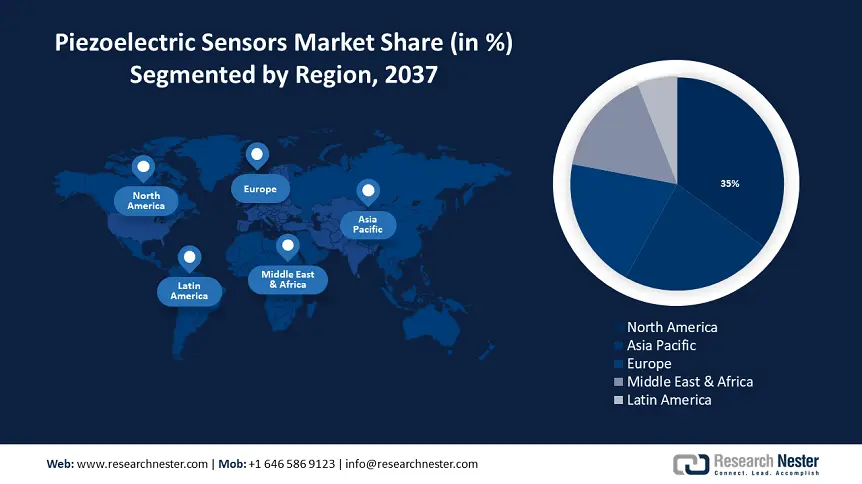

Piezoelectric Sensors Industry - Regional Synopsis

North America Market Forecast

North America piezoelectric sensor market is expected to dominate with the majority revenue share of 35% by 2037. The adoption of smart sensing technologies in various sectors is increasing to meet safety and efficiency requirements. In addition, strategic acquisitions that contribute to regional piezoelectric sensor market growth are being pursued by key players such as CTS Corporation to expand their sensor portfolio. In March 2022, the TEWA temperature sensor was purchased by CTS Corporation, a leading manufacturer of piezoelectric sensors. Supportive government programs are aiding domestic mining activities. In July 2023, the U.S. DOD awarded USD 37.5 million to Alaska’s graphite mining project, and in November of the same year, USD 3.2 million was awarded to an Alabama-based graphite project in Alabama, both provisioned under the Inflation Reduction Act.

Minerals have played a critical role in the U.S. economy, contributing to the gross domestic product in terms of mining, processing, and manufacturing finished products. The overall value of nonfuel minerals generated by the U.S. mines in 2023 was USD 105 billion. The net export value of mineral raw materials slumped marginally to USD 4.7 billion from USD 4.77 billion in 2022. Furthermore, USD 102 billion of processed mineral materials net imports were by downstream industries with an anticipated value of USD 3.84 trillion in 2023, a 6% surge from USD 3.62 trillion from the previous year. The estimated value of U.S. metal mine production in 2023 was USD 34.9 billion and the metal mining capacity utilization was 59%.

The U.S. cumulative value of synthetic and natural gemstones in 2023 was about USD 99 million. Domestic gemstone manufacturing comprises quartz, agate, coral, beryl, diamond, garnet, jasper, jade, opal, pearl, Sapphire, shell, topaz, turquoise, and tourmaline. In descending production value order, Arizona spearheaded natural gemstone manufacturing, followed by Oregon, California, Nevada, and Montana. These five States are ascribed to 64% of the natural gemstone market in the U.S. Quartz. According to the OEC 2023, quartz was the 870th most traded item and held a value of USD 1.33 billion. The U.S. emerges as a top supplier, with an export trade value of USD 146 million.

U.S. Industrial Cultured Quartz Crystal, through 2023

|

Salient Statistics |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Imports, piezoelectric quartz |

55 |

114 |

69 |

76 |

77 |

|

Exports, piezoelectric quartz |

41 |

37 |

39 |

77 |

120 |

|

Price, as-grown cultured quartz, dollars per kilogram2 |

200 |

200 |

200 |

200 |

200 |

|

Price, lumbered quartz, dollars per kilogram |

500 |

400 |

300 |

300 |

|

Source: USGA

APAC Market Statistics

The Asia Pacific piezoelectric sensor market is set to hold a notable share in the forthcoming years. The region’s growth is ascribed to the rising application of piezoelectric sensors for monitoring non-invasive cardiovascular parameters such as pulse wave, photoplethysmography (PPG), electrocardiography (ECG), seismocardiography (SCG), and ballistocardiography (BCG). The boom in the elderly population in the region is unprecedented, propelling at the rate of 26% by 2050 from 14% in 2022. By 2030, CVD-related mortality will rise steadily, thereby aiding the adoption of wearables for CVD monitoring.

China piezoelectric sensor market accounts for a major revenue share owing to its global dominance in cultured quartz crystal and piezo-electric quartz exports. In 2023, China held a 31.4% outbound share of piezo-electric quartz, and in terms of quartz, China was among the top exporters with a value of USD 224 million. The country’s positioning based on raw material supply chain is driving the piezoelectric sensor market expansion.