Biochips Market Outlook:

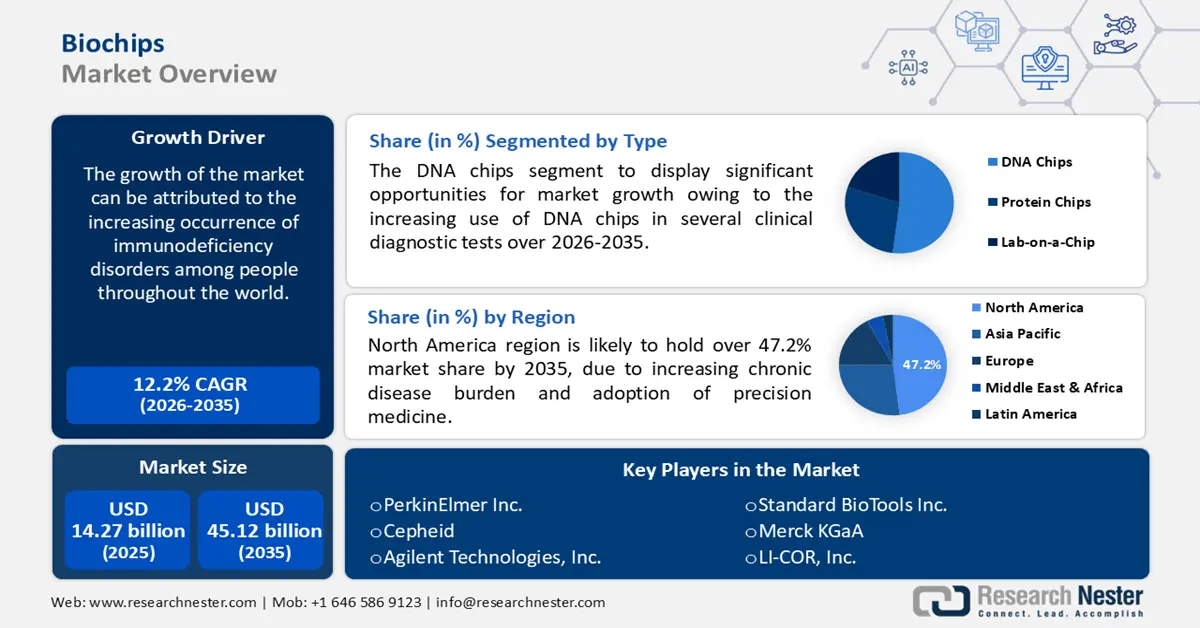

Biochips Market size was valued at USD 14.27 billion in 2025 and is set to exceed USD 45.12 billion by 2035, registering over 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biochips is evaluated at USD 15.84 billion.

The market growth is driven by increasing occurrence of immunodeficiency disorders among people across the world. For instance, more than 7 million persons worldwide were suffering from primary immunodeficiencies by 2021, with around 75 to 93% remaining untreated. Also, there are around 430 different primary immunodeficiencies or primary immunodeficiency disorders (PIDs) that have been discovered to date. Further, rapidly rising adoption of biochips in various research fields, such as genomics, drug discovery, and proteomics, will fuel the market demand.

In addition, the market revenue is propelled by rise in the need to develop novel vaccines through extensive medical research, backed by amplified funding in medical R&D activities across the globe. For instance, in 2019, the pharmaceutical industry in the United States invested more than USD 85 billion in research and development activities. These costs covered a wide range of operations, including medication research and testing, incremental enhancements including product expansions, and medical studies for safety monitoring. Additionally, increasing advances in the Lab-on-a-chip offerings along with the biomedical progression for microfluidic-based devices are predicted to boost the market expansion.

Key Biochips Market Insights Summary:

Regional Highlights:

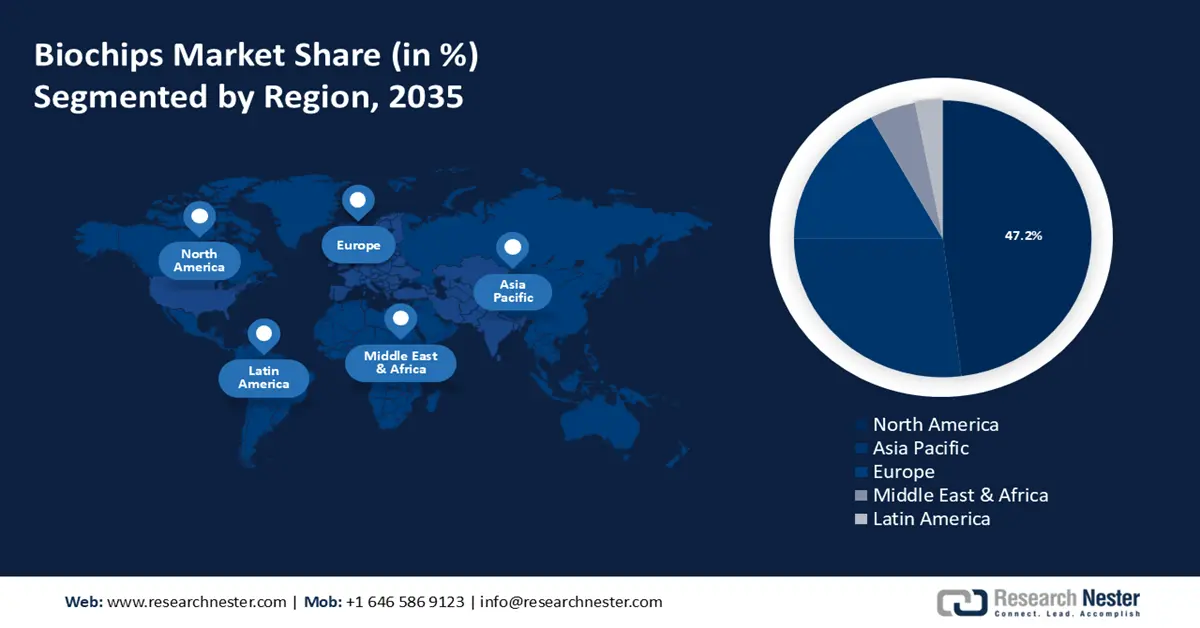

- North America biochips market will hold around 47.2% share by 2035, driven by increasing chronic disease burden and adoption of precision medicine.

- Asia Pacific market will achieve the highest CAGR during 2026-2035, driven by expanding access to medical tech and rising demand for early disorder detection.

Segment Insights:

- The pharmaceuticals segment in the biochips market is expected to achieve an impressive CAGR through 2035, influenced by increased R&D in biochips for novel biomarkers and drug discovery.

- The dna chips segment in the biochips market is projected to capture a dominant share by 2035, driven by increasing use in clinical diagnostics and genetic research.

Key Growth Trends:

- Worldwide Growing Prevalence of Cancer

- Worldwide Increasing Health Spending

Major Challenges:

- High Manufacturing Cost of Biochips

- Lack of Awareness Regarding Biochips in Emerging Economies

Key Players: Dynamic Biosensors GmbH, PerkinElmer Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., ABTECH Scientific, Inc., Standard BioTools Inc., Merck KGaA, LI-COR, Inc., Cepheid, Agilent Technologies, Inc.

Global Biochips Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.27 billion

- 2026 Market Size: USD 15.84 billion

- Projected Market Size: USD 45.12 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 8 September, 2025

Biochips Market Growth Drivers and Challenges:

Growth Drivers

-

Worldwide Growing Prevalence of Cancer – Cancer occurs when some of the body's cells grow out of control and spread to other bodily areas. Cancer can develop practically anywhere in the body, which contains trillions of cells. When this regulated mechanism fails, aberrant or defective cells expand and reproduce when they should not. These cells can conjoin to generate tumors, which are tissue masses. Tumors may or may not be cancerous. Cancer is one of the greatest causes of death globally. But, now the survival ratio of various kinds of cancer patients has been improving owing to the advancement and surging development in cancer prevention and treatment. Hence, the upsurge in cancer cases is estimated to spur the growth of the market throughout the forecast period. As per the statistics of the World Health Organization, cancer is the second leading cause of death throughout the world. In addition, it was responsible for about one out of every six deaths which denotes around 10 million deaths in 2020 across the globe.

-

Rising Proportion of Communicable Disorders - Communicable diseases, often known as infectious diseases, are disorders caused by the infection, existence, and proliferation of pathogenic biologic agents in a single human or other infected animals. Infections can be severe to fatal, hence the increasing proportion of communicable disorders is anticipated to propel the market growth. For instance, the number of visits to medical offices in the United States for infectious and parasitic diseases soared to over 10 million in 2019.

-

Worldwide Increasing Health Spending – According to the most recent expenditure data, worldwide health spending has flourished over the former 20 years, doubling in real terms to an extent of USD 8.5 trillion in 2019 and 9.8% of GDP, up from 8.5 percent in 2000. It is predicted that this surge would persist over the forecast period.

-

An Upsurge in the Development and Approval of Novel Drugs – The requirement for novel drug development has been soaring in the past two decades. This growth is owing to the proliferating deployment of novel drug delivery systems throughout the world, which is further fueling the approval of these drugs. For instance, by 2022, the clinical drug development success rate has risen by nearly 12% to 16%. Moreover, in the United States, a record of around 60 novel drugs was authorized in 2018, thus, the total number of novel drugs approved for sale expanded by 62% between 2010 and 2019 in comparison to the previous decade.

-

Rise in the Development of Novel Lab-on-a-Chip Kit - A lab-on-a-chip is a compact device that combines one or more laboratory-based studies, such as DNA sequencing or biochemical detection, on a single chip. Medical diagnostics, DNA analysis, and other applications are the key points of lab-on-a-chip research and development. Thus, the surging development of novel lab-on-a-chip (LOC) kits is also projected to spur market growth in the coming years. For instance, the University of California, Irvine's electrical engineers, and biomedical engineers have developed a novel lab-on-a-chip that can assist in the research of tumor heterogeneity in terms of lowering resistance to cancer therapies.

Challenges

- High Manufacturing Cost of Biochips – The manufacturing cost of biochips is comparatively higher than the cost of its other alternatives. Such hefty costs put barriers for emerging organizations and startups to manufacture a broad range of biochips. Hence, this factor is anticipated to hamper the market growth in the projected time frame.

- Lack of Awareness Regarding Biochips in Emerging Economies

- Concerned Risks of Biohacking and Privacy

Biochips Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 14.27 billion |

|

Forecast Year Market Size (2035) |

USD 45.12 billion |

|

Regional Scope |

|

Biochips Market Segmentation:

Type Segment Analysis

The DNA chips segment is predicted to dominate market share over the projected time frame. The segment growth can be attributed to increasing use of DNA chips in several clinical diagnostic tests and research work regarding the detection of numerous disorder., coupled with significant rise in the development of DNA chips in recent years. For instance, in 2021, Roswell Biotechnologies Inc., invented the molecular microchip that can detect an individual's molecule. The technology is expected to revolutionize disease detection, drug development, and health monitoring procedures to great extent. The chip is going to be utilized to improve DNA sequencing.

End-user Segment Analysis

The hospitals and diagnostic center segment will garner a significant share by 2035. The segment growth can be accredited to increasing need for advanced medical facilities, diagnosis technologies, and a growing patient pool. On the other hand, the pharmaceutical segment is projected to witness an impressive CAGR during the forecast period, owing to higher indulgence of pharmaceutical companies in the research and development of biochips and their integration. In addition, these pharmaceutical organizations have also been exploring new heights with the deployment of biochips in the process of novel drug discovery, research, and development of novel biomarkers, and gene expression profiling.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Function |

|

|

By Fabrication Technology |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biochips Market Regional Analysis:

North American Market Insights

North America region is likely to hold over 47.2% market share by 2035, impelled by increasing frequency of cancer amongst several people, followed by the rising burden of numerous types of chronic disorders in the region. For instance, in 2022, 6 out of 10 adults in the United States had a chronic disease, while 4 out of 10 adults had two or more chronic disorders.

Further, the growing adoption and availability of precision medicine is is estimated to radically drive the market growth. For instance, based on a report's figures, in the United States, the available number of personalized medicines in the market has increased from 135 in 2016 to 289 by 2020. Moreover, an efficient public health care system and the availability of advanced technologies which promote the application of biochips for the discovery of new drugs are some more factors that are projected to boost the market revenue. In addition, high funding for R&D activities in the healthcare sector will contribute to the expansion.

APAC Market Insights

The Asia Pacific biochips market is predicted to grow with the highest CAGR during the forecast period. The market growth is propelled by expanding access to advanced technologies in healthcare, followed by the surging patient pool which requires the early detection of disorders. Moreover, increasing investments in the R&D of medical technologies will fuel the market growth.

Biochips Market Players:

- Dynamic Biosensors GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- ABTECH Scientific, Inc.

- Standard BioTools Inc.

- Merck KGaA

- LI-COR, Inc.

- Cepheid

- Agilent Technologies, Inc.

Recent Developments

-

Bio-Rad Laboratories, Inc. announced a collaboration with Element Biosciences, Inc. to demonstrate the Bio-Rad SEQuoia RNA Sequencing Library Preparation portfolio with the Element AVITI Benchtop Sequencer. Using the new Avidity Sequencing chemistry on the Element AVITI Sequencing Platform, Bio-Rad's SEQuoia RNA Complete Stranded RNA Library Prep Kit and SEQuoia Express Stranded RNA Library Prep Kit are estimated to be easily used to achieve high RNA sequencing accuracy and repeatability across different samples and inputs.

-

Merck KGaA announced the partnership with Artios Pharma to jointly develop multiple precision oncology drugs over the next three years as part of a global research collaboration. By leveraging Artios' proprietary nuclease targeting discovery platform, the companies are projected to jointly identify multiple synthetic lethal targets for precision cancer drug candidates.

- Report ID: 2900

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biochips Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.