Protein Analyzers Market Outlook:

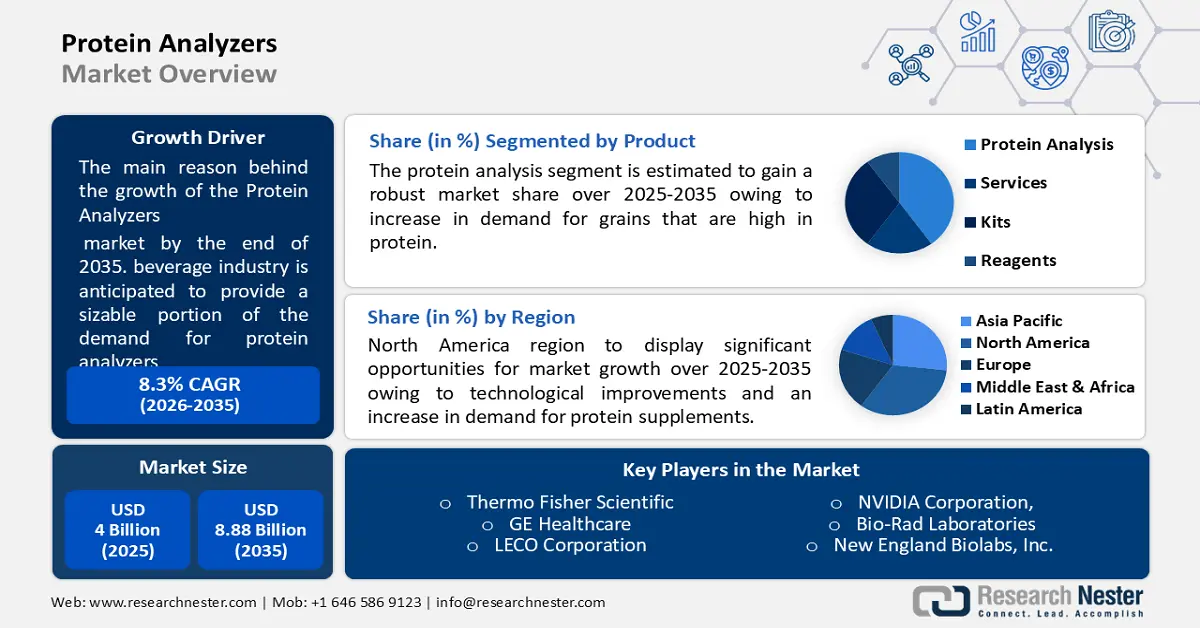

Protein Analyzers Market size was valued at USD 4 billion in 2025 and is set to exceed USD 8.88 billion by 2035, expanding at over 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of protein analyzers is estimated at USD 4.3 billion.

The beverage industry is anticipated to provide a sizable portion of the demand for protein analyzers, as it experiences rapid growth on account of changes in lifestyle. For instance, in the U.S. in 2022, the beverage industry, as a whole, witnessed sales of over USD 220 billion in a year. The increasing number of people drinking alcoholic beverages and non-alcoholic beverages such as carbonated drinks, juices, nectars, and smoothies is increasing market’s growth, as all of these are tested for their protein content in them. Energy drinks used in sports, and physical fitness also come under the category of beverages. Moreover, the rising availability of these ready-made drinks, including coffee, tea, milkshakes, and many more which are convenient to buy on the way to the office, are further anticipated to boost the market’s growth.

Protein analyzer, an efficient laboratory tool figuring out how much protein is in a sample is a protein analyzer. Protein analyzers are the most frequently used tools in laboratories of food and beverages, to determine the nutritional value of various food items such as meats, dairy products, and other food items. The growing food and beverage industries and rising demand for protein supplements increase the need for protein analyzers. When compared to the same period in FY2021-2022, India’s exports of processed food and agricultural products increased by 14% to USD 5987 million in the first 3 months of the fiscal year 2022-2023. The protein in the food products is evaluated to match the labels on the packaging. The rising preference for protein food is growing among people, as they become more health conscious. The increasing issues with obesity or overweight, and other disease conditions demand to take more protein food than fatty or carbohydrate foods to reduce complications.

Key Protein Analyzers Market Insights Summary:

Regional Insights:

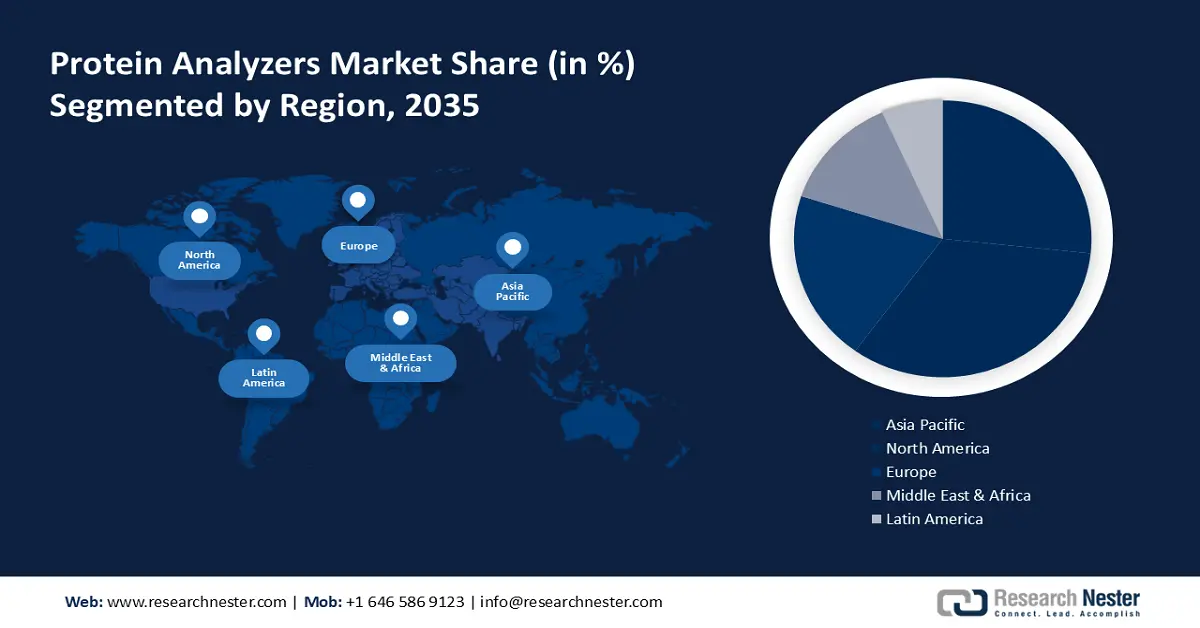

- By 2035, the North America protein analyzers market is anticipated to command the leading share, attributed to advancing technologies and rising consumption of protein supplements.

Segment Insights:

- By 2035, the protein analysis segment in the protein analyzers market is projected to hold the largest share, supported by rising demand for grains that are high in protein.

- By 2035, the DUMAS segment is expected to secure a notable share, fueled by the automation and speed of the DUMAS method.

Key Growth Trends:

- Rising Production of Animal Feed with Increasing Livestock Population

- Increasing Rate of Fertilizer Production Owing to Rising Agricultural Land

Major Challenges:

- Does not Give True Protein Measure

- Strict Guidelines for Biologics Production

Key Players: PerkinElmer, Inc., Thermo Fisher Scientific, GE Healthcare, LECO Corporation, Shimadzu Corporation, Agilent Technologies, Inc., VELP Scientifica S.r.l, NVIDIA Corporation, Bio-Rad Laboratories, New England Biolabs, Inc.

Global Protein Analyzers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4 billion

- 2026 Market Size: USD 4.3 billion

- Projected Market Size: USD 8.88 billion by 2035

- Growth Forecasts: 8.3%

Key Regional Dynamics:

- Largest Region: North America (largest share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 24 November, 2025

Protein Analyzers Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Production of Animal Feed with Increasing Livestock Population – There is an increase in animal feed consumption owing to population growth, changing lifestyles, and dietary habits. This leads to an increased demand for animal feed, and it is anticipated to boost the growth of the global protein analyzers market. More than 1 billion tons of compound feed are produced worldwide each year. More than USD 400 million in revenue is reportedly generated annually by the production of commercial feeds worldwide.

-

Increasing Rate of Fertilizer Production Owing to Rising Agricultural Land – The global production of Nitrogen, Phosphorus, and Potash fertilizers was 318,700 thousand tons in 2022, which was up from 313,500 thousand tons in 2020.

-

Increasing Production of Beer with Rising Beverage Industries – Global beer production rose from 1.78 billion hectoliters in 2020 to approximately 1.87 billion hectolitres in 2021.

-

Expanding Worldwide Population Increases the Demand for More Food – The worldwide population rose to around 7,983,241,075 as of October 2022

Challenges

-

Does not Give True Protein Measure – as the nitrogen in all foods is not in the protein form. Also, various amino acids require different corrections as they are made from different sequences of amino acids. Furthermore, it is difficult to extract protein quantitatively from processed food items as the proteins are covalently bound together. This inaccuracy in measurement is estimated to hinder market growth in the coming years.

- Strict Guidelines for Biologics Production

- Prolonged Licensing Process

Protein Analyzers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 4 billion |

|

Forecast Year Market Size (2035) |

USD 8.88 billion |

|

Regional Scope |

|

Protein Analyzers Market Segmentation:

Product Segment Analysis

The global protein analyzers market is segmented and analyzed for demand and supply by product into protein analysis, services, kits, reagents, and others. Out of these, the protein analysis segment is anticipated to hold the largest market size over the forecast period. The growth of the protein analysis segment is being driven by an increase in demand for grains that are high in protein, an increase in consumption of foods that are high in protein, a rise in R &D spending by market participants, and in-depth knowledge of how grain protein analyzers are used in other applications. For instance, the worldwide supply of soy is 2,000,000 metric tons and dairy supply is 895,000 metric tons and 141,000 metric tons of peas in 2022. The rising spending capacity of people with increasing disposable income among the middle-class population rises the purchases of protein food. Furthermore, protein-rich foods are costly compared to starchy or fatty foods, and treated as a healthy option, as they reduce the risk of heart disease, high cholesterol, and diabetes.

Technique Segment Analysis

The global protein analyzers market is also segmented and analyzed for demand and supply by technique into DUMAS, neural infrared spectrometers, Kjeldahl method, chromatography, and others. Amongst these segments, the DUMAS segment is expected to garner a significant share. The DUMAS method is the fastest and easiest method among all the protein analysis methods, as it is automated. The analysis only takes a few minutes to measure for one test. This is also referred to as the combustion method, as it ensures safety in determining components such as nitrogen. Moreover, the DUMAS method is applied in all types of laboratories, as it is fully automatic and uses the principle of DUMATEHRM as the basic method to analyze the protein content in solids or liquids. Nitrogen gas is used to estimate the hydrogen content and the nitrogen content in the samples. The accuracy is also very good for the DUMAS method compared to the Kjeldhal method. As per the analysis in 2022, the accuracy of the DUMAS method ranges within 1.8-3.8% intervals.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Technique |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Protein Analyzers Market - Regional Analysis

North American Market Insights

The North America protein analyzers market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The market is being driven by technological improvements and an increase in demand for protein supplements such as Whey protein. In the U.S., consumers reported consuming more protein supplements by 31.5% in 2020. In addition, there is a rising number of athletes and sportsmen in the region who consume more protein rich foods. The increasing demand for fresh meat packaging, backed by the surging meat consumption along with the rising population across the region, is expected to boost the market’s growth in the region. Products such as steak, mayonnaise, eggs, cereal, and chicken are some of the rich sources of protein that are available in the region. Moreover, protein-rich foods give strength to the body without adding extra weight. In the era of fast-food, protein-rich food is very rare to find which increases its demand among people. Therefore, the protein diet is getting more popular as the number of obesity cases increases owing to less physical activity, that is projected to drive the market’s growth in the region.

Protein Analyzers Market Players:

- PerkinElmer, Inc.,

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Developments

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific

- GE Healthcare

- LECO Corporation

- Shimadzu Corporation,

- Agilent Technologies, Inc.,

- VELP Scientifica S.r.l

- NVIDIA Corporation,

- Bio-Rad Laboratories

- New England Biolabs, Inc.

Recent Developments

-

Thermo Fisher Inc., - A new micro-pillar array column is being made available to proteomics and biopharmaceutical research laboratories by Thermo Fisher Scientific Inc., to make difficult bottom-up proteomics analyses simpler.

-

NVIDIA Corporation, - The company announced that it would integrate its NeMo LLM cloud service with BioNeMO, which gives academics access to pre-trained chemistry and biology language models. These services support research interaction and modify data and protein for a variety of uses, such as drug discovery.

- Report ID: 4629

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Protein Analyzers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.