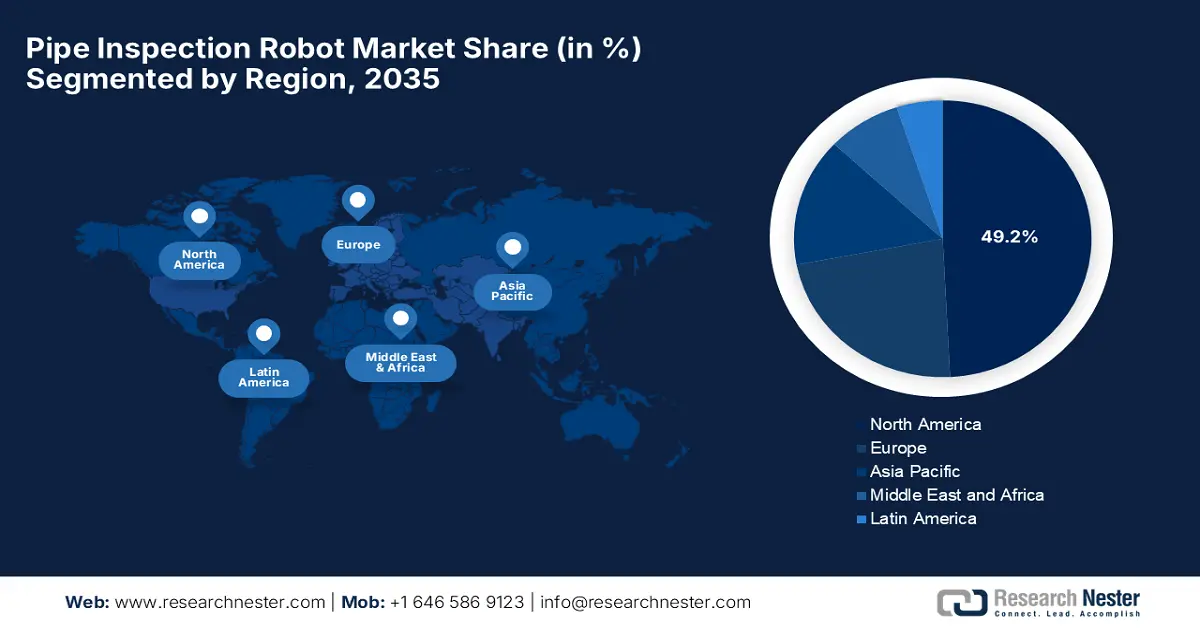

Pipe Inspection Robot Market - Regional Analysis

North America Market Insights

The pipe inspection robot market in North America is estimated to dominate the entire global dynamics, capturing the largest share of 49.2% during the forecast timeline. The prosperity of the region is effectively attributable to extensive investments in energy, water, and industrial infrastructure. The region’s market also benefits from the presence of key market players, increased automation, robotics adoption, and environmental regulations, which encourage utilities and industrial operators to integrate inspection robots. In June 2025, Fiberscope announced the launch of Proteus ExZ1, which is an ATEX Zone 1 certified explosion-proof pipe robot designed for industrial environments such as oil and gas, chemical, and pharmaceutical sectors. The robot can inspect pipes ranging from 6 to 24 inches, with optional expansion to 40 inches, using advanced motorized cameras, interchangeable explosion-proof heads, and integrated software for real-time data capture and reporting, hence making it suitable for overall pipe inspection robot market growth.

The U.S. has a strong scope to capitalize on the regional pipe inspection robot market, supported by federal and state programs that are focused on pipeline safety, water system modernization, and environmental compliance. Utilities in the country are utilizing these inspection robots to monitor critical water, oil, and gas networks, particularly in areas that have aging pipelines. In October 2024, PHMSA announced around USD 200 million in investment under the Bipartisan Infrastructure Law to replace the current aging natural gas pipelines across 20 states, supporting 60 modernization projects. It also stated that these upgrades collectively aim to enhance safety, lower household energy bills, and cover pipelines in cities such as Philadelphia, Richmond, as well as Tallahassee. Furthermore, the initiative is part of a broader USD 1 billion program to modernize community-owned gas distribution systems, repair over 1,000 miles of pipes, and hence reinforce both infrastructure resilience and environmental compliance.

Canada has gained huge exposure in the pipe inspection robot market, positively influenced by the government’s commitment to maintaining and upgrading critical energy and water infrastructure in urban and remote regions. The municipal and industrial operators in the country are opting for these robotics solutions to reduce manual procedures and cut down the maintenance schedules. Eddyfi Technologies in October 2023 reported that it has introduced its VersaTrax series of robotic inspection crawlers, which are designed for industrial inspections across sectors such as oil and gas, nuclear, and sewer systems. Furthermore, the company also mentioned that the modular robots are built in such a way that they can operate in hazardous environments, whereas VersaTrax integrates non-destructive testing technologies for safe inspections, thus denoting a positive market outlook.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the pipe inspection robot market owing to the rapid industrialization, urbanization, and increasing investments in terms of energy, water, and wastewater management systems. Prominent countries across this region are extensively adopting automation and robotics to improve operational efficiency as well as pipeline safety. In November 2022, TMSUK introduced the SPD1, which is a multi-legged walking robot designed to improve sewer inspection efficiency and mitigate manpower shortages in Japan. The company also states that these robots can navigate into complex pipe environments, adapt to different diameters, and operate individually or cooperatively wherein aim to survey and perform tasks in narrow and inaccessible spaces. Furthermore, the growing awareness of environmental regulations and the need for sustainable infrastructure practices is also accelerating the integration of inspection robots.

China is augmenting its leadership over the regional pipe inspection robot market, efficiently backed by large-scale urban water and energy infrastructure projects, along with government policies which are promoting smart city development and industrial automation. Inspection robots are being increasingly utilized in the country to monitor pipelines across oil, gas, and municipal water networks, which is significantly reducing manual labor and addressing the safety risks in work areas. In April 2024, Tianchuang Robot announced that its T9-W explosion-proof wheeled inspection robot was officially deployed at Jiangsu Sierbang Petrochemical, which marks the country’s first intelligent robot that integrates both optical and acoustic gas-leak detection. The company also underscored that this robot now conducts 24/7 autonomous inspections in the EVA tubular reactor dam area, one of the plant’s highest-risk zoneswhere dense piping, flanges, and high-pressure equipment make manual inspection slow, unsafe, and inconsistent.

India is also expanding in the pipe inspection robot market, effectively fueled by modernization initiatives in terms of municipal water supply and industrial pipelines. The country is witnessing concerns such as aging infrastructure, water losses, and urban population growth, which drive the adoption of inspection robots. Government-backed programs support the implementation of pipeline monitoring technologies to improve maintenance efficiency, enabling widespread adoption. On the other hand, the domestic robotics manufacturers and technology firms are making heavy investments in R&D, creating suitable solutions that are capable of handling complex pipeline networks. In addition, the existence of government incentives and regulatory frameworks is also providing an encouraging opportunity for both domestic and international players, allowing a steady cash influx in this field.

Europe Market Insights

Europe is maintaining strong growth consistency in the global pipe inspection robot market, attributed to the increased investments in wastewater management, strict regulatory standards imposed for safety, and infrastructure sustainability. Investments in sensor technology and predictive maintenance are enabling real-time monitoring and improved operational efficiency, positioning the region as a key growth area. In April 2025, Ireland launched a multi-year programme to upgrade national water and wastewater systems, with a €300 million (~USD 323 million) European Investment Bank loan, which was signed in July 2025. It was implemented by Uisce Éireann, the €764 million (~USD 823 million) initiative focuses on expanding and rehabilitating aging water networks, improving wastewater collection and treatment, and maintaining compliance with EU water directives. Thus, this large-scale investment strengthens climate resilience, reduces pollution, and encourages increased utilization of pipe inspection robots across Ireland.

Germany stands at the forefront of revenue generation in the regional pipe inspection robot market, which is proactively fueled by highly regulated energy and water sectors that emphasize pipeline safety, environmental protection, and infrastructure modernization. In September 2022, Waygate Technologies highlighted its robotic inspection product portfolio at the SPRINT Robotics World Conference 2022, showcasing how advanced automation is readily enhancing safety and productivity in industrial asset inspection. The company showcased solutions such as the BIKE magnetic-wheeled crawler for navigating complex pipe geometries, the BRIC robotic boiler inspection and cleaning service that removes the need for human entry into hazardous vessels, and 3D LOC technology for creating digital twins of inspected assets, hence reducing risk exposure by increasing data accuracy and operational efficiency.

The U.K. has also established itself as one of the most prominent players in the regional pipe inspection robot market, backed by the presence of government-led infrastructure renewal programs and an academic R&D ecosystem. Simultaneously, collaborative research programs between public agencies, universities, and technology firms are also propelling extensive growth in the country’s market. For instance, in November 2023, the University of Bristol team demonstrated that a network of mobile robots, which were equipped with guided acoustic-wave sensors, can inspect large steel pipelines, achieving full defect detection coverage without requiring any synchronization between units. The article also mentioned that in tests on a three-meter steel pipe containing holes, pits, and cracks, each robot independently transmitted and received acoustic waves, enabling low-cost, scalable defect detection. It was supported by EPSRC under the Pipebots program and reflects the potential for pipe monitoring in the upcoming years.