Precision Parts Market Outlook:

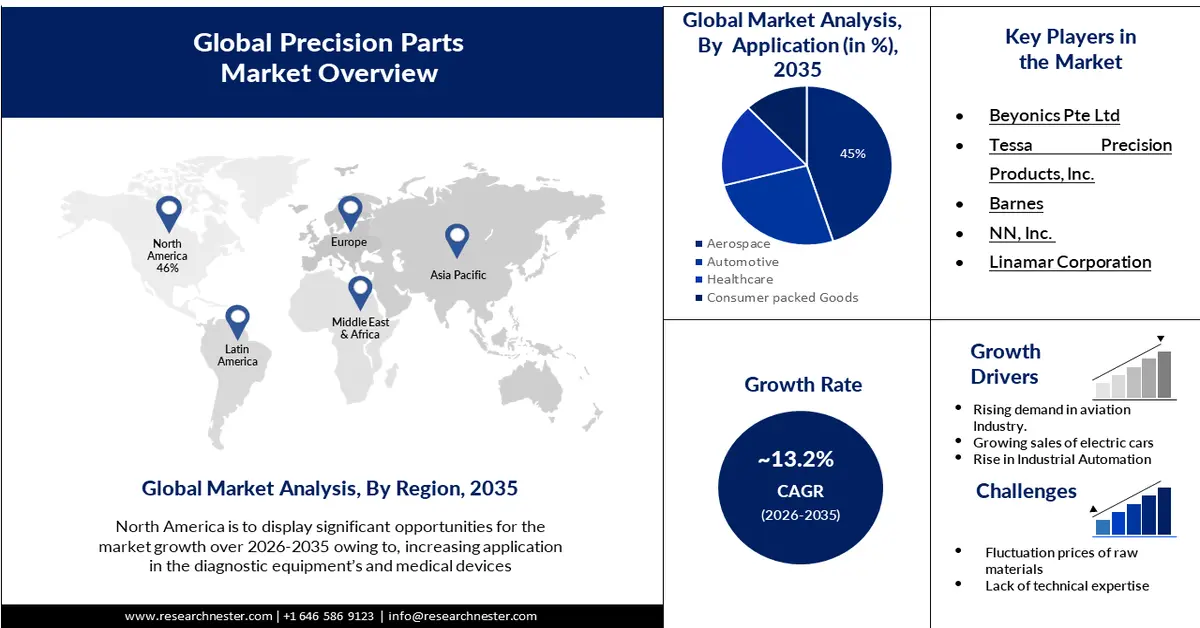

Precision Parts Market size was valued at USD 223.18 billion in 2025 and is set to exceed USD 771.12 billion by 2035, expanding at over 13.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of precision parts is evaluated at USD 249.69 billion.

The global market for precision parts is projected to grow with increasing industrial automation and innovation in industry sectors such as healthcare and medical devices. As demand for integrated and scalable products is at an all-time high, the market is constantly growing. The shift towards digitalization on the production line has been observed in the industry around the world.

Furthermore, given the growing abundance of electric cars with global sales at USD 2.3 million as of the 1st quarter of 2023, several key precision component vendors have increased their manufacturing capacity for engines, transmission, and propulsion components in hybrids and traditional EVs.

Key Precision Parts Market Insights Summary:

Regional Highlights:

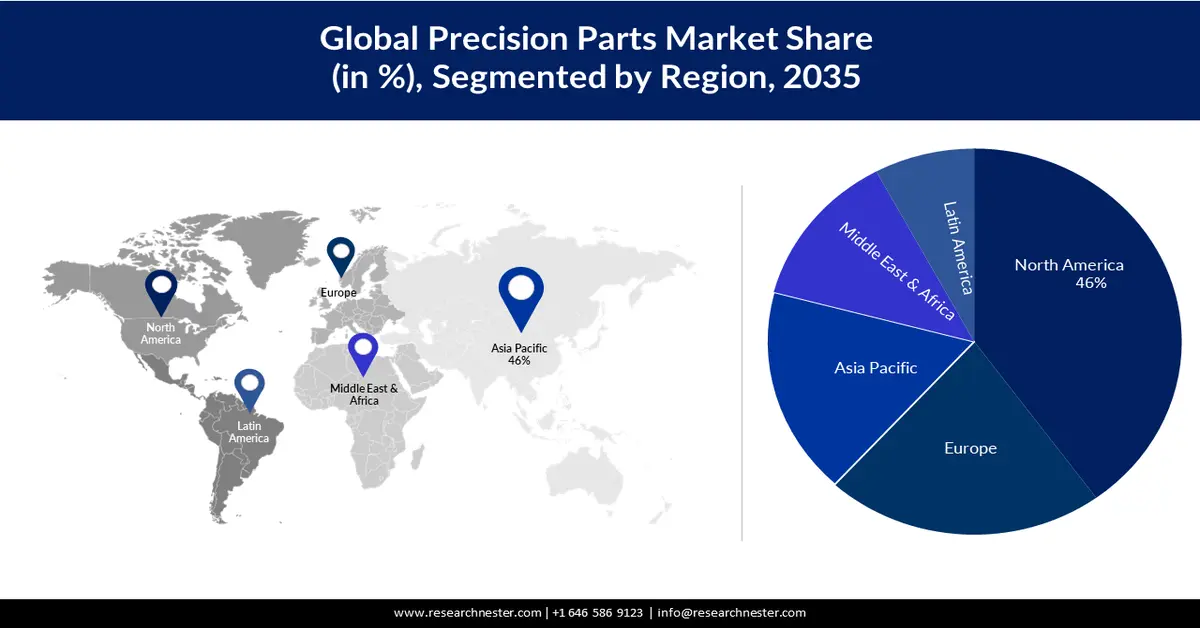

- North America is projected to secure a 46% share by 2035 in the Precision Parts Market, propelled by surging EV demand supported by updated environmental laws and federal incentives.

- Europe is expected to hold a 38% share by 2035, sustained by increasing technological innovation in medicine and healthcare manufacturing.

Segment Insights:

- The metal segment is anticipated to command a substantial revenue share by 2035 in the Precision Parts Market, propelled by rising demand in the automation industry.

- The aerospace segment is set to capture a 45% share during the forecast period, bolstered by increasing capital investments in the space sector.

Key Growth Trends:

- Rapid Digitization In The past few years, demand for electronics and semiconductors has been growing at a steady pace.

- Increasing Demand for Commercial and Défense Aircraft

Major Challenges:

- Miniaturization of Precision Parts

- Fluctuating price of raw materials.

Key Players: Sigma Components Holdings Ltd, Beyonics Pte Ltd, Tessa Precision Products, Inc., Barnes, NN, Inc., Linamar Corporation, Renishawplc., Digitaleo, Precision Castparts Corp.

Global Precision Parts Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 223.18 billion

- 2026 Market Size: USD 249.69 billion

- Projected Market Size: USD 771.12 billion by 2035

- Growth Forecasts: 13.2%

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Mexico, Brazil, Poland

Last updated on : 19 November, 2025

Precision Parts Market - Growth Drivers and Challenges

Growth Drivers

- Rapid Digitization In The past few years, demand for electronics and semiconductors has been growing at a steady pace. This growth is expected to be influenced by advances in technology such as Digital Technology, Artificial Intelligence UXI, and the anticipated introduction of 5G networks with 1.9 million subscriptions worldwide. The demand for precision components is projected to increase rapidly with the rapid development of several trending applications, e.g. Virtual Reality, Internet of Things devices, home automation, Industry 4.0 systems, and autonomous vehicles.

- Increasing Demand for Commercial and Défense Aircraft- The precision parts manufacturing market is growing at a rapid pace. Investments in the provision of Unmanned Vehicles ArielUAV are increasing by 75%. Therefore, precision components are expected to contribute positively to the global precision parts market over the forecast period by observing innovation in the aerospace industry. The requirement for precision parts among aircraft manufacturers is expected to increase as a result of replacing lighter materials with high temperature and pressure resistance while upgrading the essential plane components.

- Increasing innovation in the healthcare and medical device manufacturing sector in recent years the healthcare industry has taken steps towards innovation. The main factors expected to stimulate demand for precision parts over the forecast period are several technological developments such as cardio Pulmonary and cardiac devices, AI-based surgery planning, etc. The expenditure on health care will be significantly increased due to the growing concern about quality in medical practice and initiatives from governments offering public health insurance to boost market growth.

Challenges

-

Miniaturization of Precision Parts:

In the precision parts industry, miniaturization of parts is an important trend. As the parts shrink, tolerances which must be met by machinists are becoming more and more tight. This requires more advanced skills and experience of the machinist, along with a higher level of accuracy and costly equipment. Moreover, smaller pieces can be difficult to work with and require special fittings and tools. Moreover, because even minor imperfections may lead to problems, the miniaturization of parts is also putting increased pressure on quality control. -

Fluctuating price of raw materials.

- Demand for smaller lot sizes.

Precision Parts Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.2% |

|

Base Year Market Size (2025) |

USD 223.18 billion |

|

Forecast Year Market Size (2035) |

USD 771.12 billion |

|

Regional Scope |

|

Precision Parts Market Segmentation:

Type Segment Analysis

In precision parts market, metal segment is poised to account for substantial revenue share by the end of 2035. The rising demand in the automation industry is a major driver for the market. silicon steel has been a popular material of choice for the precision parts industry as it is strong & resistant to corrosion; making this material a primary choice in the medical device manufacturing sector. Moreover, the Electronic car market provides a major boost for the industry.

Application Segment Analysis

The precision parts market is expected to be dominated by the aerospace segment during the forecast period garnering 45% of the market. The need to precisely construct to prevent aircraft damage owing to conditions faced by aircraft based on speed, air currents, and extreme pressure. Increasing the manufacturing of defense jets and aircraft for national security is a major boost to the industry globally. Increasing capital investments in the space sector over the last decade has a major impact on the market.

Product Segment Analysis

Precision parts market from the electroforms segment is anticipated to hold the largest revenue share over the forecast period. Increased customization in the automotive industry to drive the market forward. Integration of electroforms in the medical industry, particularly in the production of nebulizer plates is a major boost for the precision parts market.

Distribution Channel Segment Analysis

Based on distribution channel, the precision parts market is segmented into online and offline, out of the two offline segment is expected to generate the largest revenue by the end of 2035. While online segment is expected to grow with the highest CAGR during the forecast period. The growing demand for high-precision components is met through online sales, as a result of integrating IoT and AI.

Our in-depth analysis of the global precision parts market includes the following segments:

|

Type |

|

|

Application |

|

|

Product |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Precision Parts Market - Regional Analysis

North American Market Forecast

The North American precision parts market is anticipated to hold a significant share of 46% over the forecast period, with significant growth during the forecast period. Demand and sales volumes for electric vehicles in the country have increased swiftly, as a result of major updates to environmental laws by the United States Environmental Protection Agency; and favorable tax and credit incentives offered by federal governments. This is the primary driver in the region. Additionally, increasing application in diagnostic equipment and medical devices provides substantial growth for the market. The United States is one of the world's largest automobile manufacturing countries, and this has also been an important factor contributing to growth in precision parts throughout the region.

European Market Statistics

Europe industry is set to hold largest revenue share of 38% by 2035, One of the main factors that are expected to stimulate market growth is increasing technological innovation in medicine and healthcare manufacturing. Additionally, increased demand for civilian and military aircraft is also providing a driver for the market.

Precision Parts Market Players:

- Sigma Components Holdings Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Beyonics Pte Ltd

- Tessa Precision Products, Inc.

- Barnes

- NN, Inc.

- Linamar Corporation

- Renishaw plc.

- Digitaleo

- Precision Castparts Corp.

Recent Developments

- At the EMO Hannover 2023, Renishaw, the world's leading engineering technology company, will demonstrate its latest tool-setting technology. The HPMAX is a new addition to the company's Highprecision Tool Setting Arms product line and has been designed to be able to handle the most demanding turning applications.

- Barnes Group Inc. has entered into definitive agreements in connection with the acquisition of MB Aerospace. For an enterprise value of approximately $740 million, MB Aerospace is a leading provider of precision aero-engine components manufacturing and repair services to major aerospace and defense engine OEMs, Tier 1 suppliers, and maintenance, repair, and overhaul providers. Assuming receipt of legal approval and fulfillment of all relevant contractual closing conditions, this transaction is estimated to close in the 4th quarter of 2023.

- Report ID: 3618

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Precision Parts Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.