Prefabricated Buildings Market Outlook:

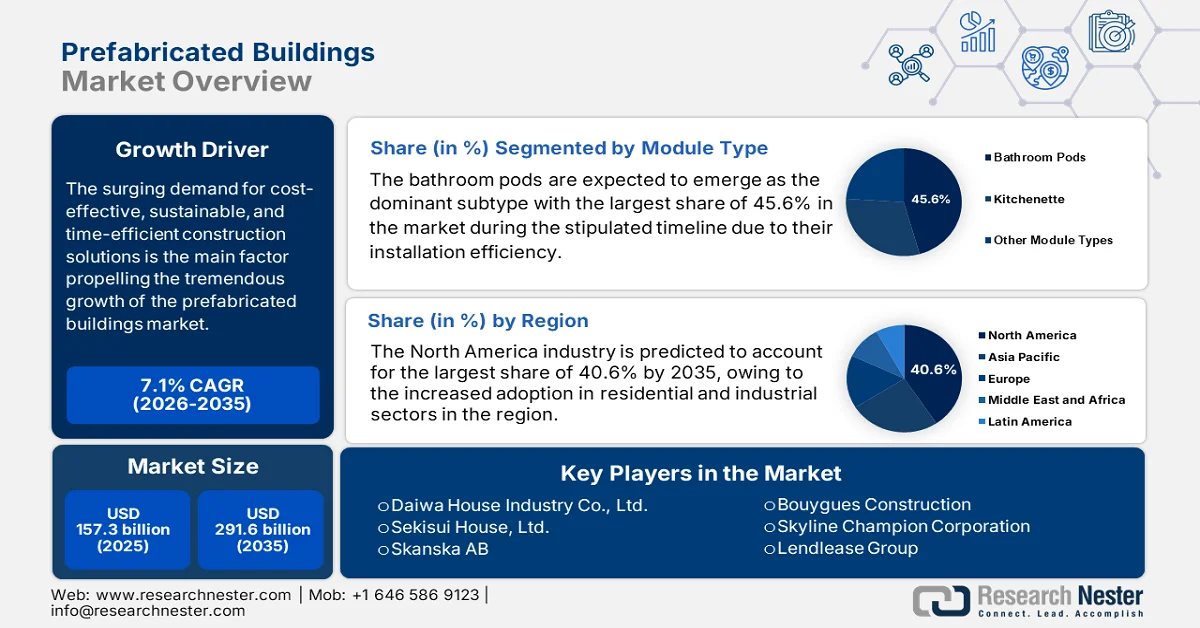

Prefabricated Buildings Market size was valued at USD 157.3 billion in 2025 and is projected to reach USD 291.6 billion by the end of 2035, rising at a CAGR of 7.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of prefabricated buildings is assessed at USD 168.4 billion.

The surging demand for cost-effective, sustainable, and time-efficient construction solutions is the main factor propelling the tremendous growth of the prefabricated buildings market. The need for affordable housing encouraged governments across different nations to promote the adoption of modular structures with their funding grants. Based on the official data from NSW, which was published in November 2025, the Minns Government has introduced building reforms in New South Wales to accelerate the adoption of prefabricated and modular homes, with the main goal to increase housing completions. It also stated that these reforms are anticipated to reduce construction time by up to 50% and lower costs by up to 20%. Moreover, such administrative measures are also expected to save approximately USD 327,000 per apartment block in design costs and strengthen compliance in modern construction methods, hence increasing the growth potential of the prefabricated buildings market.

NSW Prefabricated and Modular Housing Reforms: Key Statistics on Cost and Time Savings

|

Metric |

Statistic |

|

Housing target (NSW by 2029) |

377,000 homes |

|

Reduction in construction costs via modular/prefabricated buildings |

Up to 20% |

|

Reduction in construction time |

Up to 50% faster |

|

Average design cost savings per apartment block |

USD 327,000 |

|

Maximum penalties for certifier conflict-of-interest breaches |

USD 1.1 million (from USD 33,000) |

Source: NSW

Furthermore, the prefabricated buildings market is witnessing huge growth as a result of eco-friendly practices, national housing programs, and reduced construction waste. In this context, programs such as the Saudi Vision 2030 Housing Program have transformed access to homeownership, increasing the rate from 47% to over 60% by the end of 2022, and it is deliberately aiming for 70% by 2030. In addition, initiatives such as Sakani have supported over a million families, and the Ejar e-service, which has registered more than 4.5 million leases, provides suitable housing solutions and rental protections. Moreover, the aspect of streamlined regulations, access to finance, and digitized processes has accelerated housing delivery. Hence, such instances underscore government-driven demand and financial incentives, reflecting a strong potential for housing developers and prefabricated construction suppliers.

Key Prefabricated Buildings Market Insights Summary:

Regional Highlights:

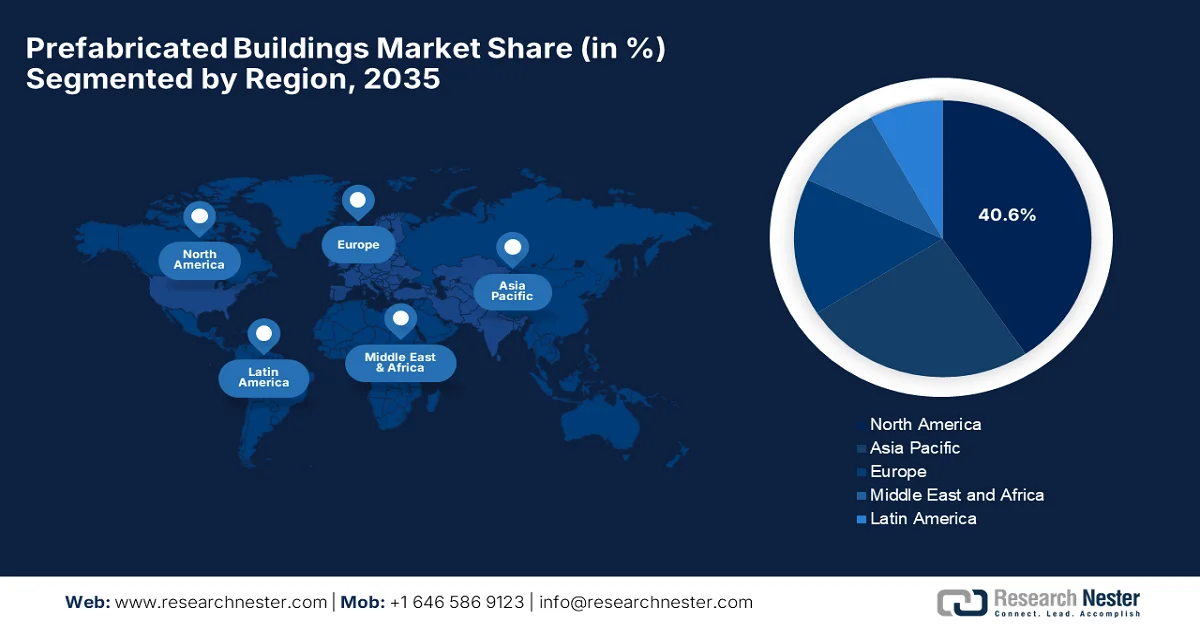

- Prefabricated Buildings Market in North America is projected to command a 40.6% share by 2035, attributed to increased adoption across residential and industrial sectors.

- Asia Pacific is anticipated to witness notable expansion in the forecast period 2026–2035, reinforced by rapid urban development and accelerating industrialization.

Segment Insights:

- Prefabricated Buildings Market bathroom pods segment is projected to account for a 45.6% share by 2035, propelled by installation efficiency and rising adoption in residential and hospitality construction.

- The concrete subtype under the material segment is anticipated to witness considerable share expansion by 2035, fueled by structural reliability and extensive existing supply chains.

Key Growth Trends:

- Fast & cost-efficient construction

- Rising urbanization and housing demand

Major Challenges:

- Transportation and logistics constraints

- Regulatory and building code variability

Key Players: Daiwa House Industry Co., Ltd. (Japan), Sekisui House, Ltd. (Japan), Skanska AB (Sweden), Bouygues Construction (France), Skyline Champion Corporation (U.S.), Lendlease Group (Australia), ATCO Ltd. (Canada), Clayton Homes, Inc. (U.S.), Astron Buildings S.A. (Europe), Cavco Industries, Inc. (U.S.), Champion Home Builders, Inc. (U.S.), Algeco – Modulaire Group (Europe), Larsen & Toubro Limited (India), EPACK Prefab Pvt. Ltd. (India), Boxabl, Inc. (U.S.).

Global Prefabricated Buildings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 157.3 billion

- 2026 Market Size: USD 168.4 billion.

- Projected Market Size: USD 291.6 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Canada, South Korea, Australia, United Arab Emirates

Last updated on : 16 February, 2026

Prefabricated Buildings Market - Growth Drivers and Challenges

Growth Drivers

- Fast & cost-efficient construction: The prefabricated buildings come up with a lower construction time duration when compared to traditional methods, which is a major driving factor for the prefabricated buildings market. This allows faster project delivery, making prefab solutions more attractive to both developers and investors. As stated by the Institute for Research on Public Policy in April 2024, prefabricated housing offers a fast, cost-effective solution to the housing crisis, which is currently witnessed in Canada, by reducing construction time by 20% to 50% and lowering labor requirements. It also stated that such modules offer distinct benefits, such as improved quality control and sustainability, allowing increased uptake. Furthermore, it underscored the urgent need for scaling the industry with government support, funding which can increase housing supply at a rapid pace and boost affordability.

Canada Prefabricated Housing Market: Supply, Construction Efficiency & Government Support Metrics (2024-2030)

|

Metric |

Value / Impact |

|

Homes needed in Canada by 2030 |

5.8 million (CMHC) |

|

Construction time reduction (mass timber) |

Up to 30% |

|

Construction time reduction (panelized) |

30% |

|

Construction time reduction (modular) |

20-50% |

|

Cost savings potential (modular) |

20% (McKinsey) |

|

Affordable Housing Innovation Fund |

USD 550.8 million |

|

Housing supply challenge fund |

USD 300 million |

|

Rapid housing initiative |

USD 4 billion |

Source: Institute for Research on Public Policy

- Rising urbanization and housing demand: Urbanization is surging across major nations, which increases the demand for more affordable housing, commercial spaces, and infrastructure, wherein the prefabricated buildings can justify those demands effectively. Also, both the public and private entities are opting for prefabrication to address housing shortages in these urbanizing regions, thereby benefiting the prefabricated buildings market. In December 2025 KSCE Journal of Civil Engineering stated that prefabricated building systems in the Philippines offer significant economic benefits, which include faster construction timelines and enhanced sustainability, making them a highly suitable solution for rapid urbanization and infrastructure demand, thereby encouraging investments in these advanced manufacturing facilities.

- Labor market and productivity pressures: This is the fundamental driving factor for the expansion of the prefabricated buildings market since there is a shortage of skilled labor in general construction processes, which is pushing builders towards factory-based prefabrication. Besides, these controlled environments are best known to help maintain labor productivity and quality. The UK government, in March 2025, notified that it made a £600 million (USD 740 million) investment to train up to 60,000 additional skilled construction workers by 2029, confirming that the sector is facing over 35,000 job vacancies, more than half unfilled due to skill shortages. It also mentioned that the program includes technical excellence colleges, foundation apprenticeships, skills bootcamps, and 40,000 industry placements annually to prepare workers for site-ready roles, hence supporting the growth of modern methods such as prefabricated construction.

Challenges

- Transportation and logistics constraints: This is the major bottleneck hampering the growth of the prefabricated buildings market. Transporting these prefabricated modules is identified as complex due to their large size and weight. Moving the large components requires suitable vehicles, route planning, and regulatory approvals, which in turn leads to increased complexity and costs, making it challenging for small and mid-sized players. On the other hand, the infrastructure limitations, such as narrow roads, low bridges, and restricted access, also pose obstacles to product delivery in densely populated areas. Furthermore, logistical challenges are mostly witnessed in remote regions or developing nations where there is an absence of adequate handling facilities, thereby limiting the scalability of the prefabricated buildings market.

- Regulatory and building code variability: The lack of uniform building codes and proper regulatory standards across different regions is yet another major challenge for the prefabricated buildings market. Prefabricated components often need to comply with both factory production standards and local on-site construction regulations, which creates considerable complications in terms of approvals and certifications. Also, any type of differences in zoning laws and fire safety requirements can impose restrictions on the reuse of standardized designs across multiple geographies. Therefore, the presence of this regulatory fragmentation reduces scaling and increases design and compliance costs, negatively impacting market upliftment.

Prefabricated Buildings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 157.3 billion |

|

Forecast Year Market Size (2035) |

USD 291.6 billion |

|

Regional Scope |

|

Prefabricated Buildings Market Segmentation:

Module Type Segment Analysis

The bathroom pods are expected to emerge as the dominant subtype with the largest share of 45.6% in the prefabricated buildings market during the stipulated timeline. The segment’s dominance in this field is mainly propelled by its installation efficiency and growing adoption in residential and hospitality construction. In May 2025, BAUDET reported that its bathroom pods have been adopted in a wide range of hospitality projects wherein hotels were utilizing fully factory-assembled units to reduce on-site labor and speed up construction. It also stated that projects such as EasyHotel in Oxford and the Stream Building in Paris integrated ready-to-install bathrooms, demonstrating improved installation efficiency and minimal disruption during construction. Furthermore, the subtypes of modular units allow for faster project timelines, hence denoting a wider segment scope.

Material Segment Analysis

The concrete subtype, which is a part of material, is anticipated to grow with a considerable share in the prefabricated buildings market. This growth is mainly driven by structural reliability and extensive existing supply chains. Besides, these prefabricated concrete panels are standardized and compatible with diverse building codes and climates, expanding their use in commercial and residential sectors. In this context Ministry of Road Transport & Highways in June 2025 stated that it published a mandatory policy in April 2022 for the utilization of precast concrete components in national highway projects, which has civil costs that exceed ₹300 crore (USD 36 million) in India. It also notes that this policy deliberately promotes factory-made precast concrete elements with a prime focus on construction efficiency, quality, and timeline predictability. Therefore, the presence of such administrative support underscores increased institutional adoption of prefabricated concrete panels for large-scale infrastructure, thereby positively impacting prefabricated buildings market growth.

Application Segment Analysis

The industrial sector is expected to garner a significant share in the prefabricated buildings market by 2035. The warehouses, manufacturing facilities, and logistics centers are identified as the leading adopters of prefabricated construction systems. The shorter construction timelines, along with scalable designs that can accommodate large, open spaces typical of industrial operations positions the subtype at the forefront of revenue generation in this industry. In addition, these components also offer improved quality control and reduced on-site labor requirements, which are highly beneficial in maintaining uninterrupted industrial workflows. Furthermore, the ability to modularize units allows for flexibility in meeting specific operational needs, making prefabrication an attractive solution for the industrial construction sector.

Our in-depth analysis of the prefabricated buildings market includes the following segments:

|

Segment |

Subsegments |

|

Module Type |

|

|

Material |

|

|

Application |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Prefabricated Buildings Market - Regional Analysis

North America Market Insights

North America prefabricated buildings market is expected to emerge as the dominating region, capturing the largest share of 40.6% by 2035. The region’s dominance is mainly propelled by increased adoption in residential and industrial sectors. Also, the region is witnessing stable demand and strong construction industry innovation, allowing a steady cash influx in the sector. In January 2025, the U.S. Department of Energy revealed that its advanced building construction initiative has successfully advanced industrialized prefabricated solutions to enhance building performance and speed. It also highlighted one of its projects at Syracuse University, which efficiently retrofitted student housing by utilizing highly insulated prefabricated exterior panels and integrated mechanical pods, thereby improving energy efficiency and durability, hence making it suitable for standard market growth.

The rising labor costs and skilled labor shortages in traditional construction are responsible factors driving the U.S., the prefabricated buildings market. The healthcare and education sectors are identified as the prominent adopters who are utilizing modular construction to reduce project timelines. In addition, there are government policies that encourage energy-efficient building practices, which contribute to the growth of prefabricated systems. As of December 2025, data from the U.S. Department of Energy in 2023, Module collaborated with the National Renewable Energy Laboratory to integrate energy-efficient strategies from the EMOD guide into their assembly process and focus on workforce training as well as factory optimization. The project supported the DOE's efficient new homes program certification and prepared a module for partnerships with organizations like the University of Pittsburgh Medical Center, which invested USD 1 million to advance affordable housing in Pittsburgh, thus driving the adoption of modular construction.

There is a strong opportunity for Canada prefabricated buildings market since there is a huge housing crisis in the country. Also, the challenges posed by harsh weather scenarios, coupled with investments in infrastructure projects and government backing is prompting a profitable business environment for both national and foreign players operating in the country. Based on the March 2025 government data from the country, the government, through Natural Resources Canada (NRCan), invested more than USD 1.5 million in 2025 to advance prefabricated wood construction in British Columbia by promoting sustainable, energy-efficient building practices. Projects that were supported are BCIT’s Robert Bosa Carpentry Pavilion, a zero-carbon, LEED Gold building for mass timber education, and initiatives to design rapid-deployment prefabricated buildings and map suppliers of off-site construction materials. Therefore, such constant efforts efficiently reduce construction costs and expand the availability of affordable, low-carbon housing.

Federal Investments in Prefabricated Wood Construction Projects in British Columbia (2025)

|

Project |

Funding (CAD) |

Objective / Description |

|

BCIT – Robert Bosa Carpentry Pavilion |

995,000 |

Construct a two-storey mass timber educational building (LEED Gold, passive house, zero-carbon) |

|

Prefab Buildings Initiative |

300,000 |

Develop energy-efficient prefabricated mass timber designs for multi-unit housing and rapid deployment. |

|

Scius Advisory |

219,870 |

Create an interactive online directory of Canadian prefabricated building suppliers and technologies. |

Source: Government of Canada

APAC Market Insights

The rapid urban development and industrialization are major factors fueling the Asia Pacific prefabricated buildings market development. Countries within this region are leveraging modular construction owing to the rise of smart cities and the adoption of digital technologies in construction processes. As stated by the Asian Development Bank Institute (ADBI) in April 2024, it hosted a two-part online roundtable on prefabricated construction with the main aim of enhancing affordable housing in developing Asia. Therefore, experts from universities, government agencies, and industry, such as Nanyang Technological University, IIT Madras, and the Ministry of Land, Infrastructure, Transport and Tourism, emphasize both theoretical foundations and practical case studies of Modular Integrated Construction (MiC). Furthermore, it aims to foster collaboration among policymakers, practitioners, and researchers to promote efficient, cost-effective housing across the region, hence suitable for bolstering market growth with such awareness initiatives.

The government backing and large-scale urbanization efforts foster a profitable business environment for the prefabricated buildings market in China. Prefabrication is being promoted in the country as one of the most important strategies to improve construction efficiency, reduce waste, and meet stringent environmental regulations. In January 2022, the country’s government officially reported that its 14th Five-Year Plan (2021 to 2025) aims to modernize the construction industry by promoting green, low-carbon production, widespread use of information technologies, and prefabricated buildings, which will account for over 30% of new construction. It also underscored that the plan emphasizes the adoption of construction robots and digital tools to improve efficiency, safety, and building quality. Therefore, with consistent government support, there is a huge growth opportunity for prefabricated buildings market exposure in China.

India prefabricated buildings market is emerging as a reliable solution for the surging population and infrastructural growth. The country’s market also benefits from innovations in materials and construction technologies that encourage faster project execution. Increased awareness of sustainable building practices and government incentives are also encouraging the adoption of prefabricated construction methods. In February 2025, IBEF stated that under the Pradhan Mantri Awas Yojana as of 2023, 1.22 crore houses were approved, out of which 72 lakh were completed and 50 lakh are under construction. Besides, in August 2024, the launch of PMAY-U 2.0 has a target of building 1 crore new houses for urban poor and middle-class families over five years, backed by an investment of USD 120 billion (₹10 lakh crore), which also includes USD 27.6 billion (₹2.30 lakh crore) in government subsidies. Hence, such instances support local employment and create lucrative growth opportunities for prefabricated buildings.

Europe Market Insights

Europe prefabricated buildings market is expected to grow at a considerable rate during the forecast period. The market’s development in the region is highly propelled by stringent environmental standards as well as the need for energy-efficient structures. Public and private sectors are proactively making investments in prefabrication to meet the demand for residential, commercial, and public spaces. As per the findings from the European Commission article, the region is making a proper transition to all new buildings from nearly-zero energy buildings to zero-emission buildings that also enforce public buildings required to comply by 2028 and all other new buildings by 2030, as per the recast Energy Performance of Buildings Directive (EU/2024/1275). It also mentioned that ZEBs must have very high energy performance, and no on-site fossil fuel emissions should be present by using on-site or nearby renewable energy, thus making it suitable for the market’s growth.

The strong regulatory frameworks and a primary focus on high-quality, energy-efficient buildings are driving the prefabricated buildings market in Germany. The market is also reaping advantages from innovative construction methods and the integration of digital technologies in manufacturing. In July 2024, based on the country’s official data, the Federal Ministry of Agriculture funded the Eco-Box modular timber construction system with an amount of €718,000 (USD 780,000) under its Renewable Resources program, which was developed by ZÜBLIN and Stuttgart University of Applied Sciences. Besides, the project aims to deliver market-ready modular room systems for multi-storey buildings by combining sustainability with efficiency by using renewable wood materials. Furthermore, it cuts up to 50% of greenhouse gas emissions when compared to conventional construction, which is suitable for bolstering the market in the country.

The government-backed initiatives that are vying to address the housing shortages efficiently propel the prefabricated buildings market in the UK. Besides, the country is making a structural shift from niche to mainstream segments by utilizing modular and panelized systems to improve efficiency and sustainability. The country’s government in November 2025 disclosed that NHS Commercial Solutions allocated an amount of £1 billion (USD 1.22 billion) framework agreement for modular and prefabricated building solutions across public sector facilities such as healthcare and educational buildings. Therefore, this particular framework covers design, supply, construction, maintenance, and consultancy services, with options for temporary or permanent modular structures. In addition, the initiative supports sustainable, flexible building solutions, hence allowing the market to flourish in the country.

Key Prefabricated Buildings Market Players:

- Daiwa House Industry Co., Ltd. (Japan)

- Sekisui House, Ltd. (Japan)

- Skanska AB (Sweden)

- Bouygues Construction (France)

- Skyline Champion Corporation (U.S.)

- Lendlease Group (Australia)

- ATCO Ltd. (Canada)

- Clayton Homes, Inc. (U.S.)

- Astron Buildings S.A. (Europe)

- Cavco Industries, Inc. (U.S.)

- Champion Home Builders, Inc. (U.S.)

- Algeco – Modulaire Group (Europe)

- Larsen & Toubro Limited (India)

- EPACK Prefab Pvt. Ltd. (India)

- Boxabl, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Daiwa House Industry Co., Ltd. is identified as a predominant leader in prefabricated and industrialized construction and is efficiently supported by advanced manufacturing capabilities and strong R&D investment. The company has built a dominant position in residential prefabrication through aspects of mass customization, automation, and high-quality standards.

- Sekisui House, Ltd. is a frontrunner in this field and is considered to be a major innovator in modular and prefabricated housing, particularly in steel and timber-based systems. In addition, the company is focused mainly on sustainability, net-zero energy housing, and lifecycle performance of buildings.

- Skanska AB is yet another prominent player leveraging prefabricated and modular construction, especially in large-scale commercial, residential, and infrastructure projects. The company also strongly emphasizes green construction, low-carbon materials, and off-site manufacturing, mainly striving to improve efficiency and reduce environmental impact.

- Skyline Champion Corporation is based in the U.S. and is one of the leading manufacturers of modular and manufactured buildings, primarily serving the residential housing segment in North America. The company benefits from a very strong production network and distribution channels across the U.S. and Canada, which has allowed it attract a widespread audience group.

- Lendlease Group is a global construction and real estate company that has a growing emphasis on prefabricated and modular building solutions. The company deliberately integrates off-site manufacturing processes into large urban development and infrastructure projects with a key goal of improving productivity and sustainability.

Below is the list of some prominent players operating in the global prefabricated buildings market:

The global prefabricated buildings market is dominated by large construction firms with international presence and particular solution providers. Pioneers operating in this field are pursuing distinct strategies such as expanding manufacturing capacity, adopting advanced automation, and integrating digital construction technologies. Simultaneously, the Japan-specific companies are focused more on precision engineering and mass customization, whereas players from Europe have their priority towards sustainability and low-carbon construction. Meanwhile, firms from North America make continued investments with a prime focus on scaling modular housing and reducing project delivery timelines. Meanwhile, companies in emerging nations such as India are rapidly expanding through affordable housing initiatives and strategic partnerships to strengthen their regional footprint.

Corporate Landscape of the Prefabricated Buildings Market:

Recent Developments

- In July 2025, CABN reported that it closed a funding round led by Active Impact Investments with participation from multiple venture partners. The investment will enable CABN to scale production and operations to deliver net-zero residential and commercial buildings and produce 1.66 million cubic feet of sustainable building materials annually.

- In February 2025, SIBS AB reported that it had entered a strategic collaboration with LINQ Modular to accelerate large-scale modular construction across the Middle East to deliver faster, high-quality residential, commercial, and hospitality projects.

- Report ID: 8394

- Published Date: Feb 16, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Prefabricated Buildings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.