Autoimmune Disease Therapeutics Market Outlook:

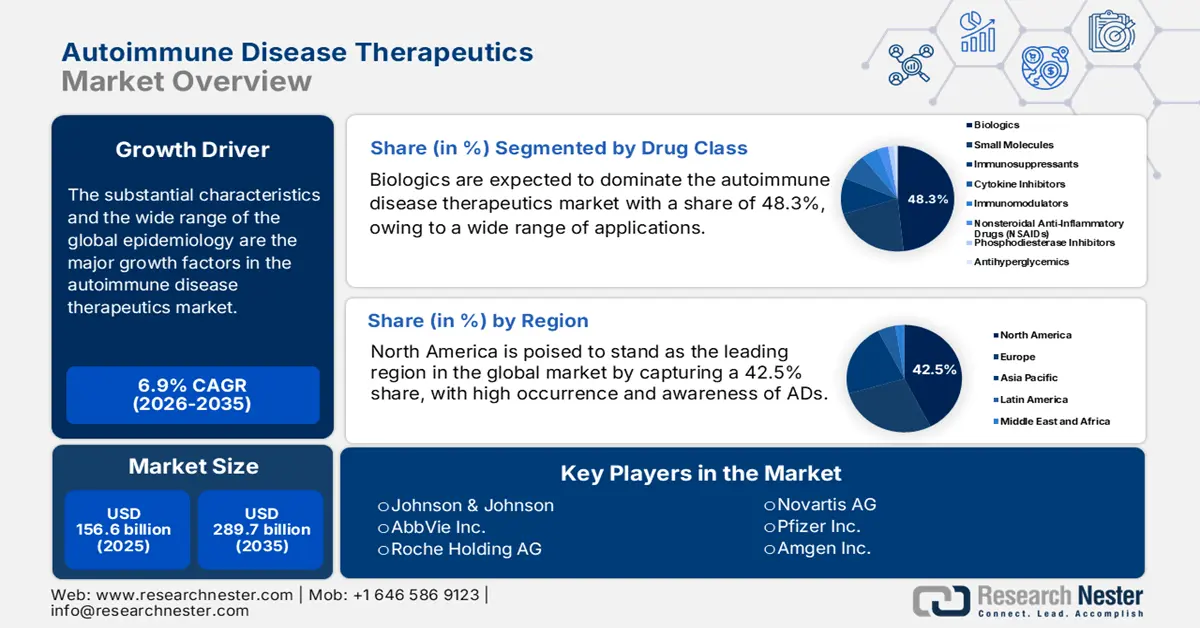

Autoimmune Disease Therapeutics Market size was over USD 156.6 billion in 2025 and is estimated to reach USD 289.7 billion by the end of 2035, expanding at a CAGR of 6.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of autoimmune disease therapeutics is estimated at USD 166.5 billion.

The substantial characteristics and the wide range of the global epidemiology are the major growth factors in the market. Testifying to such demographic expansion, a 2025 report from the Sjögren Foundation unveiled that the number of new cases of autoimmune diseases (ADs) worldwide is increasing at an annual rate of 19.1%. It also mentioned that approximately 25% of the patient population with one type of this medical discipline is estimated to develop another type of these conditions, containing more than 100 categories. This is fostering a strong foundation for the sector by creating a sustainable demand for medications with long-term effectiveness.

Source: ScienceDirect

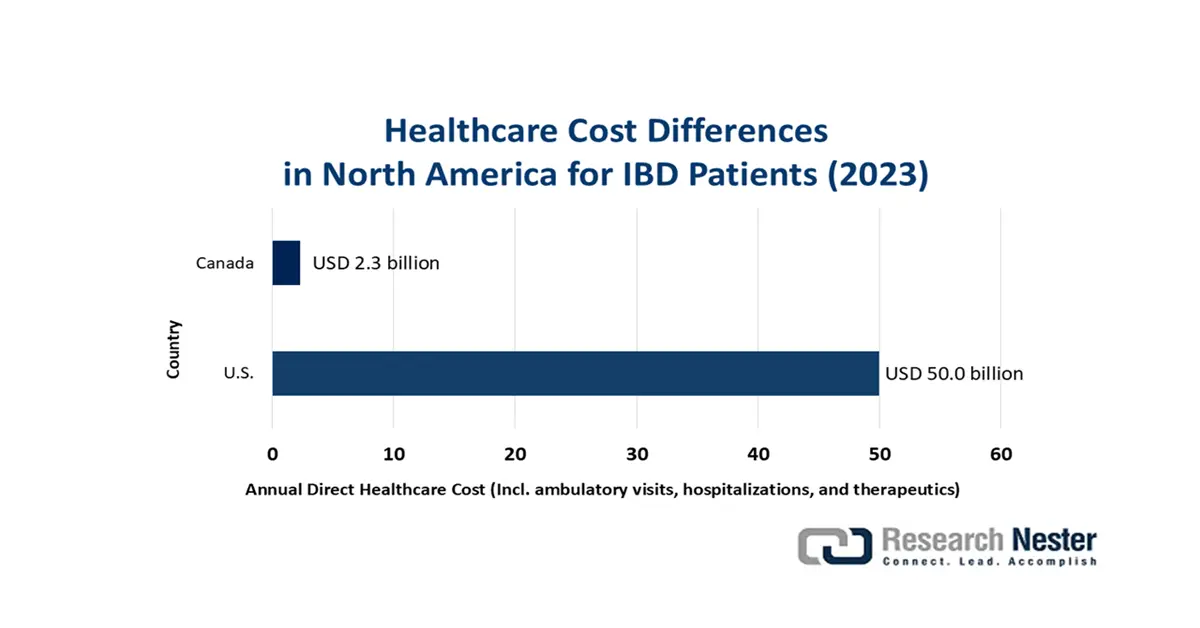

The supply chain of the autoimmune disease therapeutics market largely depends on the pharmaceutical preparations and drug availability. As a result, the rate of cash inflow in this sector is notably susceptible to the inflationary payers’ pricing for prescription medicines and associated healthcare services. This can be exemplified by the 2025 findings from the Journal of Clinical Gastroenterology and Hepatology. It calculated the annual direct expenses on each inflammatory bowel disease (IBD)-afflicted patient, including ambulatory visits, hospitalizations, and therapeutics, to be USD 9-12 thousand in high-income countries (HICs). This underscores the need for establishing uniformity and standardization in product pricing to minimize economic disparity and maximize adoption in this field.

Key Autoimmune Disease Therapeutics Market Insights Summary:

Regional Insights:

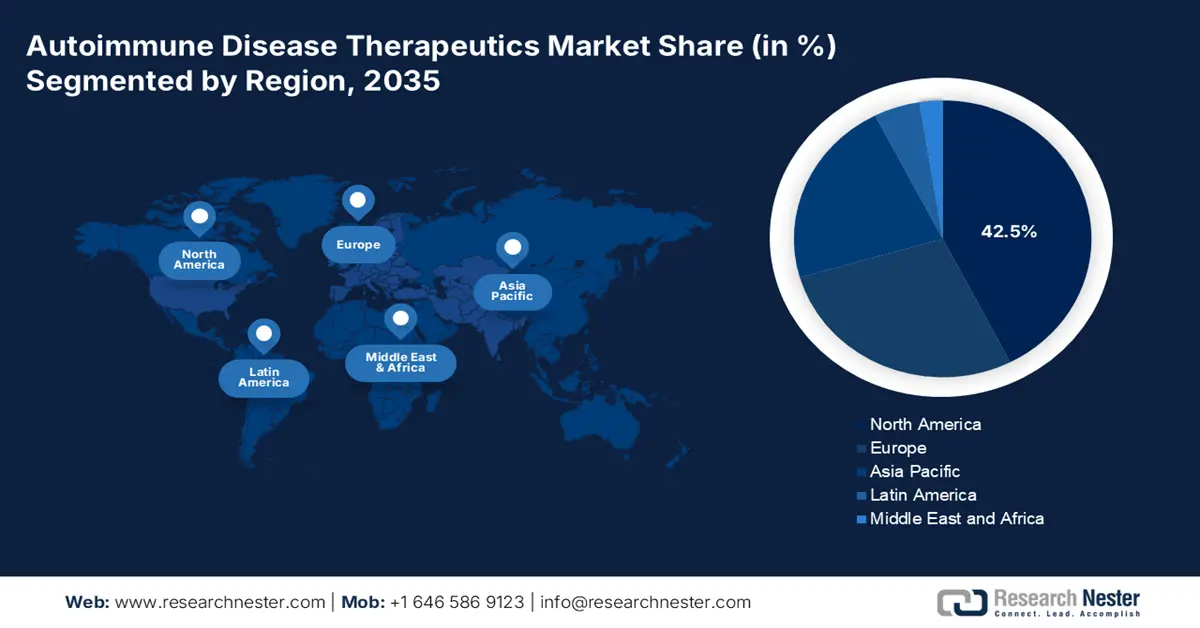

- North America is anticipated to hold a 42.5% share by 2035 in the Autoimmune Disease Therapeutics Market, sustained by its advanced healthcare infrastructure, strong R&D ecosystem, and extensive public funding for biologics and targeted therapy innovation.

- Asia Pacific is projected to emerge as the fastest-growing region by 2035, owing to expanding healthcare infrastructure, increasing biomanufacturing capabilities, and robust government initiatives supporting biologics development.

Segment Insights:

- The Biologics (monoclonal antibodies) segment is projected to account for 48.3% share by 2035 in the Autoimmune Disease Therapeutics Market, fueled by its broad therapeutic applications and superior efficacy across multiple indications.

- The Rheumatoid Arthritis (RA) segment is anticipated to secure a 25.9% share by 2035, propelled by the escalating global prevalence of RA and the continuous need for advanced, long-term treatment solutions.

Key Growth Trends:

- Expanding pipelines of novel therapies

- Favorable economic landscapes of R&D

Major Challenges:

- Limited profitability from premium pricing

- Evolutions of regulatory and insurance frameworks

Key Players: Johnson & Johnson, AbbVie Inc., Roche Holding AG, Novartis AG, Pfizer Inc., Amgen Inc., Bristol Myers Squibb, Merck & Co., Inc., Sanofi, AstraZeneca PLC, Eli Lilly and Company, UCB S.A., Gilead Sciences, Inc., Biogen Inc., Samsung Bioepis, Celltrion Inc., Dr. Reddy's Laboratories, CSL Limited, Hovid Berhad, Allogene Therapeutics, Inc., Century Therapeutics.

Global Autoimmune Disease Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 156.6 billion

- 2026 Market Size: USD 166.5 billion

- Projected Market Size: USD 289.6 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 16 September, 2025

Autoimmune Disease Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Expanding pipelines of novel therapies: The market is enriched with biologics, small molecules, and gene/cell therapies, which support persistent cash inflow. Particularly, established pharma and biotech innovators are heavily involved in extensive research, cultivating revolutionary medicinal resources, including CAR-T cells, mRNA drugs, and small molecule drugs. Exemplifying this tendency, in August 2025, Noxopharm announced the completion of the second dose cohort of SOF-SKN, a novel drug candidate for ADs, under the HERACLES trial. These progressive approaches are potentially shifting treatment paradigms, creating a robust pipeline for long-term market expansion.

- Favorable economic landscapes of R&D: According to a 2025 report from the Autoimmune Association, every USD 1.0 allocation to research in this category can produce USD 2.5 as a return-on-investment (ROI). It also highlighted that the 2023 R&D funding from the NIH generated around USD 92.8 billion in economic output, while garnering a USD 1.5 trillion biotech & pharma industry and over 400.0 thousand jobs in the U.S. landscape. Such a lucrative ROI rate and financial liability of R&D further attract more public and private organizations to engage their resources in the autoimmune disease therapeutics market.

- Tech-based advances in drug development: The benefits of utilizing cutting-edge technologies and laboratory equipment are escalating the speed and scale of progress in the autoimmune disease therapeutics market. Particularly, the amplifying usage of AI is streamlining the process of identifying new drug targets and candidates in a scalable and affordable manner. As evidence, in a 2024 article, the NLM revealed that AI-powered tools can reduce the timeline of drug discovery from 3-6 years to 1-2 years, while delivering a success rate of 80-90%. On the other hand, next-generation sequencing, CRISPR, and other gene-editing tools are showcasing remarkable curative potential, which shapes the future of this sector.

Snapshot of the Current Clinical Advances in the Market

Ongoing Clinical Trials on Autoimmune Disease Therapeutics

|

Trial Name/ID |

Status |

Sponsor |

Timeline |

Key Focus |

|

ADI-001 in Autoimmune Disease (NCT06375993) |

Recruiting |

Adicet Bio, Inc. |

2024-2027 |

Phase 1: Safety/efficacy of ADI-001 (CAR-NK cell therapy) in autoimmune diseases |

|

Safety Study of CC312 (NCT06888960) |

Recruiting |

CicloMed LLC; University of Kansas |

2024-2026 |

Dose escalation; safety of CC312 in autoimmune disease patients |

|

C-CAR168 in Autoimmune Disease (NCT06249438) |

Recruiting |

Ruijin Hospital, Shanghai Jiao Tong University School of Medicine |

2024-2040 |

CAR-T therapy targeting CD20/BCMA for autoimmune diseases |

|

CAR-T Cells for Refractory Autoimmune Disease (NCT07052565) |

Not yet recruiting |

Henan Cancer Hospital |

2025-2028 |

Phase 1: Safety and efficacy of CAR-T therapy in refractory autoimmune disease |

Source: Clinicaltrials.gov

Trends in Commercial Funding/Financing in the Autoimmune Disease Therapeutics Market

Recent Major Investments in Autoimmune Disease Biotech

|

Company |

Funding (in USD) |

Focus / Assets |

Key Details |

Year |

|

NewCo (BMS + Bain Capital) |

300 million (led by Bain Capital) |

Autoimmune disease therapies (5 immunology assets in-licensed from BMS) |

New independent biopharma company launched by BMS and Bain Capital |

2025 |

|

RheumaGen, Inc. |

15 million (Series A) |

Cell and gene therapy for autoimmune diseases (lead: RG0401 for RA) |

Trial funding for Phase I of RG0401 in treatment-resistant/refractory rheumatoid arthritis |

2025 |

|

Candid Therapeutics |

370 million (Series A) |

Bispecific T-cell engagers (TCEs) for autoimmune disorders |

Formed via merger with Vignette Bio and TRC 2004; acquired clinical-stage assets CND106 & CND261 |

2024 |

Source: Company Press Releases and c&en

Challenges

- Limited profitability from premium pricing: The increasing scale of the worldwide shift toward biosimilars is one of the major cost containment roadblocks in the autoimmune disease therapeutics market. Specifically, patent expiration of major biologic blockbusters is leading public and private payers to aggressively prefer widespread adoption of these affordable alternatives to generate greater healthcare savings. These dynamics ultimately shrink the scope of securing a good profit margin for pioneering drug developers in this field.

- Evolutions of regulatory and insurance frameworks: Continuous upgrades in the policies of healthcare technology assessment (HTA) are pushing manufacturers in the autoimmune disease therapeutics market to procure elements beyond traditional clinical endpoints. As a result, the external expenses on evaluating quality-of-life improvements, caregiver burden, and real-world evidence are increasing the overall pricing range of the finished product. This further translates to a negative reimbursement recommendation due to failure to align with affordability thresholds.

Autoimmune Disease Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 156.6 billion |

|

Forecast Year Market Size (2035) |

USD 289.7 billion |

|

Regional Scope |

|

Autoimmune Disease Therapeutics Market Segmentation:

Drug Class Segment Analysis

Biologics, specifically monoclonal antibodies (mAbs), are expected to dominate the autoimmune disease therapeutics market with a share of 48.3% by the end of 2035. A broader range of applications and high efficacy are the major reasons for the segment being the largest revenue-contributing category in this sector. During the decade-long leadership of this drug class over all treatment methods of ADs, mAbs have been rapidly gaining certification for multiple indications, where the FDA alone approved around 123 new biologics during the timeline from 2015 to 2023 and 70% of them were mAbs, as per the NLM findings. This ultimately testifies to the segment’s ongoing progress and consolidated position in this sector.

Indication Segment Analysis

Rheumatoid arthritis (RA) is predicted to continue its dominance over the disease-specific application in the autoimmune disease therapeutics market over the assessed period, while accounting for a 25.9% share. The predominant and continuously growing global occurrence of this ailment requires a robust pipeline of novel therapies, which contributes to the steady cash inflow in this sector. As evidence of the enlarging patient population, the NLM estimated the number of people living with RA around the globe to increase from 17·6 million in 2020 to 31·7 million by 2050. Besides, the chronic nature and complex pathological structure of the disease need lifelong treatment, making it the biggest consumer base for this sector.

Route of Administration Segment Analysis

Injectables are anticipated to hold the largest share of 68.6% in the autoimmune disease therapeutics market throughout the discussed timeframe. This is an evident result of the widespread use of biologics, such as mABs and fusion proteins, which are typically administered via subcutaneous or intravenous injection. Exemplifying the same, a journal published in 2023 unveiled that out of the total biological products approved by the FDA since 2015, around 45% and 36% were intravenous and subcutaneous injection, respectively, with only 10% being non-invasive. Moreover, injectables being the gold standard for rapid onset of action and higher bioavailability, positions this therapeutic space at the forefront of the sector.

Our in-depth analysis of the autoimmune disease therapeutics market includes the following segments:

|

Segment |

Subsegment |

|

Drug Class |

|

|

Indication |

|

|

Therapeutic Application |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autoimmune Disease Therapeutics Market - Regional Analysis

North America Market Insights

North America is poised to stand as the leading region in the global autoimmune disease therapeutics market during the analyzed tenure, with the highest share of 42.5%. With high occurrence and awareness of ADs, coupled with its well-established medical system, the region is continuously growing in this field. In addition, the landscape is pledged to the strong R&D competency among both domestically and internationally dominating biopharma companies, fueling the sector with continuous innovation in biologics and targeted therapies. Moreover, the public allocations for research cohorts in this category are playing an important role as a financial cushion for the merchandise in North America.

A 2025 report unleashed by the Autoimmune Association underscored the increasing annual U.S. healthcare spending toward chronic diseases, including autoimmunity, totaling USD 4.5 trillion. Further, it mentioned that the USD 600 million additional R&D funding from the National Institute of Health (NIH) presents the potential to multiply the present economic returns in the upcoming years. This portrays a strong influx of capital in this medical discipline, which is making the U.S. a global epitome of revenue generation and new discoveries in the autoimmune disease therapeutics market.

The favorable standardization frameworks and universal insurance coverage are the basic foundations of the Canada autoimmune disease therapeutics market. Such strong financial backing subsequently ensures widespread patient access and attracts greater commercial engagement. Additionally, the governing authorities are proactively promoting development in genomic sequencing, indicating the presence of a progressive culture in this field. Testifying to the same, the NLM revealed that, from 2013 to 2023, the federal government in Canada allocated a total of USD 580.1 million to empower the local network of biopharmaceutical start-ups.

APAC Market Insights

Asia Pacific is emerging remarkably to become the fastest-growing region in the global autoimmune disease therapeutics market by the end of 2035. The massive burden of AD-related mortality, investments in healthcare infrastructural development, and progress in biomanufacturing are collectively escalating the region’s position in this sector. Particularly, the growing emphasis of developing countries, including China and India, on large-scale production of advanced biologics and targeted therapies is also securing a prosperous future for this landscape. Alongside, the robust government efforts to accelerate healthcare innovation and localized biopharmaceutical expansion are attracting more pioneers to participate.

The enlarging patient population of China is the optimum revenue generator in the autoimmune disease therapeutics market. For instance, till 2024, more than 31 million adults living across the country were suffering from one or multiple ADs, as per the NLM estimation. On the other hand, the increasing disposable incomes and insurance coverage amplify the volume of adoption in this sector by enhancing accessibility. Currently, with ongoing investments in biopharmaceutical research and development, China is consolidating its significance in APAC as both the dominating consumer base and innovator.

India is also becoming the epicenter of manufacturing and innovation in the APAC autoimmune disease therapeutics market. The country is primarily utilizing its capabilities in biologics production to conquer this sector. Besides, its expanding biotech industry and increasing participation in global clinical trials offer a promising business environment for both domestic and foreign leaders in the field of AD. This can be exemplified by the rise in the industry value of biotechnology in India from USD 10 billion to USD 130 billion from 2014 to 2024, according to a report from the PIB.

Revolutionary Events in Commercial & Clinical Landscapes

|

Country |

Event Details |

Timeline |

|

India |

Researchers from the Institute of Nano Science and Technology (INST) developed a smart self-actuating drug delivery system to treat RA |

February 2025 |

|

Australia |

Noxopharm initiated the first in-human trial, HERACLES, for a novel drug candidate, SOF-SKN, for autoimmune diseases |

August 2024 |

|

Japan |

Scientists at the Okinawa Institute of Science and Technology identified phosphoenolpyruvate, which can treat a wide range of AD |

March 2023 |

Source: PIB, Press Release, and OIST

Europe Market Insights

Europe is expected to remain the second-largest shareholder in the global autoimmune disease therapeutics market over the timeline between 2026 and 2035. In support of an advanced healthcare practice and a progressive biomedical R&D culture, the region secures a stable position in this sector. Moreover, the presence of numerous leading pharmaceutical companies and well-established clinical research institutions cultivates an ideal atmosphere for continuous innovation in novel biologics and targeted therapies. This, coupled with its favorable regulatory frameworks and government subsidies, is improving patient access to cutting-edge treatments, justifying the importance of Europe in the market’s future expansion.

The UK is a key landscape within the Europe autoimmune disease therapeutics market, which largely benefits from a stable cash inflow from the National Health Service (NHS)-accommodated reimbursements and substantial investment in biomedical research. This enables broad access to innovative treatments, including advanced biologics and small molecular drugs. The robust clinical trial infrastructure of the country further encourages the development and adoption of novel therapies, making the UK a vital contributor to the persistent growth of Europe in this sector.

Germany is one of the leading hubs of innovations in the Europe autoimmune disease therapeutics market. The landscape is characterized by a high incidence of ailments and a well-developed pharmaceutical industry. Moreover, the comprehensive healthcare coverage of Germany ensures widespread patient access to cutting-edge therapies, strengthening its position in this sector. As evidence, a cross-sectional study published by the NLM revealed that, in 2022, approximately 6.3 million residents of the country with at least one AD were covered for reimbursements.

Feasible Opportunities in Key Landscapes

|

Country |

Metrics/Key Notes |

Timeline |

|

UK |

USD 4.0 million allocation to biomanufacturing of biologics and advanced therapies under Canada-UK partnership |

June-October 2023 |

|

Germany |

The launch of a Call for Application in Autoimmune Disease Research to develop a novel strategy to target autoreactive plasma cells |

November 2023 |

|

Italy |

Individuals over 65 years of age are estimated to account for 34.5% of the country’s total population by the end of 2050 |

2025-2050 |

Source: GOV.UK, BioMedX, and NLM

Key Autoimmune Disease Therapeutics Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AbbVie Inc.

- Roche Holding AG

- Novartis AG

- Pfizer Inc.

- Amgen Inc.

- Bristol Myers Squibb

- Merck & Co., Inc.

- Sanofi

- AstraZeneca PLC

- Eli Lilly and Company

- UCB S.A.

- Gilead Sciences, Inc.

- Biogen Inc.

- Samsung Bioepis

- Celltrion Inc.

- Dr. Reddy's Laboratories

- CSL Limited

- Hovid Berhad

- Allogene Therapeutics, Inc.

- Century Therapeutics

The autoimmune disease therapeutics market features a healthy competitive landscape, which is controlled by global pharma leaders and innovative biotech firms. These pioneers are currently capitalizing on the development of novel, targeted treatments. Recent approvals in Japan, such as argenx’s VYVGART for immune thrombocytopenia and Otsuka’s Lupkynis for lupus nephritis, in March and September of 2024, respectively, display this push to address unmet needs in this category. Furthermore, companies are increasingly investing in R&D to expand indications and geographic reach of their pipelines to gain benefits from regulatory support and growing patient demand.

Such key players are:

Recent Developments

- In January 2025, Allogene gained FDA approval for its Investigational New Drug (IND) application for a rheumatology basket study of ALLO-329. The investigational CAR T product has the potential to enhance therapeutic benefit and expand treatment potential across a range of autoimmune diseases.

- In April 2024, Century announced its plans to expand its pipeline in the autoimmune disease portfolio with clinical development of a CD19-targeting iNK cell therapy, CNTY-101. The company raised a USD 60 million private placement and acquired Clade Therapeutics to empower its R&D activities in this category.

- Report ID: 8108

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.