Polyacrylate Rubber Market Outlook:

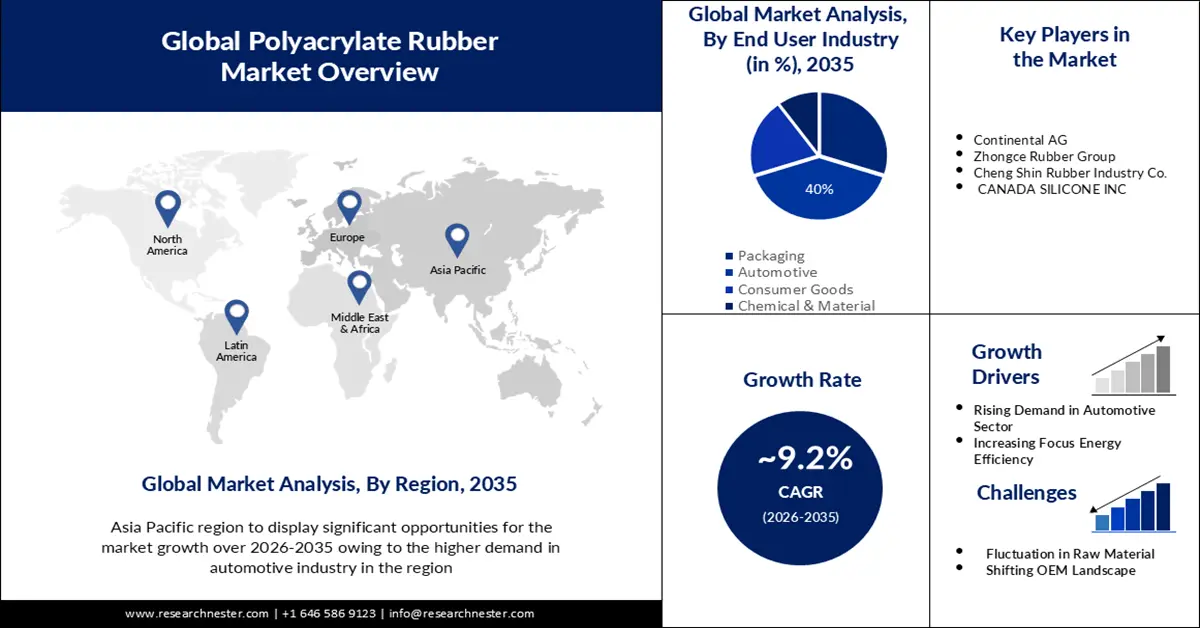

Polyacrylate Rubber Market size was over USD 9.09 billion in 2025 and is poised to exceed USD 21.92 billion by 2035, growing at over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyacrylate rubber is estimated at USD 9.84 billion.

The global market is primarily driven by the growth of the automotive industry and increasing demand for automobiles due to lifestyle changes. This acrylic rubber is primarily used in the automotive industry to add strength to seals and packages. The growing need for oil-resistant materials has also led to the introduction of these rubbers in vehicle seals. In 2022, global car sales increased to approximately 67.2 million cars, up from about 66.7 million in 2021.

Industrialization in several sectors for diverse uses has led to an increase in demand for rubber. As the world's urban population grows, rubber consumption is exploding. In the automotive industry, most of the artificial rubber is used. Its use in electronic devices and components for various devices and industries is also increasing.

Key Polyacrylate Rubber Market Insights Summary:

Regional Highlights:

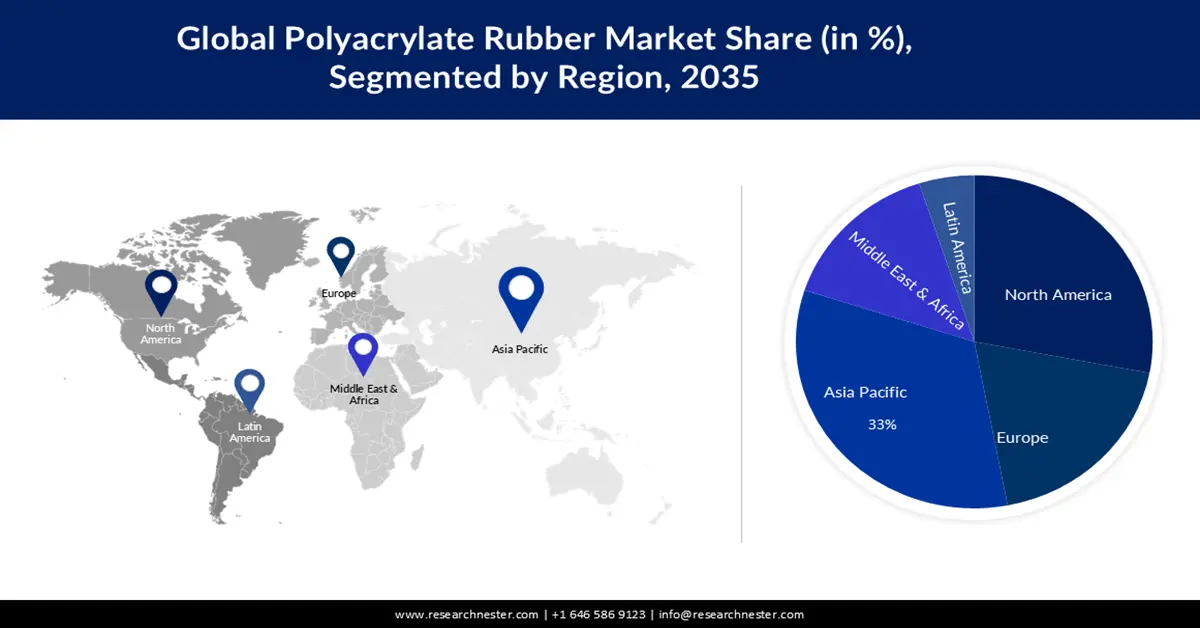

- The Asia Pacific region in the polyacrylate rubber market is anticipated to secure a 33% revenue share by 2035, with its expansion underpinned by the accelerating growth of the regional automotive industry owing to favorable FDI-driven production gains.

- The North America region is projected to witness notable growth during 2026–2035, supported by escalating demand for sealing and packaging materials across diverse end-use sectors encouraged by rapid uptake in automotive, textiles, and coatings applications.

Segment Insights:

- The automotive segment in the polyacrylate rubber market is projected to capture a 40% share by 2035, supported by the rapid transformation of the automotive landscape impelled by technological advances and new R&D initiatives.

- The ethyl acrylate segment is expected to command a 40% revenue share during 2026–2035, fueled by the rising preference for its superior heat, oxygen, and ozone resistance across multiple industrial applications.

Key Growth Trends:

- Rising Demand in End User Industries

- Focus on Energy Efficiency

Major Challenges:

- Shifting OEM Landscape

- Limited Market Awareness

Key Players: Continental AG, Zhongce Rubber Group, Cheng Shin Rubber Industry Co., CANADA SILICONE INC., Lummus Technology, Specialty Tapes Manufacturing, REDCO, Sreeji Trading Company.

Global Polyacrylate Rubber Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.09 billion

- 2026 Market Size: USD 9.84 billion

- Projected Market Size: USD 21.92 billion by 2035

- Growth Forecasts: 9.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Vietnam, Indonesia

Last updated on : 27 November, 2025

Polyacrylate Rubber Market - Growth Drivers and Challenges

Growth Factors

- Rising Demand in End User Industries - Industrialization has increased the demand for rubber in various industries and for various purposes. With the increase in population, the demand for rubber has increased tremendously. Artificial rubber is mainly used in the automotive field. Due to population growth, infrastructure, and construction activities are also increasing. Other areas are also seeing an increase in electronic devices and sealants across a variety of industries. As a result of industrialization for various uses in different industries, the consumption of rubber has increased. As urban populations around the world increase, rubber consumption is rapidly increasing. Its use in electronic devices and components for various devices and industries is also increasing.

- Focus on Energy Efficiency - The demand for energy-efficient vehicles and machinery is on the rise, promoting the use of polyacrylate rubber for reducing frictional losses and improving overall efficiency.

Challenges

- Shifting OEM Landscape - As OEMs look to develop alternative powertrain technologies, suppliers will provide an increasing portion of value-added content per vehicle. Additionally, OEMs need to ensure that their suppliers' production sites, especially in emerging markets, meet future market requirements and their own production plans.

- Fluctuating Raw Material Prices is Set to Hinder the Polyacrylate Rubber Market Growth in the Upcoming Period

- Limited Market Awareness is Poised to Hamper the Market Expansion During the Projected Period

Polyacrylate Rubber Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 9.09 billion |

|

Forecast Year Market Size (2035) |

USD 21.92 billion |

|

Regional Scope |

|

Polyacrylate Rubber Market Segmentation:

End Use Industries Segment Analysis

Based on end user industries, the automotive segment is set to dominate the polyacrylate rubber market registering a growth of 40% by the end of 2035. Technological advances and new research and development initiatives are transforming the automotive industry. According to the World Automobile Manufacturers Association, automakers around the world spent more than USD 125 billion on research and development in 2018. Consumers around the world are divided on the benefits of improved vehicle connectivity, with Indian and Chinese consumers twice as likely to embrace the idea as German consumers. Around 80% of Indians believe that improved connectivity in vehicles would be beneficial. The global automotive sector has recovered as industrial activities resumed after being temporarily shut down due to the coronavirus disease (COVID-19). Therefore, the prosperity of the automotive industry is likely to propel the growth of the market.

Source Segment Analysis

In terms of sources, the ethyl acrylate segment in the polyacrylate rubber market is anticipated to hold the largest revenue share of 40% during the time period between 2026-2035. This growth is primarily due to the increasing demand for rubber in various applications such as coatings, textiles, seals, adhesives, plastics, engine oils lubricants, and piping. Due to its excellent properties such as good heat resistance, oxygen resistance, and ozone resistance, ethyl acrylate rubber is increasingly preferred over other types of rubber.

Our in-depth analysis of the global polyacrylate rubber market includes the following segments:

|

Source |

|

|

Application |

|

|

End Use Industries |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyacrylate Rubber Market - Regional Analysis

APAC Market Insights

The Asia Pacific industry is anticipated to hold largest revenue share of 33% by 2035. The growth of this market can be attributed on account of expansion in the automotive industry in this region. According to the China Automobile Association, car production increased by 30% in 2018, and the number of new passenger car registrations increased by 23.14 million units. This growth is due to FDI policies that have favored China's automobile industry and attracted many established foreign brands to invest in the automobile industry. Major factors such as economic growth and continued high infrastructure spending are driving sales of heavy-duty trucks and commercial vehicles in the APAC region. This had a positive impact on the Asia Pacific polyacrylate rubber market. This also affected demand and supply chains, limiting growth in 2020.

North American Market Insights

The polyacrylate rubber market in the North America region is expected to grow significantly during the period between 2026-2035. The North America region is considered one of the key markets for polyacrylate rubber due to the increasing demand for materials for sealing and packaging applications in various end-use industries. The US polyacrylate rubber market is expected to offer significant opportunities due to strong growth in industries such as automotive, textiles, and paints and coatings due to its many applications in textiles, adhesives, and coatings. Increasing demand for industrial packaging and sealing applications is also another factor driving the growth of the North American market.

Polyacrylate Rubber Market Players:

- Dupont

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jet Rubber Inc.

- Continental AG

- Zhongce Rubber Group

- Cheng Shin Rubber Industry Co.

- CANADA SILICONE INC.

- Lummus Technology

- Specialty Tapes Manufacturing

- REDCO

- Sreeji Trading Company

Here is a list of key players operating in the global market:

Recent Developments

- Trinseo acquired the assets of Latex Binder and its Rheinmünster location in Germany. This acquisition will accelerate growth through an expanded product portfolio in adhesives and architectural applications.

- Lummus Technology, a global provider of process technology and value-based energy solutions, has signed an agreement with Air Liquide Engineering to license and commercialize its ester-grade acrylic acid technology and light and heavy acrylate process technology. They announced that it has signed a contract with And Construction. This addition expands Lummus' portfolio of propylene production and derivative products, offering customers more choice between upstream and downstream operations.

- Report ID: 5601

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyacrylate Rubber Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.