Portable Gas Detection Equipment Market Outlook:

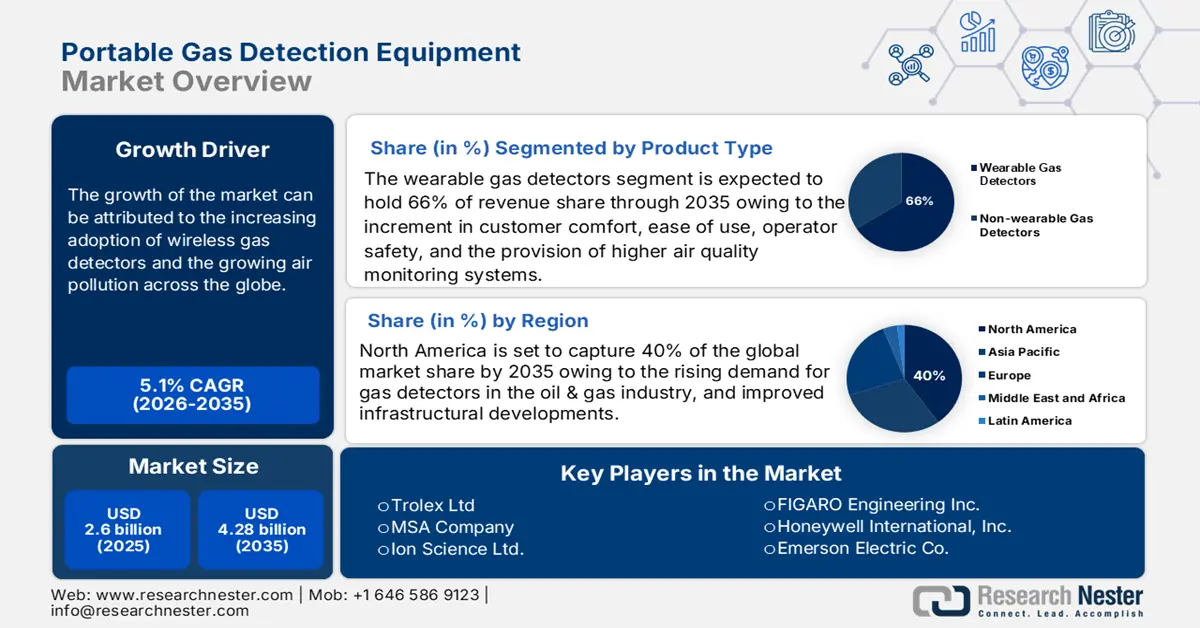

Portable Gas Detection Equipment Market size was valued at USD 2.6 billion in 2025 and is expected to reach USD 4.28 billion by 2035, registering around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of portable gas detection equipment is evaluated at USD 2.72 billion.

The growth of the portable gas detection equipment market can be attributed to the rising usage of the equipment in safely transporting LPG gas. In case of any leak, the portable sensor detects and alerts the user in less than 5 minutes. Additionally, global governments are setting targets to curb the emission of greenhouse and including strict regulations to handle the rate of emission. According to the United Nations, greenhouse emissions need to be reduced by 45% by 2030 and achieve net 0 by 2050. The portable gas detection is ideal for detecting gases such as methane and carbon dioxide. These types of equipment successfully determine the concentration and absorb specific wavelengths.

Key Portable Gas Detection Equipment Market Insights Summary:

Regional Highlights:

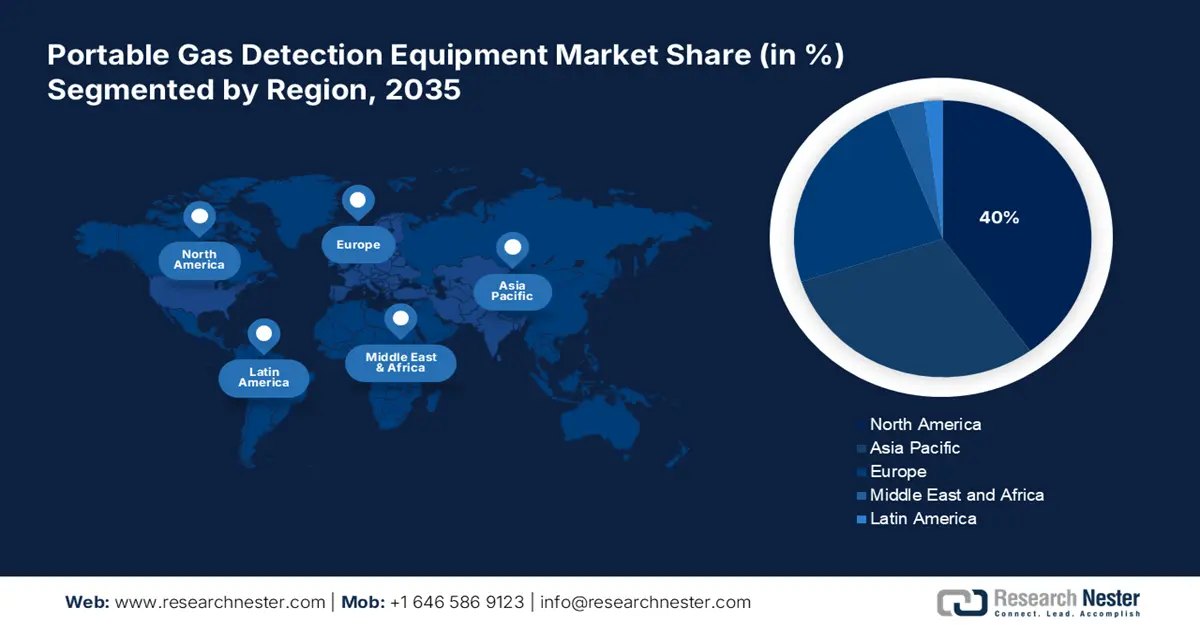

- North America portable gas detection equipment market will hold around 40% share by 2035, driven by rising shale gas production and gas detector demand.

- Asia Pacific market will achieve the fastest growth from 2026 to 2035, attributed to rising natural gas demand and industrial safety focus.

Segment Insights:

- The oil & gas (end-user) segment in the portable gas detection equipment market is expected to hold a significant share by 2035, influenced by the deployment of safety systems to prevent gas leaks in high-risk environments.

- The wearable gas detectors segment in the portable gas detection equipment market will command the largest share, driven by rising emphasis on air quality monitoring and user safety, 2026-2035.

Key Growth Trends:

- Growing air pollution across the globe

- Rising incidences of gas leakage

Major Challenges:

- High cost of portable gas detection equipment and sensors

- Reduced investment due to low-profit margins

Key Players: Honeywell International, Inc., Siemens Aktiengesellschaft, MSA Company, Drägerwerk AG & Co. KGaA, Ion Science Ltd., Emerson Electric Co., Thermo Fisher Scientific Inc, Halma plc, Trolex Ltd, FIGARO Engineering Inc.

Global Portable Gas Detection Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.6 billion

- 2026 Market Size: USD 2.72 billion

- Projected Market Size: USD 4.28 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Portable Gas Detection Equipment Market Growth Drivers and Challenges:

Growth Drivers

-

Growing air pollution across the globe: According to the United Nations International Children’s Emergency Fund, air pollution was the second leading risk factor for death among children under 5 in 2021. Various countries are using gas detection systems to measure and display the presence of gases in the air. Gas detection equipment is extremely useful in monitoring air quality and is installed in vehicles, factories, and mines.

-

Rising incidences of gas leakage: According to the U.S. PIRG Education Fund a gas pipeline incident occurs in the U.S. almost every 40 hours. It has been estimated there are more than half a million leaks in local gas distribution systems in the country. Additionally, the International Energy Agency (IEA) estimates that more than 260 billion cubic meters of gas was wasted globally in 2021 due to venting, flaring, and leaking. Governments are using practices to curb these incidents. Hence, the demand for the installation of gas detection equipment is estimated to spike.

Challenges

-

High cost of portable gas detection equipment and sensors: Portable gas detection equipment is quite expensive to install and the middle-class population is projected to find it difficult to install this equipment in their households. Additionally, most people are not aware of the equipment leading to less purchase of the device.

-

Reduced investment due to low-profit margins: It has been estimated that there are low-profit margins are obtained by the portable gas detection equipment market players. This leads to lesser investments from the market players. Also, there are stringent regulations related to the distribution of the equipment.

Portable Gas Detection Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 2.6 billion |

|

Forecast Year Market Size (2035) |

USD 4.28 billion |

|

Regional Scope |

|

Portable Gas Detection Equipment Market Segmentation:

Type Segment Analysis

The wearable gas detectors segment is estimated to gain the largest portable gas detection equipment market share by 2035, attributed to the rise in customer comfort, ease of use, operator safety, and the provision of higher air quality monitoring systems. Wearable gas detectors are used to prevent the emission of hazardous gases from vehicles that can cause severe respiratory diseases in the global population. For instance, according to Carbon Brief in 2020, 12.3 billion of carbon dioxide was emitted. The mixing of these pollutants in the air has become a global issue and governments of various nations along with organizations are working in this field to curb these emissions.

End-user Segment Analysis

The oil & gas segment in portable gas detection equipment market is expected to garner a significant share by 2035. Portable gas detection equipment is installed in oil & gas mills and mines to prevent accidents that can endanger the lives of workers and people living in nearby areas. According to ACS Publications, it has been estimated that 630,000 leaks in the U.S. mains.

Our in-depth analysis of the global portable gas detection equipment market includes the following segments:

|

Product Type |

|

|

Technology |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Gas Detection Equipment Market Regional Analysis:

North America Market Insights

The North America portable gas detection equipment market is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed to the rising demand for gas detectors in the oil & gas industry and improved infrastructural developments in the region. The market in the U.S. is expected to be the largest on the back of the higher production rate of shale gas, along with technological advancements in the extraction process. According to the U.S. Energy Information Administration, in 2023, 37.87 trillion cubic feet of total U.S. dry natural gas production was from shale gas.

Asia Pacific Market Insights

The Asia-Pacific region is projected to emerge as the fastest-growing portable gas detection equipment market by obtaining a revenue share during the assessed period. The growth of the market can be ascribed to the increasing adoption of natural gas led by India and China, where the gas extraction process benefits from strong policy support. According to the Gas Exporting Countries Forum, the natural gas demand in Asia Pacific is anticipated to reach 1,590 billion cubic meters by 2050. Additionally, the industrial sector in these countries is the main source of demand which is aspiring to double the consumption of gases to reduce their import dependence.

In India, there are rising efforts to curb the cases of gas leakage. It has been estimated that in 2023, gas leak incidents rose to 30. Portable gas detection equipment is proven to be an efficient tool to prevent such incidents. Additionally, the Middle East & Africa region is projected to witness moderate market growth owing to the adoption of wireless gas detectors in the mining and oil exploration industry as countermeasures required for a safer workplace.

Portable Gas Detection Equipment Market Players:

- Honeywell International, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Aktiengesellschaft

- MSA Company

- Drägerwerk AG & Co. KGaA

- Ion Science Ltd.

- Emerson Electric Co.

- Thermo Fisher Scientific Inc

- Halma plc

- Trolex Ltd

- FIGARO Engineering Inc.

The competitive landscape of portable gas detection equipment is rapidly evolving as established key players, automotive giants, and new entrants are investing in ensuring safety in industrial, commercial and residential areas. Key players in the portable gas detection equipment market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In October 2024, Teledyne Gas and Flame Detection announced its plans to make new proprietary Teledyne GDCloud available with the company’s GS700, GS500, and Ship surveyor portable gas leak detectors. The cloud connectivity remarkably enhances the gas leak detection process by visualizing all instrument data and converting it into actionable business insight.

- In September 2020, Riken Keiki Co., Ltd announced the launch of SD-3 Series gas detectors with signal converters. There has been surging demand from sophisticated petrochemical plants and other plant facilities for high-performance multi-function gas detectors. The company has developed SD-3 Series new gas detectors with signal converters incorporating global standards.

- Report ID: 4136

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.