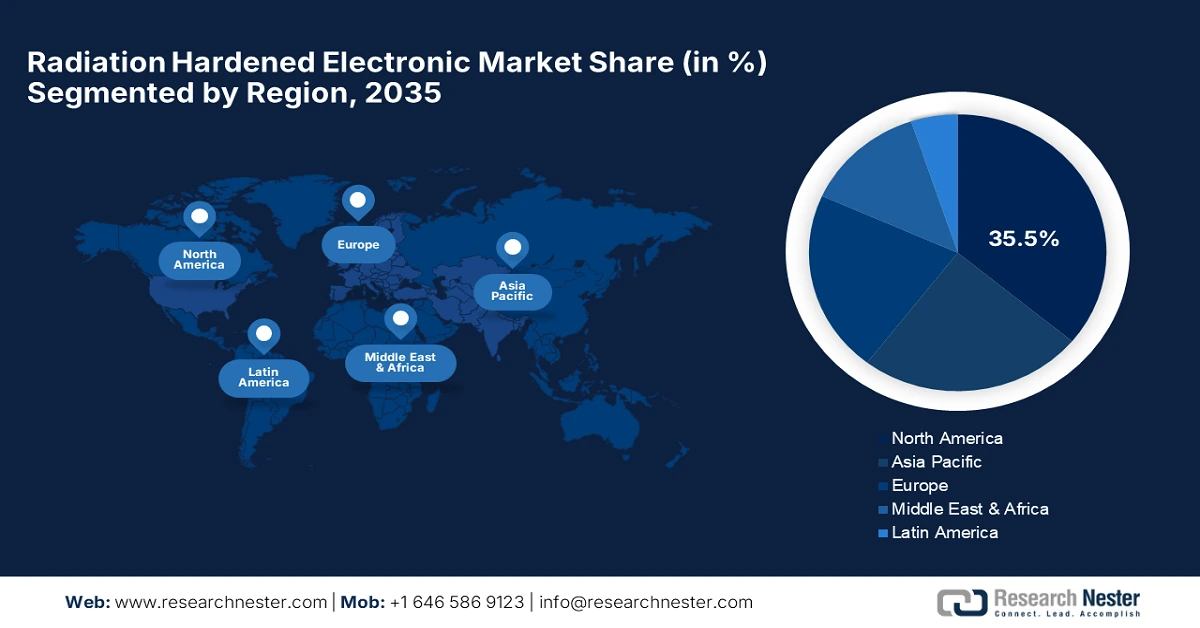

Radiation Hardened Electronic Market - Regional Analysis

North America Market Insights

North America is projected to command a 35.5% market share during the forecast period. This lead is driven by huge and ongoing investment from the U.S. government, spearheaded by the Department of Defense and NASA, and a vibrant commercial space sector. It is the headquarters for the majority of the world's top producers and has a broad and highly secure domestic supply chain for the critical components.

The U.S. is the industry leader beyond dispute, with a national strategy focused on maintaining its space and defense technological lead. It is backed by significant federal funding committed to developing innovation and establishing the domestic base of microelectronics manufacturing. In a significant development, the U.S. Department of Defense in September 2023 released the establishment of eight regional innovation centers as part of the Microelectronics Commons program. Financed with an initial USD 238 million in funding from the CHIPS Act, some of these centers are being individually tasked with creating and testing next-generation radiation-hardened electronics.

Canada is investing selectively to establish sovereign space capabilities in space technology, including radiation-resistant part production. The Canadian Space Agency (CSA) is primarily engaged in funding R&D, enabling the country to participate in foreign scientific missions and develop a domestic space industry. The government's planned spending for the CSA in the 2023-24 fiscal year was projected to be USD 537.4 million, the highest level to date, underscoring the strategic importance of the space sector to Canada's economy and sovereignty.

Europe Market Insights

Europe is likely to provide significant growth from 2026 to 2035 with the ambitious undertakings of the European Space Agency (ESA) and a solid industrial base in leading countries like France, Germany, and the UK. Europe market is expanding through an increased number of satellite launches and a collaborative strategy focused on space exploration and defense programs. The continent's focus on indigenous access to space and the creation of domestic satellite constellations, such as Galileo and Copernicus, ensures a perennial requirement for high-reliability, rad-hard parts.

Germany is witnessing stable expansion in Europe and commands a quarter of the continent's market, owing to its robust manufacturing base and massive investments in advanced technologies. This position is reinforced by the federal government's new space strategy, adopted in September 2023, which outlines the nation's goals through 2030. Germany is a hub of innovation of great repute, with immense focus laid on developing world-class technologies that enhance the performance and reliability of rad-hard systems due to having dominant industry players and a booming research institution environment.

The UK is putting effort into creating its domestic semiconductor sector and establishing its sovereign capability in critical technologies, including radiation-hardened electronics. The launch of the National Semiconductor Strategy in May 2023 demonstrates the national priority given to this effort. This ten-year plan invests up to £1 billion in backing R&D, enhancing access to prototyping, and increasing the scale of domestic businesses, a strategic investment that will pay dividends directly into the development and production of specialized rad-hard components for the space and defense markets.

APAC Market Insights

Asia Pacific radiation-hardened electronics market is expected to record a CAGR of 5.5% during the forecast period. This is led by the ambitious space programs of countries like China and India, rising defense budgets, and growing focus towards developing indigenous high-technology industries. As nations of the region transition to enhancing their strategic autonomy and becoming more active participants in the global space economy, demand for locally made and sourced radiation-hardened electronics will expand noticeably.

China is a rapidly growing market, driven by a national agenda of technological self-sufficiency and leadership in defense and space exploration. The country is investing heavily in its space station, moon mission, and satellite constellations. This government-sponsored program creates a significant and long-term domestic demand for radiation-hardened products. China's focus on military modernization is another leading motivator because cutting-edge electronic warfare and communications equipment increasingly require radiation-hardened electronics.

India radiation-hardened electronics industry is on the rise with the ISRO's incredible success and the government's Make in India flagship program. An example of such congruence is the proposed Mars lander mission. Following the addition of a rover, helicopter, sky crane, and supersonic parachute to the updated 2024 plan, the mission received decisive clearance from the Space Commission on February 21, 2025. The final nod from the Union Cabinet will kick off the development phase of the spacecraft, generating unprecedented demand for indigenous, radiation-hardened electronics. As India continues to advance its satellite fleets for navigation, communication, and Earth observation, indigenous radiation-hardened devices will only have more demands, solidifying the industry as a cornerstone of the nation's strategic space capabilities.