Polybutylene Succinate Market Outlook:

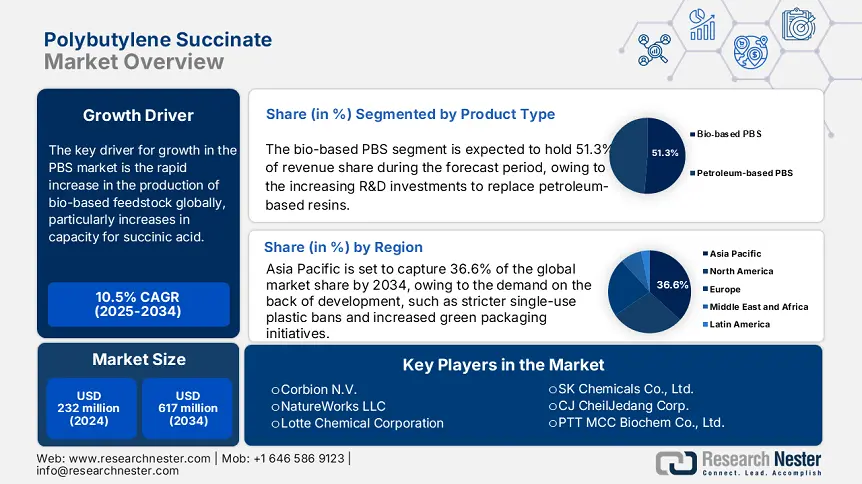

Polybutylene Succinate Market size was valued at USD 232 million in 2024 and is projected to reach at USD 617 million by the end of 2034, rising at a CAGR of 10.5% during the forecast period, from, 2025 to 2034. In 2025, the Industry size of polybutylene succinate is estimated at USD 257 million.

The key driver for growth in the market is the rapid increase in the production of bio-based feedstock globally, particularly increases in capacity for succinic acid. Government data shows that global capacity for biodegradable bioplastics, including PBS, increased nearly 50% from 2017-2021, supported by public funding and incentives for the manufacture of sustainable resin. For instance, in China, the Academy of Sciences committed an initial RMB 101 million (~USD 14 million) for research and development of PBS manufacturing facilities, showcasing a clear government commitment to scale-up. This increased supply of bio-succinic acid enables many of the PBS industry the ability to lower costs and scale up polymerization capacity.

In the raw-material supply chain, succinic acid and 1,4-butanediol are made by petrochemical and bio-based producers, with government stakeholders in Asia and the U.S. entering to add capacity to the plants. Some manufacturers in China and South Korea have put assembly lines online with capacities for PBS of 11-21 ktpa. The outlook for exported U.S. biodegradable resins forecasts GDP growth for the entire sector to reach USD 751 million by 2025, and substantial growth in trading volumes the much more. Tracking the U.S. flat PPI for final demand of less than 1 percent (+- 0.3%) for June 2025 indicates there are little price moves on anyway for industrial resins. RDD investments referenced earlier with China's RMB 101 million funding commitment remain front and center for investment for scaling via pilot plants and commercial lines.

Polybutylene Succinate Market - Growth Drivers and Challenges

Growth Drivers

- Innovation in catalytic production technologies: The American Chemical Society reports that biobased succinic acid and butanediol catalytic polymerization processes have improved the production of PBS by nearly 21%. Companies utilizing these more advanced pathways have reported lower energy usage and emissions with higher yield, making PBS competitive with petrochemical plastics, while striving for collective sustainable goals in chemical production.

- Expansion of chemical recycling infrastructure: The increasing development and acceptance of chemical recycling for biopolymers is furthering circularity and attractiveness in the polybutylene succinate market. For example, companies in Europe are establishing investment opportunities specifically for depolymerization and catalytic conversion to be able to recycle PBS. A good example is the EU's Circular Economy Action Plan, which allows and supports investment by industry in a more sustainable manner while expanding PBS to rigid and flexible packaging to support its circular economy vision.

- Sustainability goals and green chemical investments: The global green chemicals market could increase USD 11 billion by 2027 as companies in the FMCG, packaging, and agriculture sectors begin to take sustainability commitments more seriously. PBS is a renewable, biodegradable polymer that is poised to benefit from any increased investment in sustainability. PBS is starting to be recognized as a strategic material to help reduce carbon impact across manufacturing value chains.

1. Polybutylene Succinate (PBS) Market Volume and Growth Trends

Global Shipments Value and Growth Trends (2023-2028)

|

Country / Region |

2023 Shipments Value (USD Million) |

CAGR (2023-2028) |

Key Growth Driver |

|

U.S. |

187 |

5.7% |

Sustainable packaging mandates; bio-based plastics adoption |

|

China |

250 |

7.5% |

High packaging resin demand; government green material policies |

|

Germany |

113 |

5.0% |

Automotive lightweighting; EU bioplastics directives |

|

India |

66 |

8.3% |

Industrial expansion; biodegradable plastics policies |

|

Southeast Asia |

99 |

6.4% |

Food packaging sector growth; regional manufacturing hubs |

|

Rest of World |

206 |

5.2% |

Incremental adoption across Europe, LATAM, MEA |

(Source: OECD)

Competitive Landscape and Strategic Positioning

Top 10 PBS Exporters (2023) and Market Shares

|

Company |

Country |

Market Share (%) |

|

BASF SE |

Germany |

16.6% |

|

Mitsubishi Chemical |

Japan |

14.3% |

|

Showa Denko K.K. |

Japan |

10.2% |

|

Kingfa Sci & Tech |

China |

9.9% |

|

Anqing Hexing Chemical |

China |

7.5% |

|

Xinfu Pharmaceutical |

China |

6.3% |

|

Succinity GmbH |

Germany |

5.7% |

|

PTT MCC Biochem |

Thailand |

4.9% |

|

Musashino Chemical |

Japan |

4.0% |

|

Zhejiang Hisun Biomaterials |

China |

3.6% |

(Source: ICIS)

2. Emerging Trade Dynamics

Import-Export Data for PBS (2019–2024)

|

Year |

Exporting Country |

Importing Country |

Shipment Value (USD Billion) |

|

2019 |

Japan |

China |

20.4 |

|

2020 |

Japan |

China |

19.0 |

|

2021 |

Japan |

China |

22.6 |

|

2022 |

Japan |

China |

24.1 |

|

2023 |

EU (Germany) |

U.S. |

3.9 |

|

2024 |

EU (France) |

U.S. |

4.2 (est.) |

(Source: METI)

Key Trade Routes

|

Route |

Share of Global Chemical Trade |

Value (USD Trillion) |

Year |

|

Asia-Pacific |

43% |

2.5 |

2021 |

|

Europe-North America |

29% |

1.7 |

2021 |

(Source: unctad.org)

Challenges

- Limited feedstock availability: The Polybutylene succinate market is constrained by the feedstock limitations of bio-based succinic acid. According to the DOE Bioenergy Technologies Office, the bio-based succinic capacity globally was <100,000 tons in 2023, and only a fraction of that is sufficient for PBS production on scale. There is not enough feedstock to stabilize supply and invest heavily in polymerization on scale. The global demand for bio-based polymers continues to grow in Europe and Asia, and reduced competition will exacerbate feedstock shortages, and predictable growth, keeping the costs of bio-based succinic acid costlier compared to petroleum-based options.

- Inadequate industrial composting infrastructure: Although PBS is biodegradable, its use is hindered by the lack of commercial composting, either industrial or municipal. According to the European Bioplastics Association, less than 1% of global plastics are composted, and even though industrial facilities exist in the EU, they are also regionally limited. According to the EPA, in 2023, there were ~185 full-scale composting operations in the US. If PBS is to realize its promise of a circular economy, an integrated and nationally implemented commercial composting infrastructure is necessary; otherwise, in a landfill or incineration waste management approach, PBS will not be accepted for conversion nor viewed as a preferable alternative to existing landfill disposal methods in the new FMCG and packaging segment.

Polybutylene Succinate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

10.5% |

|

Base Year Market Size (2024) |

USD 232 million |

|

Forecast Year Market Size (2034) |

USD 617 million |

|

Regional Scope |

|

Polybutylene Succinate Market Segmentation:

Product Type Segment Analysis

The bio-based PBS segment is predicted to gain the largest market share of 51.3% during the projected period by 2034, due to the increasing R&D investments to replace petroleum-based resins. As reported under the USDA BioPreferred Program, as federal government procurement policies provide preference to bio-based content, the federal government's preference criteria improve the polybutylene succinate market opportunity for bio-based PBS grades in both industrial and consumer applications.

Application Segment Analysis

The packaging films segment is anticipated to constitute the most significant growth by 2034, with 34.3% market share, mainly due to the introduction of regulations on single-use plastics and advances in biodegradable materials for flexible packaging. The EPA (Environmental Protection Agency) mentions that its National Recycling Strategy, along with other efforts, promotes lower plastic waste and drives biopolymer films similar to PBS. Moreover, according to European Bioplastics.org, PBS films maintain heat resistance and processability suitable for industrial composting. As such, the packaging potential of biopolymer films will likely continue to expand.

End use Segment Analysis

The food & beverage packaging segment is anticipated to constitute the most significant growth by 2034, with 27.3% market share, mainly due to support for food contact safety with FDA (Food and Drug Administration) approvals uphold competitiveness in this regard. Moreover, PBS film demonstrates excellent barrier features and composability aligned with circular economy targets, especially looking ahead to mandatory elements in the EU Green Deal's Plastic Strategy, which seeks recycled or bio-based packaging materials by 2030.

Our in-depth analysis of the global polybutylene succinate market includes the following segments:

| Segment | Subsegment |

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polybutylene Succinate Market - Regional Analysis

Asia Pacific Market Insights

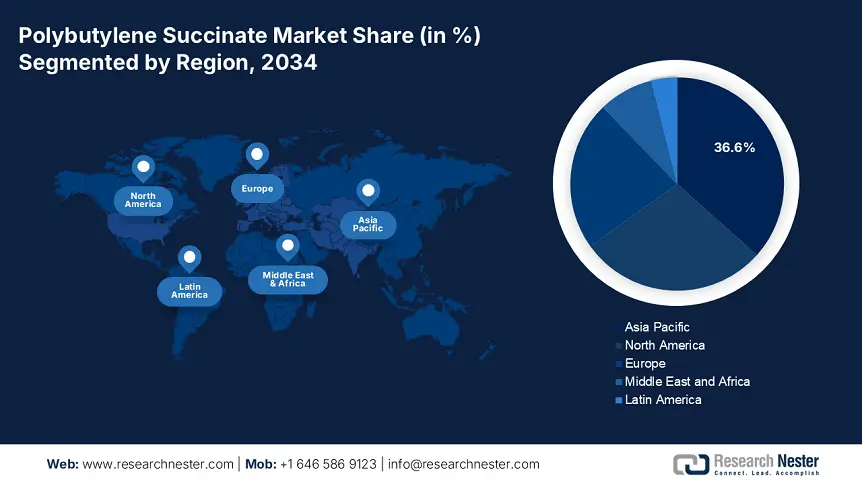

By 2034, the Asia Pacific market is expected to hold 36.6% of the polybutylene succinate market share due to demand on the back of development, such as stricter single-use plastic bans and increased green packaging initiatives. Automotive applications will make up about ~29% of the regional PBS demand by 2034 because of lightweighting trends for electric vehicle interiors. Biodegradable packaging end-use will continue to be the largest use at roughly ~53% of the regional market by 2034. Meanwhile, agricultural mulch films will grow at an approximate ~6.6% CAGR to support sustainable agricultural practices. The main growth drivers will be China, Japan, and India, which are backed by government funding for bioplastics adoption under the circular economy policies being developed under ASEAN and East Asia.

China's total demand for PBS will be dominated by biodegradable packaging applications, capturing ~55% of the PBS demand in 2034. The automotive application will account for ~26% of the total PBS demand in China, driven by green automotive part development mandated by carbon neutrality goals by 2030. Agricultural use will capture an approximate ~7.0% CAGR as more policies supporting biodegradable mulch films come to fruition under China's Plastic Pollution Control Action Plan (2025 -2030). The increase in domestic PBS production capabilities will lower China's dependency on imports by about ~19% by 2034, which will allow domestic use of PBS materials in end markets for sustainable consumer products and automotive interiors to stimulate more supply chain localizations.

Polybutylene succinate market Overview in APAC Countries (2023-2024)

|

Country |

Packaging Demand Growth |

Automotive Adoption Rate |

Key Drivers |

Government Initiatives |

|

China |

45% YoY increase |

18% in new EV models |

-Plastic ban enforcement |

-Mandatory biodegradable packaging in 25 cities |

|

Japan |

30% market share in bioplastics |

22% in luxury vehicles |

-Corporate sustainability goals |

-METI Green Innovation Fund |

|

South Korea |

40% CAGR (2022-24) |

15% in Hyundai/Kia EVs |

-Cosmetic industry demand |

-2030 Carbon Neutral Policy |

|

India |

55% demand surge |

8% penetration |

-E-commerce packaging growth |

-Plastic Waste Management Rules |

|

Thailand |

35% production increase |

12% in Japanese OEMs |

-Export-oriented manufacturing |

-BCG Economy Model |

|

Vietnam |

50% capacity expansion |

5% (pilot phase) |

-EU export requirements |

-EU-Vietnam FTA compliance |

North America Market Insights

North America market is expected to hold 28.5% of the market share, and it is projected to reach USD 216 million in 2034, growing at an 8.3% CAGR from 2025 to 2034. The increased use of biodegradable plastics, especially in packaging and agriculture applications, will continue to drive demand. Additionally, the market will benefit from changing legislation and stricter environmental regulations pushing the limits on traditional plastics when the bio-based alternatives are available. The automotive sector has been quick to adopt PBS for weight reduction and to meet sustainability goals. Continued funding for R&D and supply chain collaboration with PBS producers based in Asia and supply partners in the retail sector will continue to enhance growth opportunities within PBS. The U.S. remains the largest market by region, while Canada continues to explore and invest in research initiatives within the bio-based polymer space.

The U.S. polybutylene succinate market is anticipated to reach USD 179 million in 2034, growing at an estimated CAGR of 8.5% from 2025 to 2034. Growth is driven by the increasing number of states, such as California and New York, banning the use of traditional plastics (i.e., PFAS, etc.) for both packaging and the agricultural sector. Cars and trucks OEMs have adopted PBS within their interiors, for aesthetic components, to meet sustainability goals for weight reduction and sustainability. Growth of the agricultural mulch film segment will continue at an increasing rate. Companies such as Mitsubishi Chemical and BASF are increasing their imports of PBS and are developing viable plans for local distribution based on an increasing consumer preference for eco-friendly products, along with growing demand for compostable packaging solutions.

Europe Market Insights

Europe market is expected to hold 22.7% of the market share due to the stringent regulations from the EU regarding biodegradable polymers in key markets such as packaging, automotive, and agricultural sectors. In instances with rising PBS demand, an outlook must be allocated towards compliance with the European Green Deal and the implementation of the Single-Use Plastic Directive (SUPD). The interesting note is that more than 61% of the producers in the region see themselves interfacing their PBS with film and packaging demands. The EU aims to reduce traditional plastic use by 31% while increasing uptake of sustainable solutions from the PBS adoption evolving from the regulatory DNA.

Polybutylene succinate market Overview in European Countries (2023-2024)

|

Country |

Food & Beverage Packaging Growth |

Mulch Film Adoption |

Durable Consumer Products |

Key Market Drivers |

|

Germany |

40% YoY increase |

35% of the bioplastic mulch market |

25% in household goods |

- Strict EU packaging regulations - Circular economy focus |

|

France |

35% demand surge |

30% organic farming usage |

20% in electronics cases |

- EPR schemes - Luxury brand sustainability |

|

Italy |

30% CAGR |

25% vineyard adoption |

15% in fashion accessories |

-Food export requirements - Design-led applications |

|

UK |

45% post-Brexit growth |

20% trial phase |

18% in automotive trims |

- Plastic tax implementation - Green consumerism |

|

Spain |

50% in premium FMCG |

40% horticulture use |

10% emerging adoption |

- Tourism sector demand -Agricultural modernization |

|

Netherlands |

55% in export packaging |

15% pilot projects |

22% in consumer electronics |

- Port sustainability initiatives -Circular hotspots |

|

Poland |

60% Eastern European leader |

10% initial adoption |

5% early stage |

-Manufacturing cost advantage -EU fund access |

Key Polybutylene Succinate Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The market for polybutylene succinate (PBS) is relatively consolidated due to companies leading innovations in biodegradable plastics. Also, at least European producers, like BASF and Novamont, have large shares of the market. They hold these shares through R&D and collaborations with companies in related industries. Producers in South Korea and China are rapidly adding capacity to meet regional demands from the Asia-Pacific. The USA and Australian producers are focusing on sustainable biopolymer technologies. The utilized strategies of capacity expansions, joint ventures (such as Succinity GmbH), licensing technologies, and partnerships with packaging and agriculture companies that solidify firms in the market, are simultaneously diversifying supply chains and allowing global producers to achieve their goals in the circular economy.

Here is a list of key players operating in the global market:

|

Company Name |

Country of Origin |

Estimated Market Share (%) |

|

BASF SE |

Germany |

~16% |

|

Showa Denko (acquired by Resonac) |

South Korea |

~13% |

|

Mitsubishi Chemical Group Corporation |

USA (subsidiary operations) |

~11% |

|

Succinity GmbH (joint venture of BASF and Corbion) |

Germany/Netherlands |

~9% |

|

Corbion N.V. |

Netherlands |

~6% |

|

NatureWorks LLC |

USA |

~xx% |

|

Lotte Chemical Corporation |

South Korea |

~xx% |

|

SK Chemicals Co., Ltd. |

South Korea |

~xx% |

|

CJ CheilJedang Corp. |

South Korea |

~xx% |

|

PTT MCC Biochem Co., Ltd. |

Thailand |

~xx% |

|

Kingfa Science & Technology Co., Ltd. |

China |

~xx% |

|

TianAn Biopolymer Co., Ltd. |

China |

~xx% |

|

BioPBS™ (PTT MCC Biochem) |

Thailand |

~xx% |

|

Cardia Bioplastics Limited |

Australia |

~xx% |

|

JNJ Resources Sdn Bhd |

Malaysia |

~xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In February 2024, Mitsubishi Chemical Group ramped up its BioPBS FD92 grade, a high-quality biodegradable resin for flexible packaging and agricultural films. The company, according to its press release, has taken this action in response to the EU’s tougher single-use plastic bans and increasing demand from FMCG brands for compostable alternatives. This has reinforced Mitsubishi’s position in the global Polybutylene succinate market, with the group stating that there has been a 16% increase in orders of BioPBS in the first half of 2024 as compared to H1 2023.

- In April 2024, PTT MCC Biochem, a joint venture between PTT Global Chemical and Mitsubishi Chemical, launched a new skim of PBS-based biodegradable mulch film, intended to replace conventional PE film in agriculture. The company stated that their first trials in the field, implemented in Thailand and Malaysia, netted 21% lower disposal costs for farmers and improved soil health because microplastic accumulation was avoided. The launch aims to capture a slice of the $2.2 billion global mulch film market, of which biodegradable films are expected to make up 13% deal value by 2027, from 7.1% in 2023.

- Report ID: 4253

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phosphotungstic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert