Power MOSFET Market Outlook:

Power MOSFET Market size was over USD 8.85 billion in 2025 and is projected to reach USD 16.93 billion by 2035, growing at around 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of power MOSFET is evaluated at USD 9.38 billion.

The rapid growth in the use of smartphones, along with tablets, laptops, and other portable devices in recent years, has led to a significant demand for power management solutions. Power MOSFETs play a substantial role in controlling and converting power in these devices, ensuring enhanced energy efficiency and performance. These MOSFETs enable fast switching operations to increase battery duration and device dependability through minimized energy loss. Organizations are collaborating to reduce MOSFET-related costs and optimize power conversion performance. For instance, in March 2025, Infineon Technologies AG collaborated with Enphase Energy to boost power efficiency in consumer electronics by using their 600 V CoolMOS 8 high-voltage superjunction MOSFETs.

Moreover, the rising demand for compact consumer devices is encouraging manufacturers to innovate highly effective MOSFET technologies. Various organizations are focusing on developing MOSFETs with enhanced thermal performance, lower conduction losses, and improved switching capabilities required for high-speed operations in modern electronic gadgets. These advancements are all set to offer lucrative growth avenues to the market.

Key Power MOSFET Market Insights Summary:

Regional Highlights:

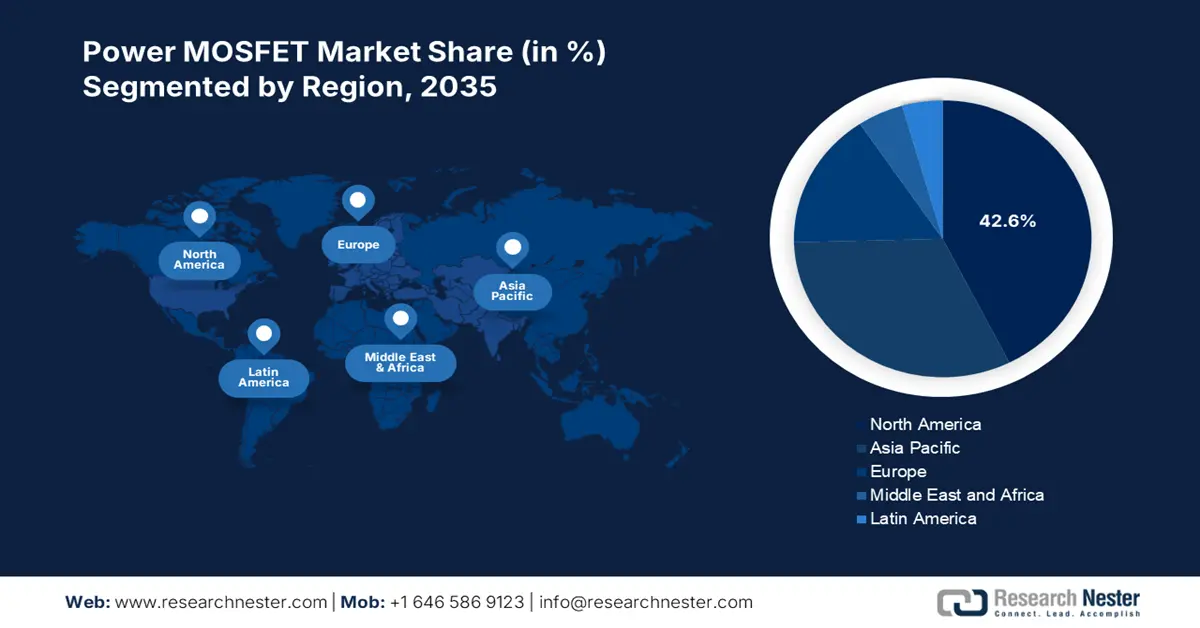

- North America dominates the Power MOSFET Market with a 42.6% share, driven by the increasing adoption of advanced power electronics in the automotive sector, strengthening its position through technological integration by 2035.

Segment Insights:

- The Enhancement Mode segment is forecasted to capture 59.2% market share by 2035, fueled by growing adoption of high-efficiency components in automotive applications.

Key Growth Trends:

- Growing dependence on electrical equipment

- Advancements in industrial automation

Major Challenges:

- Limited adoption in low-cost consumer electronics

- Voltage and current limitations

- Key Players: Digi-Key Electronics, Fairchild Semiconductors, and Infineon Technologies AG.

Global Power MOSFET Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.85 billion

- 2026 Market Size: USD 9.38 billion

- Projected Market Size: USD 16.93 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, Taiwan, India

Last updated on : 12 August, 2025

Power MOSFET Market Growth Drivers and Challenges:

Growth Drivers

- Growing dependence on electrical equipment: There is an increasing adoption of efficient power management solutions, particularly power MOSFETs, owing to the rising electrical equipment reliance across various industries. These components are essential in converting and controlling electrical energy while maintaining both high functionality and power efficiency inside technical systems. The increasing adoption of industrial automation and robotics is resulting in an increased demand for power MOSFETs since these devices are significant for motor control applications. The priority of industries to automate operations coupled with their need for efficient and high-performance is accelerating power MOSFET market growth.

Several companies are continually working on innovating power management technology platforms to fulfill increasing customer needs. For instance, in September 2024, Infineon Technologies AG released its StrongIRFET 2 power MOSFET 30 V portfolio to address the requirements of a wide range of applications such as motor drives, battery management systems, and industrial switched-mode power supplies.

- Advancements in industrial automation: The rising adoption of advanced machinery and industrial automation across various industries is fueling the requirement for efficient and strong power management systems. The industrial applications, including robotics, controlling motors, and power supplies, require power MOSFETs that provide high efficiency and fast switching characteristics. Organizations are developing advanced MOSFETs for industrial and automotive applications to attain high efficiency. For instance, in November 2022, Alpha and Omega Semiconductor launched new 650V and 750V automotive-qualified αSiC MOSFETs geared for industrial applications and electric vehicles. These MOSFETs feature low resistance levels and superior switching performance, making them suitable for industrial uses such as solar inverter systems, motor drive solutions, and energy storage installations.

Challenges

- Limited adoption in low-cost consumer electronics: The high manufacturing expenses of power MOSFETs is slowing down their use in budget-friendly consumer electronics. Manufacturers in this segment prioritize alternatives, including bipolar junction transistors along with low-cost diodes, owing to their minimal production expenses. Therefore, the adoption of these devices remains limited in low-margin products, including basic household appliances, entry-level smartphones, and budget computing devices.

- Voltage and current limitations: Power MOSFETs are excelling in low as well as medium-power ranges utilizing their high-speed operations, however, they are experiencing limitations in usage in the high voltage and current ranges. When operated at high power levels, the on-state resistance of these devices substantially increases which produces higher conduction losses and conductive heat. The industries that require high-power solutions including industrial inverters, power transmission, and large-scale renewable energy systems prefer alternatives such as insulated gate bipolar transistors or thyristors, as these devices deliver superior efficiency and reliability at high power levels.

Power MOSFET Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 8.85 billion |

|

Forecast Year Market Size (2035) |

USD 16.93 billion |

|

Regional Scope |

|

Power MOSFET Market Segmentation:

Type (Depletion Mode, Enhancement Mode)

By the end of 2035, enhancement mode segment is estimated to dominate around 59.2% Power MOSFET market share, owing to the surging adoption of high-efficiency components in automotive applications. As vehicles integrate more electronic control units and advanced sensor circuits, there is a rising need for reliable power management solutions. Enhancement mode MOSFETs, known for their low conduction losses and fast switching speeds, are gaining traction in the industry. Manufacturers are advancing and enhancing the mode power MOSFETs. For instance, in October 2023, Littelfuse launched the IXTY2P50PA, the first automotive-grade PolarP P-channel enhancement mode power MOSFET. This component is AEC-Q101 qualified, ensuring compliance with rigorous automotive standards.

The rising adoption of power-efficient semiconductor technologies in data centers and renewable energy applications is also fueling the segmental growth. These MOSFETs play a significant role in high-performance power supplies and inverter circuits, helping reduce energy losses and improve system efficiency. Organizations are innovating in this space to meet the demand for improved power density and thermal performance. As industries continue to focus on energy optimization, enhancement-mode MOSFETs are becoming essential in modern power electronics, ensuring reliable operation and superior efficiency across various applications.

Power Rate (High Power, Medium Power, Low Power)

The industrial manufacturing segment in power MOSFET market is expected to register the fastest growth, owing to the rising demand for compact and energy-efficient power management solutions in wearable devices and IoT applications. To meet the increasing demand for ultra-low-power semiconductor solutions in wearable and IoT applications, there have been active innovations by companies in power management technologies. For instance, in January 2022, Toshiba Electronic Devices & Storage Corporation launched the TCK12xBG Series of load switch ICs, designed to significantly reduce quiescent current while offering an output current rating of 1A. These ICs are housed in a compact WCSP4G package, and enable developers to create the next generation of wearables and IoT devices with lower power consumption and extended battery life.

Our in-depth analysis of the global power MOSFET market includes the following segments:

|

Type |

|

|

Power Rate |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power MOSFET Market Regional Analysis:

North America Market

North America power MOSFET market is expected to account for revenue share of more than 42.6% by the end of 2035 due to the increasing adoption of advanced power electronics in the automotive sector. With the rapid expansion of electric and hybrid vehicles, automakers are integrating high-efficiency Power MOSFETs into battery management systems, inverters, and motor controllers to enhance vehicle performance and energy efficiency. The increasing demand for high-performance computing and data centers is also creating lucrative opportunities for the market. With the rise of cloud computing, AI, and 5G networks, data centers require efficient power management solutions to optimize energy consumption and thermal performance.

The U.S. power MOSFET market is witnessing steady growth, owing to the increasing deployment of renewable energy systems. With a strong push toward clean energy, Power MOSFETs are widely integrated into solar inverters and wind power converters to enhance efficiency and reduce energy losses. According to a report from the U.S. Department of Energy, there was an allocation of USD 3 billion made in 2022 to upgrade the national power grid, emphasizing the need for advanced semiconductor components in energy storage and distribution systems.

The power MOSFET market in Canada is progressing gradually, owing to the increasing electrification of transportation. With the country’s strong push toward electric vehicles and hybrid electric vehicles, there is a rising demand for efficient power management solutions in battery management systems, motor controllers, and charging stations. Power MOSFETs enable improved energy efficiency, thermal management, and power conversion in these applications, supporting the expansion of the country’s EV ecosystem.

With increasing investments in healthcare technology, the country’s medical device sector is incorporating Power MOSFETs into advanced medical equipment. These components are used in imaging systems, wearable health monitors, and portable medical devices to ensure power efficiency, reliability, and extended battery life.

Asia Pacific Market Analysis

The power MOSFET market in Asia Pacific is expected to account for a significant share during the assessment period, owing to the rapid expansion of the consumer electronics industry. There is a growing need for efficient power management solutions, with the increasing adoption of smartphones, laptops, smart home devices, and IoT applications. Power MOSFETs play a crucial role in improving energy efficiency and thermal management in these devices, making them essential components for modern electronic products.

The increasing investments in industrial automation and electric vehicles is also boosting the power MOSFET market growth. Governments and private enterprises are pushing for advanced power electronics solutions to enhance manufacturing efficiency and support the transition to electrified transportation, leading to a higher demand for power MOSFETs in industrial and automotive applications.

The China power MOSFET market is experiencing robust growth, attributed to the strong push for semiconductor self-sufficiency. The government and domestic manufacturers are investing heavily in domestic semiconductor production to reduce reliance on foreign suppliers. This is accelerating the development and adoption of Power MOSFETs in significant sectors such as telecommunications, energy, and industrial automation, strengthening the local supply chain.

Another key factor fueling power MOSFET market expansion is the rapid development of the country’s renewable energy sector. With the country’s aggressive targets for carbon neutrality, there is a growing demand for advanced power management solutions in solar and wind energy systems. Power MOSFETs are widely used in inverters and power conversion units, ensuring higher efficiency and stability in renewable energy applications.

The India power MOSFET market is growing at a rapid pace, attributed to the country’s increasing focus on strengthening the semiconductor manufacturing ecosystem. The local government has launched initiatives such as the Production Linked Incentive scheme to encourage domestic semiconductor production, attracting global investments in power electronics. This is resulting in a surge in local power MOSFET manufacturing, reducing dependency on imports and making India a key player in the global semiconductor supply chain.

The accelerating adoption of electric vehicles and charging infrastructure is another factor propelling the power MOSFET market growth. With the local EV market witnessing rapid growth, the demand for efficient power management components, including power MOSFETs, is surging, as there is an increasing demand for MOSFETs in EVs for fast charging and reliability. In December 2023, Tata Power announced the expansion of its EV charging network, aiming to deploy 25,000 chargers across India by 2027. This initiative is driving the need for high-performance Power MOSFETs in EV powertrains and charging stations, further boosting market demand.

Key Power MOSFET Market Players:

- Digi-Key Electronics

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fairchild Semiconductors

- Infineon Technologies AG

- IXYS Corporation Power Integration

- Microchip Technology Inc.

- NXP Semiconductors

- Panasonic Corporation

- Power Integration Inc.

- STMicroelectronics

- Texas Instruments

- Vishay Siliconix

The power MOSFET market is highly competitive, with key players focusing on technological advancements, product innovations, and strategic partnerships to strengthen their market position. Leading companies such as Infineon Technologies, Toshiba, ON Semiconductor, and STMicroelectronics are investing in R&D to enhance efficiency and thermal performance. Mergers and acquisitions are shaping the landscape, with firms expanding their semiconductor capabilities. Additionally, the rise of domestic semiconductor manufacturing in regions including North America and Asia Pacific is intensifying competition. Here are some key players operating in the global power MOSFET market:

Recent Developments

- In February 2024, Nexperia expanded its MOSFET portfolio by releasing 100 V application-specific MOSFETs (ASFETs) for Power over Ethernet (PoE), eFuse, and relay replacement in a 60% smaller DFN2020 packaging. Additionally, they introduced 40 V NextPowerS3 MOSFETs with improved electromagnetic compatibility (EMC) performance, catering to various applications across multiple end markets.

- In March 2022, Microchip released the industry's lowest on-resistance 3.3 kV silicon carbide (SiC) MOSFETs and highest current-rated SiC Schottky Barrier Diodes (SBDs). These components are designed to enhance efficiency and reduce the size of systems in electrified transportation, renewable energy, aerospace, and industrial applications. The 3.3 kV MOSFETs and SBDs offer improved ruggedness, reliability, and performance, enabling designers to create solutions that are lighter, smaller, and more effective.

- Report ID: 7495

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power MOSFET Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.