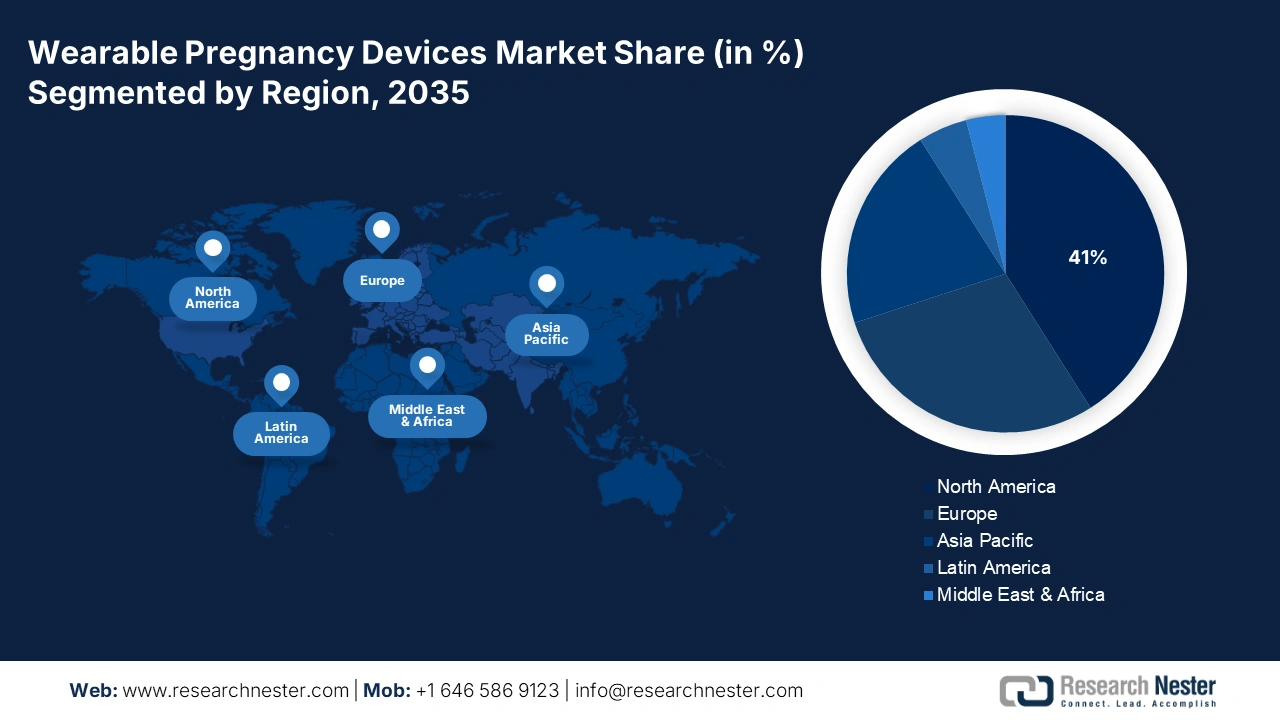

Wearable Pregnancy Devices Market - Regional Analysis

North America Market Insight

The global wearable pregnancy devices market in North America is expected to hold the highest market share of 41% within the forecast period due to its advanced healthcare infrastructure and the acceptability of digital health technologies by expectant mothers. As per a report by NIH in August 2023, compared to other high-income countries, maternal deaths in the U.S. have become a concern. There have been over 1,200 maternal deaths in the last 5 years alone. Each year, tens of thousands more Americans suffer from serious pregnancy-related complications that could predispose them to further health issues such as hypertension, diabetes, and mental illnesses. This increased maternal health burden is thus driving a high demand for continuous monitoring and early risk detection through the use of wearables.

The global market in the U.S. is expected to grow due to increasing investments in telemedicine and growing consumer awareness regarding prenatal health monitoring. As per a report by the CDC published in April 2025, the number of births increased by 1% in 2023, with 3,622,673 births registered in 2024. This increment in birth rates is bound to put pressure on pregnancy monitoring solutions. Additionally, government support for digital health initiatives and maternal care programs is continuing to increase the demand for the market. Moreover, the clinical effectiveness of wearable devices in lowering hospital visits and enhancing prenatal health outcomes has been supported by AHRQ-funded studies.

Asia Pacific Market Insight

The global wearable pregnancy devices industry in the Asia Pacific is expected to hold the fastest market share within the forecast period due to the growing population, rising disposable incomes, and enhanced access to affordable healthcare technologies. As per a report by the United Nations 2024, about 4.7 billion people, or 60% of the world's population, currently reside in Asia and the Pacific. That number will grow to 5.2 billion by 2050. This demographic surge is likely to ensure that pregnancies are expected to rise significantly, thus influencing demand for prenatal-monitoring solutions. Thereafter, due to the rapid mobile-health-software and smart-wearables adoption, pregnancy care has become increasingly accessible to urban and semi-urban citizens.

The global market in China is expected to grow due to government initiatives to encourage maternal health and rapid urbanization, thereby creating demand for advanced monitoring gadgets. According to a report by NLM in August 2024, in the last decade, the maternal death ratio in China has dropped to 7.5 per 100,000 live births, almost representing one-fourth of the decline achieved during the previous decade. The slowness during the recent decade sheds light on the much-needed emphasis on searching for innovative solutions, such as wearable monitors, to sustain this positive trend. Increasing smartphone penetration and healthcare digitalization have placed the whole wearable technology range well within reach of the great majority of expectant mothers, whether from cities or from rural areas.

Europe Market Insight

The global wearable pregnancy devices market in Europe is expected to grow steadily within the forecast period due to strong regulatory frameworks and growing acceptance of wearable health devices in prenatal care. The region is driven by the improvement in fetal monitoring, maternal health monitoring, and the growth of remote pregnancy care models. Incorporation of IoT-driven medical devices and AI technology in obstetrics is revolutionizing prenatal care via continuous monitoring and risk detection at an early stage. Regulatory harmonization supported by the government under the European Health Data Space (EHDS) has surged R&D and market authorization among the member states.

The global market in the UK is expected to grow due to increased government funding for emerging digital health innovations and the ever-increasing number of digitally savvy pregnant women. According to a report by the UK Parliament in July 2025, in 2022, the UK ranked 19 out of 22 comparable countries. In 2023, which came to the rate of 3.9 deaths per 1,000 births and a neonatal mortality rate (under 28 days) of 3.0 per 1000 births. These figures scream in favor of prenatal care improvement, and hence building a state of desire for the new-age wearable monitoring technologies.

Medical Devices Trade (Exports & Imports) by Countries in Europe (2022)

|

Country |

Exports (USD billion) |

Imports (USD billion) |

|

Ireland |

9.0 |

1.9 |

|

Switzerland |

4.5 |

2.9 |

|

Austria |

1.3 |

1.6 |

|

France |

3.9 |

6.4 |

|

Belgium |

3.2 |

4.5 |

Source: OEC, August 2025