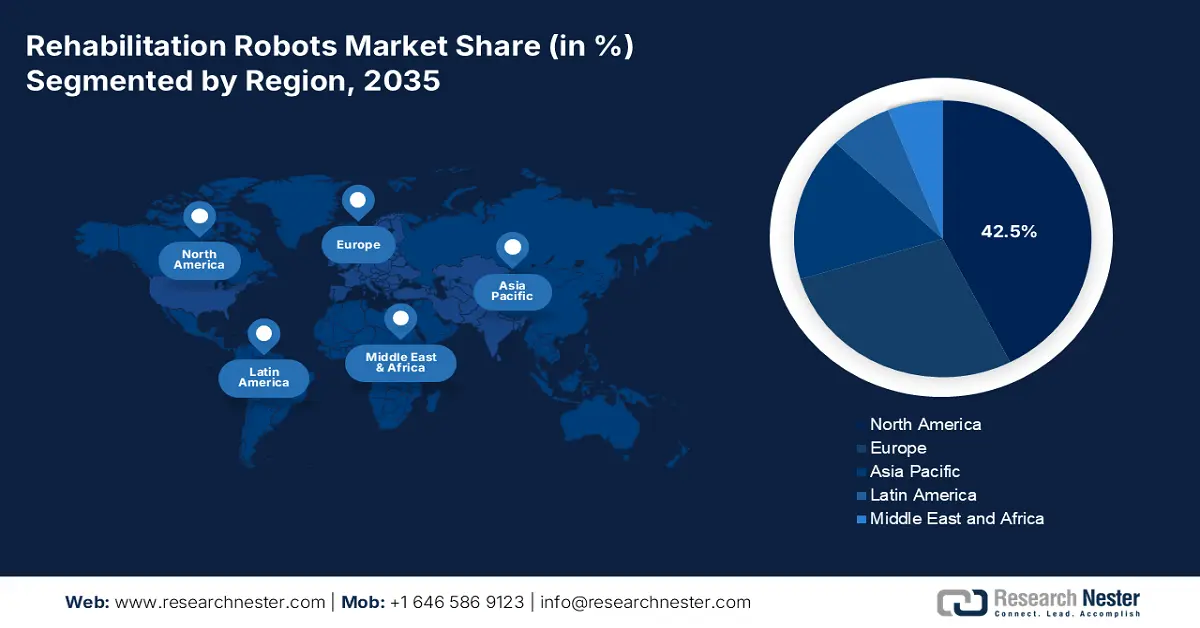

Rehabilitation Robots Market - Regional Analysis

North America Market Insights

North America is dominating the rehabilitation robots market and is projected to hold the market share of 42.5% by 2035. The region is defined by technological maturity and high adoption rates of robots in the healthcare sector. According to the NLM study in April 2025, the study evaluated the ROBERT device's effectiveness in improving hip flexor strength after SCI. The device was launched by Life Science Robotics. The result has provided positive feedback with 92% training adherence with no adverse events. This finding has highlighted that cobot-assisted training is effective in enhancing hip flexor strength.

The U.S. is dominating the North America region and is characterized by a high burden of stroke and spinal cord injuries. The NICHD data in March 2025 reports that approximately 795,000 people suffer a stroke annually, creating a substantial patient base for rehabilitation robotics. The key trend is the expansion of telehealth services, thereby supporting remote robotic therapy. Further, the utilization of systems like the ReWalk exoskeleton for spinal cord-injured veterans demonstrates federal endorsement. The market is also experiencing larger medical device companies acquiring innovative startups to expand their technological portfolios and surge commercial scaling.

Canada's rehabilitation robots market is characterized by an emphasis on fair access and integration in its publicly funded health system. The Canadian Institute for Health Information underlines that strokes are one of the primary causes of disability, with demand for effective rehabilitation technology being driven. According to the Natural Sciences and Engineering Research Council of Canada report in November 2022, emerging motion control robotics and rehabilitation tools garnered an overall award of USD 46,000 under NSERC's Discovery Grants Program (Individual). This fund aims to create algorithms that allow robots to perform complex and stable motions with applications in rehabilitation and medical devices.

Latest Rehabilitation Robots in 2025

|

Product Name |

Company / Origin |

Key Features |

Rehabilitation Focus |

Additional Notes |

|

ArmMotus EMU |

Fourier Rehab (US) |

Immersive gamified therapy, 3D cable-driven upper limb exoskeleton with de-weighting |

Upper limb motor rehabilitation |

Award-winning product, demonstrated at RehabWeek 2025 |

|

ExoMotus M4 |

Fourier Rehab (US) |

Ergonomic body frame, gait training exoskeleton, fall risk reduction |

Gait and mobility recovery |

Clinically focused on stroke, TBI, spinal cord injury patients |

|

GR-1 Humanoid Robot |

Fourier Rehab (US) |

Embodied AI, human-like movement, interactive AI-driven rehab partner |

Advanced neurorehabilitation |

Demonstrated cutting-edge embodied AI robotics for rehab |

Source: Fourier Rehab May 2025

APAC Market Insights

Asia Pacific is the fastest-growing region in the rehabilitation robots market and is expected to grow at a CAGR of 11.5% by 2035. The region is driven by the rising aging population, growing healthcare spending, and enhanced government emphasis on advanced medical technology. Japan and South Korea are leading due to their technological expertise in robotics to support elder care requirements. Strategic joint ventures between global leaders and domestic producers are the norm to meet varied regulatory environments and price sensitivities.

Japan has the biggest market share in APAC, driven by the world's most aged society with 36.23 million aged 65 or above, according to the September 2023 World Economic Forum report. The government actively encourages robotic solutions to balance labor shortages in healthcare, and the Ministry of Economy, Trade, and Industry offers subsidies for the establishment and introduction of nursing care robots. A foremost real-world instance is the Hybrid Assistive Limb from CYBERDYNE, which has received regulatory approval and is being used in most medical centers around the world, with widespread adoption within Japan itself.

India is leading the rehabilitation robots market with high growth potential defined by a large population and growing awareness of rehabilitation care. The government focuses in making healthcare more affordable and accessible, as seen in the Ayushman Bharat scheme. As per the NLM study in February 2022, the incidence of strokes in India ranges from 105 and 152 per 100,000 people per year. This number highlights a significant addressable patient base. Further companies, such as GenRobotics, are emerging, aiming to develop cost-effective exoskeleton solutions for the domestic market.

Europe Market Insights

Europe is the second largest market for rehabilitation robots and is led by the technologically advanced environment, with robust healthcare infrastructure, favorable government policies, and an increasing number of elderly populations. As per the MedTech Europe report in 2025, the medical technology sector in Europe reached €170 billion in 2024. The major drivers are the high incidence of neurological diseases, such as stroke and a heightened emphasis on enhancing post-treatment quality of life with advanced rehabilitation. A significant trend is the integration of robotics into standard clinical pathways, supported by favorable reimbursement frameworks in countries like Germany and France.

Germany is the largest rehabilitation robotics market in Europe and is fueled by its strong economy and comprehensive healthcare reimbursement system. The Federal Ministry of Health and the German statutory health insurance funds facilitate the adoption of new diagnostic and therapeutic methods, including advanced robotic aids. The Destatis report in April 2023 depicts that the healthcare expenditure in Germany reached 474 billion euros in 2021, which ensures a substantial market. Further, the country’s rising elderly population and increasing investments in robotic-assisted rehabilitation centers are surging the market expansion.

The UK market demand is high and is driven by a rising aging population and an increasing focus in improving efficiency in long-term care. In order to decrease hospital stays, the NHS Long Term Plan places a high priority on innovation in community services and rehabilitation. Investment in medical technology, such as robotics, is also a main driver leading the market. For example, the NHS's Accelerated Access Collaborative facilitates the adoption of transformative technologies, through which robotic devices can be fast-tracked. The UK Association of British Healthcare Industries points out that the wider medical technology industry is contributing more than a billion pounds to the UK economy, and this underlines the strategic value of such innovations.