Redox Flow Battery Market Outlook:

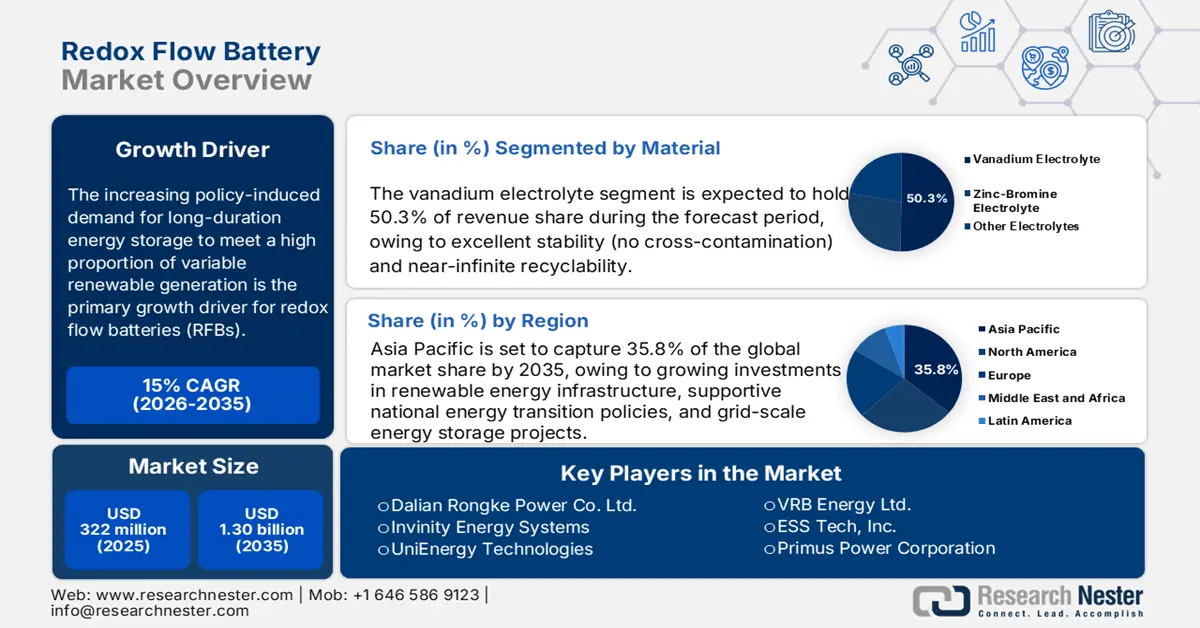

Redox Flow Battery Market size was estimated at USD 322 million in 2025 and is expected to surpass USD 1.30 billion by the end of 2035, rising at a CAGR of 15% during the forecast period, i.e., 2026-2035. In 2026, the industry size of redox flow battery is assessed at USD 370.3 million.

The increasing policy-induced demand for long-duration energy storage to meet a high proportion of variable renewable generation is the primary growth driver for redox flow batteries (RFBs). The U.S. Department of Energy states that if our grid reaches net zero by 2050, between 225 GW and 460 GW of long-duration energy storage will be required, according to a recent study. In 2021, the DOE launched its Long Duration Storage Shot initiative, committing to a 90% reduction from 2022 in 10+ hour storage technology costs, including flow batteries, by 2030 to target public R&D investment and reduce levelized storage cost by up to 60% for flow systems.

In the raw materials supply chain and manufacturing space, the availability of vanadium is a bottleneck, and it is highly concentrated production, limiting scaling to multi-gigawatt-hour deployments without significant supply growth. The price of vanadium-based systems is about $491/kWh, and iron and zinc-based systems are $196 and the lowest of $153/kWh. Both government and industry established new electrolyte production and flow battery assembly plants, for example, in South Africa, which includes vanadium beneficiation and domestic production lines for direct support to regional and export markets. The general patterns of trade are consistent for developing economies to manufacture Industry 4.0 in their region.

Key Redox Flow Battery Market Insights Summary:

Regional Highlights:

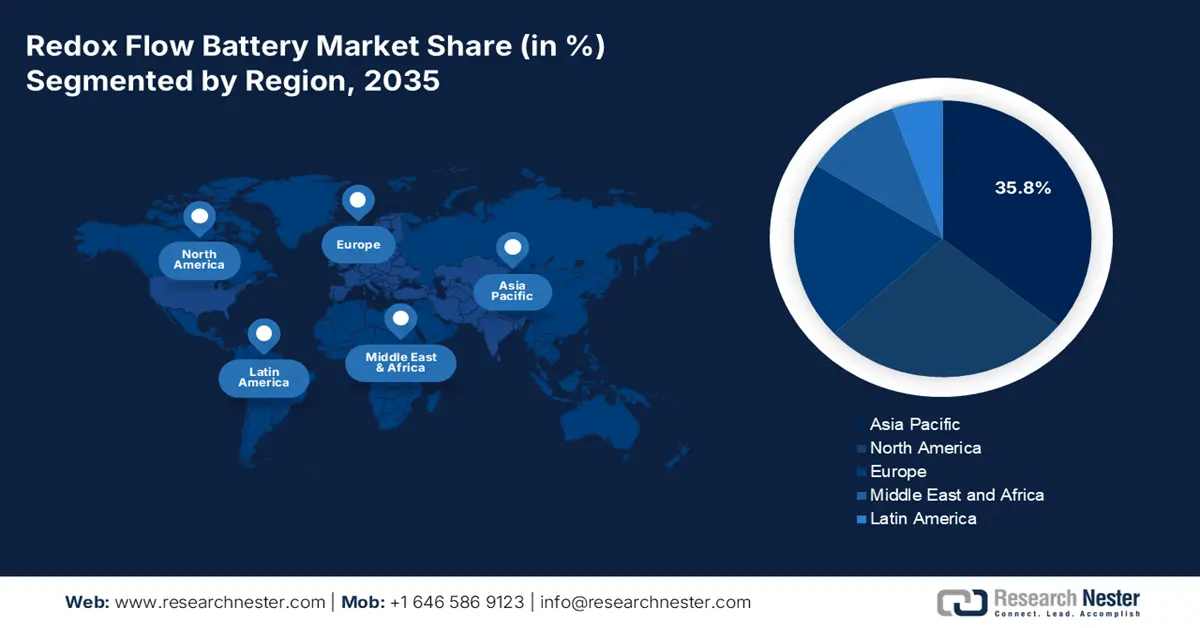

- By 2035, the Asia Pacific region is projected to secure a 35.8% share of the redox flow battery market, underpinned by expanding renewable energy programs and national energy-transition initiatives advancing long-duration storage adoption.

- North America is expected to capture a 27.2% share by 2035, supported by accelerating capital inflows and ongoing commercialization efforts among established flow-battery vendors.

Segment Insights:

- The vanadium electrolyte segment is projected to command a 50.3% share by 2035 in the redox flow battery market, bolstered by its strong stability profile and recyclability advantages.

- The traditional (fluid-fluid) segment is anticipated to hold around a 40% share by 2035, strengthened by its long cycle life and scalable architecture.

Key Growth Trends:

- Grid modernization & stability requirements

- Demand for long-duration & large-scale energy storage

Major Challenges:

- Low energy density & bulkiness

- Supply chain constraints & volatile raw‑material costs

Key Players: Dalian Rongke Power Co. Ltd., Invinity Energy Systems, UniEnergy Technologies, VRB Energy Ltd., ESS Tech, Inc., Primus Power Corporation, redT Energy Plc, Elestor (Elestor BV), CellCube Energy Storage GmbH (Enerox GmbH), Vionx Energy Corporation, EverFlow (Everflow GmbH), Stryten Energy, ViZn Energy Systems, H2, Inc., Redflow Limited.

Global Redox Flow Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 322 million

- 2026 Market Size: USD 370.3 million

- Projected Market Size: USD 1.30 billion by 2035

- Growth Forecasts: 15% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Australia, United Kingdom, Canada, Netherlands

Last updated on : 18 August, 2025

Redox Flow Battery Market - Growth Drivers and Challenges

Growth Drivers

- Grid modernization & stability requirements: As the world's governments invest huge funds into grid modernization programs to improve reliability and accommodate distributed energy resources, flow batteries are contributing to those objectives because of their ability to offer grid stabilization, fast response, and long cycle life. Flow batteries are equipped with unique benefits that support grid development by having the ability to support grid stability, fast response, and long cycle life. As utilities pursue decarbonization objectives, modernizing their existing infrastructure with flow battery storage would aid substantially in meeting demand-response and capacity objectives. The U.S. Department of Energy’s funding to support domestic flow-battery supply chains establishes an intentional strategy for derisking and strengthening grid infrastructure resiliency.

Taxonomy of innovations for RFB

|

Innovation Category |

Innovation |

|

Raw materials sourcing |

|

|

Supply chain |

|

|

Technology components |

|

|

Manufacturing |

|

|

Advanced materials development |

|

|

Deployment |

|

|

End of life |

|

Initial Cost Benchmarking

The capital costs of each redox flow battery project typically vary depending upon site-specific factors, including plant size, location, technology, and required civil works. According to the July 2023 report by the U.S. Department of Energy, a 10-hour energy storage capacity 100-MW VFB system installation was estimated at USD 384.5/kWh. A 1,000-MW VFB set up costs USD 365.2/kWh. The table below depicts cost-to-performance 2030 assumptions for a 100-MW VFB system with the same hours of storage. The 10-hour system levelized cost of storage (LCOS) at a rated power of 1,000 MW and 100 MW is anticipated to reach USD 0.15/kWh and USD 0.16/kWh by the end of 2030.

Projected VFB cost and performance parameters in 2030 for a 100-MW, 10-hour VFB storage system

|

Parameter |

Value |

Description |

|

Storage Block Calendar Life for Stacks and Pumps |

12 |

Deployment life (years) |

|

Cycle Life (Electrolyte) |

10,000 |

Base total number of cycles |

|

Round-trip Efficiency (RTE) |

65% |

Base RTE |

|

Storage Block Costs |

166.16 |

Base storage block costs ($/kWh) |

|

Balance of Plant Costs |

29.86 |

Base balance of plant costs ($/kWh) |

|

Controls and Communication Costs |

1.12 |

Controls & communication costs ($/kW) |

|

Power Equipment Costs |

101.54 |

Power equipment costs ($/kW) |

|

System Integration Costs |

32 |

System integration costs ($/kWh) |

|

Project Development Costs |

42.33 |

Project development costs ($/kWh) |

|

Engineering, Procurement, & Construction (EPC) Costs |

36.81 |

EPC costs ($/kWh) |

|

Grid Integration Costs |

16.97 |

Grid integration costs ($/kW) |

|

Fixed Operations & Maintenance (O&M) Costs |

9.95 |

Base fixed O&M costs ($/kW-year) |

|

Variable O&M Costs |

0.0005125 |

Base variable O&M costs ($/kWh) |

Source: U.S. DoE

Pathways to $0.05/kWh

DoE’s Energy Storage Grand Challenge Storage Innovations 2030 (SI 2030) brought together industry experts to identify potential roadblocks for future development and R&D opportunities to foster the USD 0.05/kWh LCOS goal. The following assessment was done by the SI Flight Paths Team in January 2023 after studying 14 commercial flow battery-related players (5 organic-based, 2 zinc-based, 3 vanadium-based, 1 iron-based, and 2 membrane companies) and focused on the impediments limiting flow battery technologies and component deployment.

Flow battery components that could benefit most from technological improvements

|

Flow Battery Technology |

Developmental Opportunities |

|

Membranes |

Higher conductivity, selectivity, and stability/durability |

|

Electrodes |

Impact of additives on carbon electrodes |

|

Bipolar plate |

Improved durability and lower cost |

|

Power electronics |

Improved low-voltage systems |

|

Other (e.g., electrolyte production) |

Higher efficiency production, domestic supply chains, and reduced transportation costs |

Source: U.S. DoE

- Demand for long-duration & large-scale energy storage: With grid-operators and utilities searching for grid-scale storage solutions capable of multi-hour discharge durations for future deployment, vanadium redox flow batteries (VRFBs) fit the profile and are ideal for these longer-duration applications due to their modular tank-based system design. Recent large-sized and sized verifications, like China’s 175 MW/700 MWh VRFB, stakeholder confidence in their large differentiated systems regarding scalability and durability is strengthened. VRFBs have decades-long lifespans with little capacity degradation and are functionally capable of holding energy for up to 80 hrs of utility dispatchable power. VRFB systems are eminently feasible for utility-scale applications where long-duration and durability are economic drivers.

- Supportive government policies & incentives: Governments have also enacted other policies, mandates, and funding opportunities to promote the greater use of energy storage solutions. In the United States, the Department of Energy has funded over USD 120 million in grants to enhance domestic supply chains for the domestic flow-battery supply chain. These initiatives are designed to reduce reliance on foreign vanadium, increase domestic manufacturing, and maximize commercialization efficiency. As countries pursue clean energy targets and net-zero policies, government incentives and regulatory behaviors continue to promote the adoption of long-duration storage solutions (e.g., RFBs).

SME-Favored Capital Deployment Strategies for RFB Advancements (Cells with asterisks (*) represent the preferred mechanism)

|

Innovation |

National Laboratory Research |

R&D Grants |

Loans |

Technical Assistance |

|

Mining and metallurgy innovations |

14.3% |

21.4% |

28.6% |

35.7%* |

|

Secondary sourcing |

20.0% |

26.7%* |

26.7% |

26.7% |

|

Supply chain analytics |

38.9%* |

22.2% |

11.1% |

27.8% |

|

Low-cost membranes with high selectivity and durability |

31.3% |

50.0%* |

12.5% |

6.3% |

|

Power performance |

27.8% |

44.4%* |

11.1% |

16.7% |

|

System design and packaging |

14.3% |

57.1%* |

21.4% |

7.1% |

|

Manufacturing for scalable flow batteries |

11.8% |

47.1%* |

41.2% |

0.0% |

|

Novel active electrolytes |

41.2%* |

35.3% |

11.8% |

11.8% |

|

Bipolar plates |

41.7%* |

33.3% |

8.3% |

16.7% |

|

Separators/Membranes |

40.9%* |

31.8% |

13.6% |

13.6% |

|

Accelerating the discovery loop for battery metrics and materials |

50.0%* |

31.3% |

0.0% |

18.8% |

|

Scaling and managing the energy storage system |

17.4% |

34.8%* |

30.4% |

17.4% |

|

Demonstration projects |

13.6% |

36.4%* |

36.4% |

13.6% |

|

Enhancing domestic recycling |

30.4%* |

26.1% |

17.4% |

26.1% |

Source: U.S. DoE

Challenges

- Low energy density & bulkiness: In contrast to lithium-ion batteries, RFBs have low energy density. The large tanks necessary for aqueous electrolytes compound issues of weight and space efficiency in these systems to the extent that it restricts their use in space-constrained spaces (for example, residential applications) or mobile applications (such as transport). The considerable amount of equipment usable for RFBs, including pumps, valves, membranes, and the like, exacerbates these volume and footprint issues. This means that RFBs are not ideal when compact power storage is a requirement or is desirable.

- Supply chain constraints & volatile raw‑material costs: Compounding these limitations is the reliance of RFBs on the supply chain of the dominant vanadium chemistry, which is geographically concentrated and prone to volatility, including China and Russia. Vanadium pentoxide prices can exceed $31/ kg, or can change quickly, creating unpredictability in the cost of vanadium if vanadium is run as a battery or fuel cell application on its own. Alternative electrolytes are still limited in development. The supply challenges and price instability with many critical materials create procurement risk as well as high inventory costs, which detract from consideration of financial investment.

Redox Flow Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15% |

|

Base Year Market Size (2025) |

USD 322 million |

|

Forecast Year Market Size (2035) |

USD 1.30 billion |

|

Regional Scope |

|

Redox Flow Battery Market Segmentation:

Material Segment Analysis

The vanadium electrolyte segment is predicted to gain the largest redox flow battery market share of 50.3% during the projected period by 2035, due to excellent stability (no cross-contamination) and near-infinite recyclability. Recent decreases in the cost of vanadium electrolytes as a result of improved mining operations and the reuse of electrolytes also allow it to be more competitive in price. Vanadium maintains efficiency over time and therefore has no cost associated with replacement like zinc-bromine. Other factors that guarantee that vanadium stays the top electrolyte across all applications are that China ranks one in all vanadium produced globally. Lastly, its high energy density and ability to maintain stability regardless of temperature make it the clear leader for large-scale storage and use as an electrolyte versus any alternative.

Type Segment Analysis

The traditional (fluid-fluid) segment is anticipated to constitute the most significant growth by 2035, around 40% redox flow battery market share, mainly due to its long cycle life, scalability potential (modularity allows capacity to be easily expanded), and overall efficiency. The U.S. Department of Energy highlighted the potential for Vanadium-based battery types in grid storage, given their longevity and deep discharge potential. Though lithium-ion batteries degrade so much more quickly, VRFBs can provide excellent long-duration storage with the capability of deep discharge, as well as being non-flammable and recyclable to encourage their emerging adoption in applications like microgrids and renewable energy integration.

Application Segment Analysis

The utility-scale energy storage segment is anticipated to constitute the most significant growth by 2035, with 38.2% redox flow battery market share, mainly due to the increased demand for energy generated from renewable energy sources, requiring grid stabilization. IRENA projects more demand for grid storage capacity in the forthcoming years due to the intermittency of solar/wind as mainstream energy generation performance is debated. VRFBs—specifically redox flow batteries-will continue their advancements in long-duration (6-12+ hours), peak shaving, and load balancing storage capabilities. Governments, such as the U.S., have created incentives for specific deployments, such as the Bipartisan Infrastructure Law funding of flow battery projects. The low lifecycle cost and their more than 20-year life make long-duration VRFBs an economically reliable option for states and utility organizations.

Our in-depth analysis of the global redox flow battery market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Application |

|

|

Material |

|

|

Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Redox Flow Battery Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 35.8% of the redox flow battery market share due to growing investments in renewable energy infrastructure, supportive national energy transition policies, and grid-scale energy storage projects. These leading countries have large-scale solar and wind prerogatives, resulting in energy storage alternatives being sought, thus a growing interest in long-duration storage capabilities. The Asia Pacific redox flow battery market growth is ascribed to increasing investments, local manufacturing opportunities, the rising frequency of grid instabilities being observed, and increasing demand for alternatives to lithium-based energy storage.

China is projected to undergo phenomenal growth, with the redox flow battery market value projected to reach USD 975.7 million by 2034, increasing from USD 210.8 million in 2025. These projections are mainly due to national goals of achieving carbon neutrality by 2060 and aggressive Victorian Electricity Commission's aggressive move to incentivize energy storage. China has commissioned numerous vanadium redox flow battery projects and surpassed 100 MWh of solutions, and has more planned for grid reliability and potential peak shaving. State-owned enterprises have increased investment in R&D, furthering supply chain investment and reducing unnecessary dependence on valuable lithium imports, while also putting redox flow batteries in immediate consideration for energy storage solutions.

Renewable Energy Adoption & Government Policy Support

|

Country |

Renewable Energy Capacity/Share of Clean Power Mix (2030 Target) |

|

Japan |

38% share in overall clean electricity

|

|

China |

Surpass 1,200 GW 2030 target 6 years early |

|

India |

500 GW non-fossil target |

Source: Ember, Climate Action Tracker, PIB

North America Market Insights

The North American market is expected to hold 27.2% of the redox flow battery market share and about 125 million USD, with an anticipated average growth of about 26% CAGR from 2024 to 2031. The U.S. has witnessed over USD 500 million in capital funding into redox flow firms in the last 15 years via an amalgamation of private equity/venture capital and public equity raises. According to the Pacific Northwest National Laboratory September 2024 report, long-duration energy storage (LDES) entrants were granted USD 3.4 billion through VC/private equity funding. The US flow battery sector has yet to reach commercial liftoff. In North America, there are established vendors such as Sumitomo, ESS Inc., VRB Energy, and others that are moving utility‐scale and hybrid deployments forward.

In 2024, the U.S. led North American adoption with over 370 MWh of redox flow battery capacity installed. The U.S. contributed approximately USD 99 million to the North American market in 2024, and grew at a staggering CAGR towards the end of 2020 across North America. The primary drivers of this growth are grid modernization, renewable integration, federal subsidies, pilot programs aimed at arbitrage, frequency regulation, and long-duration storage. Major suppliers supporting this market growth include US-based suppliers such as ESS, Vionx Energy, and hybrid innovators.

Europe Market Insights

The European market is expected to hold 20.9% of the redox flow battery market share, and expects that with the EU 2030 climate objectives and energy storage incentives that there will be significant deployments supporting those 2030 targets. The EU anticipates a wide variety of approaches that will include public-private partnerships and broader funding through Horizon Europe, which will support a growing redox flow battery presence at scale while keeping in mind that redox flow batteries represented and estimated 18% of large-scale storage deployments in 2024. Redox flow batteries showcase great potential for high-capacity stationary energy. However, they exhibit significant challenges in mass transport, and sluggish kinetics adversely affect their efficiency. As a result, the ERC-funded RECHARGE initiative that commenced in January 2024 will integrate structured 3D electrodes with pulsatile flow to elevate RFB output to new heights. The project intends for a 1,000 mW/cm² power density and a round-trip efficiency of 85%.

Key Redox Flow Battery Market Players:

- Dalian Rongke Power Co. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Invinity Energy Systems

- UniEnergy Technologies

- VRB Energy Ltd.

- ESS Tech, Inc.

- Primus Power Corporation

- redT Energy Plc

- Elestor (Elestor BV)

- CellCube Energy Storage GmbH (Enerox GmbH)

- Vionx Energy Corporation

- EverFlow (Everflow GmbH)

- Stryten Energy

- ViZn Energy Systems

- H2, Inc.

- Redflow Limited

The redox flow battery market is modestly concentrated—Dalian Rongke Power, a Chinese company, dominates through large utility projects involving economies of scale, low domestic vanadium, and massive installations. European and North American firms such as Invinity (UK/Canada) and UniEnergy (US) are taking advantage of modular vanadium systems, long warranties, and electrolyte recycling capabilities. United States companies like ESS, Primus Power, VRB Energy, and Stryten have developed a competitive advantage by utilizing hybrid chemistries (iron or zinc-based), targeting specific industrial niches and business models (electrolyte leasing, energy-as-a-service). Partnerships and strategic alliances, vertical integration (example: Largo/Stryten transferring vanadium from Largo's supply chain to Stryten's business model and customer value), cooperative R&D, R&D investments in novel membranes, and service contracts are to become key drivers of competitive advantage.

Some of the key players operating in the market are listed below:

Recent Developments

- In September 2024, Delectrik Systems presented their containerized Vanadium Redox Flow Battery (VRFB), capable of 2 MW / 10 MWh with the potential to be built to over 100 MWh for Commercial and utility-scale projects. Looking for investment opportunities, this product acts as a boost to India’s long-duration energy storage strategy, as this goes hand-in-hand with the National Electricity Plan for long-duration battery energy storage systems (BESS) generating 411 GWh of energy by 2031–32. Its first multi-MWh installation will occur in H1 2025, a step further in modernizing the grid and providing low-carbon energy solutions.

- Report ID: 3015

- Published Date: Aug 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Redox Flow Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.