Wearable Pregnancy Devices Market Outlook:

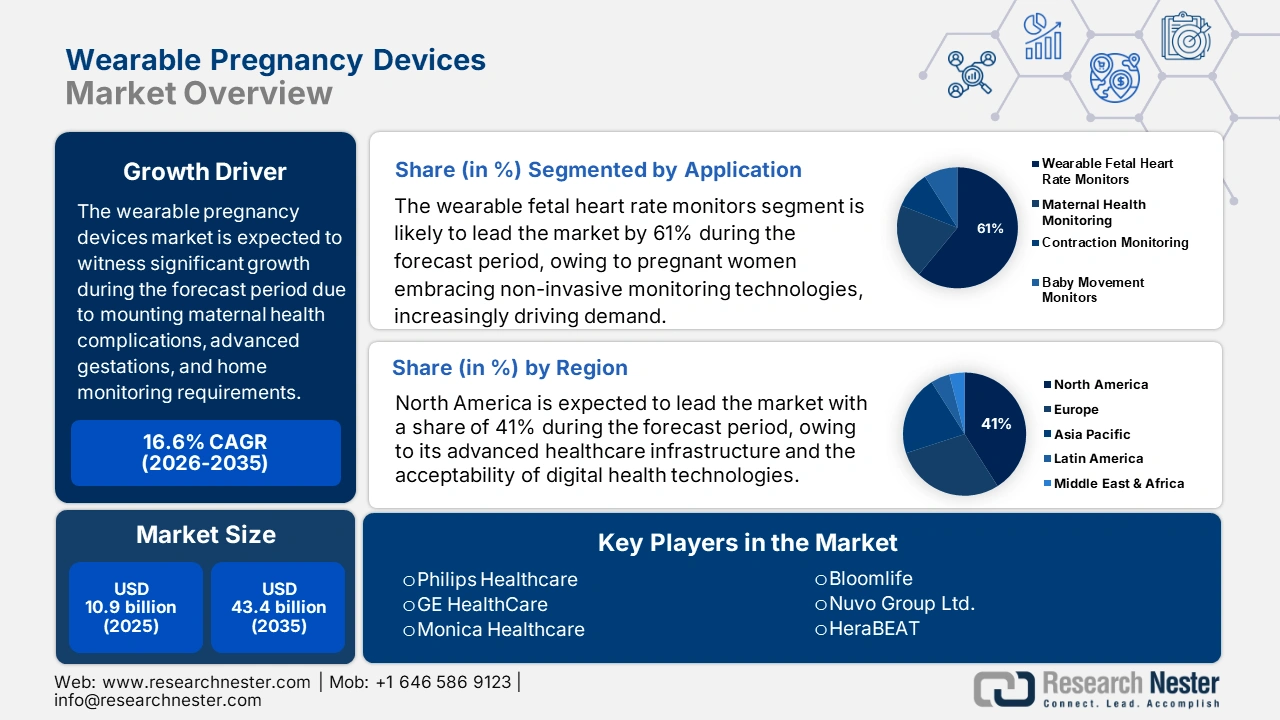

Wearable Pregnancy Devices Market size is valued at USD 10.9 billion in 2025 and is projected to reach USD 43.4 billion by the end of 2035, rising at a CAGR of 16.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of wearable pregnancy devices is estimated at USD 12.7 billion.

The international market is facing significant growth due to mounting maternal health complications, advanced gestations, and home monitoring requirements. As per a report published by NIH in August 2024, in the U.S. alone, 3.6 million births occurred in 2023. This patient pool caused a consistent growth in the market. Additionally, as per a report by the BLS in August 2025, the producer price index (PPI) for medical supplies and devices increased 0.9% from July 2024 to July 2025, reflecting benign inflation in upstream device manufacturing costs. Current FDA regulations give importance to all wearable medical device parts imported into the nation, needing to meet U.S. requirements in submissions via the automated commercial environment system.

The market’s demographic foundation is growing with global demand for maternal health care. Government-funded R&D spending is fueling innovation in maternal health tech. For example, according to a report published by the NIH in August 2023, the NIH Institutes of Health provided USD 24 million in initial funding to establish Maternal Health Research Centers of Excellence. On the supply side, Research centers are expected to engage with community partners, such as state and local public health authorities, community health centers, and faith-based institutions. A high percentage of the medical devices or device components are imported into the U.S., with the majority from Asia, in which case assembly takes place locally under FDA-regulated frameworks. The problem of relying on imported APIs and semiconductors continues to affect the manufacturing and supply of wearable pregnancy devices.

Key Pregnancy Wearable Devices Market Insights Summary:

Regional Insights:

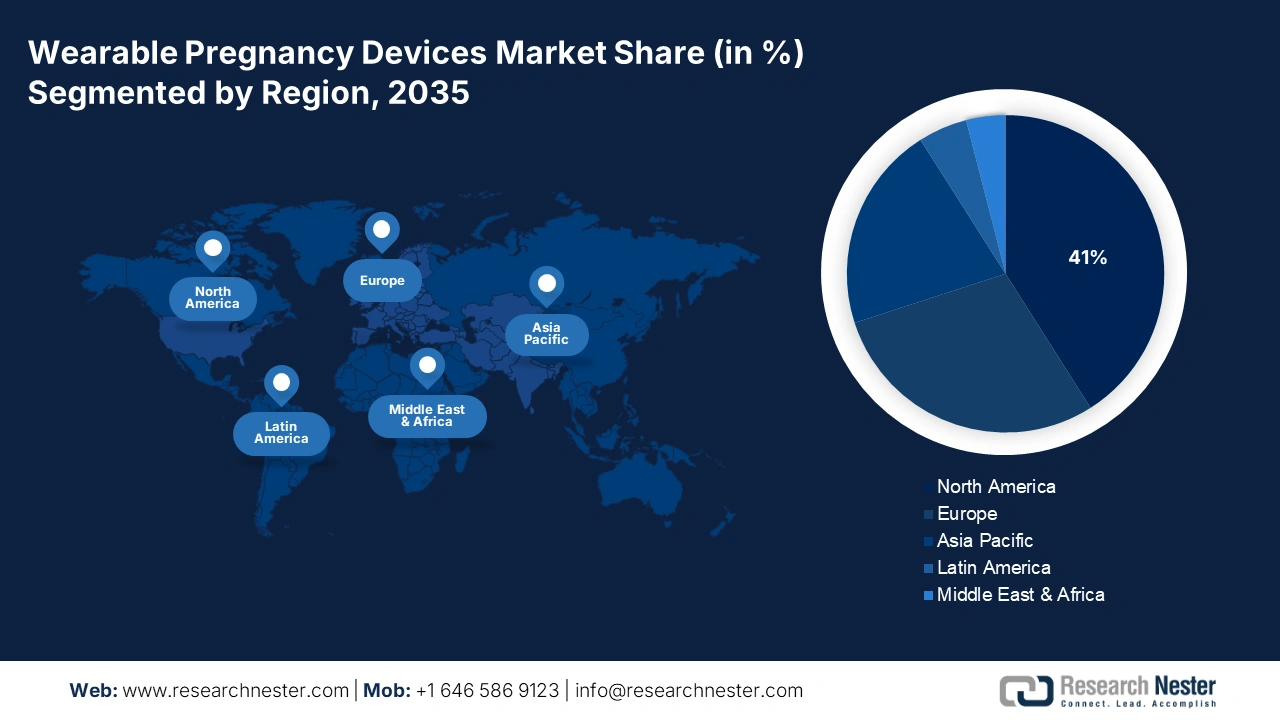

- North America: The wearable pregnancy devices market in North America is predicted to hold a 41% share by 2035, fueled by advanced healthcare infrastructure and the increasing adoption of digital health technologies by expectant mothers.

- Asia Pacific: The wearable pregnancy devices market in Asia Pacific is expected to witness the fastest growth by 2035, owing to rising population, higher disposable incomes, and expanding access to affordable healthcare technologies.

Segment Insights:

- Wearable Fetal Heart Rate Monitors: The wearable fetal heart rate monitors sub-segment is projected to account for 61% share by 2035, owing to pregnant women increasingly adopting non-invasive monitoring technologies.

- Premium Devices: The premium devices sub-segment is expected to hold the highest market share by 2035, propelled by growing consumer demand for personalized and data-driven pregnancy care.

Key Growth Trends:

- Rising maternal age and pregnancy complexity

- Sustained demand from national birth rates

Major Challenges:

- Navigating complex regulatory landscapes

Key Players: Philips Healthcare,GE HealthCare,Monica Healthcare (now part of GE),Bloomlife,Nuvo Group Ltd.,HeraBEAT,MC10 Inc.,MindChild Medical,OvuSense by Fertility Focus,Comarch Healthcare,Biotricity Inc.,EarlySense,Owlet Inc.,Sensible Baby,Biofourmis

Global Pregnancy Wearable Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 258.2 million

- 2026 Market Size:USD 271.4 million

- Projected Market Size: USD 426.9 million by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries – United States, Germany, Japan, United Kingdom, Canada

- Emerging Countries – China, India, South Korea, Brazil, Australia

Last updated on : 29 September, 2025

Wearable Pregnancy Devices Market - Growth Drivers and Challenges

Growth Drivers

- Rising maternal age and pregnancy complexity: The market is experiencing a potential growth as the maternal age has shifted to the advanced maternal age with a high risk. According to a report by the National Vital Statistics Reports, March 2025, there was a decline of 4% in the birth rate for females 15 to 19 years of age from 2022 to 2023, birth rates rose by less than 1% for females 20 to 24, and birth rates fell for females 25 to 44 by 1% to 3%. Most cases of advanced maternal age require closer monitoring of the mother and fetus, thus making use of continuous, non-invasive wearable technology. This trend offers manufacturers the chance to increase their addressable patient population.

- Sustained demand from national birth rates: The market is supported by a strong national birth rate, ensuring long-term product relevance. According to a report published by the CDC in April 2023, the cesarean delivery rate in 2024 went up to 32.4%, since the low-risk cesarean delivery rates remained 26.6%. Hence, stable or slightly uplifted birth rates serve as a steady user base for maternal health-monitoring tools. This very steadiness benefits the B2B procurement planning workings of hospitals, insurers, and providers of remote health care. It also strengthens scaling constructions by suppliers of devices in the market domain.

- Government-supported innovation and R&D funding: Government health authorities are supporting new product development in the wearable pregnancy devices market with focused R&D incentives. In a report published by the NIH in September 2023, the National Institutes of Health will award up to a total of USD 2 million in cash prizes to encourage innovation in diagnosis and monitoring technologies to enhance fetal health outcomes for low-resource environments. The project promotes the development of wearable, low-cost, and scalable fetal monitoring technologies. Such public investments de-risk early-stage innovation and trigger commercial partnerships. Hence, the device developers are encouraged to expedite go-to-market strategies under sponsored pilot plans.

Export and Import Values of Medical Instruments (2023)

|

Country |

Exports (USD billion) |

Imports (USD billion) |

|

U.S. |

34.8 |

37.7 |

|

Germany |

18.4 |

13.1 |

|

China |

12.3 |

10.6 |

|

Japan |

7.2 |

6.4 |

|

Netherlands |

9.3 |

14.1 |

|

Mexico |

17.6 |

4.6 |

Source: OEC, August 2025

Challenge

-

Navigating complex regulatory landscapes: The global markets face various barriers to growth, among which regulatory fragmentation across international markets is the most significant. The manufacturers must negotiate among various standards regarding device safety, data privacy, and clinical validation. It delays the time to market and skyrockets the costs of compliance. An instance would be that a device would be approved according to FDA regulations, but needs to be completely reevaluated for CE marking in Europe, or may even have to undergo approval procedures under the SFDA in Asia. Coordinating all the different expectations based on these regulations is hampering the smooth development.

Wearable Pregnancy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.6% |

|

Base Year Market Size (2025) |

USD 10.9 billion |

|

Forecast Year Market Size (2035) |

USD 43.4 billion |

|

Regional Scope |

|

Wearable Pregnancy Devices Market Segmentations:

Application Segment Analysis

The wearable fetal heart rate monitors sub-segment is expected to hold the highest market share of 61% in the application segment within the forecast period in the wearable pregnancy devices market, as pregnant women embrace non-invasive monitoring technologies, increasingly driving demand. As per a report by NLM June 2022, mean sensitivity (Se), positive predictive value (PPV), accuracy (ACC), and F1 score for detection of fetal QRS (fQRS) complex are stated as 99.6%, 97.9%, 97.4%, and 98.6%, respectively, indicating high accuracy and reliability of such monitoring devices. Technological advancements in wireless and patch-based monitoring provide for continuous and comfortable monitoring of fetal health outside clinical settings.

Price Tier Segment Analysis

The premium devices sub-segment is expected to hold the highest market share in the price tier segment within the forecast period in the wearable pregnancy devices market, as customers of developed regions are willing to spend on premium devices for enhanced maternal and fetal well-being continuously. These devices are likely to have advanced features such as real-time monitoring, mobile connectivity, and AI-based analytics. The growing demand for data-backed and personalized pregnancy care is also fueling premium product uptake. Wireless and patch-based technology breakthroughs make possible the continuous, unobtrusive monitoring of fetal well-being away from the clinic setting.

End user Segment Analysis

The hospitals sub-segment is expected to hold the highest market share in the end user segment within the forecast period in the wearable pregnancy devices market, as customers of developed regions are becoming increasingly willing to spend on premium devices for enhanced maternal and fetal well-being. These devices are likely to have advanced features such as real-time monitoring, mobile connectivity, and AI-based analytics. The growing demand for data-backed and personalized pregnancy care is also fueling premium product uptake. Wireless and patch-based technology breakthroughs make possible the continuous, unobtrusive monitoring of fetal well-being away from the clinic setting.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

Application |

|

|

Price Tier |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wearable Pregnancy Devices Market - Regional Analysis

North America Market Insight

The global wearable pregnancy devices market in North America is expected to hold the highest market share of 41% within the forecast period due to its advanced healthcare infrastructure and the acceptability of digital health technologies by expectant mothers. As per a report by NIH in August 2023, compared to other high-income countries, maternal deaths in the U.S. have become a concern. There have been over 1,200 maternal deaths in the last 5 years alone. Each year, tens of thousands more Americans suffer from serious pregnancy-related complications that could predispose them to further health issues such as hypertension, diabetes, and mental illnesses. This increased maternal health burden is thus driving a high demand for continuous monitoring and early risk detection through the use of wearables.

The global market in the U.S. is expected to grow due to increasing investments in telemedicine and growing consumer awareness regarding prenatal health monitoring. As per a report by the CDC published in April 2025, the number of births increased by 1% in 2023, with 3,622,673 births registered in 2024. This increment in birth rates is bound to put pressure on pregnancy monitoring solutions. Additionally, government support for digital health initiatives and maternal care programs is continuing to increase the demand for the market. Moreover, the clinical effectiveness of wearable devices in lowering hospital visits and enhancing prenatal health outcomes has been supported by AHRQ-funded studies.

Asia Pacific Market Insight

The global wearable pregnancy devices industry in the Asia Pacific is expected to hold the fastest market share within the forecast period due to the growing population, rising disposable incomes, and enhanced access to affordable healthcare technologies. As per a report by the United Nations 2024, about 4.7 billion people, or 60% of the world's population, currently reside in Asia and the Pacific. That number will grow to 5.2 billion by 2050. This demographic surge is likely to ensure that pregnancies are expected to rise significantly, thus influencing demand for prenatal-monitoring solutions. Thereafter, due to the rapid mobile-health-software and smart-wearables adoption, pregnancy care has become increasingly accessible to urban and semi-urban citizens.

The global market in China is expected to grow due to government initiatives to encourage maternal health and rapid urbanization, thereby creating demand for advanced monitoring gadgets. According to a report by NLM in August 2024, in the last decade, the maternal death ratio in China has dropped to 7.5 per 100,000 live births, almost representing one-fourth of the decline achieved during the previous decade. The slowness during the recent decade sheds light on the much-needed emphasis on searching for innovative solutions, such as wearable monitors, to sustain this positive trend. Increasing smartphone penetration and healthcare digitalization have placed the whole wearable technology range well within reach of the great majority of expectant mothers, whether from cities or from rural areas.

Europe Market Insight

The global wearable pregnancy devices market in Europe is expected to grow steadily within the forecast period due to strong regulatory frameworks and growing acceptance of wearable health devices in prenatal care. The region is driven by the improvement in fetal monitoring, maternal health monitoring, and the growth of remote pregnancy care models. Incorporation of IoT-driven medical devices and AI technology in obstetrics is revolutionizing prenatal care via continuous monitoring and risk detection at an early stage. Regulatory harmonization supported by the government under the European Health Data Space (EHDS) has surged R&D and market authorization among the member states.

The global market in the UK is expected to grow due to increased government funding for emerging digital health innovations and the ever-increasing number of digitally savvy pregnant women. According to a report by the UK Parliament in July 2025, in 2022, the UK ranked 19 out of 22 comparable countries. In 2023, which came to the rate of 3.9 deaths per 1,000 births and a neonatal mortality rate (under 28 days) of 3.0 per 1000 births. These figures scream in favor of prenatal care improvement, and hence building a state of desire for the new-age wearable monitoring technologies.

Medical Devices Trade (Exports & Imports) by Countries in Europe (2022)

|

Country |

Exports (USD billion) |

Imports (USD billion) |

|

Ireland |

9.0 |

1.9 |

|

Switzerland |

4.5 |

2.9 |

|

Austria |

1.3 |

1.6 |

|

France |

3.9 |

6.4 |

|

Belgium |

3.2 |

4.5 |

Source: OEC, August 2025

Key Wearable Pregnancy Devices Market Players:

- Philips Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE HealthCare

- Monica Healthcare (now part of GE)

- Bloomlife

- Nuvo Group Ltd.

- HeraBEAT

- MC10 Inc.

- MindChild Medical

- OvuSense by Fertility Focus

- Comarch Healthcare

- Biotricity Inc.

- EarlySense

- Owlet Inc.

- Sensible Baby

- Biofourmis

The global wearable pregnancy devices industry is very competitive, and the leading manufacturers are using AI integration, remote monitoring, and home-based diagnostics to gain market share. Companies such as Philips, GE HealthCare, and Bloomlife are actively investing in telemedicine platforms, cloud connectivity, and noninvasive sensors to overcome the maternal health gaps. On the other hand, Nuvo Group and HeraBEAT focus on FDA-cleared consumer-grade pregnancy wearables and driving the adoption for home use. Companies in Japan are advancing the devices with AI-enabled fetal analytics. Robust regulatory tracking, partnerships, and collaboration dominate the market with go-to-market strategies mainly in the Asia Pacific, Europe, and the U.S.

Here is a list of key players operating in the global market:

Recent Developments

· In September 2024, Samsung Electronics released its new Samsung Health Research Stack to increase data-based digital health research, supporting digital health research on Android and Wear OS devices. It enables continuous health data measurement and analysis, helping developers and researchers create advanced healthcare apps as part of the Samsung Health SDK Suite.

· In February 2024, MedM Health Monitoring Platform announced that they are integrating connected Garmin devices into its consumer-centric B2C health diary applications and remote patient monitoring (RPM) programs. Users can benefit from quality health data received from Garmin devices via the Garmin Connect Developer Program.

- Report ID: 470

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pregnancy Wearable Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.