Potassium Sorbate Market Outlook:

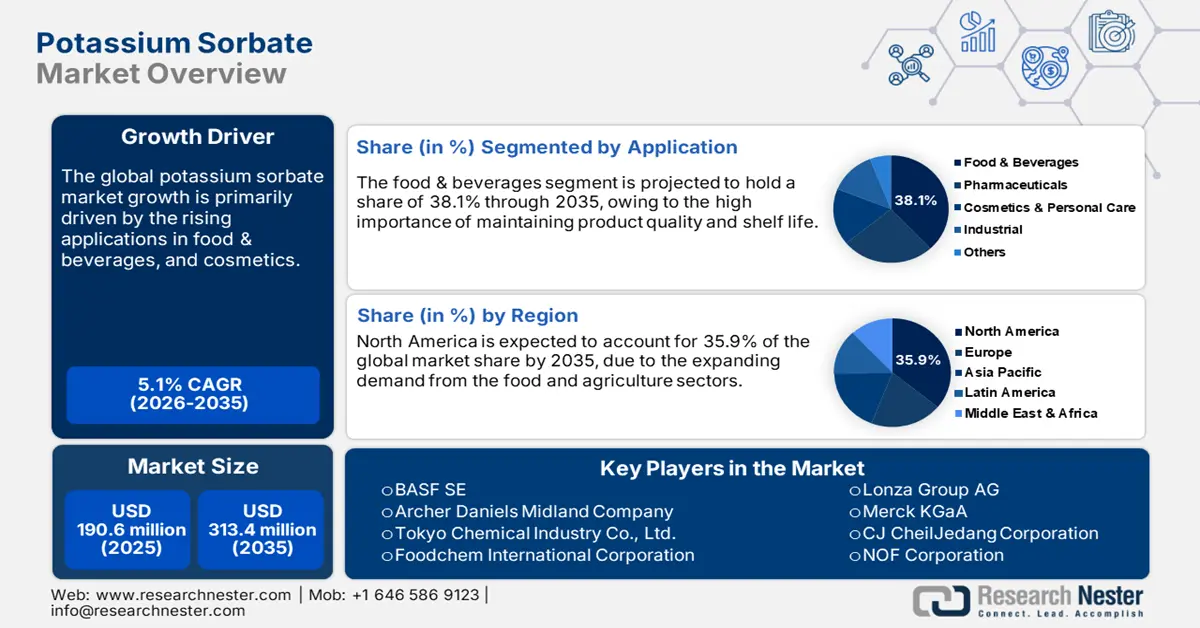

Potassium Sorbate Market size was USD 190.6 million in 2025 and is estimated to reach USD 313.4 million by the end of 2035, expanding at a CAGR of 5.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of potassium sorbate is estimated at USD 200.3 million.

The expanding cosmetics and personal care trade is expected to fuel the consumption of potassium sorbate. The creams, lotions, shampoos, and makeup products are often incorporated with potassium sorbate to increase their shelf life. The Federal Reserve Bank of St. Louis discloses that the consumer price index for personal care products in the U.S. totaled 179.777 in July 2025. This indicates that a robust demand for beauty and personal care products is propelling the potassium sorbate trade. The Environmental Working Group states that the use of personal care products in men has doubled, owing to increasing awareness of skin health. Consumers are also shifting toward paraben-free and milder preservative systems, which is likely to accelerate the consumption of potassium sorbate as it fits well into this demand profile. Further, the direct-to-consumer (DTC) boom in skincare startups is anticipated to amplify the sales of potassium sorbate in the years ahead.

|

Personal care product use at a glance |

|||

|

|

Average adult 2023 |

Women 2023 |

Men 2023 |

|

Number used every day |

12 |

13 |

11 |

|

Unique ingredients |

112 |

114 |

105 |

Source: Environmental Working Group

Key Potassium Sorbate Market Insights Summary:

Regional Highlights:

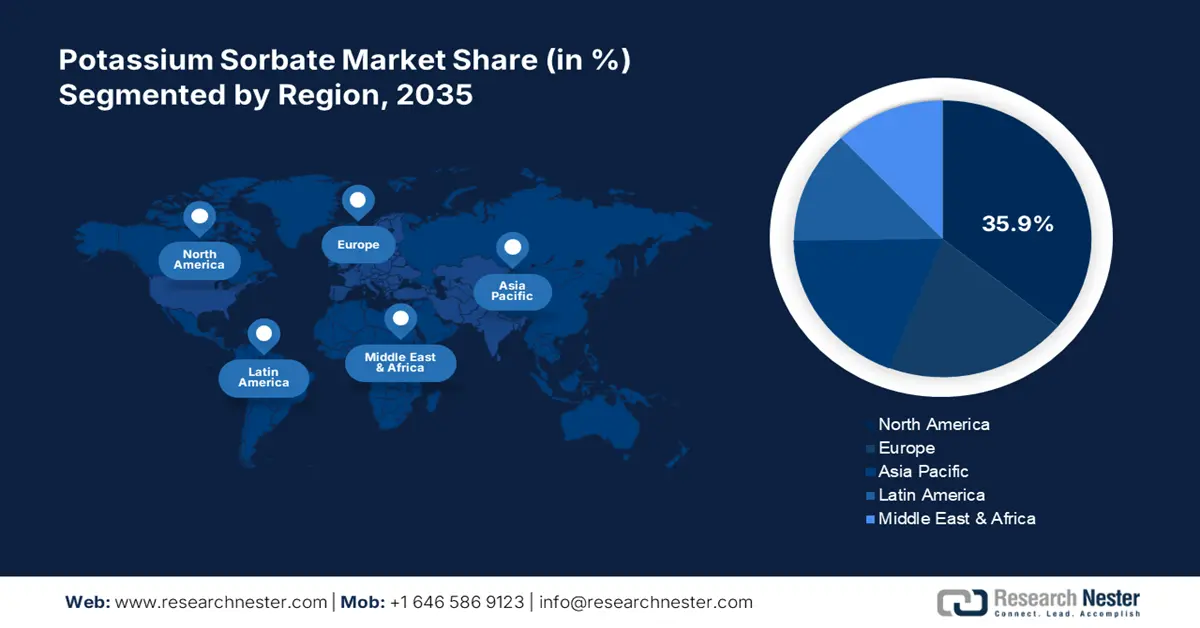

- North America is projected to secure a 35.9% share through 2035 in the potassium sorbate market, supported by the food and beverage industry's strong demand for preservatives.

- Asia Pacific is expected to register the fastest CAGR from 2026–2035, driven by rapid urbanization and higher demand for packaged and convenience foods.

Segment Insights:

- Powder segment is projected to capture 51.2% share by 2035 in the potassium sorbate market, propelled by its versatility and ease of handling.

- Food and beverage segment is anticipated to hold a 38.1% share by 2035, fueled by the critical need to maintain product quality and shelf life.

Key Growth Trends:

- Green chemistry production methods

- Rising demand for functional foods and nutraceuticals

Major Challenges:

- Competition from natural preservatives

- Price volatility of raw materials

Key Players: ADM (Archer Daniels Midland Company), Tokyo Chemical Industry Co. Ltd., Foodchem International Corporation, Lonza Group AG, Merck KGaA, CJ CheilJedang Corporation, NOF Corporation, Shandong Fuyu Chemical Co. Ltd., Nacalai Tesque Inc., Zhejiang Huitong Chemical Co. Ltd., Ashland Global Holdings Inc., Maruzen Chemicals Co. Ltd., Ajinomoto Co. Inc., Gujarat Alkalies.

Global Potassium Sorbate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 190.6 million

- 2026 Market Size: USD 200.3 million

- Projected Market Size: USD 313.4 million by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 22 September, 2025

Potassium Sorbate Market - Growth Drivers and Challenges

Growth Drivers

- Green chemistry production methods: The rise of green chemistry is expected to lead to new ways of making potassium sorbate. Consumers and regulations are pushing high demand for sustainable products, so major companies are investing in advanced technologies to make their products more environmentally friendly. They are also lowering their carbon emissions by using bio-based materials or renewable energy in production. The eco-labeling and certifications are further estimated to boost their market position and expand their profit margins in the years ahead.

- Rising demand for functional foods and nutraceuticals: The surge in fortified and probiotic-rich food products is estimated to fuel the demand for effective preservatives, including potassium sorbate. The boom in consumption of kombucha, plant-based drinks, and dietary supplements is directly propelling the sales of potassium sorbate. The report by IFT discloses that the U.S. sales of functional foods and beverages totaled USD 92.1 billion in 2023. Thus, the growing functional food and nutraceuticals trends are expected to drive the overall market growth during the study period.

- Increasing application in agriculture: The agriculture sector is driving the sales of potassium sorbate, owing to its high importance in post-harvest preservation. To avoid crop waste from mold and yeast, farmers are increasingly using agriculture-grade potassium sorbate. The propelling agricultural practices are set to double the profits of agriculture-grade potassium sorbate manufacturers in the years ahead. The Food and Agriculture Organization (FAO) reports that in 2023, the world produced nearly 9.9 billion tons of primary crops. This indicates that increasing cultivation and modern farming practices are likely to boost the demand for potassium sorbate during the forecast period.

Challenges

- Competition from natural preservatives: The natural preservatives are emerging as the major competitors for potassium sorbate, due to the swift shift toward clean-label and organic trends. The growing demand for minimally processed foods from fitness enthusiasts is likely to limit the consumption of potassium sorbate. Overall, natural alternatives are likely to limit the profit margins of potassium sorbate manufacturers in the years ahead.

- Price volatility of raw materials: The supply chain of raw materials often leads to price volatility, hampering the production and commercialization of potassium sorbate. Most of the sorbic acid capacity is concentrated in Asia Pacific, which increases the global dependency on imports, leading to tariff challenges. Thus, raw material volatility impacts profitability and leads to long-term planning.

Potassium Sorbate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 190.6 million |

|

Forecast Year Market Size (2035) |

USD 313.4 million |

|

Regional Scope |

|

Potassium Sorbate Market Segmentation:

Form Segment Analysis

The powder segment is expected to capture 51.2% of the global potassium sorbate market share through 2035. The versatility and ease of handling characteristics are accelerating the production and commercialization of powder potassium sorbate. The food & beverage and cosmetics & personal care sectors highly consume the powdered form of potassium sorbate. This form is also easier to transport and store compared to other counterparts. Overall, potassium sorbate’s multiple characteristics are mainly contributing to its sales growth.

Application Segment Analysis

The food and beverage segment is anticipated to hold 38.1% of the global potassium sorbate market share by 2035, owing to the high importance of maintaining product quality and shelf life. The F&B companies mainly utilize potassium sorbate in baked goods, soft drinks, dairy products, fruit juices, and processed foods due to its effectiveness against bacteria and molds. The Federal Reserve Bank of St. Louis discloses that the global producer price index for food and beverages stood at 136.09596 in the second quarter of 2025. The expanding food demand and consistently evolving consumers' needs are set to drive the consumption of potassium sorbate in the years ahead.

Grade Segment Analysis

The food-grade potassium sorbate is estimated to account for the leading market share throughout the forecast period. The primary reason for boosting the consumption of food-grade potassium sorbate is the high need for safe preservatives in food and beverage products. The strict government regulations and increasing demand for processed foods are accelerating the sales of food-grade potassium sorbate. This grade type is most preferred by F&B manufacturers as it helps them to meet the rising production requirements for clean-label, minimally processed, and fortified foods.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Form |

|

|

Application |

|

|

Grade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Potassium Sorbate Market - Regional Analysis

North America Market Insights

The North America potassium sorbate market is projected to capture 35.9% of the global revenue share through 2035, primarily driven by the food and beverage industry. The growing demand for packaged and convenience foods and ready-to-eat meals is also contributing to the increasing sales of potassium sorbate. The e-commerce growth and changing consumer lifestyles are propelling a high demand for beauty & personal care products, which subsequently is fueling the consumption of potassium sorbate.

The U.S. potassium sorbate market is expected to be driven by the well-established food and beverage industry. The increasing demand for cosmetics and nutraceuticals is accelerating the procurement and commercialization of potassium sorbate. The Federal Reserve Bank of St. Louis reveals that the consumer price index for cosmetics, perfume, bath, nail preparations, and implements stood at 190.717 in July 2025. Thus, the high trade of beauty products is directly propelling the potassium sorbate sales.

Europe Market Insights

The Europe potassium sorbate market is estimated to hold the second-largest global revenue share throughout the study period. The high production of bakery products and ready-to-eat meals is promoting the consumption of potassium sorbate. The strict food safety standards are driving innovations in the EU market. Consumer trends toward clean-label and minimally processed foods are also contributing to the increasing sales of potassium sorbate. Furthermore, Germany, France, and the U.K. are some of the key markets for potassium sorbate companies.

The sales of potassium sorbate in Germany are expected to be driven by the increasing adoption of modern agriculture practices and robust trade of bakery and processed food products. The RESET Organization discloses that each household in the country consumes about 56 kilograms of bread and baked goods every year. Further, the GRAS-equivalent recognition and compatibility with clean-label initiatives are set to propel the application of potassium sorbate in minimally processed products.

APAC Market Insights

The Asia Pacific potassium sorbate market is estimated to increase at the fastest CAGR from 2026 to 2035. Rapid urbanization, coupled with increasing demand for packaged and convenience foods, is likely to propel the sales of potassium sorbate. The robust industrial expansion is also expected to drive the consumption of potassium sorbate. The increasing e-commerce trade of beauty and personal care products is further set to double the profits of potassium sorbate companies in the years ahead.

The India potassium sorbate market is expected to register a healthy growth through 2035, owing to the robust rise in demand for processed food and beverages. The India Brand Equity Foundation (IBEF) estimates that the food processing market is projected to reach USD 700 billion by 2030. The changing dietary habits are pushing demand for packaged bakery items and ready-to-eat meals, creating a lucrative environment for potassium sorbate companies.

Key Potassium Sorbate Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ADM (Archer Daniels Midland Company)

- Tokyo Chemical Industry Co., Ltd.

- Foodchem International Corporation

- Lonza Group AG

- Merck KGaA

- CJ CheilJedang Corporation

- NOF Corporation

- Shandong Fuyu Chemical Co., Ltd.

- Nacalai Tesque, Inc.

- Zhejiang Huitong Chemical Co., Ltd.

- Ashland Global Holdings Inc.

- Maruzen Chemicals Co., Ltd.

- Ajinomoto Co., Inc.

- Gujarat Alkalies and Chemicals Ltd.

The potassium sorbate market is led by big companies with strong research and distribution networks. These companies are boosting their revenue shares through introducing new technologies, partnering with others, merging with businesses, and expanding into new regions. They are also teaming up to create new products and reach to wider customer base. Expansion in emerging markets is expected to double their profits.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2024, ADM, a top company in the potassium sorbate market, received the 2024 Sustainability Leadership Award from the Business Intelligence Group. This award highlights their efforts in promoting sustainable practices.

- In June 2023, Mitsui & Co., Ltd. signed a strategic agreement with Celanese Corporation, a major U.S. chemical company, to acquire a 70% share in Nutrinova Netherlands B.V., a Celanese subsidiary that produces and commercializes ingredients for functional foods. This development positively influences the potassium sorbate market growth.

- Report ID: 5052

- Published Date: Sep 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Potassium Sorbate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.