Renin Inhibitor Market Outlook:

Renin Inhibitor Market size was valued at USD 1.5 billion in 2025 and is projected to reach USD 3.7 billion by the end of 2035, rising at a CAGR of 9.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the renin inhibitor is estimated at USD 1.6 billion.

Hypertension has turned into an epidemic and is primarily addressed in adults worldwide. According to the study of the World Health Organization, over 1.4 billion adults suffer from hypertension, of which many people are unaware of their situation, creating a demand for renin inhibitors. Antihypertensive therapy is the most efficient intervention strategy to deal with the health risk and implications of renin inhibitors, including aliskiren is most suitable. Demographic switch led to a rise in the aging population and increased the chances of cardiovascular health risk, which significantly uplifts the demand for renin inhibitors.

Investments in the research, development, and deployment of the market is modest and targeted. The Newsroom report in April 2025 has stated that researchers are awarded with USD 15 million to study and research on cardiovascular and kidney syndrome. These funds finance pharmacokinetic studies, clinical tests, and molecular pathway studies. Regulatory oversight by the FDA ensures safety and effectiveness standards compliance, influencing R&D timelines and cost profiles. With increasing demand for precision therapies, R&D spend is likely to grow, especially in biomarker-led patient stratification and formulation science.

Key Renin Inhibitor Market Insights Summary:

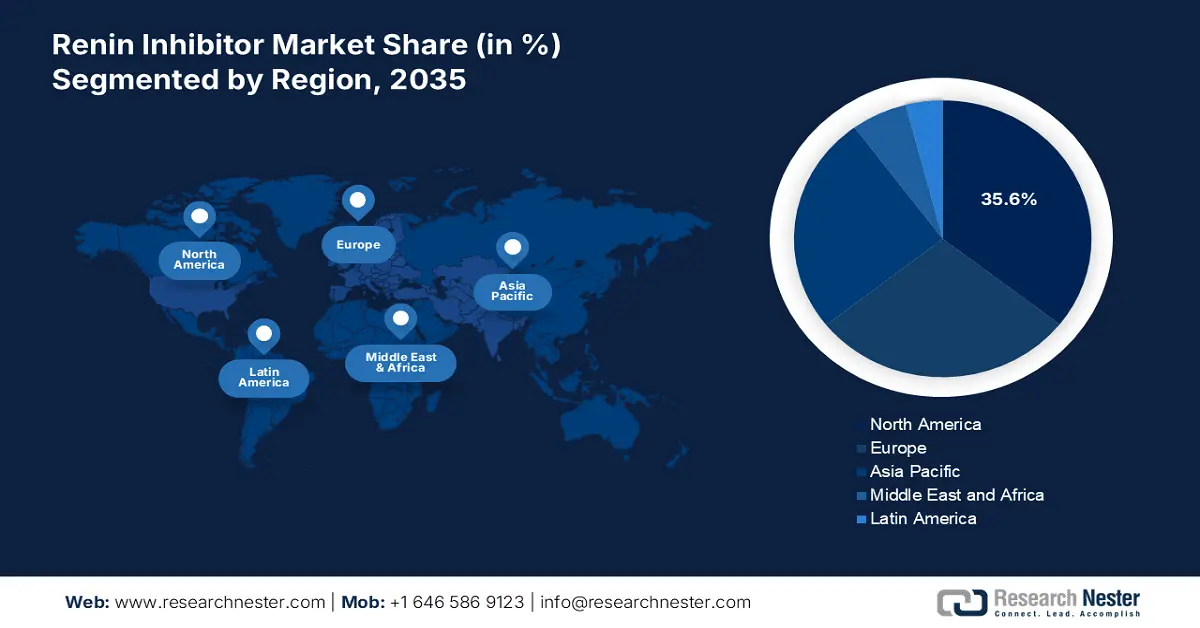

Regional Insights:

- North America is projected to capture a 35.6% share of the Renin Inhibitor Market by 2035, sustained by an aging population, growing hypertension burden, and early uptake of personalized and combination therapies enabled by regulatory approvals.

- By 2035, the Asia Pacific region is expected to expand rapidly and secure a notable share, underpinned by accelerating government healthcare investments, wider screening programs, and cost-efficient local manufacturing.

Segment Insights:

- By 2035, the oral tablets segment in the Renin Inhibitor Market is set to command a 71% share, bolstered by superior convenience, strong patient adherence, and the affordability of widely available generics.

- The hypertension segment is expected to hold a significant share by 2035, fueled by rising global prevalence, greater awareness, and nationwide screening initiatives.

Key Growth Trends:

- Rising disease prevalence

- Expansion of emerging markets

Major Challenges:

- Consumer affordability and low insurance coverage

- Low-cost generic competition

Key Players: Novartis AG,Pfizer Inc.,Merck & Co.,Bayer AG,Sanofi,AstraZeneca PLC,Bristol-Myers Squibb,Gilead Sciences,Daiichi Sankyo,Takeda Pharmaceutical,Roche Holding AG,Johnson & Johnson,GlaxoSmithKline (GSK),Teva Pharmaceutical,Sun Pharmaceutical,Cipla Ltd.,Dr. Reddy's Laboratories,CSL Limited,Celltrion Inc.,Hovid Bhd

Global Renin Inhibitor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 3.7 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 3 October, 2025

Renin Inhibitor Market - Growth Drivers and Challenges

Growth Drivers

- Rising disease prevalence: Changes in lifestyle, rapid urbanization, and many other factors are addressed that lead to a rise in hypertension symptoms among adults. For instance, approximately 30% of UK adults are dealing with the issues of hypertension, as per the study of the NHS report in May 2023. Over 1.28 billion cases of hypertension are registered annually, which demands effective pharmaceutical intervention. A growing number of health risks, such as hypertension, cardiovascular problems, and many more have created an opportunity for renin inhibitors to increase in the global market.

- Expansion of emerging markets: Growth opportunities are reshaping the APAC and Latin America, where growing disposable incomes and improving healthcare infrastructure are increasing access to advanced medicines. While current penetration may be low due to cost, governments in these regions are increasingly prioritizing non-communicable disease control. This provides opportunities for manufacturers via tiered pricing, collusion with local generic firms, and listing in national essential medicine lists, filling the gap in access being exposed in nations such as India.

- Significant government healthcare expenditures and reimbursement policy: Government payers play a key role in shaping market access. As per the NLM study in December 2024, the healthcare expenditure associated to hypertension is USD 2,759. In the U.S., Medicare and Medicaid expenditures for prescription medications, such as antihypertensives, are significant. Positive reimbursement decisions by the Centers for Medicare & Medicaid Services (CMS) on the basis of clinical guidelines can drive adoption significantly. For instance, the addition of a renin inhibitor to a Medicare Part D plan's formulary directly affects its availability for the elderly patient group, a major cohort for cardiovascular therapies.

Clinical Trials of Renin Inhibitor Drugs

|

Trial Name / NCT ID |

Drug / Intervention |

Indication / Condition |

Study Design / Phase |

Years Active |

Key Primary Endpoints |

|

Dysfunctional Renin-Angiotensin System in Septic Shock (NCT06746753) |

Angiotensin II vs Norepinephrine |

Septic shock, vasopressor need |

Randomized, interventional |

2024-2025 |

Mean renin levels, vasopressor-free hours, organ failure score, kidney & liver injury markers |

|

Safety and Efficacy Study of Add on Aliskiren (NCT00881439) |

Aliskiren (direct renin inhibitor) |

Hypertension & kidney/renal blood flow |

Phase III, double-blind |

(pre-2022 start; ongoing if recent results posted) |

Blood pressure, renal blood flow, adverse event rates |

Source: Clinical Trials.gov

Challenges

- Consumer affordability and low insurance coverage: High cost of production leads to a rise in the price of the renin inhibitors in the global renin inhibitor market. People from the low to medium income group face a barrier to accessing the treatment. For instance, the population in India finds renin inhibitors out of their budget, which limits the market accessibility. Availability of medical coverage is also low, which restricts the patient from availing the facility of renin inhibitors. According to the Medicaid report, the coverage is allocated for the aliskiren brand. The high cost of the intervention limits Medicaid to provide maximum coverage to the patient.

- Low-cost generic competition: The patent life of first-generation renin inhibitors such as aliskiren has flooded, and the market is now filled with low-cost generics. Price competition by any new player against entrenched generics is virtually impossible. The value story needs to be dramatically better in order to persuade payers and physicians to use a high-price branded product. This compels businesses to focus extremely narrow, high-need subpopulations (e.g., resistant hypertension) where they can still show distinctive value, naturally constraining the total addressable market.

Renin Inhibitor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 3.7 billion |

|

Regional Scope |

|

Renin Inhibitor Market Segmentation:

Formulation Segment Analysis

Oral tablets are leading the formulation segment and are expected to hold the greatest revenue share of 71% during the study period, till 2035. Their convenience, ease of administration, and patient adherence advantages over other dosage forms make them the preferred choice in hypertension management. Aliskiren's once-daily dosing improves compliance, particularly for extended therapy. Furthermore, the widespread availability of generics in tablet form ensures cost-effectiveness, making them suitable for mass hypertension treatment programs.

Application Segment Analysis

Under the application segment, hypertension leads the segment and is poised to hold a considerable share value by 2035. The rising prevalence of high blood pressure and increased awareness, as well as some national screening programs are the growth factors of the market. As per the WHO data in August 2021, 700 million people are living with hypertension, making it a critical health issue. Renin inhibitors, mainly for patients who are intolerant to ACE inhibitors or ARBs, are gaining traction as targeted alternatives, making hypertension a dominant segment.

Drug Type Segment Analysis

Aliskiren, the only direct renin inhibitor approved by the FDA, leads the market because it has been shown to effectively reduce blood pressure and renin activity. As per the Frontiers study in February 2023, the cost of aliskiren is USD 1.14 per day. The FDA emphasizes aliskiren as a suitable alternative in patients with contraindications against ACE inhibitors and ARBs, especially patients with hypertension. Research sponsored by the National Institutes of Health (NIH) indicates that renin inhibitors reduce systolic and diastolic blood pressure substantially relative to placebo, adding clinical value.

Our in-depth analysis of the renin inhibitor market includes the following segments:

|

Segments |

Subsegments |

|

Drug Type |

|

|

Formulation |

|

|

Distribution Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Renin Inhibitor Market - Regional Analysis

North America Market Insights

The renin inhibitor market of North America is the leading region and is projected to acquire a global market share of 35.6% by 2035. Demographic switch in North America results in the growth of an aging population, which has raised the hypertension cases and created demand for renin inhibitors. A significant trend is the shift towards personalized medicine, guided by genetic biomarkers to optimize patient selection for renin inhibitor therapy. Approval of clearance through the Food and Drug Administration led to early adoption of combo therapies in the North American market.

The U.S. market of renin inhibitors dominates in the North America region. The key driver fueling the market is the high burden of cardiovascular disease. As per the Million Hearts report in May 2023, nearly 119.9 million people in the U.S. have hypertension. A trend is the incorporation of real-world evidence (RWE) into regulatory and reimbursement decisions. The allocation of the health budget to the development of renin inhibitors created a market demand growth. Availability of advanced healthcare infrastructure and adoption of telehealth integration are currently in market trends. This resulted in an acceleration in adherence to the use of renin inhibitors through the prescription of tele-healthcare.

In Canada, the renin inhibitor market is shaped by a publicly-funded healthcare system and the Patented Medicine Prices Review Board, which is used to regulate the drug prices. The prevalence of hypertension among people in Canada is 1 in 4, which is considered the major driver fueling the market, as per the NLM study in May 2025. Further, the primary trend is the province-by-province formulary management, where bodies like the pan-Canadian Pharmaceutical Alliance negotiate prices for public coverage. Data from CIHI shows that spending on prescribed drugs continues to rise, increasing pressure for cost-effective therapies.

Prevalence of Hypertension in U.S. and Canada

|

Country |

Estimated Prevalence (%) |

Official Definition Used |

Notes / Trends |

|

U.S. |

Nearly 50% [119.9M adults] |

≥130/80 mm Hg |

Prevalence has increased due to the updated, lower BP threshold |

|

U.S. |

1.56 billion in 2025 |

≥140/90 mm Hg (older standard) |

Prevalence lower with old threshold; increased awareness rates |

|

Canada |

23% from 2023-2024 |

≥140/90 mm Hg |

Recent slight increases, declining control rates among women |

|

Canada |

1 in 4 adults |

≥140/90 mm Hg |

1 in 4 adults, linked to rising obesity and aging population |

|

Canada |

19.5% from 2007–2010 |

≥140/90 mm Hg |

Historically lower prevalence than US and England |

Source: Million Hearts May 2023, NLM August 2013, NLM May 2024, CMA Impact Inc. 2025,

Asia Pacific Market Insights

The APAC is the fastest growing region in the global renin inhibitor market and is poised to accumulate a global market share by 2035. The government investment expanded at a rapid scale to develop the healthcare infrastructure and introduce modernization. This initiated a larger number of government-led screenings, which raised the number of new cases included for hypertension. Accumulation of huge raw material for the production of renin inhibitors made Asia Pacific eligible to deliver the product at an affordable price range. Boom with local manufacturing expanded the market of renin inhibitors in the Asia Pacific.

China holds the largest renin inhibitor market in the Asia Pacific. As per the report of the NLM study in August 2025 depicts that the prevalence of hypertension people is 31.6% in China 2021 to 2022. The growing aging population is one of the significant drivers to leverage the demand for renin inhibitors. This raised the scope of advanced therapy using renin inhibitors and accelerated the demand for the market. The National Medical Products Administration of China approved twelve new local renin inhibitors in 2024 that gained high market adoption.

The renin inhibitors market in India is also expanding rapidly and the market is driven by the low-cost generics, making therapies more accessible to a wide population. The National Health Mission’s budget for non-communicable diseases, which includes hypertension, has grown substantially. According to the WHO report in May 2023, 75 million people are with hypertension and diabetes on standard care. This large-scale screening program is accelerating awareness, early diagnosis, and demand for affordable treatment options nationwide.

Prevalence of Hypertension in Indian Adults

|

Category |

Aware (%) |

On Treatment (%) |

Under Control (%) |

|

Total |

34.3 |

13.7 |

7.8 |

|

Male |

26.6 |

12.1 |

5.9 |

|

Female |

45.9 |

16.1 |

10.8 |

Source: NLM September 2023

Europe Market Insights

The renin inhibitor market in Europe is a stable but mature segment, with a high level of regulatory control by the European Medicines Agency (EMA) and well-established, but tightly budgeted, national healthcare systems. Key drivers such as high incidence of hypertension and cardiovascular disorders are the drivers for market growth, which are also associated with an aging population throughout the region. Yet it is softened by aggressive pressure from health technology assessment (HTA) agencies, like NICE in the UK and IQWiG in Germany, requiring strong cost-effectiveness data for reimbursement.

The UK renin inhibitor market is highly influenced by the National Institute for Health and Care Excellence (NICE) guidance. The market is also propelled by the increasing prevalence of hypertension, diabetes, and cardiovascular disease across the nation. According to the NHS report of May 2023, almost 60% of individuals over the age of 65 have hypertension. The NHS England budget for cardiovascular disease prevention is substantial, though specific allocation to a single drug class like renin inhibitors is not publicly detailed. The UK life sciences industry spends heavily on cardiovascular R&D, the Association of the British Pharmaceutical Industry (ABPI) reports.

Germany holds the largest renin inhibitor market in Europe based on the country's comparatively swift drug acceptance process and robust public health insurance infrastructure. The Federal Ministry of Health (BMG) operates a healthcare system with appreciable expenditure on pharmaceuticals. Although an exact figure for renin inhibitors is not available, the German Medical Association (BÄK) indicates cardiovascular diseases as the primary cause of death, with this in turn guaranteeing continued demand. For instance, the number of approved clinical trials for new antihypertensive combinations remains stable according to the German Institute for Drugs and Medical Devices (BfArM) database, which suggests continuous innovation and investment within the therapeutic class.

Key Renin Inhibitor Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Merck & Co.

- Bayer AG

- Sanofi

- AstraZeneca PLC

- Bristol-Myers Squibb

- Gilead Sciences

- Daiichi Sankyo

- Takeda Pharmaceutical

- Roche Holding AG

- Johnson & Johnson

- GlaxoSmithKline (GSK)

- Teva Pharmaceutical

- Sun Pharmaceutical

- Cipla Ltd.

- Dr. Reddy's Laboratories

- CSL Limited

- Celltrion Inc.

- Hovid Bhd

The market of the renin inhibitor is consolidated around the three key strategic approaches that include patient-protecting combo therapy, WHO-qualified products, and solutions for local healthcare. For instance, Novartis is a big pharmaceutical company focused on developing patient-protected combination therapies that deliver high patient outcomes. Lupin is following the generics of India and has expanded the market performance through WHO-prequalified products. Takeda, being the regional player, focused on aligning with the unmet needs of the local healthcare system and escalated the market share for the company.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In June 2025, George Medicines announced FDA approval of WIDAPLIK (telmisartan, amlodipine, and indapamide), which is a new single-pill combination treatment used to treat hypertension in adults, including for initial treatment.

- In April 2025, Novartis announced that the U.S. FDA had granted the accelerated approval for Vanrafia (atrasentan), which is a potent and selective endothelin A (ETA) receptor antagonist used for the reduction of proteinuria in adults with primary immunoglobulin A nephropathy (IgAN) at risk of rapid disease progression.

- In September 2024, Travere Therapeutics announced full FDA approval of FILSPARI (sparsentan), which is the only non-immunosuppressive treatment used to slow kidney function decline in IgA nephropathy significantly.

- Report ID: 2633

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Renin Inhibitor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.