Prefilled Syringes Market Outlook:

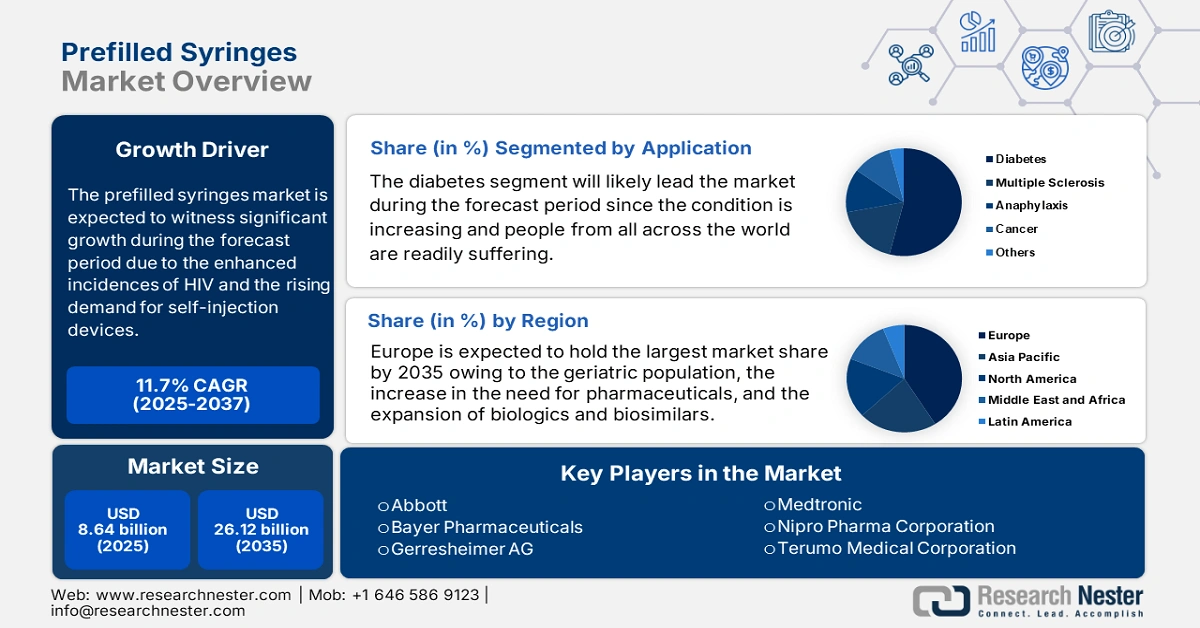

Prefilled Syringes Market size was over USD 8.64 Billion in 2025 and is poised to exceed USD 26.12 Billion by 2035, witnessing over 11.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of prefilled syringes is estimated at USD 9.55 Billion.

The growth of the market can be attributed to the increasing prevalence of HIV and hepatitis-B cases. The self-filling needles used with patients who have hepatitis and HIV have frequently been used incorrectly. Therefore, prefilled syringes are the ideal treatment option for people with hepatitis and HIV. Further, the growing adoption of biologics and biosimilars, is also expected to add to the market growth. According to estimates, over 1,180,000 Americans had HIV in 2019.

In addition to these, factors that are believed to fuel the market growth of prefilled syringes include the rise in demand of self-injection devices. For instance, prefilled syringes are increasingly used to dispense self-administered medications such as anticoagulants, growth hormones, and insulin. Further, these syringes offer patients a quick, precise, and secure option to self-administer these medications.

Key Prefilled Syringes Market Insights Summary:

Regional Highlights:

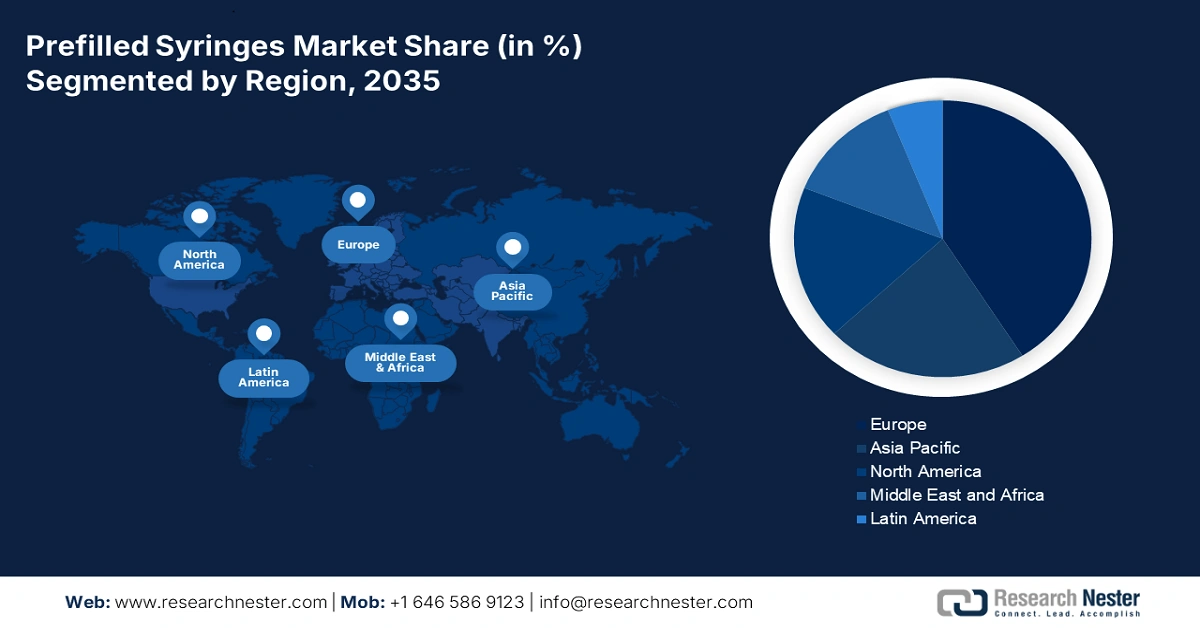

- Europe’s prefilled syringes market will dominate over 41% share by 2035, fueled by rising geriatric population and preference for simpler drug delivery.

- Asia Pacific market will secure the second largest share by 2035, attributed to increasing injectable drug use and chronic disease prevalence.

Segment Insights:

- The glass-based (material) segment in the prefilled syringes market is expected to secure a 54% share by 2035, attributed to the superior barrier properties and stability offered by glass materials.

- The diabetes segment in the prefilled syringes market market will capture a 54% share, driven by rising diabetes cases and increased preference for self-injection, 2026-2035.

Key Growth Trends:

- Growing Prevalence of Chronic Diseases

- Rising Geriatric Population

Major Challenges:

- Leakage in the Syringes

- Stringent Regulations Associated with the Production of Syringes

Key Players: Abbott, Bayer Pharmaceuticals, Baxter BioPharma Solutions, BG (Becton, Dickinson and Company), Gerresheimer AG, Medtronic, Nipro Pharma Corporation, Terumo Medical Corporation, Vetter Pharma International GmbH, West Pharmaceutical Services, Inc.

Global Prefilled Syringes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.64 Billion

- 2026 Market Size: USD 9.55 Billion

- Projected Market Size: USD 26.12 Billion by 2035

- Growth Forecasts: 11.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Prefilled Syringes Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Prevalence of Chronic Diseases – The need for pre-filled syringes is being driven by the increasing prevalence of chronic diseases such as diabetes, cancer, and autoimmune diseases. In 2018, over 27% of American people had more than one chronic disease.

-

Rising Geriatric Population – The Elderly population is more prone to chronic diseases and the rising number of elderly populations across the globe is estimated to drive market growth. According to estimates, the proportion of the aged population in India increased by more than 10% in 2021.

-

Increasing Spending in Healthcare – Demand for pre-filled syringes is expected to certainly increase as a result of rising healthcare spending as healthcare professionals look for innovative tools and solutions that is poised to enhance patient outcomes, cut costs, and boost productivity. According to the most recent expenditure data, health spending in the US increased by over 2% in 2021.

-

Increasing Number of Needles-Related Infectious Cases – It is expected that infectious illnesses can spread as a result of needlestick injuries. Further, sharing injecting supplies raises the possibility of spreading and catching blood-borne illnesses including HIV and hepatitis B and C, which is anticipated to drive the market growth. According to the WHO, 6 billion injections with contaminated needles are given each year, accounting for more than 4% of all new HIV cases worldwide.

Challenges

- Leakage in the Syringes- The increasing concern amongst individuals for the leakage and impurity in the syringes is one of the major factors predicted to slow down the market growth. For instance, syringe breakage and medication leakage could be caused by poor shipping and low-quality materials utilized to make the devices. The market growth is anticipated to be hampered by defects such as bent needles, and punctured rubber seals or plungers.

- Stringent Regulations Associated with the Production of Syringes

- Chance of Artery Blockage and Blood Clotting while Injecting Air

Prefilled Syringes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.7% |

|

Base Year Market Size (2025) |

USD 8.64 Billion |

|

Forecast Year Market Size (2035) |

USD 26.12 Billion |

|

Regional Scope |

|

Prefilled Syringes Market Segmentation:

Application Segment Analysis

The global prefilled syringes market is segmented and analyzed for demand and supply by application into diabetes, multiple sclerosis, anaphylaxis, cancer and others. Out of the five applications of prefilled syringes, the diabetes segment is estimated to gain the largest market share of about 54% in the year 2035. The growth of the segment can be attributed to the increasing prevalence of diabetes across the globe. The need for pre-filled syringes and insulin is expected to rise along with the prevalence of diabetes. For instance, insulin shots are necessary to maintain normal blood sugar levels in patients with diabetes. Pre-filled syringes offer a quick and convenient way to inject insulin at home or on the go for patients with diabetes who need frequent dosage. Further, the rising popularity of self-medication is projected to boost demand for pre-filled syringes among diabetic patients as it decreases the need for frequent trips to medical facilities. According to estimates, diabetes affected over 37 million Americans in 2019.

Material Segment Analysis

The global prefilled syringes market is also segmented and analyzed for demand and supply by material into glass-based, and plastic based. Amongst these two segments, the glass-based segment is expected to garner a significant share of around 54% in the year 2035. Drug makers prefer glass-based prefilled syringes owing to their superior barrier qualities. Oxygen and water vapor are shielded from drug molecules by the barrier qualities of glass. For instance, glass is utilized in over 90% of PFSs. Besides this, glass provides long-term drug stability for biopharmaceuticals. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Design |

|

|

By Material |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Prefilled Syringes Market Regional Analysis:

Europe Market Insights

The market share of prefilled syringes in Europe, amongst the market in all the other regions, is projected to be the largest with a share of about 41% by the end of 2035. The growth of the market can be attributed majorly to the increasing geriatric population. As the older population grows, there is predicted to be a growing demand for healthcare services in the region, including the usage of pre-filled syringes to administer medication. For instance, pre-filled syringes have a number of advantages, including their simplicity of use, which is crucial for senior patients who may find it difficult to handle conventional vials and syringes. Also, the demand for some pharmaceuticals, such as vaccinations and biologics, which are frequently administered via pre-filled syringes, is probably going to rise as the older population in the area continues to rise. Further, the growing adoption of self-injection devices in the region, along with the expansion of the biologics and biosimilar market, are also anticipated to contribute to the market growth in the region. In addition, the growing investment in injectable pharmaceuticals and rapid vaccination drive is also anticipated to boost the market growth during the forecast period. According to statistics, Europe had over 15% of old people in 2021.

APAC Market Insights

The Asian Pacific prefilled syringes market is estimated to hold the second largest, share by the end of 2035. The growth of the market can be attributed majorly to the increasing use of injectable drugs. For instance, injectable drugs are increasingly required to treat a variety of chronic disorders, such as diabetes, cancer, and autoimmune diseases, as the region's population continues to age and increase. Pre-filled syringes are becoming more and more common in the area as they are simpler to use and safer than conventional syringes and vials. Particularly for patients who self-administer their medication at home, they provide a more practical and effective method of medication delivery. Further, the increasing technological advancements in the field of prefilled syringes in the region and the surging geriatric population are also anticipated to boost the market growth during the forecast period.

North American Market Insights

North America region is expected to observe significant growth till 2035. The growth of the market can be attributed majorly to the increasing incidence of chronic disorders. For instance, the need for pre-filled syringes is also anticipated to increase owing to the rising aging population in the region. As people get older, their immune systems deteriorate, making them more prone to chronic illnesses that need long-term medicine. Pre-filled syringes have grown in popularity in the area as they are a convenient, safe, and accurate method of administering a variety of medications, including biologics, vaccinations, and biosimilars. As more patients are given chronic disease diagnoses, there will undoubtedly be an increase in demand for these medications and pre-filled syringes. In addition, the region's expanding healthcare infrastructure and rising growing use of increasing usage of injectable medicine is also anticipated to boost the market growth during the forecast period.

Prefilled Syringes Market Players:

- Abbott

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayer Pharmaceuticals

- Baxter BioPharma Solutions

- BG (Becton, Dickinson and Company)

- Gerresheimer AG

- Medtronic

- Nipro Pharma Corporation

- Terumo Medical Corporation

- Vetter Pharma International GmbH

- West Pharmaceutical Services, Inc.

Recent Developments

-

Baxter BioPharma Solutions a pioneer in the delivery and production of sterile drugs expanded its sterile fill/finish manufacturing facilities located in Bloomington, Ind. Further, a high-speed automated syringe fills line with a fill rate of up to 600 units per minute, and a new high-speed automated visual inspection line were all part of the facility's planned infrastructure expansion.

-

BG (Becton, Dickinson and Company) introduced BD Effivax Glass Prefillable Syringe to establish a new benchmark for vaccine PFS performance. Further, it is expected to provide clients with additional support to handle the demanding requirements of today's vaccine manufacturing through design improvements targeted at fill/finish and container dependability.

- Report ID: 4398

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Prefilled Syringes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.