Pipe Inspection Robot Market Outlook:

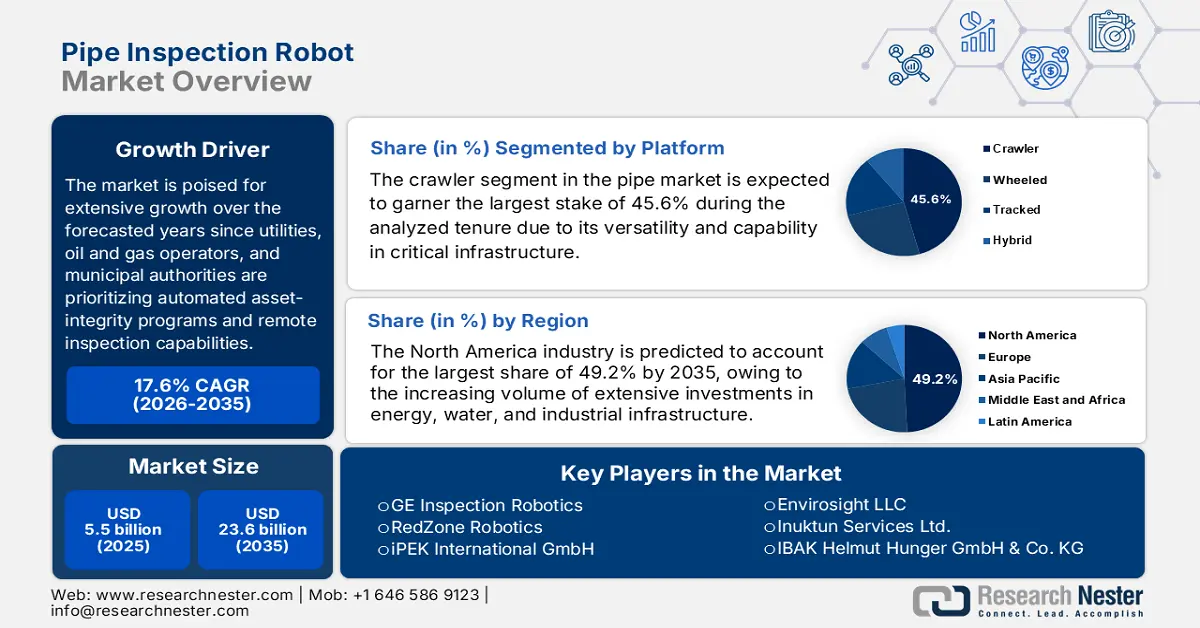

Pipe Inspection Robot Market size was valued at USD 5.5 billion in 2025 and is projected to reach USD 23.6 billion by the end of 2035, rising at a CAGR of 17.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pipe inspection robot is evaluated at USD 6.4 billion.

The international pipe inspection robot market is poised for extensive growth over the forecasted years since utilities, oil and gas operators, and municipal authorities are prioritizing automated asset-integrity programs and remote inspection capabilities. As per an article published in August 2025, the 2022 Economic Census shows that U.S. manufacturing continues to adopt industrial robotic equipment, in which overall 6.4% of manufacturing plants use robots, and 25.7% of employees work along with them. Related industries such as machinery manufacturing, electrical equipment, and fabricated metal product manufacturing show robotic adoption rates between 7.5% and 8.9%, which reflects automation integration in production processes critical to pipe inspection robot components. Hence, this experimental dataset represents how robotics is being integrated into production environments, and these technologies readily influence operational procedures across different plant sizes.

Furthermore, the growing investments in this sector are also prompting a profitable business environment for the pipe inspection robot market. In December 2024, ANYbotics announced that it had secured an additional USD 60 million in funding to enhance its services & deliver results across all nations, which was led by Qualcomm Ventures and Supernova Invest, bringing its total capital raised to over USD 130 million to support its U.S. expansion. Also, the company specializes in terms of AI-based robotic inspections, wherein there has been a growing demand from the energy, metals, and chemical sectors. In addition, the company is advancing its ANYmal robot by integrating built-in GPUs for faster processing and enhanced AI analytics, thereby enabling more efficient and precise inspections. In addition, partnerships with AWS, NVIDIA, Siemens Energy, and others are strengthening the firm’s worldwide reach and technological capabilities, hence positively impacting pipe inspection robot market growth.

Key Pipe Inspection Robot Market Insights Summary:

Regional Insights:

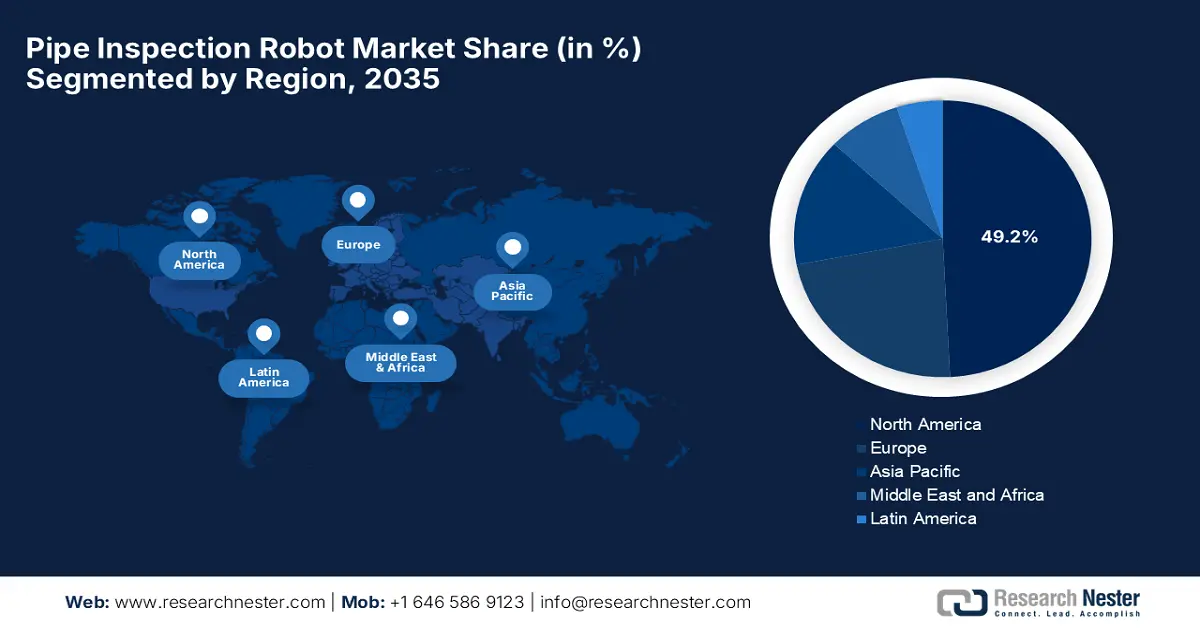

- North America is projected to command a 49.2% share by 2035 of the pipe inspection robot market, owing to extensive investments in energy, water, and industrial infrastructure.

- By 2035, Asia Pacific is expected to exhibit the fastest expansion, supported by rapid industrialization, urbanization, and rising investment in energy, water, and wastewater management systems.

Segment Insights:

- The crawler platform segment in the pipe inspection robot market is projected to command a 45.6% share by 2035, propelled by the urgent need to assess aging water infrastructure.

- By 2035, the drain & sewer application segment is anticipated to secure a leading share, spurred by global governmental and municipal mandates to upgrade aging and failing wastewater infrastructure.

Key Growth Trends:

- Aging pipeline infrastructure

- Technological advances

Major Challenges:

- High initial investment

- Technical complexity

Key Players: GE Inspection Robotics (Switzerland), RedZone Robotics (U.S.), iPEK International GmbH (Germany), Envirosight LLC (U.S.), Inuktun Services Ltd. / Eddyfi Technologies (Canada), IBAK Helmut Hunger GmbH & Co. KG (Germany), Mini Cam Ltd. (UK), RIEZLER Inspektionssysteme GmbH (Germany), SuperDroid Robots, Inc. (U.S.), Inspector Systems GmbH (Germany), Aries Industries, Inc. (U.S.), Deep Trekker Inc. (Canada), Taurob GmbH (Austria), ULC Robotics (U.S.), Breivoll Inspection Technologies AS (Norway).

Global Pipe Inspection Robot Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.5 billion

- 2026 Market Size: USD 6.4 billion

- Projected Market Size: USD 23.6 billion by 2035

- Growth Forecasts: 17.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Italy, Australia

Last updated on : 4 December, 2025

Pipe Inspection Robot Market - Growth Drivers and Challenges

Growth Drivers

- Aging pipeline infrastructure: The pipeline networks, such as gas, water, waste wastewater, are aging, due to which the operators are facing increased risk of leaks and failures, constantly driving growth in the pipe inspection robot market. The governing bodies are recognizing robotic crawlers for their integrity in complex distribution systems, encouraging more players to make investments in this field. As per an article published by PHMSA in August 2024, a study by Oak Ridge National Laboratory, with Blade Energy Partners, analyzed different integrity assessment methods for distribution pipelines, more than direct assessment. The research found that robots and crawlers are the most promising technologies, which are capable of navigating complex pipeline networks and providing safety levels equal to or exceeding DA, wherein the performance depends on platform and sensor capabilities, providing encouraging opportunities for pioneers in this field.

- Technological advances: There has been significant progress in advances of sensors and autonomy, which is readily encouraging adoption in the pipe inspection robot market. Improvements in robotics, such as modular, untethered platforms, AI-driven defect detection, and advanced imaging sensors, are enhancing both inspection accuracy, autonomy. In this regard, Skipper NDT in January 2025 reported that it was awarded the innovation award at the 37th pipeline pigging & integrity management conference. The company is recognized as a specialist in terms of automated pipeline maintenance solutions, combining hardware and software to monitor underground infrastructure in water, energy, electricity, and hydrogen sectors. The company also mentioned that its technologies generate high-accuracy geospatial digital twins for buried assets, thereby enabling accurate data acquisition, automated analysis, and repeatable inspections in environments such as river crossings or geohazard-prone areas.

- Infrastructure modernization: There have been strong investments in infrastructural renewal, such as water systems, oil & gas pipelines, coupled with organizations shifting towards predictive maintenance, allowing an increased uptake in the pipe inspection robot market. In January 2025, Ofwat announced the expansion of its innovation fund to a substantial £400 million (USD 536 million), which is aimed at supporting water-sector transformation projects by the end of 2030. In this regard, the fund promotes collaborative innovation, including initiatives such as Pipebots, which are designed to detect cracks in hard-to-reach sewage pipelines. The organization also mentioned that the original fund supported 93 projects with 240 partners, fostering solutions to challenges such as leak prevention, climate adaptation, and net-zero emissions. Therefore, the increased funding emphasizes scaling proven technologies and solutions, creating a strong environment for inspection technologies, including robotic platforms for pipeline monitoring.

Challenges

- High initial investment: The cost barrier is limiting the widespread adoption of the pipe inspection robot market. These robots often necessitate extreme upfront costs to procure, integrate, and maintain them. Also, the industrial-grade robots are complex, wherein incorporating advanced sensors, mobility mechanisms, and real-time data monitoring elevates the purchase cost. Most of the municipal utilities and smaller industrial operators can restrict themselves to operating in this field, particularly when budgets are limited. In addition, integration of these robots with existing infrastructure often necessitates custom software and training, further adding to deployment costs. Therefore, the existence of these financial constraints can ultimately slow down pipe inspection robot market penetration, particularly in developing regions.

- Technical complexity: This, coupled with maintenance challenges, is yet another challenge for the pipe inspection robot market to capture the desired consumer base. The inspection robots require sophisticated engineering to navigate confined and complex pipelines. In this regard, ensuring reliable mobility in narrow, corroded, or irregular interiors can be challenging, whereas maintaining sensor precision in terms of harsh environmental conditions, such as high temperature, pressure, also makes it extremely critical. Therefore, regular maintenance and calibration are essential to avoid operational errors, but access to skilled technicians may be limited, especially in remote areas. Furthermore, integrating multi-sensor data streams for analysis demands robust software and AI capabilities, creating dependencies in this field.

Pipe Inspection Robot Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.6% |

|

Base Year Market Size (2025) |

USD 5.5 billion |

|

Forecast Year Market Size (2035) |

USD 23.6 billion |

|

Regional Scope |

|

Pipe Inspection Robot Market Segmentation:

Platform Segment Analysis

The crawler platform segment in the pipe inspection robot market is expected to garner the largest stake of 45.6% during the analyzed tenure. Their versatility and capability in critical infrastructure sectors are the key factors reinforcing the subtype’s dominance in this field. On the other hand, its superior traction, stability on slippery surfaces, and ability to carry heavy sensor payloads such as high-resolution cameras, LiDAR, and sonar make it the preferred choice for inspecting complex and damaged municipal sewer and industrial pipes. In addition, the segment’s growth is also driven by the urgent need to assess aging water infrastructure, as stated by the U.S. Environmental Protection Agency, which released its 2022 Clean Watersheds Needs Survey, highlighting that over USD 630 billion will be required in the next 20 years to modernize wastewater, stormwater, and other clean water infrastructure. This also includes upgrades to publicly owned treatment works, decentralized systems, and nonpoint source controls to ensure water quality and public safety.

Application Segment Analysis

By the end of 2035, the drain & sewer application is expected to capture a lucrative share in the pipe inspection robot market, owing to the worldwide governmental and municipal mandates to upgrade aging and failing wastewater infrastructure. Also, the high cost of pipe failures, both in economic damage from sinkholes and in environmental contamination, creates a continuous, non-discretionary demand for inspection robots. On the other hand, most of the prominent organizations advocate for advanced assessment technologies to implement cost-effective asset management, ensuring a high-volume market for pipe inspection robotics. The EU-funded PIPEON project, which is coordinated by Tallinn University of Technology, aims to develop autonomous robotic and AI technologies for sewer inspection and maintenance across Europe’s 3.2 million kilometers of sewers. Besides, the project, running from 2025 to 2028, is looking to reduce inspection costs and prevent flooding and wastewater spills into rivers.

Pipe Diameter Segment Analysis

In terms of pipe diameter 12–24-inch segment is expected to grow in the pipe inspection robot market over the forecasted years. The sub-segment encompasses the primary municipal sewer mains that form the backbone of urban wastewater networks, allowing a steady cash influx in this sector. These pipes are most prone to blockages, root intrusion, and structural defects, thereby necessitating frequent and rigorous inspection. Municipal authorities across most nations are opting for these robotic inspection solutions to ensure uninterrupted service and reduce maintenance costs. In addition, integration with predictive maintenance programs allows municipalities to schedule interventions, avoiding costly emergency repairs and service disruptions. Furthermore, since there has been an increasing emphasis on sustainable urban infrastructure and regulatory mandates for regular inspections, consumers are also preferring this diameter range due to proven efficacy.

Our in-depth analysis of the pipe inspection robot market includes the following segments:

|

Segment |

Subsegments |

|

Platform |

|

|

Application |

|

|

Pipe Diameter |

|

|

Type |

|

|

Operation |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pipe Inspection Robot Market - Regional Analysis

North America Market Insights

The pipe inspection robot market in North America is estimated to dominate the entire global dynamics, capturing the largest share of 49.2% during the forecast timeline. The prosperity of the region is effectively attributable to extensive investments in energy, water, and industrial infrastructure. The region’s market also benefits from the presence of key market players, increased automation, robotics adoption, and environmental regulations, which encourage utilities and industrial operators to integrate inspection robots. In June 2025, Fiberscope announced the launch of Proteus ExZ1, which is an ATEX Zone 1 certified explosion-proof pipe robot designed for industrial environments such as oil and gas, chemical, and pharmaceutical sectors. The robot can inspect pipes ranging from 6 to 24 inches, with optional expansion to 40 inches, using advanced motorized cameras, interchangeable explosion-proof heads, and integrated software for real-time data capture and reporting, hence making it suitable for overall pipe inspection robot market growth.

The U.S. has a strong scope to capitalize on the regional pipe inspection robot market, supported by federal and state programs that are focused on pipeline safety, water system modernization, and environmental compliance. Utilities in the country are utilizing these inspection robots to monitor critical water, oil, and gas networks, particularly in areas that have aging pipelines. In October 2024, PHMSA announced around USD 200 million in investment under the Bipartisan Infrastructure Law to replace the current aging natural gas pipelines across 20 states, supporting 60 modernization projects. It also stated that these upgrades collectively aim to enhance safety, lower household energy bills, and cover pipelines in cities such as Philadelphia, Richmond, as well as Tallahassee. Furthermore, the initiative is part of a broader USD 1 billion program to modernize community-owned gas distribution systems, repair over 1,000 miles of pipes, and hence reinforce both infrastructure resilience and environmental compliance.

Canada has gained huge exposure in the pipe inspection robot market, positively influenced by the government’s commitment to maintaining and upgrading critical energy and water infrastructure in urban and remote regions. The municipal and industrial operators in the country are opting for these robotics solutions to reduce manual procedures and cut down the maintenance schedules. Eddyfi Technologies in October 2023 reported that it has introduced its VersaTrax series of robotic inspection crawlers, which are designed for industrial inspections across sectors such as oil and gas, nuclear, and sewer systems. Furthermore, the company also mentioned that the modular robots are built in such a way that they can operate in hazardous environments, whereas VersaTrax integrates non-destructive testing technologies for safe inspections, thus denoting a positive market outlook.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the pipe inspection robot market owing to the rapid industrialization, urbanization, and increasing investments in terms of energy, water, and wastewater management systems. Prominent countries across this region are extensively adopting automation and robotics to improve operational efficiency as well as pipeline safety. In November 2022, TMSUK introduced the SPD1, which is a multi-legged walking robot designed to improve sewer inspection efficiency and mitigate manpower shortages in Japan. The company also states that these robots can navigate into complex pipe environments, adapt to different diameters, and operate individually or cooperatively wherein aim to survey and perform tasks in narrow and inaccessible spaces. Furthermore, the growing awareness of environmental regulations and the need for sustainable infrastructure practices is also accelerating the integration of inspection robots.

China is augmenting its leadership over the regional pipe inspection robot market, efficiently backed by large-scale urban water and energy infrastructure projects, along with government policies which are promoting smart city development and industrial automation. Inspection robots are being increasingly utilized in the country to monitor pipelines across oil, gas, and municipal water networks, which is significantly reducing manual labor and addressing the safety risks in work areas. In April 2024, Tianchuang Robot announced that its T9-W explosion-proof wheeled inspection robot was officially deployed at Jiangsu Sierbang Petrochemical, which marks the country’s first intelligent robot that integrates both optical and acoustic gas-leak detection. The company also underscored that this robot now conducts 24/7 autonomous inspections in the EVA tubular reactor dam area, one of the plant’s highest-risk zoneswhere dense piping, flanges, and high-pressure equipment make manual inspection slow, unsafe, and inconsistent.

India is also expanding in the pipe inspection robot market, effectively fueled by modernization initiatives in terms of municipal water supply and industrial pipelines. The country is witnessing concerns such as aging infrastructure, water losses, and urban population growth, which drive the adoption of inspection robots. Government-backed programs support the implementation of pipeline monitoring technologies to improve maintenance efficiency, enabling widespread adoption. On the other hand, the domestic robotics manufacturers and technology firms are making heavy investments in R&D, creating suitable solutions that are capable of handling complex pipeline networks. In addition, the existence of government incentives and regulatory frameworks is also providing an encouraging opportunity for both domestic and international players, allowing a steady cash influx in this field.

Europe Market Insights

Europe is maintaining strong growth consistency in the global pipe inspection robot market, attributed to the increased investments in wastewater management, strict regulatory standards imposed for safety, and infrastructure sustainability. Investments in sensor technology and predictive maintenance are enabling real-time monitoring and improved operational efficiency, positioning the region as a key growth area. In April 2025, Ireland launched a multi-year programme to upgrade national water and wastewater systems, with a €300 million (~USD 323 million) European Investment Bank loan, which was signed in July 2025. It was implemented by Uisce Éireann, the €764 million (~USD 823 million) initiative focuses on expanding and rehabilitating aging water networks, improving wastewater collection and treatment, and maintaining compliance with EU water directives. Thus, this large-scale investment strengthens climate resilience, reduces pollution, and encourages increased utilization of pipe inspection robots across Ireland.

Germany stands at the forefront of revenue generation in the regional pipe inspection robot market, which is proactively fueled by highly regulated energy and water sectors that emphasize pipeline safety, environmental protection, and infrastructure modernization. In September 2022, Waygate Technologies highlighted its robotic inspection product portfolio at the SPRINT Robotics World Conference 2022, showcasing how advanced automation is readily enhancing safety and productivity in industrial asset inspection. The company showcased solutions such as the BIKE magnetic-wheeled crawler for navigating complex pipe geometries, the BRIC robotic boiler inspection and cleaning service that removes the need for human entry into hazardous vessels, and 3D LOC technology for creating digital twins of inspected assets, hence reducing risk exposure by increasing data accuracy and operational efficiency.

The U.K. has also established itself as one of the most prominent players in the regional pipe inspection robot market, backed by the presence of government-led infrastructure renewal programs and an academic R&D ecosystem. Simultaneously, collaborative research programs between public agencies, universities, and technology firms are also propelling extensive growth in the country’s market. For instance, in November 2023, the University of Bristol team demonstrated that a network of mobile robots, which were equipped with guided acoustic-wave sensors, can inspect large steel pipelines, achieving full defect detection coverage without requiring any synchronization between units. The article also mentioned that in tests on a three-meter steel pipe containing holes, pits, and cracks, each robot independently transmitted and received acoustic waves, enabling low-cost, scalable defect detection. It was supported by EPSRC under the Pipebots program and reflects the potential for pipe monitoring in the upcoming years.

Key Pipe Inspection Robot Market Players:

- GE Inspection Robotics (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- RedZone Robotics (U.S.)

- iPEK International GmbH (Germany)

- Envirosight LLC (U.S.)

- Inuktun Services Ltd. / Eddyfi Technologies (Canada)

- IBAK Helmut Hunger GmbH & Co. KG (Germany)

- Mini Cam Ltd. (UK)

- RIEZLER Inspektionssysteme GmbH (Germany)

- SuperDroid Robots, Inc. (U.S.)

- Inspector Systems GmbH (Germany)

- Aries Industries, Inc. (U.S.)

- Deep Trekker Inc. (Canada)

- Taurob GmbH (Austria)

- ULC Robotics (U.S.)

- Breivoll Inspection Technologies AS (Norway)

- GE Inspection Robotics is a part of GE’s energy‑services business, which is leveraging decades of track record in nondestructive testing. The company has self-propelled inspection robots that can navigate pipes up to 1,000 ft long and inspect various diameters (6-30 in) using ultrasonic and electromagnetic sensors. Furthermore, the company’s strategy combines advanced robotics with in-field service, offering bundled inspection services that minimize excavation and reduce maintenance risk.

- RedZone Robotics is a major innovator in the field of autonomous in-pipe crawlers, especially for sewer and water infrastructure. Their crawlers integrate AI-driven analytics and predictive maintenance tools, which allow them to capture consumer interest. The company’s growth strategy emphasizes service partnerships and data-driven insights, thereby enabling utilities to move from reactive to proactive asset‑management models.

- Eddyfi Technologies / Inuktun Services Inuktun, now part of Eddyfi Technologies, provides modular robotic crawlers designed for confined or hazardous pipeline environments. Eddyfi’s strategic initiative includes scaling through acquisition: they acquire specialty robotics firms (like Inuktun) to expand their NDT and pipe-inspection capabilities and to serve industrial markets with integrated hardware and software solutions.

- Envirosight LLC is focused on municipal and industrial pipeline inspection, offering modular camera-based crawlers. The competitive approach of the firm centers around U.S.ability, modularity, and service: they provide plug-and-play platforms that can be easily upgraded with different sensor types, making them attractive to utilities that have mixed infrastructure.

- IBAK Helmut Hunger GmbH & Co. KG is a longstanding European leader in pipeline inspection robotics. They manufacture a wide range of crawlers (push rod, tracked, floating) tailored to both municipal and industrial pipelines. Further, deep technical expertise, domestic presence, and tailored solutions are a few key focus areas of the company, which are enabling them to maintain a strong footprint in Europe’s market.

Below is the list of some prominent players operating in the global pipe inspection robot market:

The pipe inspection robot market is primarily shaped by the combination of large established firms along with emerging entities. Companies such as GE Inspection Robotics and iPEK International are emphasizing industry experience and strong global networks, whereas RedZone Robotics, Envirosight, and Eddyfi (via Inuktun) are integrating advanced imaging and AI-driven analytics, attracting a wider base of consumers. In March 2022, Baker Hughes announced that it had acquired Qi2 Elements, which is one of the most prominent developers of advanced robotic sensor systems for inspecting and monitoring critical energy infrastructure. The acquisition enhances Baker Hughes’ existing gas pipeline inspection capabilities and introduces new robotic inspection technologies for liquid storage tanks, allowing above-ground inspections without a person to enter into the hazardous spaces. Hence, this strategic move strengthens the company’s asset integrity solutions, broadening offerings across energy as well as the adjacent industries.

Corporate Landscape of the Pipe Inspection Robot Market:

Recent Developments

- In November 2025, SROD Industrial Group announced that its pipeline-inspection robots were deployed in Belgorod, aiding major upgrades to the city’s water-supply infrastructure. The robots inspect deep underground pipelines to accurately locate damage, significantly reducing excavation and public disruption.

- In March 2025, JFE Steel introduced a new wireless Scan-WALKER pipeline-inspection robot that eliminates cables and reduces worker workload by enabling remote inspections of elevated or hard-to-reach steel pipes. The robot uses a magnetized eddy-current sensor and a flexible, magnet-crawler body to detect wall thickness.

- Report ID: 5235

- Published Date: Dec 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pipe Inspection Robot Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.