Powder Coatings Market Outlook:

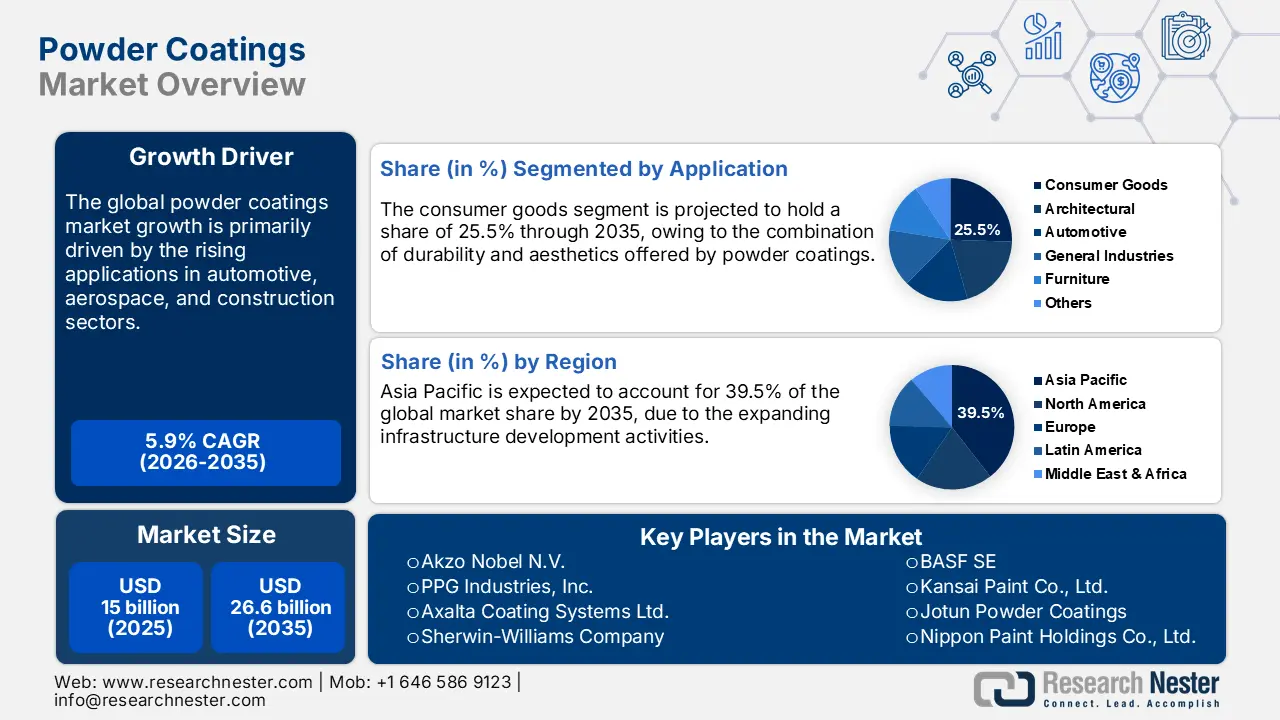

Powder Coatings Market size was USD 15 billion in 2025 and is estimated to reach USD 26.6 billion by the end of 2035, expanding at a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of powder coatings is estimated at USD 15.8 billion.

The swiftly expanding infrastructure construction activities globally are expected to propel the demand for powder coating solutions. The accelerating investments in urban development and smart city projects are emerging as a boon for powder coating producers. The pipelines, fittings, steel structures, aluminum profiles, window frames, and doors are some of the leading application areas for powder coatings in modern buildings and infrastructure. The report by the Global Infrastructure Outlook, a G20 Initiative, discloses that the current investment trends globally are around USD 79 trillion.

The smart city initiatives are driving high investments from the public and private sectors, mainly in markets such as Asia Pacific, the Middle East, and Europe. The move toward eco-friendly buildings and sustainability is expected to increase the use of powder coating solutions. The large transportation projects, such as railways, bridges, and airports, are also boosting the demand for powder coatings. Overall, global infrastructure growth is likely to double the earnings of major companies in this industry during the study period.

Key Powder Coating Market Insights Summary:

Regional Highlights:

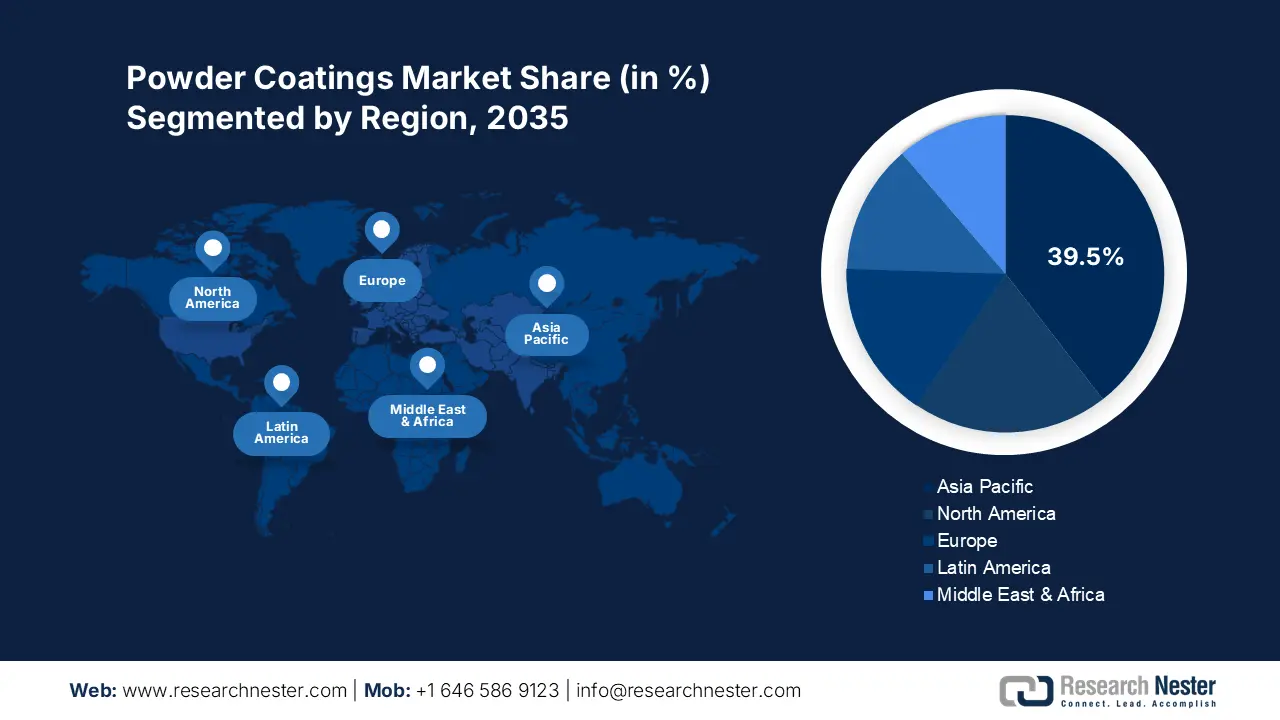

- Asia Pacific is projected to hold 39.5% share by 2035, driven by rapid industrialization, urbanization, and growth in construction, automotive, and consumer goods sectors.

- North America is expected to capture the second-largest share by 2035, impelled by stringent environmental regulations and green building trends promoting powder coatings.

Segment Insights:

- The polyester segment is projected to account for 27.9% share by 2035, propelled by its versatility, durability, and cost-effectiveness across construction and infrastructure applications.

- The consumer goods segment is anticipated to hold 25.5% share by 2035, driven by rising demand for durable and aesthetically appealing coatings in home appliances, furniture, and electronics.

Key Growth Trends:

- Rising EV and battery manufacturing

- Adoption in 3D printing and additive manufacturing

Major Challenges:

- High initial capital investment

- Competition from alternative coatings

Key Players: Akzo Nobel N.V., PPG Industries, Inc., Axalta Coating Systems Ltd., Sherwin-Williams Company, BASF SE, Kansai Paint Co., Ltd., Jotun Powder Coatings, Nippon Paint Holdings Co., Ltd., Tiger Coatings GmbH, Valspar Corporation, IVC Coatings, Asian Paints Ltd., Hempel A/S, PPG Asian Operations, Kansai Nerolac Paints Ltd.

Global Powder Coating Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15 billion

- 2026 Market Size: USD 15.8 billion

- Projected Market Size: USD 26.6 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Germany, Japan, Canada

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 22 September, 2025

Powder Coatings Market - Growth Drivers and Challenges

Growth Drivers

- Rising EV and battery manufacturing: The rapid production of electric vehicles (EVs) and energy storage batteries is estimated to fuel the sales of powder coating solutions in the years ahead. The growing demand for lightweight, durable, and safe materials is increasing the application of powder coatings. The report by the International Energy Agency (IEA) discloses that the electric car sales crossed 17 million in 2024. This directly fuels the installation of EV batteries. Thus, to improve thermal management and meet fuel economy, automakers are increasingly investing in specialized and lightweight materials such as powder coatings.

- Adoption in 3D printing and additive manufacturing: The sectors, including aerospace, automotive, medical devices, and consumer, are increasingly focusing on additive manufacturing, especially 3D printing. Powder coatings are highly used in many 3D-printed parts during post-processing to enhance their finish and durability. France is the fourth largest country in the additive manufacturing (3D printing) industry, behind Germany, Italy, and the UK, making up 3% of the world’s revenue in this sector, according to the International Trade Administration (ITA). The same source also estimates that the France market is expected to grow by 17% each year through 2030. This indicates that powder coating is expected to exhibit a high demand across various regions of the world.

- Penetration into aerospace and defense: The aerospace and defense sector is offering lucrative earning opportunities for powder coating manufacturers. The evolving need for lightweight materials and long-lasting protective materials is likely to double the revenues of key players. The Aerospace Industries Association (AIA) reports that in 2024, the aerospace and defense industry employed over 2.23 million people in the U.S. These jobs make up about 1.4% of all U.S. jobs and grew by more than 100,000 workers in 2024. The robust developments in the aerospace and defense sector are poised to propel the consumption of powder coating solutions during the forecast period.

Challenges

- High initial capital investment: The production of powder coatings is a capital-intensive process, which acts as a major restraining factor for small and new companies. Setting up advanced infrastructure often deters budget-constrained companies from achieving higher market shares. Thus, this cost hurdle slows down innovative powder coating solution adoption in certain regions.

- Competition from alternative coatings: The strong presence of alternatives such as liquid coatings and newer waterborne formulations is expected to act as a major restraining factor for powder coatings. The similar and advanced characteristics of these alternatives limit the profit margins of key players. The increasing emergence of eco-friendly alternatives is intensifying competition for powder coating companies.

Powder Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 15 billion |

|

Forecast Year Market Size (2035) |

USD 26.6 billion |

|

Regional Scope |

|

Powder Coatings Market Segmentation:

Resin Segment Analysis

The polyester segment is projected to account for 27.9% of the global powder coatings market share by 2035, owing to its versatility, durability, and cost-effectiveness. The excellent balance between mechanical performance and chemical resistance is also contributing to the increasing sales of polyester resins. The architectural panels, window frames, and outdoor furniture are some of the prime application areas of polyester powder coatings. The expanding construction and infrastructure projects are set to double the revenues of key players in the years ahead.

Application Segment Analysis

The consumer goods segment is anticipated to capture 25.5% of the global market share through 2035. The combination of durability and aesthetics is expanding the application of power coatings in consumer goods. The propelling trade of home appliances, furniture, electronics, and kitchenware is expected to fuel the consumption of powder coatings in the years ahead. The powder coatings are particularly attractive for metal substrates such as aluminum and steel used in appliances and electronics, offering both protective and decorative benefits. The table below indicates the consumer spending, or personal consumption expenditures, in the U.S.

|

Consumer Spending or Personal Consumption Expenditures (PCE) |

|

|

July 2025 |

+0.5% |

|

June 2025 |

+0.4% |

|

May 2025 |

+0.0% |

|

April 2025 |

+0.2% |

Source: Bureau of Economic Analysis

Coating Method Segment Analysis

The electrostatic spray segment is anticipated to hold the largest market share throughout the forecast period. The electrostatic spray coating method is most preferred owing to its effectiveness and precision. The high transfer efficiency makes electrostatic spray cost-effective for large-scale industrial applications. Also, the reduced powder waste and minimal VOC emissions are driving the adoption of the electrostatic spray coating method. The automotive and consumer goods sector is expected to lead the demand for electrostatic spray coating technologies.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Resin |

|

|

Application |

|

|

Coating Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Powder Coatings Market - Regional Analysis

APAC Market Insights

The Asia Pacific powder coatings market is estimated to account for 39.5% of the global revenue share through 2035. The rapid industrialization and urbanization activities are anticipated to fuel the application of powder coatings. The construction, automotive, and consumer goods sectors are some of the prime end users of powder coating solutions in the region. Furthermore, the rise in smart cities and high-rise construction projects is set to fuel the trade of powder coatings.

China leads the sales of powder coatings, due to the construction boom and strong manufacturing base. The country’s automotive and electronics sectors are anticipated to propel the consumption of power coatings in the years ahead. The China Automotive Technology and Research Center and China Auto Standardization Research Institute’s study reveals that between January and October 2024, the country sold around 24.62 million vehicles, which is 2.7% more than the same period in the previous year. This indicates that the swift vehicle production is expected to boost the use of powder coatings.

North America Market Insights

The North America powder coatings industry is anticipated to account for the second-largest revenue share throughout the study period. Environmental regulations in the U.S. and Canada, such as stringent VOC limits and EPA compliance standards, are expected to encourage manufacturers to shift from solvent-based coatings to powder coatings. The green building trends and increasing use of specialized materials in the automotive and electronics sectors are poised to open lucrative doors for powder coating companies.

The U.S. market is expected to be driven by the expanding aerospace, automotive, and consumer goods industries. The Bureau of Transportation Statistics reveals that around 1,609,035 and 1,247,656 hybrid electric vehicles and electric vehicles were sold in 2024. The increasing demand for lightweight aluminum parts in EVs and commercial vehicles is accelerating the sales of powder coatings. The booming construction activities are also amplifying the demand for powder coating solutions.

Europe Market Insights

The European powder coatings market is forecast to grow at the fastest pace from 2026 to 2035. The stringent environmental regulations and industrial modernization trends are likely to fuel the sales of powder coatings in the years ahead. The EU’s regulations on volatile organic compounds (VOCs) and REACH compliance are expected to drive innovation in power coatings. Germany, France, and the U.K. are some of the leading marketplaces for power coating companies.

The sales of power coatings in Germany are anticipated to be driven by its robust industrial base, advanced manufacturing infrastructure, and strict environmental policies. The automotive industry is a primary driver for powder coatings owing to its leadership in modern automobile production. The increasing adoption of advanced technologies such as automated electrostatic spray systems and UV-curable powders is set to drive the overall market growth in the coming years.

Key Powder Coatings Market Players:

- Akzo Nobel N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries, Inc.

- Axalta Coating Systems Ltd.

- Sherwin-Williams Company

- BASF SE

- Kansai Paint Co., Ltd.

- Jotun Powder Coatings

- Nippon Paint Holdings Co., Ltd.

- Tiger Coatings GmbH

- Valspar Corporation

- IVC Coatings

- Asian Paints Ltd.

- Hempel A/S

- PPG Asian Operations

- Kansai Nerolac Paints Ltd.

The global market is characterized by the strong presence of top companies and the increasing emergence of start-ups. The leading companies are focused on R&D activities to introduce innovative solutions and attract a wider consumer base. They are also entering into strategic partnerships with other players to expand their product offerings. Some of the industry giants are exploring their operations in the developing markets to earn lucrative gains. The organic sales are expected to offer double-digit percent profit gains in the years ahead.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2025, the Powder Coating Institute (PCI) announced that Powder Coating Week 2026 would take place in Indianapolis. This event is offering a lucrative opportunity for companies to display their products and services.

- In January 2025, NEUMAN & ESSER announced that its Process Technology experts attended the European Coatings Show 2025. This event allowed the company to meet important decision-makers and investors and discuss the latest advancements in pigments, additives, adhesives, and raw materials.

- Report ID: 4825

- Published Date: Sep 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Powder Coating Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.