Plasma Fractionation Market Outlook:

Plasma Fractionation Market size was over USD 36.95 Billion in 2025 and is poised to exceed USD 80.51 Billion by 2035, growing at over 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plasma fractionation is estimated at USD 39.64 Billion.

The growth of the market is primarily attributed to the rising prevalence of bleeding disorders that occur when there is an issue that opposes the body’s blood clotting procedure. Based on the U. S. Centers for Disease Control estimates, there are nearly 3 million people nationwide, who have been suffering from bleeding disorders.

Immunoglobulins are derived from the fractionation of plasma and are very effective in treating various neurologic, immunologic, and hematologic diseases. Hence, the increasing prevalence of immunological diseases among the population is anticipated to increase the need for immunoglobulins & alpha-1-antitrypsin in numerous areas of medicine. In addition to that, the increased focus on characterizing and diagnosing immunodeficiency is also expected to generate a high demand for plasma fractionation in the next few years owing to the high number of diagnosed patients. Further, another major factor expected to contribute to the growth of the market is the surge in plasma collection centers across the globe. For instance, a pioneer in the creation of plasma-derived medicines, Grifols has opened its 300th plasma donation site in the United States, the second in New England and the first in the state of Massachusetts.

Key Plasma Fractionation Market Insights Summary:

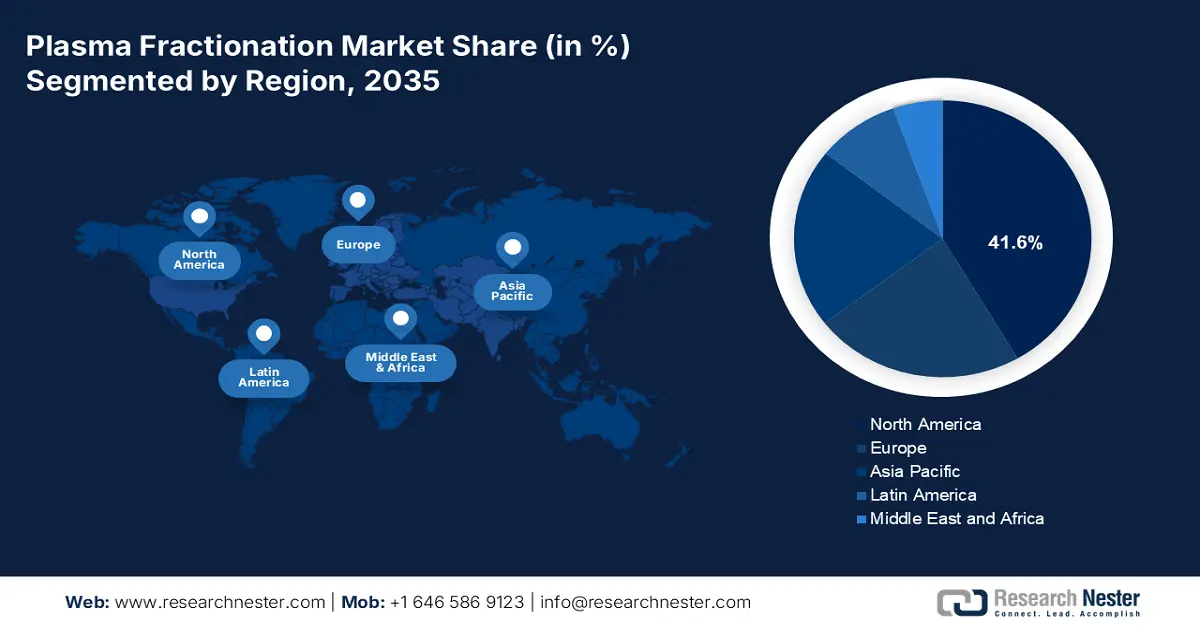

Regional Highlights:

- North America plasma fractionation market will hold over 41.6% share by 2035, fueled by a high number of hemophilic patients and rising prevalence of other chronic diseases.

- Europe market will capture a significant revenue share by 2035, attributed to rising cases of immunodeficiency and bleeding disorders, along with increased plasma collection facilities and favorable regulations.

Segment Insights:

- The neurology segment in the plasma fractionation market is expected to achieve the largest share by 2035, driven by rising neurological disorders and increased research into IVIG applications.

- The hospitals segment in the plasma fractionation market is anticipated to hold the highest market share by 2035, driven by increased use of plasma-derived therapies and growing hospital infrastructure.

Key Growth Trends:

- Proliferation in the Number of Chronic Diseases

- Growing Geriatric Population

Major Challenges:

- High Cost Related to Plasma Therapy

- Increasing the Use of Recombinant Alternatives

Key Players: CSL Limited, Grifols, S.A., Takeda Pharmaceutical Company Limited, Kedrion S.p.A, Octapharma AG, Bio Products Laboratory Ltd., Biotest AG, LFB Group, Japan Blood Products Organization, Intas Pharmaceuticals Ltd.

Global Plasma Fractionation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.95 Billion

- 2026 Market Size: USD 39.64 Billion

- Projected Market Size: USD 80.51 Billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Plasma Fractionation Market Growth Drivers and Challenges:

Growth Drivers

- Proliferation in the Number of Chronic Diseases –There have been growing cases of chronic disease, which has increased the demand for its treatments. Among various treatments, plasma therapy is the most extensively used treatment. Hence, the plasma fractionation market is expected to grow further over the forecast period. For instance, the most common and expensive medical illnesses in the US are chronic diseases. About 133 million Americans, or roughly 45% of the population, have at least one chronic illness, and the number is rising.

- Growing Geriatric Population – Old people have a weakened immune system and are prone to both chronic and acute diseases. Thus, for effective diagnostic and treatment procedures plasma fractionation has become imperative which is projected to create a positive outlook by the end of the forecast period. According to the World Health Organization figures, by 2030, one in every six persons on the planet would be 60 or older.

- Increased Investment by Major Players in Effective Treatment – For instance, CSL Behring & Takeda Pharmaceutical Company Ltd. collaborated with Biotest, BPL, LFB, and Octapharma to develop an effective plasma-derived drug for the treatment of COVID-19.

- Increasing Autoimmune Diseases - According to current estimates, the number of autoimmune disease cases worldwide is increasing between 3% to approximately 10% yearly.

- Unhealthy Lifestyle Involving Consumption of Alcohol, Tobacco, and Fast Food – The recent shift of the population towards an unhealthy lifestyle has made the human body weak and with a low resistance to fight diseases and illnesses. As a result, for the diagnosing and treatment of these disorders, the demand for products from plasma fractionation is forecasted to increase in the upcoming years. According to the Centers for Disease Control and Prevention, 25.1% of adults aged 18 and over in the world are reported to have at least one day of heavy drinking (five or more drinks for males and four or more drinks for women) during the previous year.

Challenges

- High-Cost Related to Plasma Therapy - Plasma therapy is usually an expensive one, as it proves to be a lifesaver in severe cases where the patient has suffered trauma, burn, or severe kind of liver disorder and is in dire need of plasma. The recent scenario of the pandemic has also seen the great importance of plasma therapy such as convalescent plasma therapy, in the treatment of severe patients with Covid-19. For instance, it was observed in a clinical study that convalescent plasma was capable of substantially lower down the 28-day mortality and mechanical ventilation time of severe or critical COVID-19 patients. However, when plasma therapy is not given on time, usually when the symptoms are moderate, the cost is expected to increase, hence hindering the growth of the plasma fractionation market.

- Increasing the Use of Recombinant Alternatives

- Restricted Medical Reimbursement Policies

Plasma Fractionation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 36.95 Billion |

|

Forecast Year Market Size (2035) |

USD 80.51 Billion |

|

Regional Scope |

|

Plasma Fractionation Market Segmentation:

Application Segment Analysis

The global plasma fractionation market is segmented and analyzed for demand and supply by application into immunology, hematology, critical care, rheumatology, and neurology. Out of these, the neurology segment is anticipated to garner the largest revenue by the end of 2035, backed by increasing cases of neurological disorders such as Alzheimer, and Parkinson’s. According to the Pan America Health Organization, in 2019, neurological diseases were responsible for 533,172 deaths in the region, with men accounting for 213,129 (40%) and women accounting for 320,043 (60%). Also, the application of immunoglobulin is supposed to increase in the forecast period for treating cases of chronic inflammatory demyelinating polyneuropathy (CIDP), multifocal motor neuropathy (MMN), myasthenia gravis, and inflammatory myopathies, thus expanding the segment share in the forecast period. Also, the rise in old age patients suffering from neurological disease across the globe along with increased research activities for using IVIG for neurology indications is another factor that is considered to bring growth opportunities.

End-user Segment Analysis

The global plasma fractionation market is also segmented and analyzed for demand and supply by end-user in hospitals, clinical research labs, and academic institutes. Out of these, the hospitals segment is attributed generate the highest revenue during the forecast period. The major factor that is attributed to fuel the segment’s growth is the increasing adoption of plasma fractionation products in treating various disorders which includes autoimmune disease, neurological diseases, bleeding, and other disorders, along with the increased patient pool opting for plasma-derived therapies worldwide. Further, the growing number of hospitals in every region of the world and the presence of plasma donation centers in hospitals are also estimated to fuel the segment’s growth. Other growth factors for the segment development include rising investments in the hospital infrastructure, and the expansion of the healthcare sector.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Product

|

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plasma Fractionation Market Regional Analysis:

North American Market Insights

North America region is set to dominate around 41.6% market share by 2035, fueled by a high number of hemophilic patients and rising prevalence of other chronic diseases. The high number of hemophilic patients along with the rising prevalence of other chronic diseases in the region is considered to be the major factor for the market growth in the region. In addition, the escalation in health disorders, including severe fever with thrombocytopenia syndrome (SFTS), hemophilia, and immune deficiencies, is also considered a growth factor for the market.

Europe Market Insights

On the flip side, the European plasma fractionation market is also estimated to garner a significant share by the end of the assessment period. The major factors for the market growth in the region are attributed to the rising cases of immunodeficiency and bleeding disorders among Europeans. For instance, the total number of patient identified with a specific PI defect increased by 45.2% in Western Europe, and by 25.7% in Eastern Europe from 2013 to 2021.Furthermore, the increased count of blood plasma collection facilities across the region, and favorable regulations from the government are further propelling the growth of the market over the assessment period in the region.

Plasma Fractionation Market Players:

- CSL Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Grifols, S.A.

- Takeda Pharmaceutical Company Limited

- Kedrion S.p.A

- Octapharma AG

- Bio Products Laboratory Ltd.

- Biotest AG

- LFB Group

- Japan Blood Products Organization

- Intas Pharmaceuticals Ltd.

Recent Developments

-

Grifols, S.A., a global healthcare company and one of the world's leading producers of plasma-derived medicines, announced the acquisition of its first donation center in Canada as part of the company's commitment to increasing access to lifesaving plasma medications in the country.

-

The Czech health authority SUKL has granted Biotest AG the operating license for the 12th Cara Plasma plasmapheresis center in the Czech Republic.

- Report ID: 4548

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plasma Fractionation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.