the report of the NLM study in August 2025 depicts that the prevalence of hypertension people is 31.6% in China 2021 to 2022. The growing aging population is one of the significant drivers to leverage the demand for renin inhibitors. This raised the scope of advanced therapy using renin inhibitors and accelerated the demand for the market. The National Medical Products Administration of China approved twelve new local renin inhibitors in 2024 that gained high market adoption.

The renin inhibitors market in India is also expanding rapidly and the market is driven by the low-cost generics, making therapies more accessible to a wide population. The National Health Mission’s budget for non-communicable diseases, which includes hypertension, has grown substantially. According to the WHO report in May 2023, 75 million people are with hypertension and diabetes on standard care. This large-scale screening program is accelerating awareness, early diagnosis, and demand for affordable treatment options nationwide.

Prevalence of Hypertension in Indian Adults

|

Category |

Aware (%) |

On Treatment (%) |

Under Control (%) |

|

Total |

34.3 |

13.7 |

7.8 |

|

Male |

26.6 |

12.1 |

5.9 |

|

Female |

45.9 |

16.1 |

10.8 |

Source: NLM September 2023

Europe Market Insights

The renin inhibitor market in Europe is a stable but mature segment, with a high level of regulatory control by the European Medicines Agency (EMA) and well-established, but tightly budgeted, national healthcare systems. Key drivers such as high incidence of hypertension and cardiovascular disorders are the drivers for market growth, which are also associated with an aging population throughout the region. Yet it is softened by aggressive pressure from health technology assessment (HTA) agencies, like NICE in the UK and IQWiG in Germany, requiring strong cost-effectiveness data for reimbursement.

The UK renin inhibitor market is highly influenced by the National Institute for Health and Care Excellence (NICE) guidance. The market is also propelled by the increasing prevalence of hypertension, diabetes, and cardiovascular disease across the nation. According to the NHS report of May 2023, almost 60% of individuals over the age of 65 have hypertension. The NHS England budget for cardiovascular disease prevention is substantial, though specific allocation to a single drug class like renin inhibitors is not publicly detailed. The UK life sciences industry spends heavily on cardiovascular R&D, the Association of the British Pharmaceutical Industry (ABPI) reports.

Germany holds the largest renin inhibitor market in Europe based on the country's comparatively swift drug acceptance process and robust public health insurance infrastructure. The Federal Ministry of Health (BMG) operates a healthcare system with appreciable expenditure on pharmaceuticals. Although an exact figure for renin inhibitors is not available, the German Medical Association (BÄK) indicates cardiovascular diseases as the primary cause of death, with this in turn guaranteeing continued demand. For instance, the number of approved clinical trials for new antihypertensive combinations remains stable according to the German Institute for Drugs and Medical Devices (BfArM) database, which suggests continuous innovation and investment within the therapeutic class.