Global Power Schottky-Diode Market

- An Outline of the Global Power Schottky-Diode Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

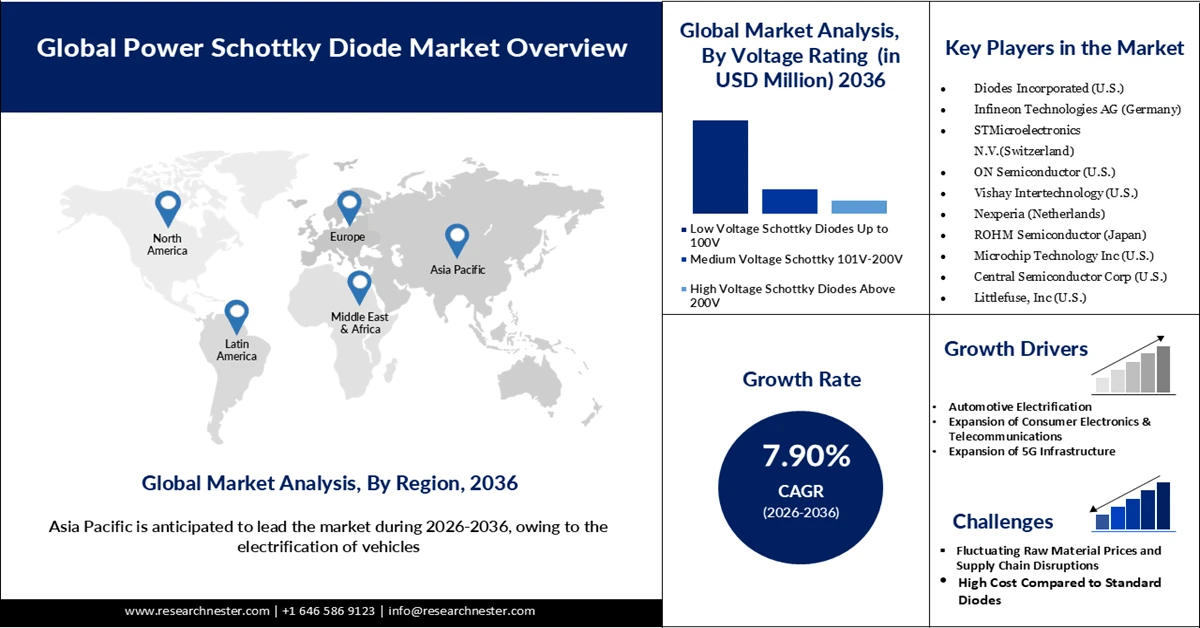

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Power Schottky-Diode

- Recent News

- Regional Demand

- Global Power Schottky-Diode by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Power Schottky-Diode Demand Landscape

- Global Power Schottky-Diode Demand Trends Driven by Sustainability, Veganism and Long Lasting Impact (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Power Schottky-Diode Porter Five Forces

- PESTLE

- Comparative Positioning

- Power Schottky-Diode – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Diodes Incorporated Chanel

- Infineon Technologies AG

- STMicroelectronics N.V

- ON Semiconductor

- Vishay Intertechnology

- Nexperia

- ROHM Semiconductor

- Microchip Technology Inc

- Central Semiconductor Corp

- Littlefuse, Inc

- Business Profile of Key Enterprise

- Global Power Schottky-Diode Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Tons), and Compound Annual Growth Rate (CAGR)

- Global Segmentation Power Schottky-Diode Analysis (2026-2036)

- By Type

- Standard Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Barrier Rectifiers, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Power Diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Transistors, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Voltage Rating

- Low Voltage Schottky-diodes Up to 100V, Market Value (USD Million), and CAGR, 2026-2036F

- Medium Voltage Schottky 101V-200V, Market Value (USD Million), and CAGR, 2026-2036F

- High Voltage Schottky-diodes Above 200V, Market Value (USD Million), and CAGR, 2026-2036F

- By Material

- Silicon Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Silicon Carbide Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Gallium Nitrate Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Factory Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Data Servers, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Mobile Phones, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

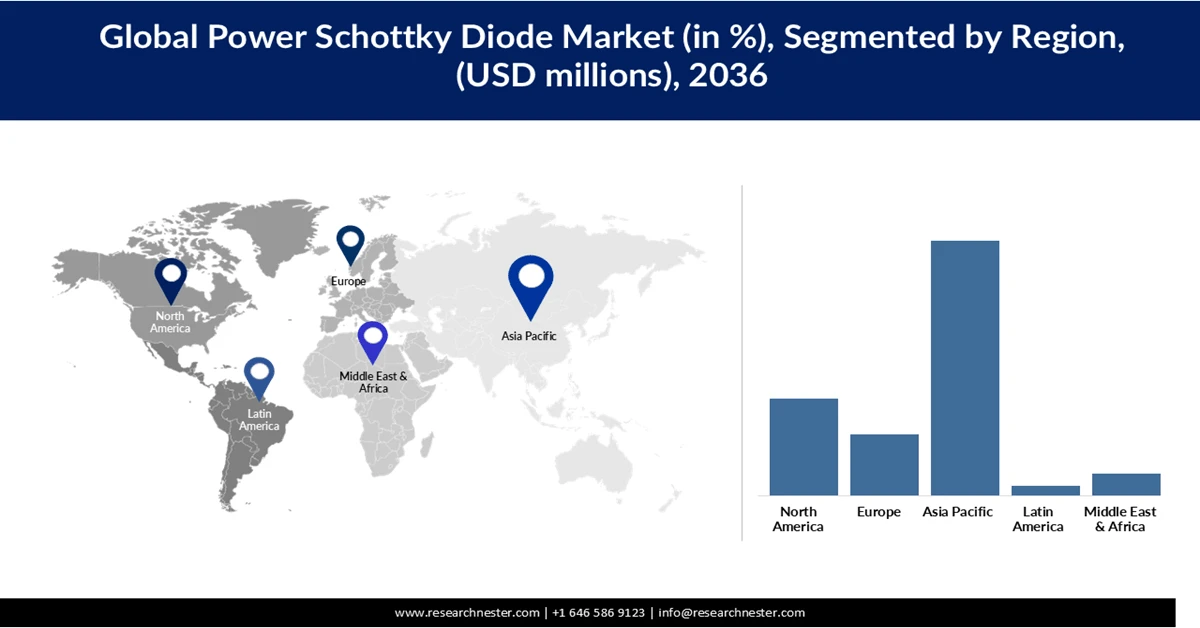

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Type

- Standard Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Barrier Rectifiers, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Power Diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Transistors, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Voltage Rating

- Low Voltage Schottky-diodes Up to 100V, Market Value (USD Million), and CAGR, 2026-2036F

- Medium Voltage Schottky 101V-200V, Market Value (USD Million), and CAGR, 2026-2036F

- High Voltage Schottky-diodes Above 200V, Market Value (USD Million), and CAGR, 2026-2036F

- By Material

- Silicon Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Silicon Carbide Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Gallium Nitrate Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Factory Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Data Servers, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Mobile Phones, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Type

- Standard Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Barrier Rectifiers, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Power Diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Transistors, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Voltage Rating

- Low Voltage Schottky-diodes Up to 100V, Market Value (USD Million), and CAGR, 2026-2036F

- Medium Voltage Schottky 101V-200V, Market Value (USD Million), and CAGR, 2026-2036F

- High Voltage Schottky-diodes Above 200V, Market Value (USD Million), and CAGR, 2026-2036F

- By Material

- Silicon Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Silicon Carbide Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Gallium Nitrate Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Factory Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Data Servers, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Mobile Phones, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Type

- Perfume/ Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Parfum, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Toilette, Market Value (USD Million), and CAGR, 2026-2036F

- Eau de Cologne, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Origin

- Natural, Market Value (USD Million), and CAGR, 2026-2036F

- Synthetic, Market Value (USD Million), and CAGR, 2026-2036F

- By Price Tier

- Luxury, Market Value (USD Million), and CAGR, 2026-2036F

- Premium, Market Value (USD Million), and CAGR, 2026-2036F

- Mass, Market Value (USD Million), and CAGR, 2026-2036F

- By Sales Channel

- Department Stores, Market Value (USD Million), and CAGR, 2026-2036F

- Duty-Free Shops, Market Value (USD Million), and CAGR, 2026-2036F

- E-commerce, Market Value (USD Million), and CAGR, 2026-2036F

- Salon & Spa, Market Value (USD Million), and CAGR, 2026-2036F

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Specialty Retail, Market Value (USD Million), and CAGR, 2026-2036F

- Supermarkets and Drug Store, Market Value (USD Million), and CAGR, 2026-2036F

- Other, Market Value (USD Million), and CAGR, 2026-2036F

- By Demographics

- Female, Market Value (USD Million), and CAGR, 2026-2036F

- Male, Value (USD Million), and CAGR, 2026-2036F

- Unisex, Market Value (USD Million), and CAGR, 2026-2036F

- Children/Teen, Market Value (USD Million), and CAGR, 2026-2036F

- By Scent Family

- Floral, Market Value (USD Million), and CAGR, 2026-2036F

- Woody, Value (USD Million), and CAGR, 2026-2036F

- Amber, Market Value (USD Million), and CAGR, 2026-2036F

- Musk, Market Value (USD Million), and CAGR, 2026-2036F

- Powdery, Market Value (USD Million), and CAGR, 2026-2036F

- Fresh/Citrus/Aquatic, Market Value (USD Million), and CAGR, 2026-2036F

- Fruity, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End User

- Personal Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Home Fragrance, Value (USD Million), and CAGR, 2026-2036F

- Personal Care Fragrance, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial/Institutional, Market Value (USD Million), and CAGR, 2026-2036F By Type

- Standard Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Barrier Rectifiers, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Power Diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Transistors, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Voltage Rating

- Low Voltage Schottky-diodes Up to 100V, Market Value (USD Million), and CAGR, 2026-2036F

- Medium Voltage Schottky 101V-200V, Market Value (USD Million), and CAGR, 2026-2036F

- High Voltage Schottky-diodes Above 200V, Market Value (USD Million), and CAGR, 2026-2036F

- By Material

- Silicon Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Silicon Carbide Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Gallium Nitrate Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Factory Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Data Servers, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Mobile Phones, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Type

- Standard Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Barrier Rectifiers, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Power Diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Transistors, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Voltage Rating

- Low Voltage Schottky-diodes Up to 100V, Market Value (USD Million), and CAGR, 2026-2036F

- Medium Voltage Schottky 101V-200V, Market Value (USD Million), and CAGR, 2026-2036F

- High Voltage Schottky-diodes Above 200V, Market Value (USD Million), and CAGR, 2026-2036F

- By Material

- Silicon Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Silicon Carbide Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Gallium Nitrate Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Factory Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Data Servers, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Mobile Phones, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Type

- Standard Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Barrier Rectifiers, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Power Diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Schottky Transistors, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Voltage Rating

- Low Voltage Schottky-diodes Up to 100V, Market Value (USD Million), and CAGR, 2026-2036F

- Medium Voltage Schottky 101V-200V, Market Value (USD Million), and CAGR, 2026-2036F

- High Voltage Schottky-diodes Above 200V, Market Value (USD Million), and CAGR, 2026-2036F

- By Material

- Silicon Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Silicon Carbide Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- Gallium Nitrate Schottky-diodes, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Factory Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Data Servers, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Mobile Phones, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Power Schottky Diode Market Outlook:

Power Schottky Diode Market size is valued at USD 1.81 billion in 2025 and is expected to grow to USD 4.18 billion by 2036, registering a CAGR of 7.90% during the forecast period, i.e., 2026-2036. In 2026, the industry size of power schottky diode is evaluated at USD 1.95 billion.

The rapid expansion of solar energy adoption in industrial and domestic settings is driving demand in the power schottky diode market. Solar power, a leading renewable energy source, enables users to significantly reduce electricity costs, thereby encouraging broader installation of solar systems. In 2024, global solar photovoltaic (PV) installed capacity increased by 452 GW, accounting for 72 % of all new installed capacity growth among power technologies, and solar generation grew by 475 TWh, the largest increase of any electricity source worldwide. This surge reflects the accelerating deployment of solar systems across power Schottky diode markets such as China, the U.S., and India. A power Schottky diode plays an important role in solar power electronics by minimizing voltage drops and ensuring stable, efficient power flow to panels and inverters, which improves overall system performance and reliability. Emerging economies in the Asia-Pacific region are witnessing a strong rise in solar panel adoption as part of government energy conservation and renewable energy strategies, supported by favorable policies and declining solar-energy costs. In April 2025, Infineon Technologies introduced its first industrial-grade gallium nitride (GaN) power transistor family with integrated Schottky diodes, the CoolGaN Transistors G5, designed to reduce switching losses and enhance power-conversion efficiency in systems such as DC-DC converters and power supplies. This product exemplifies ongoing innovations that boost power efficiency and simplify designs in renewable energy and power systems.

Key Power Schottky Diode Market Insights Summary:

Regional Highlights:

- Asia-Pacific in the power schottky diode market is projected to command the largest share of 57.33% by 2036, anchored in large-scale consumer electronics manufacturing, expanding EV infrastructure, and rising industrial and renewable energy investments.

- North America is forecast to secure a 21.79% share by 2036, supported by accelerating adoption of electric vehicles, growing data center deployments, and increased integration of renewable energy systems.

Segment Insights:

- The standard Schottky-diode segment in the power schottky diode market is projected to account for a dominant 38.30% share by 2036, supported by its widespread adoption in cost-sensitive consumer electronics requiring stable, thermally responsive, and sub-100V power management solutions.

- The low-voltage Schottky-diodes (Up To 100V) segment is anticipated to capture a substantial 69.51% share by 2036, underpinned by escalating demand from consumer electronics and fast-charging applications that rely on efficient low-voltage power regulation.

Key Growth Trends:

- Automotive Electrification

- Expansion in consumer electronics and telecommunication

Major Challenges:

- More expensive than traditional diodes

- Raw material volatility and risks

Key Players: Diodes Incorporated, Infineon Technologies AG, ON Semiconductor, Vishay Intertechnology, Nexperia, Microchip Technology Inc, and Central Semiconductor Corp.

Global Power Schottky Diode Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.81 billion

- 2026 Market Size: USD 1.95 billion

- Projected Market Size: USD 4.18 billion by 2036

- Growth Forecasts: 7.90% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (57.33% Share by 2036)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Thailand, Malaysia

Last updated on : 3 February, 2026

Power Schottky Diode Market - Growth Drivers and Challenges

Growth Drivers

- Automotive Electrification: The increasing adoption of electric vehicles is boosting power demand for Schottky diodes because EVs require more and more high-efficiency power electronics to manage energy conversion and distribution in systems such as onboard chargers, DC-DC converters, and inverters. According to the International Energy Agency (IEA), global electric car sales are expected to exceed 20 million units in 2025, representing over one-quarter of all new car sales worldwide, with sales up about 35 % in the first quarter of 2025 versus the same period in 2024 and strong growth in major markets such as China, Europe, and the U.S. EVs contain significantly more power semiconductor content than traditional internal combustion vehicles due to the need for efficient high-current switching and minimal energy loss; power Schottky diodes are widely used in these applications because of their low forward voltage drop and fast switching characteristics. As EV penetration rises, supported by policies to reduce emissions and increasing consumer uptake, the power market for Schottky diodes expands in parallel to meet the growing requirement for reliable, efficient power conversion components in electrified automotive systems.

- Expansion in consumer electronics and telecommunication: Rapid growth in consumer electronics and telecommunications significantly boosts the power Schottky Diode market because modern electronic devices and network equipment require highly efficient power management and fast switching components. The global consumer electronics semiconductor market, which supplies critical power and signal components for devices such as smartphones, laptops, wearables, smart appliances, and other connected products, is projected to grow from approximately USD 190.5 billion in 2024 to about USD 357.6 billion by 2034, driven by continued demand for advanced, energy-efficient electronics.

Simultaneously, the widespread rollout and densification of 5G networks, a cornerstone of modern telecommunications infrastructure, amplify demand for semiconductors that support high-frequency switching and power conversion in base stations, small cells, routers, and related equipment. While global telecom device data shows strong power Schottky diode market momentum in 5G deployments and connected devices, expanding networks and services are supported by policies and infrastructure investment that improve connectivity and device performance. In both sectors, power Schottky diodes play a crucial role due to their low forward voltage drop and fast switching speeds, which help reduce power loss, improve energy efficiency, and enhance thermal performance in compact circuits, making them increasingly indispensable in power supplies, chargers, and RF front ends across consumer and telecom applications. - Expansion in 5G networks: The rapid deployment and expansion of 5G networks are significantly driving the power schottky diode market because modern 5G infrastructure requires highly efficient, high-frequency power management components to support increased data traffic, network densification, and energy-efficient operation. As of early 2025, global 5G connections reached about 2.25 billion worldwide, with forecasts projecting continued strong growth and network build-outs across regions such as North America, Europe, and Asia-Pacific. 5G base stations, small cells, and supporting telecom equipment demand power conversion modules that minimize voltage drops and heat generation while maintaining fast switching performance characteristics for which power Schottky diodes are particularly well suited. Because 5G networks handle vastly greater throughput and connectivity than previous generations, operators are investing in more power-dense and efficient electronics throughout the network infrastructure. This drives volume demand for Schottky diodes in rectification stages, power supplies, and RF front-end modules within 5G equipment. As 5G continues to expand with commercial networks surpassing 350 deployments globally and coverage and connection numbers growing rapidly, power semiconductor components that enhance energy efficiency and reliability, including Schottky diodes, are increasingly integrated into next-generation telecommunications hardware.

Challenges

- More expensive than traditional diodes: Power Schottky diodes are expensive when compared to other types of diodes. The SiC-based devices have a premium cost driven by the high manufacturing cost. For products such as power adaptors and low-cost power supplies, designers often reject the use of SiC-based power Schottky-diodes, as that may enhance the cost of installations.

- Raw material volatility and risks: Many Schottky diodes are specifically the SiC-based variant, which rely on the raw material that has a fluctuating price, which restricts designers from employing them within the systems. SiC wafer production demands high-purity substrates, which often face price increases, leading to an increased cost of the product.

Power Schottky Diode Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

Base Year |

|

Forecast Year |

2026-2036 |

|

CAGR |

7.90% |

|

Base Year Market Size (2025) |

USD 1.81 billion |

|

Forecast Year Market Size (2036) |

USD 4.18 billion |

|

Regional Scope |

|

Power Schottky Diode Market Segmentation:

Type Segment Analysis

The standard Schottky-diode segment will hold the dominating share of 38.30% by 2036, owing to its usage in consumer electronics that require stable and thermally responsive circuit boards. The rise of smartphones, laptops, and tablets will increase the adoption of the power Schottky diode market. Moreover, the cost of a standard Schottky diode is less than that of other specialty power Schottky diodes. For electronics that require less than 100V of power, the standard Schottky-diode segment is suitable, which reduces the power consumption and provides the optimum power supply needed for battery-powered devices and power adaptors.

Voltage Rating Segment Analysis

The low-voltage Schottky-diodes (Up To 100V) segment is expected to hold a share of 69.51% by the end of 2036. The demand is driven by the growth of consumer electronics such as mobile phones and tablets, which require low-voltage Schottky diodes. Regions such as the Asia Pacific are focusing on consumer electronics, which have significantly raised the demand. Manufacturers aim to develop cost-effective and cheap consumer electronics using low-voltage Schottky diodes. The use is also extended towards fast charging adaptors that require the low voltage components to ensure a consistent flow of power and minimal switching cuts.

Application Segment Analysis

The automotive segment is projected to command the largest power schottky diode market share of 32.14% by 2036, driven primarily by the increasing integration of power Schottky diodes in electric vehicles (EVs). Modern EV architectures incorporate advanced driver-assistance systems (ADAS), digital infotainment platforms, and multiple sensor modules, all of which require efficient power regulation and low-loss current flow, key advantages offered by power Schottky diodes. These diodes are also valued for their high thermal tolerance and fast switching capabilities, making them highly reliable for demanding automotive environments. Furthermore, EVs depend heavily on battery management systems for stable and optimized power delivery, where power Schottky diodes play a critical role in minimizing voltage drops and improving charging efficiency. As vehicle electrification accelerates and electronic content per vehicle continues to rise, the adoption of power Schottky diodes across onboard chargers, DC-DC converters, and battery protection circuits is expected to expand steadily, reinforcing the segment’s power schottky diode market dominance.

Our in-depth analysis of the global power schottky diode market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Voltage Rating |

|

|

Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Schottky Diode Market - Regional Analysis

Asia Pacific Market Insights

The region is expected to capture the largest power schottky diode market share of 57.33% by 2036, driven by large-scale manufacturing of consumer electronics and extensive industrial and renewable energy investments. Asia-Pacific, led by China, accounts for a substantial portion of global electronics output, with China alone responsible for over 33% of global electronics manufacturing and approximately 65% of semiconductor production, underscoring its dominant role in supplying devices that incorporate power Schottky diodes, such as smartphones, tablets, and personal computers. The presence of major automotive manufacturers and the expansion of EV infrastructure are further stimulating demand for power electronics, as these vehicles rely on efficient power conversion components. Supportive government policies aimed at boosting semiconductor and electronics capacity are reinforcing power schottky diode market growth across the region. China’s rapid clean energy deployment, adding hundreds of gigawatts of renewable capacity, while detailed national figures show significant installed renewable energy growth, reflects broader industrial momentum.

China’s leadership in consumer electronics and manufacturing ecosystems effectively drives the demand for power-efficient systems that utilize Schottky diodes in both consumer and automotive applications. The country’s large-scale production, advanced supply chain, and investments in power electronics technologies position it as a central hub for the component’s adoption. Meanwhile, India’s expanding industrial and renewable energy infrastructure, marked by strong renewable capacity growth and ambitious targets for non-fossil energy expansion, supports rising demand for power electronic components in industrial machinery and energy conversion systems.

Power schottky diode Market growth in India is being supported by rapid expansion across renewable energy, electric mobility, and industrial automation, all of which rely heavily on efficient power management components such as power Schottky diodes. Government initiatives, including Make in India, Digital India, and the Production Linked Incentive (PLI) scheme for electronics and semiconductors, are strengthening domestic manufacturing capabilities and encouraging localization of power electronic components. Rising deployment of solar and wind projects is increasing demand for high-efficiency rectification and DC-DC conversion systems, where Schottky diodes are widely used to minimize energy losses. In parallel, India’s accelerating EV ecosystem and charging infrastructure development are driving the adoption of power semiconductors for onboard chargers and battery management systems. Growth in industrial machinery and automation is further reinforcing demand, as factories increasingly depend on reliable high-voltage power conversion for stable operations. Together, these structural shifts toward clean energy, electrified transport, and advanced manufacturing are positioning India as a fast-emerging contributor to the regional power schottky diode market.

North America Market Insights

North America will represent a power schottky diode market share of 21.79% owing to the expansion in electric vehicles and data centres, which employ a variety of power Schottky diodes. The region has also witnessed a shift in microgrids and renewable energy, which require thermally stable components, including diodes. North America has stress on sustainability, leading to widespread adoption of wind and solar energy, further increasing the dominance of power Schottky diodes.

The U.S. includes some of the key manufacturers in the automotive which fuels the growth of power Schottky-diode. The rise of electric vehicles is a planned strategy of the government to enhance sustainability and minimize pollution, resulting in market expansion. Certain components, such as in-car charging systems and battery management systems, employ the use of low-power Schottky diodes that significantly expand the power schottky diode market.

Canada is well-versed in sustainability trends, and as a result, the government is heavily investing in renewable energies such as wind and solar. The turbines and the battery used to power the motors need a thermally responsive system that can reduce switching cuts and stop reverse current flow. The consumer electronics market of Canada is also booming, which has further accelerated the growth of the power Schottky diode.

Europe Market Insights

Europe is expected to account for 13.78% of the power schottky diode market share, owing to strict regulations on energy-efficient and renewable energy sources. Rapid electrification of the rural areas is fueling the growth of power Schottky diodes. The automotive sector of the region is driven by the adoption of electric vehicles that accelerate the uptake of SiC-based Schottky diodes, especially in the EV battery and onboard chargers. In November 2025, Onsemi received a major approval from the European Commission valued at USD 525.57 million to build a SiC semiconductor manufacturing facility that would start production by 2027.

The UK is dedicated to reducing environmental pollution, which is resulting in strategies to use clean and renewable energy, such as solar panels, especially for domestic settings. To further curb the environmental damage, the country has to adopt EVs that will significantly support in keeping the environment clean and healthy. The rising concern regarding environmental challenges has significantly advanced the growth of the power Schottky diode. Moreover, Germany’s domination over industrial automation has enhanced the reliance on high-quality quality thermally stable diodes. Heavy industries employ machines and equipment that function on high voltage. The association of a high-voltage power Schottky diode ensures consistent performance and helps in minimizing reverse current flow.

Key Power Schottky Diode Market Players

- Diodes Incorporated (U.S.)

- Infineon Technologies AG (Germany)

- STMicroelectronics N.V.(Switzerland)

- ON Semiconductor (U.S.)

- Vishay Intertechnology (U.S.)

- Nexperia (Netherlands)

- ROHM Semiconductor (Japan)

- Microchip Technology Inc (U.S.)

- Central Semiconductor Corp (U.S.)

- Littlefuse, Inc (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ON Semiconductor is the leading American Semiconductor supplier with a wide product list of custom solutions for industrial, automotive, and telecommunication sectors. It has geographical footprints in North America, Europe, and the Asia Pacific. The primary focus of the business lies in EVs and industrial automation.

- Vishay Intertechnology, an American semiconductor manufacturer with a portfolio in resistors, diodes, rectifiers, supplying to automotive, industrial computing, and telecommunication. The business has made strategic investments in securing a wafer fab to enhance the production of SiC

- Nexperia is a global semiconductor company that heavily focuses on the high-volume production of diodes. The products are tailored for automotive, industrial, and consumer electronics. The business largely focuses on efficiency and reliability, which increases the demand for the products.

- ROHM Semiconductor, a Japanese manufacturer of semiconductors and electronic components. The business deals in a variety of integrated circuits, discrete semiconductors, and passive automotive components. Consumer electronics, automotive, and industrial automation are some of the core areas of focus for the business.

Below is the list of the key players operating in the global power schottky diode market:

The players operating in the global power schottky diode market are expected to face intense competition during the forecast timeline. The power Schottky diode market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the power schottky diode market. Key players in the market are significantly supported by the governments for research and innovation.

Competitive Landscape of the Global Power Schottky Diode Market Key Players

Recent Developments

- In December 2025, ROHM Semiconductor signed a strategic collaboration with Tata Electronics in India to power the manufacturing of semiconductors. The manufacturing will focus on assembly and testing of automotive chips and is expected to mass produce by 2026.

- In December 2025, Littlefuse acquired Basler Electric and enhanced its potential in high-power industrial markets with a core focus on data centre and power generation. Basler is a leader in innovative electrical control that has earned a global presence.

- Report ID: 8376

- Published Date: Feb 03, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Schottky Diode Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.