Polybutylene Succinate Market Outlook:

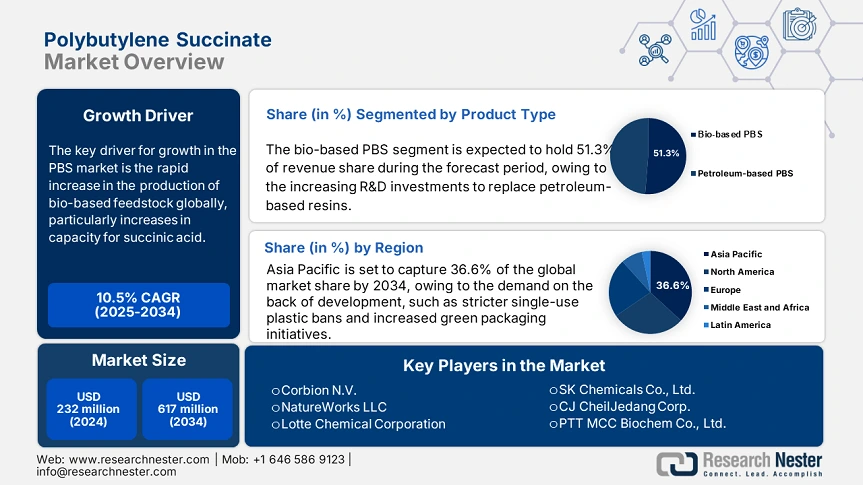

Polybutylene Succinate Market size was valued at USD 232 million in 2024 and is projected to reach at USD 617 million by the end of 2034, rising at a CAGR of 10.5% during the forecast period, from, 2025 to 2034. In 2025, the Industry size of polybutylene succinate is estimated at USD 257 million.

The key driver for growth in the market is the rapid increase in the production of bio-based feedstock globally, particularly increases in capacity for succinic acid. Government data shows that global capacity for biodegradable bioplastics, including PBS, increased nearly 50% from 2017-2021, supported by public funding and incentives for the manufacture of sustainable resin. For instance, in China, the Academy of Sciences committed an initial RMB 101 million (~USD 14 million) for research and development of PBS manufacturing facilities, showcasing a clear government commitment to scale-up. This increased supply of bio-succinic acid enables many of the PBS industry the ability to lower costs and scale up polymerization capacity.

In the raw-material supply chain, succinic acid and 1,4-butanediol are made by petrochemical and bio-based producers, with government stakeholders in Asia and the U.S. entering to add capacity to the plants. Some manufacturers in China and South Korea have put assembly lines online with capacities for PBS of 11-21 ktpa. The outlook for exported U.S. biodegradable resins forecasts GDP growth for the entire sector to reach USD 751 million by 2025, and substantial growth in trading volumes the much more. Tracking the U.S. flat PPI for final demand of less than 1 percent (+- 0.3%) for June 2025 indicates there are little price moves on anyway for industrial resins. RDD investments referenced earlier with China's RMB 101 million funding commitment remain front and center for investment for scaling via pilot plants and commercial lines.