Protein Biochips Market Outlook:

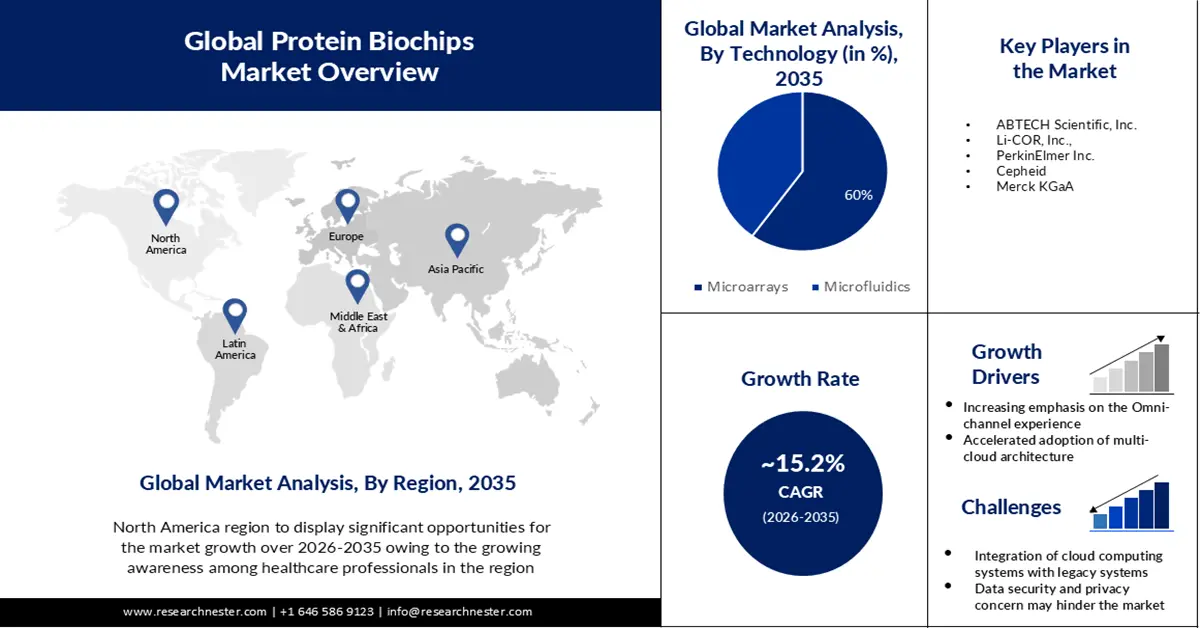

Protein Biochips Market size was valued at USD 10.41 billion in 2025 and is set to exceed USD 42.85 billion by 2035, expanding at over 15.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of protein biochips is evaluated at USD 11.83 billion.

The growth of the market can be attributed to the rising prevalence of chronic diseases, such as cancer which are increasing the demand for advanced diagnostic and therapeutic applications. As per the World Health Organization, nearly 10 million deaths in 2020 across the world were due to cancer. Protein biochips are small chips that contain proteins that can detect specific biomarkers associated with cancer.

Moreover, the advances in biochip technology, such as miniaturization and integration of sensors have enabled the development of more sensible and accurate protein biochips. There has been growing investment in research institutes that is expected to surge the need for protein biochips.

Key Protein Biochips Market Insights Summary:

Regional Highlights:

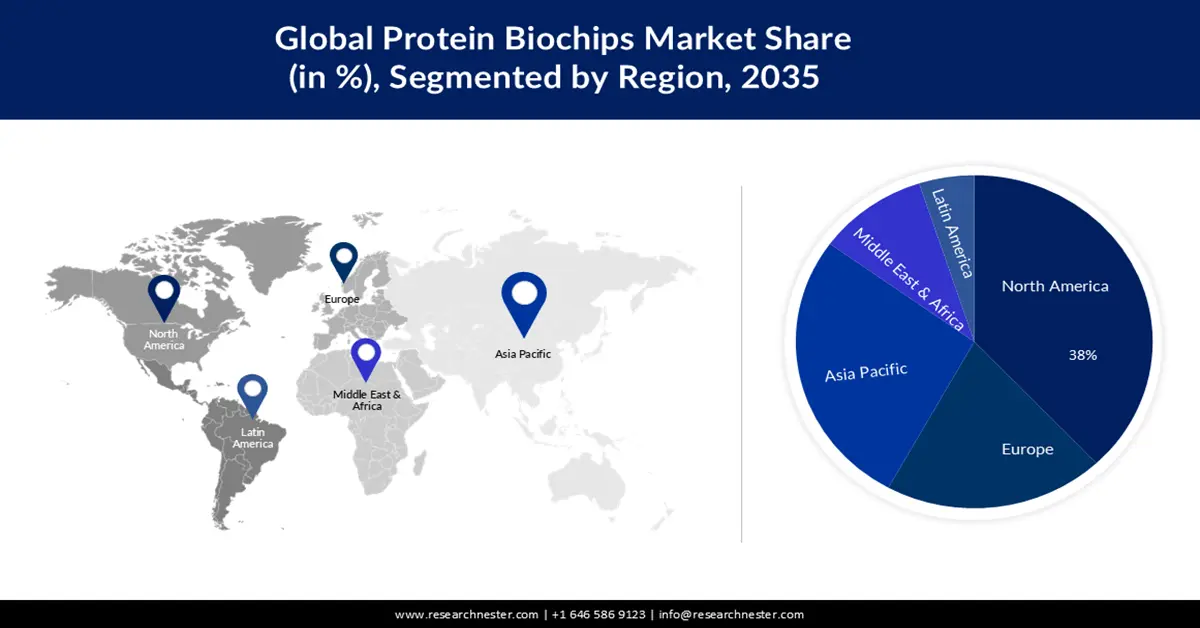

- By 2035, North America is projected to command a 38% share of the protein biochips market, underpinned by heightened professional awareness of biochip accuracy, sensitivity, and rapid result delivery.

- By 2035, Asia Pacific is expected to attain a 27% share, supported by rising health consciousness and expanding life-sciences research activity across India and China.

Segment Insights:

- By 2035, the microarrays segment is anticipated to capture a 60% share of the protein biochips market, sustained by growing utilization of microarrays for multiplex biomarker assessment and increasing adoption in personalized medicine and drug discovery.

- By 2035, biotechnology & pharmaceutical companies are set to achieve a 35% share, reinforced by the expanding biopharmaceutical ecosystem, escalating clinical trial volumes, and advancements enabling precision-driven therapeutic development.

Key Growth Trends:

- Growing Diabetes Prevalence

- Intensified Funding for Pharmaceutical R&D Activities Across the Globe

Major Challenges:

- The Shortage of Experienced Professionals for Developing and Operating Protein Biochip

- Biochips are Expensive to Produce

Key Players: Dynamic Biosensors GmbH, PerkinElmer Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., ABTECH Scientific, Inc., Standard BioTools Inc., Merck KGaA, LI-COR, Inc.

Global Protein Biochips Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.41 billion

- 2026 Market Size: USD 11.83 billion

- Projected Market Size: USD 42.85 billion by 2035

- Growth Forecasts: 15.2%

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 19 November, 2025

Protein Biochips Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Diabetes Prevalence- Protein biochips are used to measure level of glucose and other proteins in the blood. This can be used to detect early signs of diabetes, which is becoming increasingly common owing to changes in lifestyle and diet. Nearly 37.3 million Americans have diabetes according to the Centers for Disease Control and Prevention. Additionally, protein biochips can be used to monitor the progression of diabetes and to ensure that patients are receiving proper treatment.

- Intensified Funding for Pharmaceutical R&D Activities Across the Globe- A wide range of activities were covered by the costs, including medication research and testing, incremental enhancements, or expansions of products, and medical studies to monitor their safety. For instance, the US pharmaceutical companies spent more than USD 85 billion on research and development in 2019.

- Rapid Emergence of Next-Generation Sequencing- The Next-Generation Sequencing NGS technology has revolutionized genomic research with its high throughput capabilities. Thousands to millions of molecules can be sequenced simultaneously using NGS methods as they are highly parallelized. Protein biochips are used to capture and analyze proteins in a sample. By analyzing the proteins, researchers can gain insights into the biological processes taking place within the sample. This makes it a valuable tool for Next-Generation Sequencing NGS which seeks to analyse a large number of samples quickly and efficiently.

Challenges

-

The Shortage of Experienced Professionals for Developing and Operating Protein Biochip- The Technology's complexity and the necessity of it highly specialized knowledge and skills to develop and operate protein biochips makes it difficult to find the right people with the necessary skills. That's making things difficult. Companies want to use the technology more widely. It also restricts the growth possibilities of the market.

-

Biochips are Expensive to Produce

-

Lack of Understanding Between People on the Subject Use of Protein Biochips for Potential Benefits

Protein Biochips Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.2% |

|

Base Year Market Size (2025) |

USD 10.41 billion |

|

Forecast Year Market Size (2035) |

USD 42.85 billion |

|

Regional Scope |

|

Protein Biochips Market Segmentation:

By Technology Segment Analysis

The microarrays segment is estimated to hold 60% share of the global protein biochips market in the year 2035. The growth of the segment can be attributed to the increasing preference for microarrays owing to its ability to detect multiple biomarkers in a single assay, as well as its ability to generate higher throughput data compared to other technology-based protein biochips. Additionally, the rising demand for protein biochips for personalized medicine and drug discovery is also expected to contribute to the growth of the microarray segment. According to a study, there are 73,000 genetic testing products, and 250-300 personalized medicines that are currently available for cancer patients, genetic rare disease patients, and people with chronic and infectious diseases.

End-User Segment Analysis

By end-user segment, the biotechnology & pharmaceutical companies’ market is expected to gain growth of 35% by the year 2035. The growth of this segment can be attributed to the increasing number of biotechnology companies, growth in the biopharmaceutical Industry and, increasing numbers of clinical trials for the development of innovative medicines and treatments. According to the US National Library of Medicine, there are 446,246 clinical trials taking place in all 50 states and in 221 countries as of March 2023. Furthermore, the advancement in technology capabilities is also enabling the development of more targeted and precision medicine and treatments, further stimulating the growth of the segment.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Protein Biochips Market - Regional Analysis

North American Market Insights

North America industry is estimated to dominate majority revenue share of 38% by 2035, The growth of the market can be attributed majorly to the growing awareness among healthcare professionals regarding the various advantages associated with protein biochips. This includes better accuracy, sensitivity, and specificity of the results, as well as their ability to provide quick and reliable results. Moreover, the lack of access to proper healthcare and nutrition, as well as the prevalence of unhealthy lifestyle choices, has caused a dramatic increase in the number of people suffering from chronic diseases such as diabetes, hypertension, and heart disease in the region. As reported by the Centers for Disease Control and Prevention CDC, in 2022, 6 out of 10 adults in the United States had a chronic illness, while 4 out of 10 adults had two or more chronic illnesses.

Asia Pacific Market Insights

The Asia Pacific protein biochips market is estimated to be the second largest, registering a share of about 27% by the end of 2035. The growth of the market can be attributed majorly to the increasing health consciousness among people and rising awareness of the benefits of protein-based functional food and beverages are some of the major factors driving the growth of the market. Moreover, the rapid growth in life sciences research activities in India, and China supported by biotechnology and pharmaceutical research, and low infrastructure costs are significant factors driving the development of protein biochip market in the APAC region.

Protein Biochips Market Players:

- Dynamic Biosensors GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- ABTECH Scientific, Inc.

- Standard Bio Tools Inc.

- Merck KGaA

- LI-COR, Inc.

- Cepheid

- Nutcracker Therapeutics, Inc

Recent Developments

- Merck KGaA and Artios Pharma announced a global research collaboration that will lead to the development of multiple precision oncology drugs within the next three years. The collaboration will focus on the research of novel approaches to target cancer-causing mutations, with the goal of developing drugs that can be used to treat a variety of cancers.

- Bio-Rad Laboratories Inc, a global leader of life science research & clinical diagnostic products, announced the acquisition of Celsee, Inc., a company which offers instruments and consumables for the isolation, detection, and analysis of single cell.

- Report ID: 3257

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Protein Biochips Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.