Radiation Hardened Electronic Market Outlook:

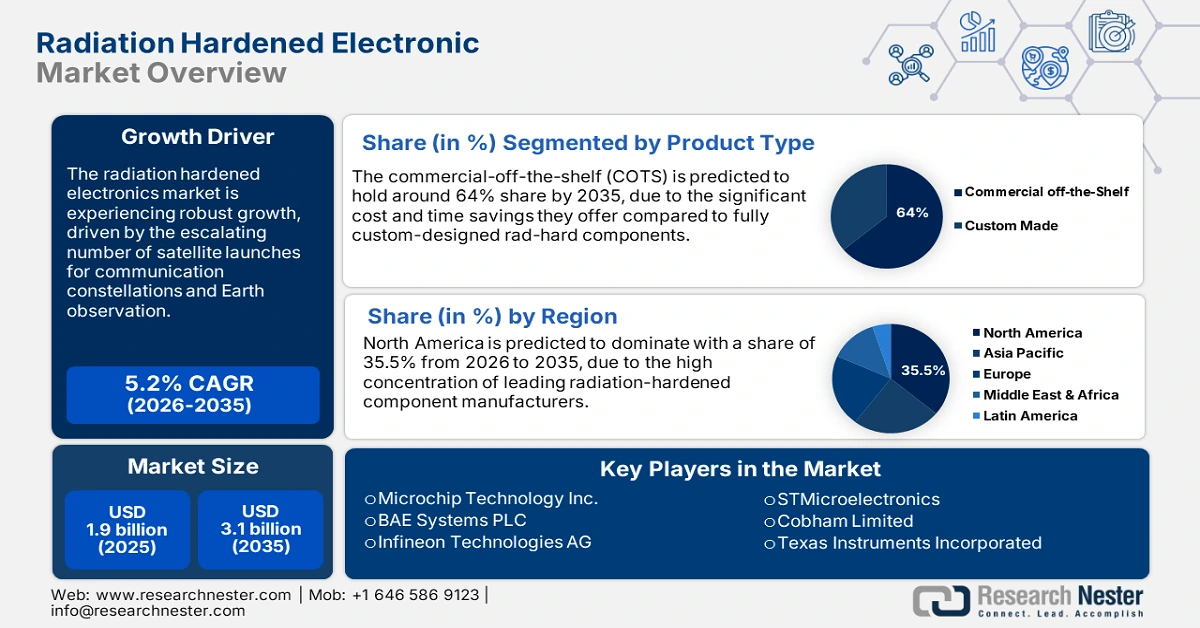

Radiation Hardened Electronic Market size is valued at USD 1.9 billion in 2025 and is projected to reach a valuation of USD 3.1 billion by the end of 2035, rising at a CAGR of 5.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of radiation hardened electronic is anticipated at USD 2 billion.

The radiation hardened electronic market is experiencing robust growth, fueled by increasing demand for robust components in hostile environments that can withstand ordinary electronics. Demand is strongest for the space, defense, and nuclear sectors, where system failure is not an option. Producers continuously develop to meet these stringent specifications, as seen in June 2024 when Infineon Technologies launched the world's first space-qualified 1 Mb and 2 Mb parallel interface F-RAM devices. These memories offer unsurpassed reliability with data retention up to 120 years and are a faster, more resilient alternative to traditional storage in satellites.

The market's trajectory is driven hard by robust government investment aimed at building national strategic capacity and boosting in-country supply chains. The U.S. Department of Defense, for instance, pointed out the critical role of this sector in August 2024 when it awarded a USD 25.8 million contract to Honeywell to sustain the nation's strategic radiation-hardened microelectronics supply. This strategic investment, coupled with the consistent demand from nuclear power industries, with 413 reactors currently in operation worldwide as of December 2023, reported by the International Atomic Energy Agency (IAEA), provides a solid and long-term foundation for market expansion.

Key Radiation Hardened Electronic Market Insights Summary:

Regional Highlights:

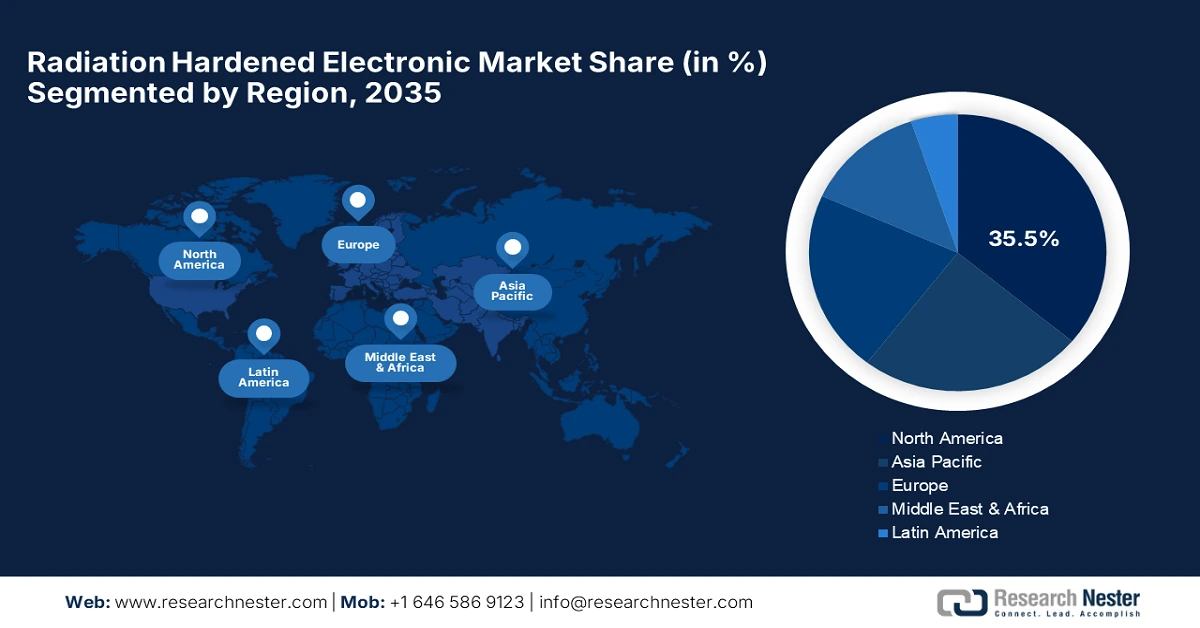

- North America is projected to command a 35.5% market share in the radiation hardened electronic market during the forecast period, owing to robust government investment and a strong commercial space sector.

- Europe is likely to experience substantial growth from 2026 to 2035, driven by ESA initiatives, domestic satellite programs, and a solid industrial base.

Segment Insights:

- The Power Management segment is projected to hold a 34.5% share of the radiation hardened electronic market by 2035, owing to the need for stable and efficient power in hostile environments.

- The Radiation Hardening by Design (RHBD) segment is predicted to command a 58% market share by 2035, propelled by its efficiency in developing inherently radiation-tolerant semiconductor architectures.

Key Growth Trends:

- Accelerating rate of space exploration

- Modernization of defense and strategic systems

Major Challenges:

- Radiation testing sophistication and high expense

- Strict export controls and regulatory barriers

Key Players: Microchip Technology Inc., BAE Systems PLC, Honeywell International Inc., Infineon Technologies AG, STMicroelectronics, Cobham Limited, Analog Devices, Inc., Texas Instruments Incorporated, Teledyne Technologies Incorporated, Mercury Systems, Inc., Northrop Grumman, 3D PLUS

Global Radiation Hardened Electronic Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2 billion

- Projected Market Size: USD 3.1 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share during forecast period)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, France, Germany, United Kingdom, Japan

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 9 August, 2025

Radiation Hardened Electronic Market - Growth Drivers and Challenges

Growth Drivers

- Accelerating rate of space exploration: Both national and commercial entities are increasingly involved in the burgeoning space race, which is a key catalyst for the radiation hardened electronic market. Every satellite, probe, and spacecraft that ventures into space requires electronics that can withstand the harsh radiation environment beyond Earth's atmosphere. In a significant story affirming this requirement, BAE Systems announced in March 2023 that its high-performance RAD5545 single board computer had been selected to power the M-STAR mission, testifying to the trust placed in these parts for performing challenging processing operations in extreme space environments.

- Modernization of defense and strategic systems: Continuing modernization of world defense and strategic systems is creating a continuing demand for highly reliable, radiation hardened electronic. They have to be employed in order to maintain the operation of critical assets, ranging from missile defense systems and war-fighting satellites to future fighter aircraft, in the event of a nuclear attack. For instance, in December 2023, the U.S. Department of Commerce funded around USD 35 million in CHIPS Act for BAE Systems to modernize its plant producing rad-hard chips for national defense programs, including the F-35 fighter aircraft.

- New onboard processing and AI technologies: The increasing need for advanced onboard data processing, artificial intelligence (AI), and sensor fusion capability within orbit is pushing the boundaries of rad-hard memory and processor technologies. This demand means denser and faster components that will perform in space. In a milestone moment in history, Mercury Systems announced in January 2024 the first-ever DDR4 memory device qualified for space. This ruggedized 960 GB solid-state drive has been created to endure harsh temperatures and radiation so that advanced data processing is enabled for AI applications on satellite.

Challenges

- Radiation testing sophistication and high expense: One of the significant challenges facing the industry is the high expense, limited availability, and intricacy of radiation testing facilities, required to qualify components for the defense and space industries. This bottleneck can slow down the introduction and application of new technology. In order to alleviate this, the U.S. Defense Advanced Research Projects Agency (DARPA) initiated in June 2023 the Advanced Sources for Single-event Effects Radiation Testing (ASSERT) program. The program aims to create compact, low-cost test sources to make radiation testing more accessible throughout the entire microelectronics design process.

- Strict export controls and regulatory barriers: The military and strategic importance of radiation hardened electronics subjects them to rigorous government controls and export bans, which can be a significant obstacle to manufacturers and overseas allies. The controls are meant to keep harmful technology from falling into adverse hands, but can also complicate the global supply chain. In March 2024, the U.S. Bureau of Industry and Security (BIS) amended the Export Administration Regulations to specify more clearly the controls over these components, setting them at being able to withstand a total ionizing dose of 5 x 10^5 rads (Si) or greater, an important technical parameter governing their trade.

Radiation Hardened Electronic Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 3.1 billion |

|

Regional Scope |

|

Radiation Hardened Electronic Market Segmentation:

Component Segment Analysis

The power management segment is projected to hold a 34.5% share of the market, as the simplest requirement of any electronic system used in a hostile environment is to provide solid, stable, and efficient power. The components involved, such as voltage regulators and power converters, must be extremely rugged to ensure that every other system on a satellite or a strategic missile functions properly and uninterruptedly. In November 2023, Texas Instruments made technical details available to enable engineers to utilize its space-grade power devices, such as the TPS7H4010-SEP, to accelerate the design of durable power supply designs for next-generation FPGAs for space. The relevance of this market is heightened by the rigorous qualification tests that these devices must undergo before they can be considered for defense or space applications.

Manufacturing Technique Segment Analysis

The radiation hardening by design (RHBD) segment is predicted to command a 58% market share by 2035, as this methodology offers a more efficient and effective approach to developing radiation tolerance within semiconductor architecture, as opposed to shielding individual components. Instead of applying shielding to a typical component, RHBD methods change the circuit layout and logic design to make it resistant to the effects of radiation inherently. This methodology is increasingly favored for creating power-efficient, scalable, and reliable solutions.

In April 2025, Microchip Technology announced the completion of its radiation-hardened (rad-hard) power MOSFET family, meeting the MIL-PRF-19500/746 slash-sheet specification. The company also achieved JANSF qualification for its JANSF2N7587U3, a 100V N-channel MOSFET, which can withstand up to 300 Krad (Si) Total Ionizing Dose (TID). The popularity of the RHBD approach is also evident in recent announcements on new products from leading suppliers, which increasingly rely on this approach to achieve the highest performance levels and radiation tolerance.

Product Type Segment Analysis

The commercial-off-the-shelf (COTS) is expected to dominate the radiation hardened electronic market due to the need to lower costs and accelerate development cycles for space and defense systems, particularly within the expanding NewSpace sector. Manufacturers are able to offer more affordable and available solutions by leveraging proven, high-volume commercial technologies and adapting them for radiation environments.

A critical aspect of this process is gaining official qualification, as evidenced by Microchip Technology's achievement of Qualified Manufacturers List (QML) qualification for its RT PolarFire SoC FPGA in October 2023. This qualification makes the implementation of this COTS-based device more efficient for satellite payloads. The movement towards COTS is also fueling the design of components that are radiation-tolerant rather than fully radiation-hardened, offering a compromise of dependability for less demanding missions, such as those in Low Earth Orbit (LEO).

Our in-depth analysis of the global radiation hardened electronic market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Material Type |

|

|

Manufacturing Technique |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radiation Hardened Electronic Market - Regional Analysis

North America Market Insights

North America is projected to command a 35.5% market share during the forecast period. This lead is driven by huge and ongoing investment from the U.S. government, spearheaded by the Department of Defense and NASA, and a vibrant commercial space sector. It is the headquarters for the majority of the world's top producers and has a broad and highly secure domestic supply chain for the critical components.

The U.S. is the industry leader beyond dispute, with a national strategy focused on maintaining its space and defense technological lead. It is backed by significant federal funding committed to developing innovation and establishing the domestic base of microelectronics manufacturing. In a significant development, the U.S. Department of Defense in September 2023 released the establishment of eight regional innovation centers as part of the Microelectronics Commons program. Financed with an initial USD 238 million in funding from the CHIPS Act, some of these centers are being individually tasked with creating and testing next-generation radiation-hardened electronics.

Canada is investing selectively to establish sovereign space capabilities in space technology, including radiation-resistant part production. The Canadian Space Agency (CSA) is primarily engaged in funding R&D, enabling the country to participate in foreign scientific missions and develop a domestic space industry. The government's planned spending for the CSA in the 2023-24 fiscal year was projected to be USD 537.4 million, the highest level to date, underscoring the strategic importance of the space sector to Canada's economy and sovereignty.

Europe Market Insights

Europe is likely to provide significant growth from 2026 to 2035 with the ambitious undertakings of the European Space Agency (ESA) and a solid industrial base in leading countries like France, Germany, and the UK. Europe market is expanding through an increased number of satellite launches and a collaborative strategy focused on space exploration and defense programs. The continent's focus on indigenous access to space and the creation of domestic satellite constellations, such as Galileo and Copernicus, ensures a perennial requirement for high-reliability, rad-hard parts.

Germany is witnessing stable expansion in Europe and commands a quarter of the continent's market, owing to its robust manufacturing base and massive investments in advanced technologies. This position is reinforced by the federal government's new space strategy, adopted in September 2023, which outlines the nation's goals through 2030. Germany is a hub of innovation of great repute, with immense focus laid on developing world-class technologies that enhance the performance and reliability of rad-hard systems due to having dominant industry players and a booming research institution environment.

The UK is putting effort into creating its domestic semiconductor sector and establishing its sovereign capability in critical technologies, including radiation-hardened electronics. The launch of the National Semiconductor Strategy in May 2023 demonstrates the national priority given to this effort. This ten-year plan invests up to £1 billion in backing R&D, enhancing access to prototyping, and increasing the scale of domestic businesses, a strategic investment that will pay dividends directly into the development and production of specialized rad-hard components for the space and defense markets.

APAC Market Insights

Asia Pacific radiation-hardened electronics market is expected to record a CAGR of 5.5% during the forecast period. This is led by the ambitious space programs of countries like China and India, rising defense budgets, and growing focus towards developing indigenous high-technology industries. As nations of the region transition to enhancing their strategic autonomy and becoming more active participants in the global space economy, demand for locally made and sourced radiation-hardened electronics will expand noticeably.

China is a rapidly growing market, driven by a national agenda of technological self-sufficiency and leadership in defense and space exploration. The country is investing heavily in its space station, moon mission, and satellite constellations. This government-sponsored program creates a significant and long-term domestic demand for radiation-hardened products. China's focus on military modernization is another leading motivator because cutting-edge electronic warfare and communications equipment increasingly require radiation-hardened electronics.

India radiation-hardened electronics industry is on the rise with the ISRO's incredible success and the government's Make in India flagship program. An example of such congruence is the proposed Mars lander mission. Following the addition of a rover, helicopter, sky crane, and supersonic parachute to the updated 2024 plan, the mission received decisive clearance from the Space Commission on February 21, 2025. The final nod from the Union Cabinet will kick off the development phase of the spacecraft, generating unprecedented demand for indigenous, radiation-hardened electronics. As India continues to advance its satellite fleets for navigation, communication, and Earth observation, indigenous radiation-hardened devices will only have more demands, solidifying the industry as a cornerstone of the nation's strategic space capabilities.

Key Radiation Hardened Electronic Market Players:

- Microchip Technology Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BAE Systems PLC

- Honeywell International Inc.

- Infineon Technologies AG

- STMicroelectronics

- Cobham Limited

- Analog Devices, Inc.

- Texas Instruments Incorporated

- Teledyne Technologies Incorporated

- Mercury Systems, Inc.

- Northrop Grumman

- 3D PLUS

The global radiation hardened electronic market is a highly specialized and consolidated marketplace with a commanding share by a niche of well-established aerospace, defense, and semiconductor firms. Primary competitors such as BAE Systems, Honeywell International, Infineon Technologies, Microchip Technology, and STMicroelectronics compete on the basis of better technology, product reliability, and ability to meet the stringent qualification requirements of the defense and space communities. The industry is characterized by lengthy design cycles, intimate customer relationships, and a perpetual drive to put more performance into smaller, lower power packages.

Underscoring competitive dynamics in the field, in January 2025, NASA awarded Alphacore Inc. four new Small Business Innovation Research (SBIR) Phase II contracts. The contracts are intended specifically to advance leading-edge, radiation-hardened mixed-signal microelectronics for future space missions. This shows one of the major trends in the market includes government agencies actively promoting innovation by investing in smaller, more agile companies to produce next-generation technologies, a step that is increasing competition and accelerating the pace of technological advancement in this critical sector.

Here are some leading companies in the global radiation hardened electronic market:

Recent Developments

- In March 2025, Teledyne Technologies Incorporated announced the delivery of its 100th large format infrared detector focal plane module to support the Space Development Agency’s (SDA) global tracking layer. The company's manufacturing line produces these radiation-hardened, high-sensitivity sensors, which are a critical component of the fire control system designed to counter advanced missile threats from orbit.

- In March 2025, Infineon Technologies AG added P-channel power MOSFETs to its family of radiation-tolerant products for space applications. This expansion complements the company's existing N-channel devices, giving designers greater flexibility to create more efficient and lighter power management systems for Low-Earth-Orbit (LEO) satellite constellations.

- Report ID: 3314

- Published Date: Aug 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.