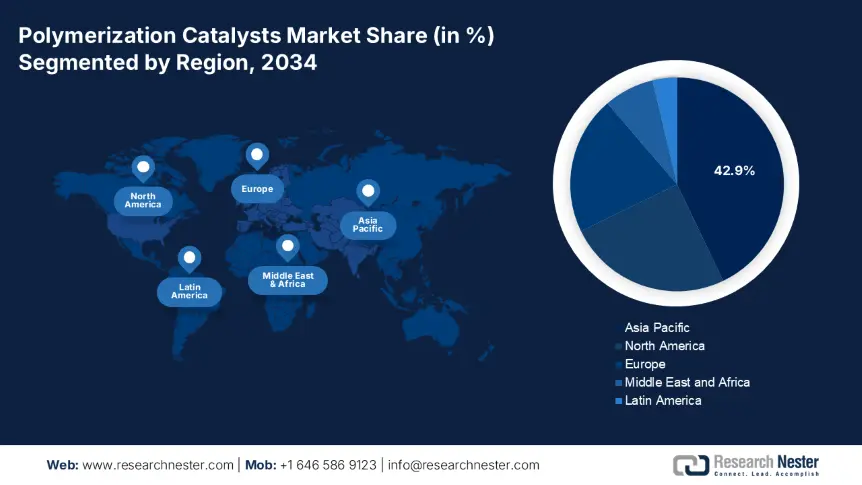

Polymerization Catalysts Market - Regional Analysis

Asia Pacific Market Insights

By 2034, the Asia Pacific market is expected to hold 42.9% of the polymerization catalysts market share and grow from about USD 3.6 B in 2025 to USD 7.3 B in 2034, at a CAGR of around 7.7%, propelled by the region's rapid industrialization, urbanization, and infrastructure growth of leading industrial hubs. China and India are key players, benefitting from national initiatives tied to industrial development and increasing polymer production. The exceptional growth in advanced catalyst technologies and evolving environmental legislation also fuels demand for production. In addition, new uses for a plethora of lightweight materials in the automotive and packaging sectors also contribute to growing polymer usage. Manufacturers have been aggressively investing in R&D in APAC, since surrounding favorable government investment policies and strong domestic markets.

China is likely to represent a big portion of APAC growth, due to large-scale polymer and chemical companies and production. National industrial policies and general low-cost production will certainly support further catalyst adoption in the packaging, automotive, and construction industries. The capacity expansion of catalysts, including large increases in facilities such as new plants publicly announced by BASF for Canada, will support physical volume growth. As advanced formulations continue to be developed, and governments and customers pursue environmental compliance support for more modern polymerization reactors, demand will continue to grow for polymerization catalysts. Further positive demand is expected as China is pursuing sustainable manufacturing and providing production for export of polymers, which represents a critical return into the projected growth in APAC.

Country-wise Insights of Polymerization Catalysts (Sectoral Demand)

|

Country |

Packaging Demand |

Automotive Demand |

Construction Demand |

Key Drivers |

|

Japan |

+6 % annual polymer use |

Lightweight materials +8 % pa |

Industrial foams rising |

Emission norms, EV growth |

|

China |

38 % of PLA market share |

Automotive polymer use +8 % |

Catalyst-driven infrastructure |

Packaging dominance; catalyst plant expansions |

|

India |

polymer use alt. packaging |

Auto sector expansion |

Infrastructure construction |

Make-in-India, urban migration |

|

Indonesia |

~31 % packaging growth |

Rising domestic auto fleet |

Housing, infrastructure build |

Urbanization, foreign FDI |

|

Malaysia |

Packaging growth steady |

Auto components production |

Construction polymer demand |

Petrochemical investments, sustainable packaging |

|

Australia |

Bioplastics uptake +7 % |

Lightweight composites |

Foams & sealants demand |

Environmental regulation |

|

South Korea |

Advanced packaging tech |

Automotive polymer use +8 % |

Infrastructure polymer use |

EV push, export‐oriented industries |

|

Rest of APAC |

5–11 % poly growth |

Polymer composites growth |

Construction material demand |

Industrialization across SEA |

(Source: epa.gov)

North America Market Insights

The North American market is expected to hold 24.9% of the polymerization catalysts market share due to increasing polymer demand driven by automotive applications and packaging applications. The North America polymerization catalysts market values are expected to grow to approximately USD 2.87 billion by 2034, with a projected CAGR of about 4.6% over the period. Factors supporting this growth include added polypropylene and polyethylene production capacity, especially in the U.S. Gulf Coast area. Also, the region's concerted effort on developing advanced catalyst technologies for sustainability and recyclability will continue to enhance market opportunities across the end-use industry spectrum.

The U.S. polymerization catalysts market is projected to reach USD 2.15 billion in 2034, with an estimated CAGR of 4.5% from 2025-2034. The increase of polyethylene and polypropylene production, especially in Texas and Louisiana, is anticipated to boost polymerization catalyst consumption due to additional expansion in polypropylene and polyethylene production capacity. Sustained investment in ethane cracker development, coupled with metallocene catalyst adoption, which enhances polymer performance properties, will continue to fuel expectations for catalyst consumption growth. The continued increase in demand for high-performance polymers across packaging, consumer goods and automotive will continue to lubricate catalyst usage growth.

Europe Market Insights

The European market is expected to hold 20.9% of the polymerization catalysts market share due to increased production of polypropylene and polyethylene. Polymers catalysts market is projected to reach around USD 1.49 billion by 2034, fueled by automotive light-weighting initiatives, recycled polymer consumption, and rules around emissions. Further, consumption of Ziegler-Natta and metallocene catalysts is expected to grow significantly owing to aggressive capacity expansions in France, Italy, and Spain in both polypropylene and polyethylene facilities within the region.

Country-Level Statistics for Automotive & Packaging Sectors

|

Country |

Automotive Demand (%) |

Packaging Demand (%) |

|

U.K. |

33.6% |

46.8% |

|

Germany |

39.3% |

42.9% |

|

France |

28.0% |

49.6% |

|

Italy |

24.5% |

51.4% |

|

Spain |

22.9% |

54.2% |

|

Russia |

18.7% |

58.8% |

|

Nordic |

29.6% |

47.5% |

|

Rest of Europe |

25.2% |

50.9% |

(Source: epa.gov)