Potassium Zirconium Fluoride Market Outlook:

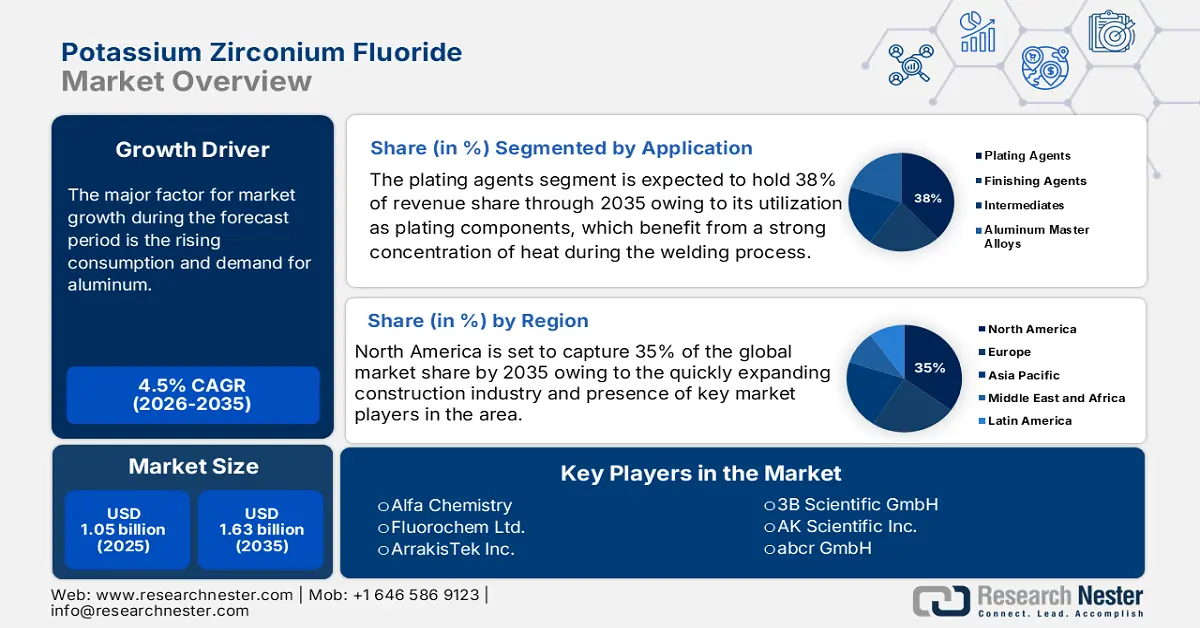

Potassium Zirconium Fluoride Market size was over USD 1.05 billion in 2025 and is projected to reach USD 1.63 billion by 2035, growing at around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of potassium zirconium fluoride is assessed at USD 1.09 billion.

The major factor for market growth during the forecast period is the rising consumption and demand for aluminum. In the recent period, aluminum has been in constant demand from various industries such as automotive, aerospace, construction, and packaging. This factor is estimated to increase the demand for potassium zirconium fluoride as it is an imperative material that is used in the production of aluminum. For instance, it was estimated that global aluminum consumption is projected almost 65 million metric tons in 2021. Furthermore, the total aluminum production from 2021 to 2022 was almost 135,55o thousand metric tonnes of aluminum around the world.

Potassium zirconium fluoride is a crystalline white solid and is marginally soluble in water. Today, potassium zirconium fluoride is a highly effective substance that is used in metal processing, as a catalyst in chemical manufacturing, and for a variety of applications. Moreover, owing to its highly advantageous properties, which include chemical resistance, thermal stability, mechanical strength, and transparency, make potassium zirconium fluoride is a favored commodity in industries such as automobiles, pharmaceuticals, coatings, and others. All these factors are anticipated to couple up to bring lucrative growth opportunities to the market during the forecast period.

Key Potassium Zirconium Fluoride Market Insights Summary:

Regional Highlights:

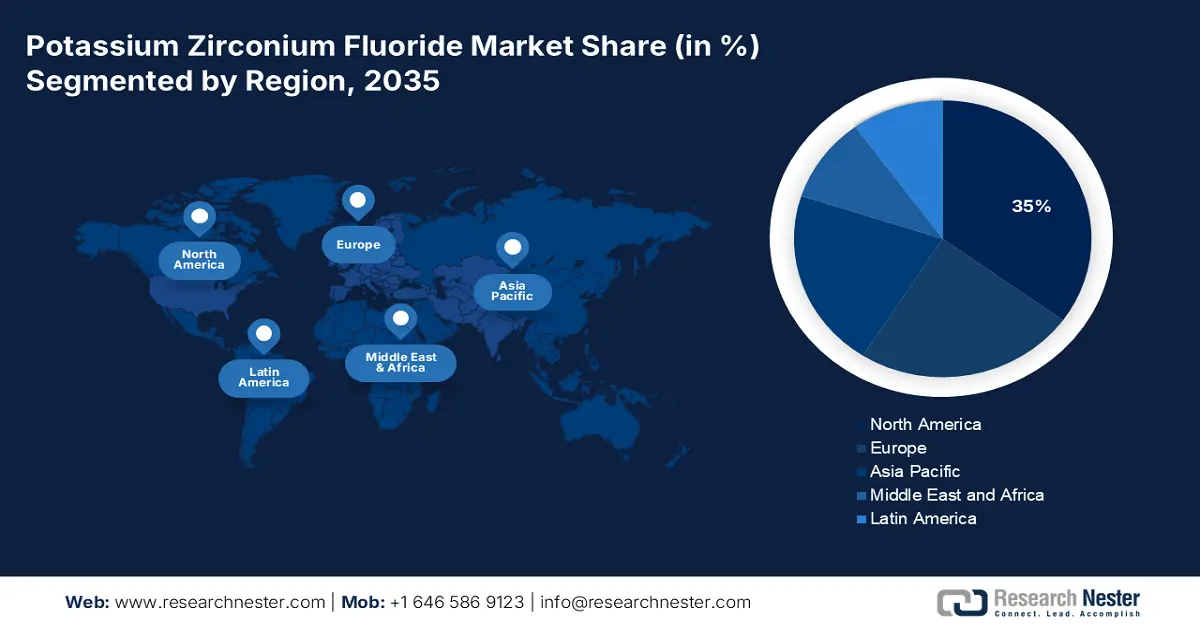

- By 2035, North America is projected to secure a 35% share of the potassium zirconium fluoride market, supported by accelerating construction activities and the expanding use of welding and plating applications.

- Europe is anticipated to capture about 24% share by 2035, underpinned by steady industrial demand and supportive regional manufacturing initiatives.

Segment Insights:

- The plating agent segment is forecasted to account for nearly 38% share by 2035 in the potassium zirconium fluoride market, propelled by its growing use in automotive and aerospace welding applications.

- The construction segment is set to hold around 32% share by 2035, bolstered by robust real estate expansion and rising infrastructure development initiatives.

Key Growth Trends:

- Extensive Growth in the Automotive Industry

- Rapid Growth of the Construction Industry

Major Challenges:

- Increasing Cost of Potassium Zirconium Fluoride

- Long Manufacturing Cycles

Key Players: Ambinter SARL, Alfa Chemistry, Fluorochem Ltd., ArrakisTek Inc., Finetech Industry Limited, Aurora Fine Chemicals LLC, 3B Scientific GmbH, AK Scientific Inc., abcr GmbH.

Global Potassium Zirconium Fluoride Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.05 billion

- 2026 Market Size: USD 1.09 billion

- Projected Market Size: USD 1.63 billion by 2035

- Growth Forecasts: 4.5%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 20 November, 2025

Potassium Zirconium Fluoride Market - Growth Drivers and Challenges

Growth Drivers

- Extensive Growth in the Automotive Industry – Potassium zirconium fluoride is considered to be an imperative component by vehicle manufacturers for producing high-quality vehicles along with electric vehicles and hybrid electric vehicles owing to its advantages such as high tensile strength, increased durability, enhanced conduction, and others. In addition, many parts of vehicles are made with aluminum which is also estimated to increase the utilization rate of potassium zirconium fluoride. Thus, the expansion of the automotive industry is projected to bring lucrative growth opportunities for market growth during the forecast period. Recently, it has been calculated that the global automotive industry manufacturing industry amounted to almost USD 3 trillion by the end of 2021.

- Rapid Growth of the Construction Industry – One of the most common applications of potassium zirconium fluoride is as a flux in the welding and brazing process which is highly beneficial for the construction industry. Thus, with the growing construction industry, the global potassium zirconium fluoride market is also estimated to expand considerably in the upcoming years. For instance, the global construction industry amounted to almost USD 6 trillion in 2020, and it is expected to reach almost USD 14 trillion by 2030.

- Escalation in the Chemical Industry – As per recent statistics, it has been revealed that the revenue generated by the global chemical industry stood at around USD 5 trillion in 2021 which is forecasted to grow during the near future.

- Increased Investment in the Research & Development (R&D) Sector – As per the World Bank, the Research and Development expenditure accounted for 2.63% of total GDP in 2020. This was a rise from 2.13% of the total GDP in 2017.

- The Surge in Demand for Electronics & Electrical Devices - With the growing economies and the penetration of electric manufacturing services (EMS), the demand for electronics and smart devices has considerably grown up. For instance, the sale of mobile phones in 2021 across the globe totaled approximately 1740 million units, accounting for 7800 million mobile people users, or about 20% of the world's population, buying a mobile in that particular year. The recent shift towards introducing technologically advanced electronic products along with the rising investment in the electrical sector has bought significant growth in the electronic industry which is anticipated to increase the demand for potassium zirconium fluoride for the proper functioning of the products.

Challenges

- Increasing Cost of Potassium Zirconium Fluoride – The high cost of potassium zirconium fluoride is propelling the global consumer base to shift towards more cost-efficient alternatives that are available in the market. Also, a high initial investment is required for the manufacturing process of potassium zirconium fluoride which is again estimated to lower the adoption rate among the population with low-income and small businesses. All these factors are projected to couple up to pose a challenge to the growth of the global market during the forecast period.

- Long Manufacturing Cycles

- Requirement of Higher Initial Investment

Potassium Zirconium Fluoride Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 1.05 billion |

|

Forecast Year Market Size (2035) |

USD 1.63 billion |

|

Regional Scope |

|

Potassium Zirconium Fluoride Market Segmentation:

Type Segment Analysis

The global potassium zirconium fluoride market is segmented and analyzed for demand and supply by type into finishing agents, plating agents, intermediates, aluminum, and master alloys. Out of these segments, the plating agent segment is estimated to gain the largest market share of about 38% in the year 2035. Potassium zirconium fluoride salts are mainly used as plating components which have the advantage of high heat concentration during the welding process. Owing to this advantage, potassium zirconium fluoride is being highly used as a plating agent mainly in the automobile and aerospace industries. Also, the rising construction industry is anticipated to bring lucrative growth opportunities for segment expansion as it has a huge number of applications that require plating agents. All these factors couple up to generate favorable opportunities for the growth of the segment during the assessment period.

End-user Segment Analysis

The market is also segmented and analyzed for demand and supply by end-user into construction, automotive, metallurgy, aerospace & aviation, oil & gas, manufacturing, and others. Amongst these segments, the construction segment is expected to garner a significant share of around 32% in the year 2035. The major factor for segment growth during the forecast period is the rapid growth of the real estate sector and the rising favorable initiatives for infrastructure development. As per recent estimates, the revenue generation of real estate companies worldwide stood at approximately USD 10 billion in 2021. Furthermore, the escalation in the number of projects of residential and non-residential buildings along with the rising investments in research and development activities is also estimated to fuel segment growth.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Potassium Zirconium Fluoride Market - Regional Analysis

North American Market Insights

North America industry is likely to hold largest revenue share of 35% by 2035, owing to the rapidly growing construction sector, strong presence of market players in the region. Also, the increasing demand for welding and plating applications is estimated to increase the utilization rate of potassium zirconium fluoride in the region. Along with that, the presence of favorable policies and initiatives by the government and the availability of major key players is also anticipated to create a positive outlook for market growth in the upcoming years.

Europe Market Insights

The European potassium zirconium fluoride market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The market in Asia Pacific is estimated to witness noteworthy growth over the forecast period on the back of the growing technological advancements in the automobile industry, and rising demand for premium-quality welding products in the region. In addition, high manufacturing output, especially in China and India, is also expected to drive market growth in the region in the coming years. In 2020, China’s manufacturing output was about USD 4,000 billion, up from USD 3,700 billion in 2019 and USD 3,600 billion in 2018, respectively.

Further, the market in the European region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The favorable initiatives started by the European government for the introduction of potassium zirconium fluoride for various applications in numerous industries are considered to be one of the major reasons for market growth in the region during the forecast period. In addition to the other factors, the growing industrialization is exhibited by augmenting industrial output as well as increasing investment in the research and development sector backed by expanding technical expertise, resources, and competitive edge of the existing electronic manufacturing company in the region.

Potassium Zirconium Fluoride Market Players:

- Ambinter SARL

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alfa Chemistry

- Fluorochem Ltd.

- ArrakisTek Inc.

- Finetech Industry Limited

- Aurora Fine Chemicals LLC

- 3B Scientific GmbH

- AK Scientific Inc.

- abcr GmbH

Recent Developments

- abcr GmbH has announced the inauguration of the service lab in Brushsal, Germany. This new lab is estimated to bring new possibilities for the company to grow its portfolio by aiding the synthesis of new products and for research and development activities in the field of material science, life science, and others.

- 3B Scientific GmbH has introduced the new 3B Smart Anatomy app for its anatomy models. These new features are expected to transform anatomy lessons by offering the virtual twin of every 3B Scientific anatomy model on any device.

- Report ID: 4011

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Potassium Zirconium Fluoride Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.