Prosthetic Disc Nucleus Market Outlook:

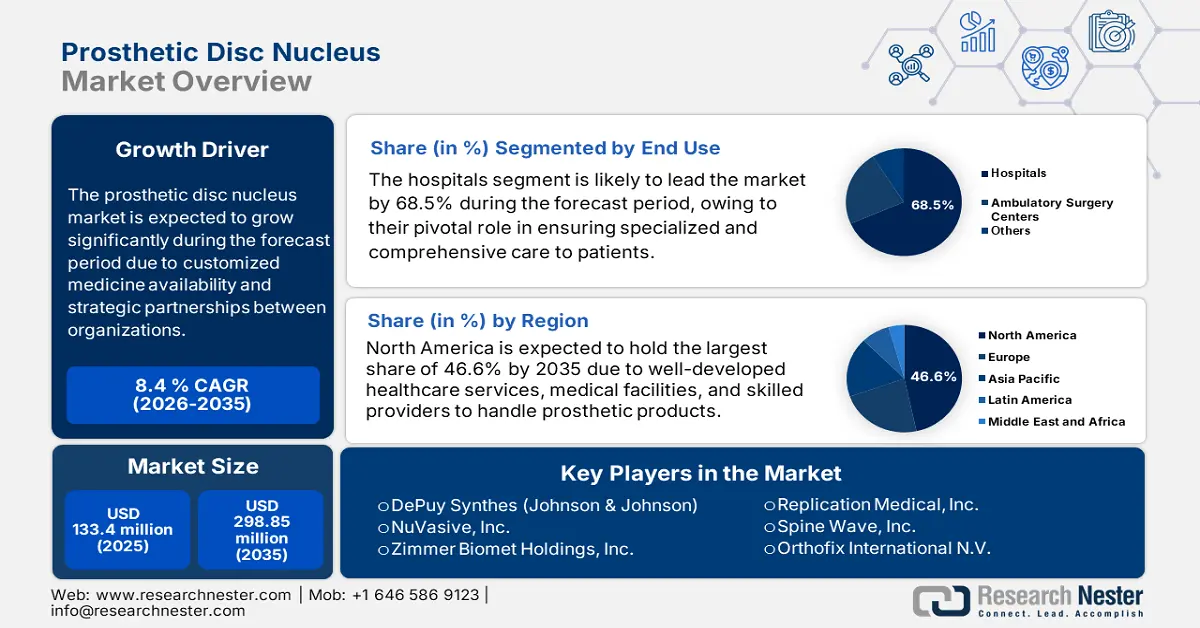

Prosthetic Disc Nucleus Market size was over USD 133.4 million in 2025 and is poised to exceed USD 298.85 million by 2035, growing at over 8.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of prosthetic disc nucleus is estimated at USD 143.49 million.

Prosthetic disc nucleus has gained momentum owing to its utilization as an alternative to ensure spinal synthesis for aiding degenerative disc disorder. The ultimate aim is to preserve spinal motion and reduce pain, as well as assist in re-establishing disc height, offer pain relief, and curtail further degeneration in adjacent spinal segments. According to an article published by Engineered Regeneration in June 2024, a Phase III trial was conducted, wherein the success rate of the device was 88 % for a population of 356 patients. In addition, 23 patients demonstrated an 82.9% reduction in degenerative disc disorder with an average decrease in pain by 74.6%, thereby a positive impact on the upliftment of the market globally.

The evolution of the prosthetic disc nucleus market is highly driven by replacement surgery, which is also known as artificial disc replacement surgery. This surgical procedure includes the replacement of the injured disc with a synthetic implant to reinstate vertebral height and movement. Besides, the pricing strategy for this procedure depends on the location, type of hospital, and the specific procedure performed. As stated in the 2025 Yashoda Hospitals report, the current expense of the surgery usually ranges between ₹3,50,000 (USD 4,128.0) to ₹6,00,000 (USD 7,074.7), and the overall surgery cost is almost USD 4,00,000 (USD 4,716.4), thus a prolific opportunity for market demand and expansion.

Key Prosthetic Disc Nucleus Market Insights Summary:

Regional Highlights:

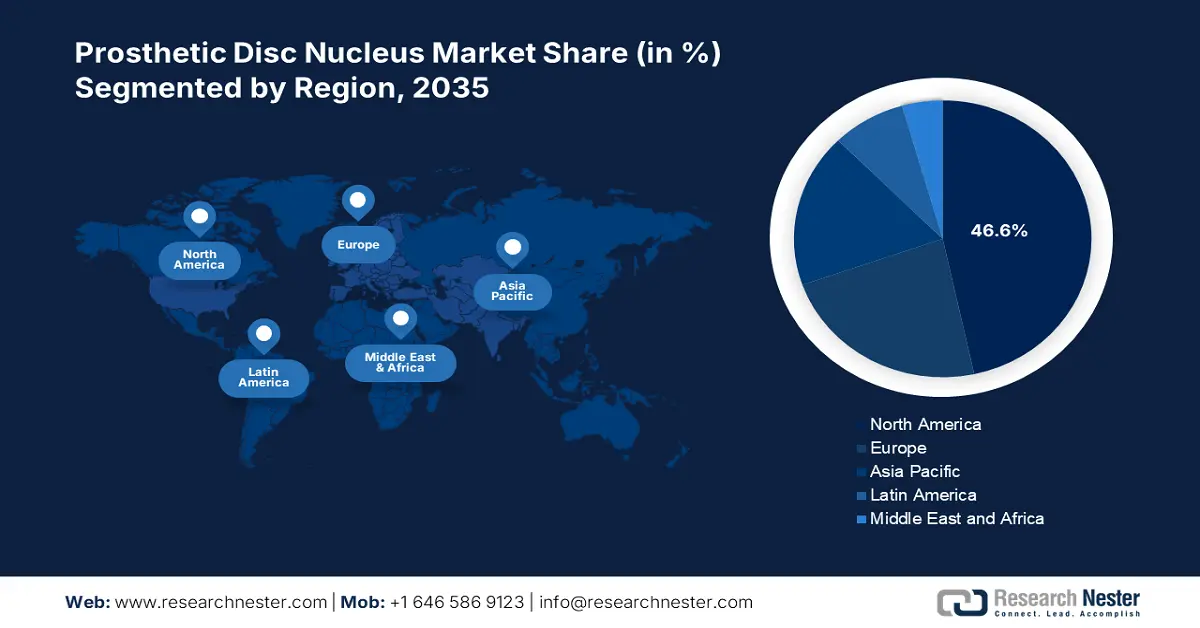

- North America leads the Prosthetic Disc Nucleus Market with a 46.6% share, fueled by economic development, innovative health infrastructures, and rising degenerative disorders, supporting robust growth through 2026–2035.

- The Asia Pacific Prosthetic Disc Nucleus Market is expected to grow rapidly by 2035, propelled by the rise in the aging population and availability of healthcare infrastructures.

Segment Insights:

- The Minimally Invasive Spine Surgery segment is expected to capture 61.7% market share by 2035, fueled by its less invasive surgical approach and high success rates using modified endoscopes.

- The Hospitals segment is projected to capture a 68.5% market share by 2035, driven by specialized care from experienced surgeons for prosthetic disc nucleus implantations.

Key Growth Trends:

- Rising incidence of degenerative disc disease

- Innovation in health technology

Major Challenges:

- Huge surgery cost

- Presence of strict policies

- Key Players: NuVasive, Inc., Zimmer Biomet Holdings, Inc., Stryker Corporation, Replication Medical, Inc..

Global Prosthetic Disc Nucleus Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 133.4 million

- 2026 Market Size: USD 143.49 million

- Projected Market Size: USD 298.85 million by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Prosthetic Disc Nucleus Market Growth Drivers and Challenges:

Growth Drivers

-

Rising incidence of degenerative disc disease: An increase in the aging population internationally results in the enhancement of spine-based disorders, which denotes a positive outlook for the prosthetic disc nucleus market. According to the October 2020 article published by the Journal of Clinical Orthopaedics and Trauma, a clinical study was conducted wherein over 40% of 30-year-old patients suffered from multilevel disc degeneration due to low back pain. Therefore, the implementation of prosthetic disc nucleus as an innovative solution is essential to combat such a condition at a younger age.

-

Innovation in health technology: The aspect of ongoing research and development has led to a drastic transition in spine surgery, which is yet another factor driving the prosthetic disc nucleus market growth globally. As stated in the June 2024 NLM article, the adoption of machine learning tools, including deep learning and convoluted neural networks, extracts images that are difficult to detect with the naked eye, account for 97.0% accuracy. Additionally, these tools assist in evaluating the intensity and shape of disks by utilizing the feature-extraction technique, thus suitable for increasing the market demand.

Challenges

-

Huge surgery cost: The growth of the prosthetic disc nucleus market is hindered by the expensive price of surgeries, as well as follow-up sessions for physical therapy. For a few patients, the treatment is not cost-effective and affordable, thereby resulting in increased health deterioration. Besides, the overall surgery can result in side effects from the surgery, such as chronic pain and height loss which constitutes a negative impact on the market across nations.

-

Presence of strict policies: The different types of systems and devices essential for undertaking the surgery generally receive approval from regulatory bodies, which is usually time-consuming. In addition, manufacturers and organizations face the limitation of introducing the newest products into the existing market, and in turn, patients are deprived of suitable spine treatment and diagnostic solutions. This results in delayed surgical procedures, which limits the upliftment of the prosthetic disc nucleus market.

Prosthetic Disc Nucleus Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 133.4 million |

|

Forecast Year Market Size (2035) |

USD 298.85 million |

|

Regional Scope |

|

Prosthetic Disc Nucleus Market Segmentation:

End Use (Hospitals, Ambulatory Surgery Centers)

Based on end use, the hospitals segment is projected to hold the largest share of 68.5% in the prosthetic disc nucleus market by the end of the forecast timeline. Hospitals play a crucial role in providing specialized and comprehensive care pertaining to spinal disc replacement procedures that involve prosthetic disc nucleus implantations. As per a clinical study published by NLM in February 2021, 694,165 patients were treated by 8,503 experienced surgeons and 68,036 by new surgeons in hospitals. Out of the overall patients, 25.8% were elderly people, handled by new surgeons with 53.9% of emergency admission. Therefore, a successful surgery depends upon the care provided in hospitals by surgeons, thus uplifting the segment.

Surgery Type (Minimally Invasive Spine Surgery, Open Spine Surgery)

Based on surgery type, the minimally invasive spine surgery segment is expected to garner a share of 61.7% in the prosthetic disc nucleus market during the forecast period. The segment’s growth is attributed to the surgical approach that constitutes small incisions and the absence of time disruption, leading to a revolutionized treatment of spinal disorders. According to the June 2024 NLM article, this particular spine surgery is suitable for conducting treatment with the use of a modified endoscope that accounts for a 72.5% success rate, thereby a suitable application for patients that caters to the segment’s upliftment.

Our in-depth analysis of the global prosthetic disc nucleus market includes the following segments:

|

End Use |

|

|

Surgery Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Prosthetic Disc Nucleus Market Regional Analysis:

North America Market Analysis

North America is anticipated to account for the largest share of 46.6% in the prosthetic disc nucleus market by the end of 2036. The market dominance is fueled by economic development, innovative health infrastructures, and the rising occurrence of degenerative disorders. Moreover, the region also comprises progressive medical facilities, educated and skilled professionals, rapid implementation of health solutions, and the availability of innovative market entry strategies are other factors responsible for the market growth.

The prosthetic disc nucleus market in the U.S. is expanding due to organizational contributions to launch the latest devices for spine treatment. For instance, in April 2024, Centinel Spine, LLC proclaimed the accomplishment of the 5,000th case in the country with the prodisc C Vivo and prodisc C SK Cervical TDR System. More than 600 surgeons utilized this newest system, which is suitable for the appropriate implant selection for patients. Also, almost 75% of the overall surgeons have demonstrated repeatedly to use it, thus accelerating the user base and conversion.

The prosthetic disc nucleus market in Canada is gaining more exposure since provincial programs regarding spine care are being initiated by the government and administrative organizations. For instance, in April 2024, such a program was established in Manitoba, a province in Canada, to provide knowledge about ensuring acute spinal care. In addition, more than USD 12 million was spent to develop the program that can ultimately result in reduced waiting time for patients to consult with surgeons, coordinate care levels, and establish centralized wait lists, thus suitable for the market expansion.

APAC Market Statistics

Asia Pacific is projected to be the fastest-growing region in the prosthetic disc nucleus market during the forecast period. The prevalence of the condition is continuously growing in the region, attributed to the rise in the aging population and the availability of healthcare and medical infrastructures. Besides, there have been advancements in the provision of minimally invasive surgery, which is another factor for the market expansion in the region. Additionally, a surge in rare disorders is enhancing the demand for replacement surgeries, which is a growth opportunity for the market.

The prosthetic disc nucleus market in India has been growing significantly since the treatment procedure is affordable and is suitable for the economy. As per the 2025 Medical Tourism Corporation report, the artificial disc replacement surgery cost in New Delhi is over USD 5,200 in comparison to USD 30,000 to USD 45,000 in the U.S. Therefore, the conduct of surgery in the country has the capability to save almost 85.0% in medical expenses, thus making it suitable for middle-income patients to undergo the surgery and a positive outlook for the market growth.

Price Comparison of Other Spine Surgeries Between India and the U.S.

|

Spine Surgery Type |

India |

U.S. |

|

Spinal Fusion |

USD 5,500 |

USD 110,000 |

|

Lumbar Discectomy |

USD 4,200 to USD 5,500 |

USD 20,000 to USD 50,000 |

|

Endoscopic discectomy |

USD 3,500 to USD 6,000 |

USD 50,000 to USD 100,000 |

|

Lumbar Disc Replacement with Implants |

USD 4,700 |

USD 50,000 |

|

Cervical Rib Surgery |

Over USD 5,500 |

USD 29,000 |

Source: Medical Tourism Corporation 2025

The prosthetic disc nucleus market in China has gained popularity owing to its effective and primary utilization for lumbar disc herniation. As stated in the December 2024 NLM article, a clinical study was conducted on 4,545 people in the country, and the prevalence rate of the condition was found to be 22.77%, especially in Gansu. This prevalence highly depends on the nationality, latitude, demographic influences, potential lifestyles, and gender, thus increasing the demand of the market in the country.

Key Prosthetic Disc Nucleus Market Players:

- DePuy Synthes (Johnson & Johnson)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NuVasive, Inc.

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- Replication Medical, Inc.

- Spine Wave, Inc.

- Orthofix International N.V.

- Centinel Spine, LLC

- Spineart USA Inc.

Organizations in the prosthetic disc nucleus market are continuously conducting clinical trials of the newest prosthetic products before making them available to the market. For instance, in February 2021, Spineart USA Inc. declared that Atrium Musculoskeletal Institute and Carolina Neurosurgery performed the first surgery in the two-level U.S. Investigational Device Exemption (IDE) clinical trial of the BAGUERA C Cervical Disc Prosthesis. It is an investigational device designed to restructure the cervical disc following two-level discectomy at end-to-end segments for symptomatic cervical disc disease, thus driving the expansion of the market.

Here's the list of some key players:

Recent Developments

- In August 2024, Johnson & Johnson MedTech announced that DePuy Synthes launched a proprietary dual-use robotics and standalone navigation platform developed in collaboration with eCential Robotics.

- In April 2021, NuVasive, Inc. proclaimed the U.S. FDA approval of the NuVasive Simplify Cervical Artificial Disc for two-level cervical total disc replacement (cTDR) to strengthen the growth opportunities for the NuVasive C360 portfolio.

- Report ID: 7621

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Prosthetic Disc Nucleus Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.