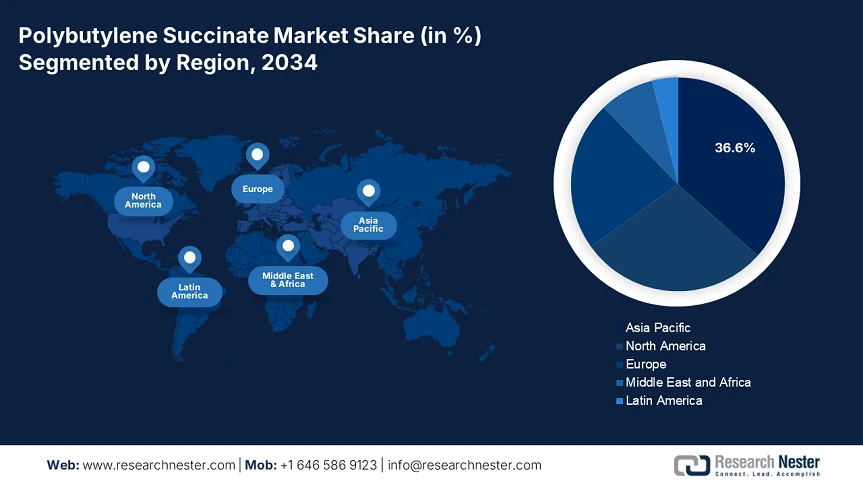

Polybutylene Succinate Market - Regional Analysis

Asia Pacific Market Insights

By 2034, the Asia Pacific market is expected to hold 36.6% of the polybutylene succinate market share due to demand on the back of development, such as stricter single-use plastic bans and increased green packaging initiatives. Automotive applications will make up about ~29% of the regional PBS demand by 2034 because of lightweighting trends for electric vehicle interiors. Biodegradable packaging end-use will continue to be the largest use at roughly ~53% of the regional market by 2034. Meanwhile, agricultural mulch films will grow at an approximate ~6.6% CAGR to support sustainable agricultural practices. The main growth drivers will be China, Japan, and India, which are backed by government funding for bioplastics adoption under the circular economy policies being developed under ASEAN and East Asia.

China's total demand for PBS will be dominated by biodegradable packaging applications, capturing ~55% of the PBS demand in 2034. The automotive application will account for ~26% of the total PBS demand in China, driven by green automotive part development mandated by carbon neutrality goals by 2030. Agricultural use will capture an approximate ~7.0% CAGR as more policies supporting biodegradable mulch films come to fruition under China's Plastic Pollution Control Action Plan (2025 -2030). The increase in domestic PBS production capabilities will lower China's dependency on imports by about ~19% by 2034, which will allow domestic use of PBS materials in end markets for sustainable consumer products and automotive interiors to stimulate more supply chain localizations.

Polybutylene succinate market Overview in APAC Countries (2023-2024)

|

Country |

Packaging Demand Growth |

Automotive Adoption Rate |

Key Drivers |

Government Initiatives |

|

China |

45% YoY increase |

18% in new EV models |

-Plastic ban enforcement |

-Mandatory biodegradable packaging in 25 cities |

|

Japan |

30% market share in bioplastics |

22% in luxury vehicles |

-Corporate sustainability goals |

-METI Green Innovation Fund |

|

South Korea |

40% CAGR (2022-24) |

15% in Hyundai/Kia EVs |

-Cosmetic industry demand |

-2030 Carbon Neutral Policy |

|

India |

55% demand surge |

8% penetration |

-E-commerce packaging growth |

-Plastic Waste Management Rules |

|

Thailand |

35% production increase |

12% in Japanese OEMs |

-Export-oriented manufacturing |

-BCG Economy Model |

|

Vietnam |

50% capacity expansion |

5% (pilot phase) |

-EU export requirements |

-EU-Vietnam FTA compliance |

North America Market Insights

North America market is expected to hold 28.5% of the market share, and it is projected to reach USD 216 million in 2034, growing at an 8.3% CAGR from 2025 to 2034. The increased use of biodegradable plastics, especially in packaging and agriculture applications, will continue to drive demand. Additionally, the market will benefit from changing legislation and stricter environmental regulations pushing the limits on traditional plastics when the bio-based alternatives are available. The automotive sector has been quick to adopt PBS for weight reduction and to meet sustainability goals. Continued funding for R&D and supply chain collaboration with PBS producers based in Asia and supply partners in the retail sector will continue to enhance growth opportunities within PBS. The U.S. remains the largest market by region, while Canada continues to explore and invest in research initiatives within the bio-based polymer space.

The U.S. polybutylene succinate market is anticipated to reach USD 179 million in 2034, growing at an estimated CAGR of 8.5% from 2025 to 2034. Growth is driven by the increasing number of states, such as California and New York, banning the use of traditional plastics (i.e., PFAS, etc.) for both packaging and the agricultural sector. Cars and trucks OEMs have adopted PBS within their interiors, for aesthetic components, to meet sustainability goals for weight reduction and sustainability. Growth of the agricultural mulch film segment will continue at an increasing rate. Companies such as Mitsubishi Chemical and BASF are increasing their imports of PBS and are developing viable plans for local distribution based on an increasing consumer preference for eco-friendly products, along with growing demand for compostable packaging solutions.

Europe Market Insights

Europe market is expected to hold 22.7% of the market share due to the stringent regulations from the EU regarding biodegradable polymers in key markets such as packaging, automotive, and agricultural sectors. In instances with rising PBS demand, an outlook must be allocated towards compliance with the European Green Deal and the implementation of the Single-Use Plastic Directive (SUPD). The interesting note is that more than 61% of the producers in the region see themselves interfacing their PBS with film and packaging demands. The EU aims to reduce traditional plastic use by 31% while increasing uptake of sustainable solutions from the PBS adoption evolving from the regulatory DNA.

Polybutylene succinate market Overview in European Countries (2023-2024)

|

Country |

Food & Beverage Packaging Growth |

Mulch Film Adoption |

Durable Consumer Products |

Key Market Drivers |

|

Germany |

40% YoY increase |

35% of the bioplastic mulch market |

25% in household goods |

- Strict EU packaging regulations - Circular economy focus |

|

France |

35% demand surge |

30% organic farming usage |

20% in electronics cases |

- EPR schemes - Luxury brand sustainability |

|

Italy |

30% CAGR |

25% vineyard adoption |

15% in fashion accessories |

-Food export requirements - Design-led applications |

|

UK |

45% post-Brexit growth |

20% trial phase |

18% in automotive trims |

- Plastic tax implementation - Green consumerism |

|

Spain |

50% in premium FMCG |

40% horticulture use |

10% emerging adoption |

- Tourism sector demand -Agricultural modernization |

|

Netherlands |

55% in export packaging |

15% pilot projects |

22% in consumer electronics |

- Port sustainability initiatives -Circular hotspots |

|

Poland |

60% Eastern European leader |

10% initial adoption |

5% early stage |

-Manufacturing cost advantage -EU fund access |