Global Piezoelectric Sensor Market Size, Forecast, and Trend Highlights Over 2025-2037

Piezoelectric Sensor Market size is predicted to expand from USD 2.79 billion to USD 6.02 billion, registering a CAGR of over 6.1% throughout the forecast period, from 2025 to 2037. In the year 2025, the industry size of piezoelectric sensor is assessed at USD 2.93 billion.

The piezoelectric sensor market is driven by its widespread demand from the aerospace sector, satellite control, fuel preservation, and atmospheric particle readings. In 2023, piezo-electric quartz was the 4140th most traded item, with an overall trade of USD 83.6 million. The export of piezo-electric quartz in 2023 reached USD 83.6 million, contributing 0.00037% of world trade. According to the OEC, in 2023, the top piezo-electric quartz exporters were China (USD 26.2 million), the U.S. (USD 13.3 million), Japan (USD 12 million), Chinese Taipei (USD 5.9 million), and the Philippines (USD 5.2 million).

Piezoelectric Sensor Market: Growth Drivers and Challenges

Growth Drivers

- Increasing mining and material production: Mining capacity for critical materials and minerals is expanding at a steady rate. The worldwide graphite production in 2023 was 1.6 million tons, underscoring a 23% spike from 2022. According to the Government of Canada, about 4,261 tons of graphite was generated by Canada and was the 11th largest exporter, globally. Furthermore, Canada’s outbound trade was USD 14 million in synthetic graphite and USD 18 million in natural graphite, predominantly to the U.S.

World Mine Production of Graphite, By Country (2023)

|

Country |

Thousand Tons |

Percentage of Total |

|

China |

1,230.0 |

77.4 |

|

Madagascar |

100.0 |

6.3 |

|

Mozambique |

6.3 |

6.0 |

|

Brazil |

73.0 |

4.6 |

|

Republic of Korea |

27.0 |

1.7 |

|

Russia |

16.0 |

1.0 |

|

India |

11.5 |

0.7 |

|

North Korea |

8.1 |

0.5 |

|

Norway |

7.2 |

0.5 |

|

Tanzania |

6.0 |

0.4 |

|

Canada |

4.3 |

0.3 |

|

Others |

9.4 |

0.6 |

|

Total (rounded) |

1,588.5 |

100.0 |

Source: Government of Canada

The U.S. lead mine production (recoverable) in August 2024 reached 25,600 metric tons (t). The USGS estimated that the average daily mine capacity utilization was 827 t, 4% more than that in July 2024 and 43% more than in August 2023. The secondary refined lead manufacturing was 84,700 t in August 2024, marginally less than the previous month and 3% more over a year. The average lead price in North America market price was USD 1.05 per pound in August 2024, 5% less than that in July 2024 and 7% less than a year before. The U.S. is a prominent lead concentrate exporter and was 142,000 t in 2024. The main export destinations included China (58%), the Republic of Korea (11%), Japan (18%), Mexico (7%), and Canada (5%). The country’s imports of unwrought lead through August 2024 were 260,000 t, marking a 27% yearly decline. Leading import sources were Canada (29%), the Republic of Korea (34%), and Mexico (26%).

- Piezoelectric sensor development for CVD mitigation: CVD stands as a global cause of mortality, leading to a subsequent rise in demand for advanced wearables for continuous monitoring of heart rhythms and offering real-time updates. By 2030, CVDs are anticipated to rise steadily from the presently 17.9 million to 23.6 million individuals. A review by the Royal Society of Chemistry, in collaboration with the University of Michigan and Shanghai Jiao Tong University emphasized the development of a comfortable and flexible piezoelectric passive sensor based on machine learning technology for diagnosis. With piezoelectric sensing techniques gaining traction, a shift from conventional, inflexible wearable interfaces to compact CVD monitoring devices is being observed. For instance, Samartkit et al. in 2022 reported a dynamic, yet non-invasive heart rate monitoring system, powered with piezoelectric PZT sensors.

Challenges

- High cost of materials: Piezoelectric sensors are made from specialized materials such as lead zirconate titanate, which can be expensive. This makes it difficult for manufacturers to compete on price, especially in cost-sensitive applications.

Piezoelectric Sensor Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.1% |

|

Base Year Market Size (2024) |

USD 2.79 billion |

|

Forecast Year Market Size (2037) |

USD 6.02 billion |

|

Regional Scope |

|

Piezoelectric Sensors Segmentation

Sensor Type (Motors, Transducers, Actuators, Generators)

The actuator segment in piezoelectric sensor market is set to hold the largest revenue share of 60% during the forecast period, ascribed to its widespread use case in aerospace, transportation, and industrial processes. It is employed in critical load power management in aircraft control surfaces. NASA uses an electro-mechanical actuator (EMA), that takes real-time and online estimates of the time-to-failure (TTF) or remaining useful life (RUL) for components nearing their end of life (EOL). As per the U.S. Census Bureau, there were approximately 291 employer establishments of fluid power cylinders and actuators manufacturing in 2021 in the country.

End user (Healthcare, IT & Telecom, Defense & Aerospace, Industrial Manufacturing, Automotive, Oil & Gas)

The healthcare segment in the piezoelectric sensor market is set to hold a substantial revenue share by the end of 2037. This is due to the increasing use of piezoelectric sensors in a variety of healthcare applications, such as the removal of calculus and plaque using dental scales, ultrasonic surgical instruments, and ultrasound scanners for medical imaging. Owing to high accuracy, better visibility, safety, and faster recovery time, piezoelectric sensors are preferred by healthcare professionals compared to traditional techniques.

Our in-depth analysis of the global piezoelectric sensor market includes the following segments:

|

Sensor Type |

|

|

Vibration Mode |

|

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

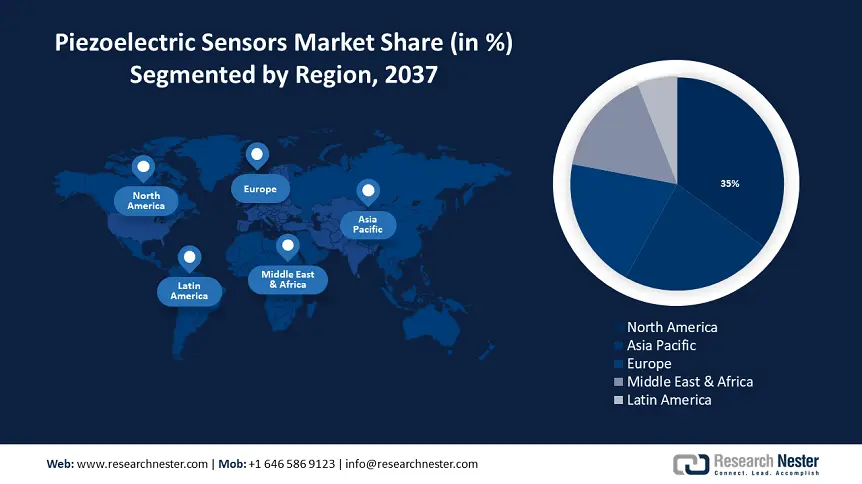

Piezoelectric Sensors Industry - Regional Synopsis

North America Market Forecast

North America piezoelectric sensor market is expected to dominate with the majority revenue share of 35% by 2037. The adoption of smart sensing technologies in various sectors is increasing to meet safety and efficiency requirements. In addition, strategic acquisitions that contribute to regional piezoelectric sensor market growth are being pursued by key players such as CTS Corporation to expand their sensor portfolio. In March 2022, the TEWA temperature sensor was purchased by CTS Corporation, a leading manufacturer of piezoelectric sensors. Supportive government programs are aiding domestic mining activities. In July 2023, the U.S. DOD awarded USD 37.5 million to Alaska’s graphite mining project, and in November of the same year, USD 3.2 million was awarded to an Alabama-based graphite project in Alabama, both provisioned under the Inflation Reduction Act.

Minerals have played a critical role in the U.S. economy, contributing to the gross domestic product in terms of mining, processing, and manufacturing finished products. The overall value of nonfuel minerals generated by the U.S. mines in 2023 was USD 105 billion. The net export value of mineral raw materials slumped marginally to USD 4.7 billion from USD 4.77 billion in 2022. Furthermore, USD 102 billion of processed mineral materials net imports were by downstream industries with an anticipated value of USD 3.84 trillion in 2023, a 6% surge from USD 3.62 trillion from the previous year. The estimated value of U.S. metal mine production in 2023 was USD 34.9 billion and the metal mining capacity utilization was 59%.

The U.S. cumulative value of synthetic and natural gemstones in 2023 was about USD 99 million. Domestic gemstone manufacturing comprises quartz, agate, coral, beryl, diamond, garnet, jasper, jade, opal, pearl, Sapphire, shell, topaz, turquoise, and tourmaline. In descending production value order, Arizona spearheaded natural gemstone manufacturing, followed by Oregon, California, Nevada, and Montana. These five States are ascribed to 64% of the natural gemstone market in the U.S. Quartz. According to the OEC 2023, quartz was the 870th most traded item and held a value of USD 1.33 billion. The U.S. emerges as a top supplier, with an export trade value of USD 146 million.

U.S. Industrial Cultured Quartz Crystal, through 2023

|

Salient Statistics |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Imports, piezoelectric quartz |

55 |

114 |

69 |

76 |

77 |

|

Exports, piezoelectric quartz |

41 |

37 |

39 |

77 |

120 |

|

Price, as-grown cultured quartz, dollars per kilogram2 |

200 |

200 |

200 |

200 |

200 |

|

Price, lumbered quartz, dollars per kilogram |

500 |

400 |

300 |

300 |

|

Source: USGA

APAC Market Statistics

The Asia Pacific piezoelectric sensor market is set to hold a notable share in the forthcoming years. The region’s growth is ascribed to the rising application of piezoelectric sensors for monitoring non-invasive cardiovascular parameters such as pulse wave, photoplethysmography (PPG), electrocardiography (ECG), seismocardiography (SCG), and ballistocardiography (BCG). The boom in the elderly population in the region is unprecedented, propelling at the rate of 26% by 2050 from 14% in 2022. By 2030, CVD-related mortality will rise steadily, thereby aiding the adoption of wearables for CVD monitoring.

China piezoelectric sensor market accounts for a major revenue share owing to its global dominance in cultured quartz crystal and piezo-electric quartz exports. In 2023, China held a 31.4% outbound share of piezo-electric quartz, and in terms of quartz, China was among the top exporters with a value of USD 224 million. The country’s positioning based on raw material supply chain is driving the piezoelectric sensor market expansion.

Companies Dominating the Piezoelectric Sensor Market

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Morgan Advanced Materials plc

- Omega Piezo Technologies Inc.

- Parker Hannifin Corporation

- Aerotech Inc.

- APC International Ltd.

- CeramTec GmbH

- Dytran Instruments Inc.

- Kistler Group

The piezoelectric sensor market for piezoelectric sensors is driven by the rising key applications in electricity and power generation. The players are engaged in strategic initiatives such as product launches, expanding geographical presence, adapting to changing government tariffs, mergers and acquisitions, collaborations, and critical mineral R&D. Some of the companies operating in the piezoelectric sensor market include:

Recent Developments

- In September 2024, Spectris plc acquired Piezocryst Advanced Sensorics GmbH for USD 136.8 million to expand its customer base for piezoelectric sensors. This enables Spectris plc to penetrate the high-precision sensor market with Piezocryst’s cutting-edge technology.

- In March 2024, KCF Technologies launched Piezo Sensing as part of its SMARTsensing suite. The addition to the hardware product lineup renders unmatched precision across several industrial applications such as automotive, paper, mining, metals, glass, and energy.

- In April 2023, TDK Corporation rolled out its piezoelectric (PVDF) sensors and actuators, pressure and temperature sensors, acoustic data link solutions, ultrasonic sensor modules, and accelerometers. The company aims to cater to sensor innovations and passive components for automobiles, healthcare, power electronics, renewable energy, and other industrial applications.

- Report ID: 5717

- Published Date: Mar 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Piezoelectric Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert