Project Portfolio Management Market Outlook:

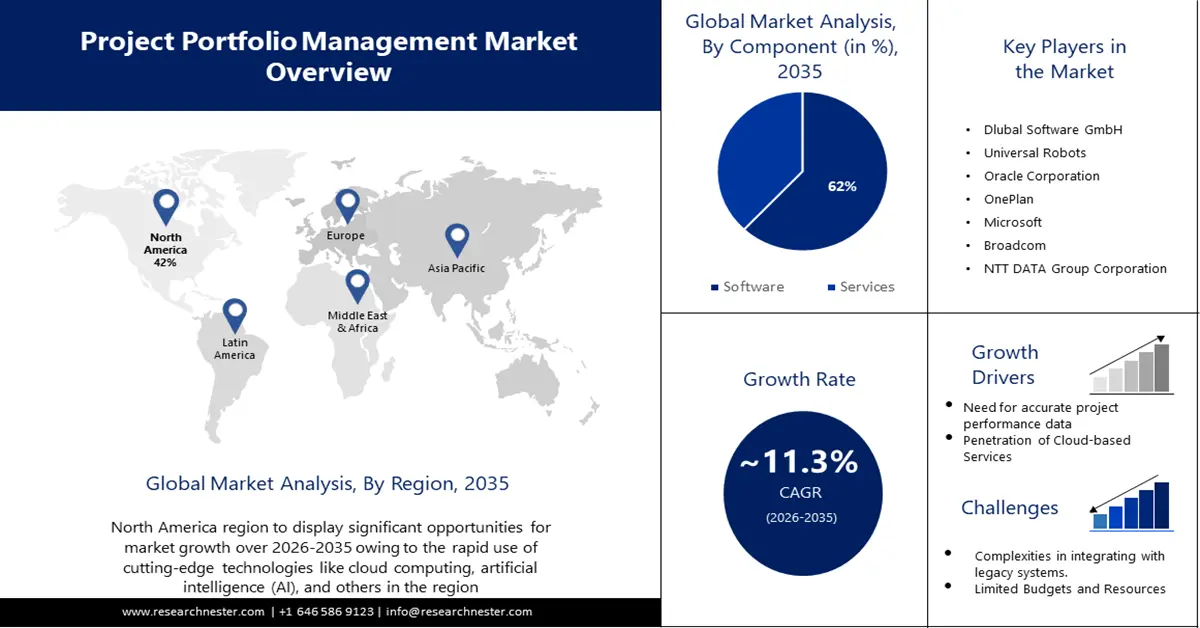

Project Portfolio Management Market size was over USD 6.54 billion in 2025 and is poised to exceed USD 19.08 billion by 2035, growing at over 11.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of project portfolio management is estimated at USD 7.21 billion.

The market is predicted to experience significant growth due to the increasing adoption of business process automation. More and more businesses are relying on automated processes, such as automated order entry, email automation, batch processing, file transfer, and report generation and distribution. Additionally, approximately 66% of businesses have already automated at least one of their processes.

Moreover, as the business landscape continues to evolve, there is an increasing need for cloud-based software across various industries. In particular, the demand for cloud-based project management solutions is on the rise. This trend may accelerate the adoption of cloud technology for portfolio management solutions as well, leading to more robust revenue growth in the overall market.

Key Project Portfolio Management Market Insights Summary:

Regional Highlights:

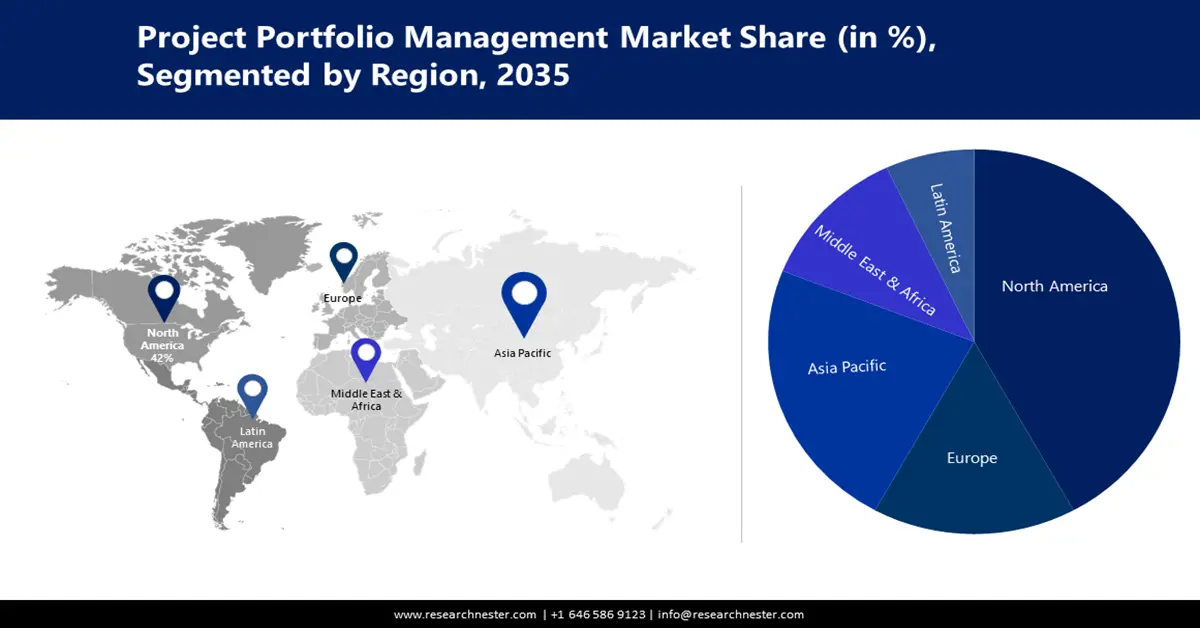

- North America project portfolio management market is expected to capture 42% share by 2035, multi-cloud adoption and tech innovation.

- Asia Pacific market will achieve significant revenue share by 2035, rising software use and cloud infrastructure demand.

Segment Insights:

- The software segment in the project portfolio management market is projected to capture a 62% share in 2026-2035, driven by increasing demand for cloud-based software and IT vendor adoption across industries.

- The cloud-based deployment segment in the project portfolio management market is anticipated to hold a significant share by 2035, driven by the popularity of SaaS technologies offering flexible pricing and easy maintenance.

Key Growth Trends:

- Increasing demand for digital transformation among organizations

- Growing Workforce Management Application Industry

Major Challenges:

- Lack of standardization and best practices

- Complexity of managing portfolios for Large organizations

Key Players: Wrike, Inc., Total Synergy Consulting Pvt. Ltd., Deltek, Inc., MeisterLabs, Wax Inc., Stewart Technology Associates, Dlubal Software GmbH, Universal Robots, Oracle Corporation, OnePlan, Microsoft, Broadcom.

Global Project Portfolio Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.54 billion

- 2026 Market Size: USD 7.21 billion

- Projected Market Size: USD 19.08 billion by 2035

- Growth Forecasts: 11.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Canada, China

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Project Portfolio Management Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for digital transformation among organizations- Project portfolio management market expansion is anticipated to be fuelled by rising demand for digital transformation efforts. As organizations seek to use technology to increase their operational effectiveness, customer experience, and competitive advantage, digital transformation has become an essential priority for businesses across all industries. PPM plays a crucial role in managing and executing digital transformation projects effectively. The implementation of process modifications and the adoption of new technology are just two examples of the numerous projects and activities that together make up digital transformation.

- Growing Workforce Management Application Industry- Workforce management apps help businesses allocate and manage human resources across multiple projects. This enhances project portfolio management by optimizing resource utilization and leading to more successful outcomes. These apps allow businesses to make informed decisions based on data, align resources with objectives, and improve overall efficiency. In 2020, the workforce management application industry generated around USD 2.5 billion in revenue. The estimated total revenue from 2018 to 2020 was USD 650 million.

- Rise of Agile and Lean Methodologies - The use of Agile techniques has revolutionized project management by promoting adaptability, teamwork, and speed while reducing waste and rework. By utilizing the framework provided by PPM, Agile, and DevOps teams can keep up with the pace of change while aligning their projects with the overall business strategy. Additionally, Lean Six Sigma methodologies focus on process improvement, waste reduction, and quality assurance. With the help of PPM, organizations can apply Lean Six Sigma principles to their project portfolio, resulting in better projects delivered faster and with fewer defects.

Challenges

- Lack of standardization and best practices- PPM varies across industries, making it difficult to establish universal procedures and benchmarks. Customized strategies may be necessary for sectors with unique project characteristics, regulations, and compliance needs.

- Complexity of managing portfolios for Large organizations.

- Limited budgets and resources can restrict an organization's ability to execute all planned projects.

Project Portfolio Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.3% |

|

Base Year Market Size (2025) |

USD 6.54 billion |

|

Forecast Year Market Size (2035) |

USD 19.08 billion |

|

Regional Scope |

|

Project Portfolio Management Market Segmentation:

Component Segment Analysis

The software segment in the project portfolio management market is anticipated to hold 62% of the revenue share by 2035. The primary attribute to the segments growth is IT vendors’ enormous demand in all industries. emergence of cloud-based software triggers positive market response due to additional features with flexible price packages. To scale infrastructure, supply exquisite web services, and scale and analyze enough data storage for the expansion of small and large businesses, 90% of organizations engage in and execute cloud computing operations, promoting the segments growth.

Deployment Segment Analysis

The cloud-based segment is expected to attain a significant market share by 2035. Rising recognition of SaaS technologies is a primary driver for the segment. The demand for cloud-based software is expected to rise because of its flexible pricing models, convenient maintenance packages, easy upgrade options, and accessibility. Additionally, cloud-based solutions are popular because of their affordability, adaptability, and scalability. SaaS is uncomplicated and fast to install, with a hosted deployment strategy. In a survey conducted in 2021, 73% of businesses declared they would use SaaS applications for all of their workloads.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Deployment |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Project Portfolio Management Market Regional Analysis:

North American Market Insights

North America is anticipated to account for 42% share of the global project portfolio management market by 2035. The rapid use of cutting-edge technologies like cloud computing, artificial intelligence (AI), and others is fuelling the expansion of the project portfolio management market in North America with 89% of companies using a multi-cloud approach. Organizations can manage their project portfolios with the help of cloud-based solutions, which is what is driving the industry. Similar to this, the market would grow as SMEs increasingly adopted cloud-based solutions. The industry's major players, including Oracle Corporation, Microsoft Corporation, Adobe (Workfront), Hewlett Packard Enterprise Development LP, Broadcom Inc., ATLASSIAN, Planview, Inc., and others, are concentrating on product launches and acquisitions, which are predicted to drive the market growth in the area.

APAC Market Insights

Asia Pacific is expected to hold a significant market share by the end of 2035. The increased use of project management software in all types of organizations is responsible for the market's expansion. Additionally, throughout the forecast period, rising demand for cloud-based infrastructure is anticipated to fuel market expansion. According to a recent ranking, Singapore has the highest potential for innovation and business environment, scoring almost 65% out of 100% in 2021. Additionally, the demand for project management software in the IT sector of the Asia Pacific region is expected to increase significantly over the forecast period.

Project Portfolio Management Market Players:

- Cloud Software Group, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Wrike, Inc

- Total Synergy Consulting Pvt. Ltd.

- Deltek, Inc.

- MeisterLabs

- Wax Inc.

- Stewart Technology Associates

- Dlubal Software GmbH

- Universal Robots

- Oracle Corporation

- OnePlan

- Microsoft

- Broadcom

Recent Developments

- The debut of OnePlan's new agile portfolio management solution, which supports Jira's features, was announced in March 2023. OnePlan is a leading supplier of strategic portfolio management software. This new solution aims to help firms take control of their portfolios, connect their operations with strategic goals, and make data-driven decisions.

- To provide cloud services, Capgemini and Orange created a new company named Bleu in France. This company intends to offer comprehensive project portfolio management and cloud solutions to businesses that firmly uphold French national sovereignty.

- Report ID: 4813

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Project Portfolio Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.