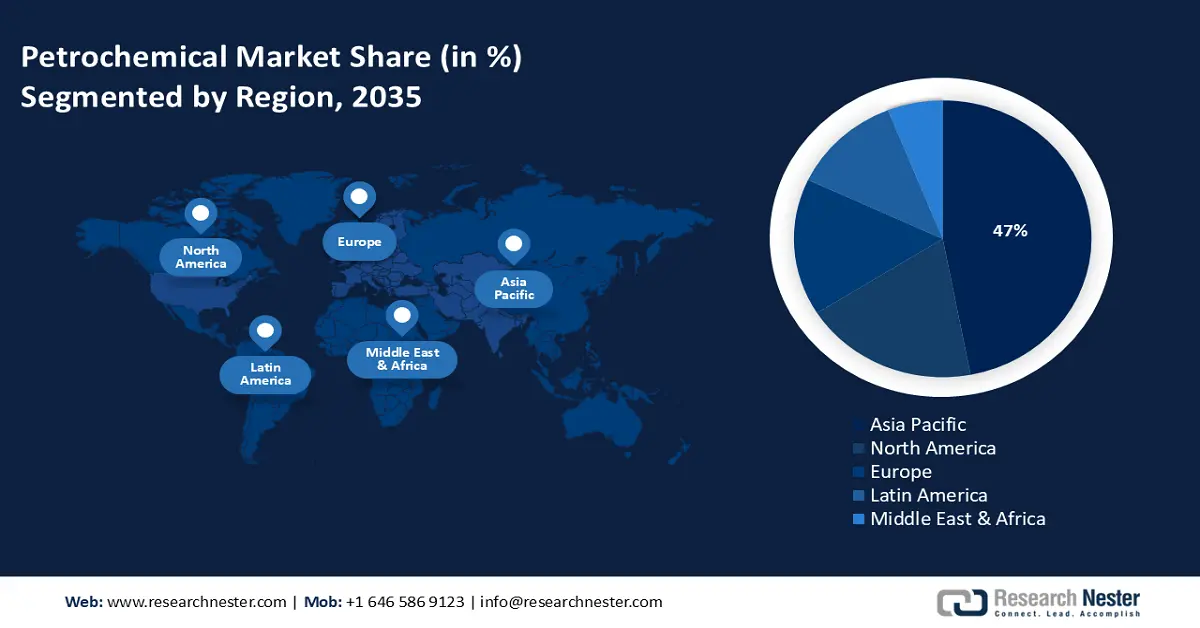

Petrochemical Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific petrochemical market is expected to hold 47% of the global market by 2035, driven by industrialization, urbanization, rising consumer demand, supportive policies, and investments in sustainable technologies. Over the past five years, government funding for clean chemical technologies has increased, led by agencies such as the Ministry of Ecology and Environment (MEE) and the National Development and Reform Commission (NDRC). In 2023, millions of businesses in China embraced sustainable chemical practices, underscoring the extensive involvement of the industry in eco-friendly initiatives. These statistics underscore China's strong investment in sustainable development and its strategic leadership in the petrochemical sector.

India's chemicals and petrochemicals sector is expected to be one of the fastest-growing sectors in the country. Demand for chemicals is expected to increase nearly threefold, while the petrochemicals sector is expected to touch USD 1 trillion by 2040. India ranks sixth in the world when it comes to the production of chemicals (third in Asia) and exports chemicals to over 175 countries, accounting for 15% of its total exports. The sector aims to garner an investment of USD 87 billion over the next decade. This is backed by the PCPIR Policy 2020–35, which aims to achieve ₹10 lakh crore (USD 142 billion) by 2025.

North America Market Insights

North America, comprising the United States and Canada, is forecasted to hold approximately 19% of the market by 2035, growing at a CAGR of 2.9% from 2026 to 2035. The market growth is driven by robust demand in the automotive, packaging, and construction sectors, alongside increasing investments in sustainable and advanced manufacturing technologies.

The U.S. petrochemical market holds control of the North American market, leveraging affordable shale gas feedstock and a comprehensive refining network. The U.S petrochemical industry is a major supplier of ethylene and polyethylene, with rising demand from the packaging materials and automotive industry. The Gulf Coast is also key to larger volume, capital projects. The U.S. continues to support our petrochemical industry through introductory policies for cleaner (lower carbon) process routes, along with the backing of carbon reduction technologies by the Department of Energy and the EPA.

Europe Market Insights

Europe market is projected to hold 16% of the global market by 2035, driven by essential raw material services for plastics, fertilizers, and specialty chemicals, while adapting to the decarbonization policies outlined in the European Green Deal. The sector will grow through ongoing innovation focused on circular economy initiatives, renewable feedstocks, and recycling technologies. As decarbonizing the global economy gains increasing importance in supply chains and production processes, the industry continues to evolve in line with innovation and growth. Germany is considered by some reports to possess some of Europe’s most advanced advantages in existing petrochemical hub needs.

Further, ethylene exports play a crucial role in driving Europe's petrochemical market by supporting cracker utilization and balancing regional supply-demand gaps. As a foundational building block for plastics and chemicals, strong export performance helps offset domestic overcapacity and weak derivative demand. It also sustains competitiveness amid rising energy costs and regulatory pressures like the EU Emissions Trading Scheme. Ultimately, ethylene trade reinforces Europe's position in global petrochemical value chains while influencing investment and production strategies.

Ethylene Exports in 2023

|

Region / Country |

Export Value (USD ’000) |

Quantity (Kg) |

|

United Kingdom |

517,486.97 |

398,067,000 |

|

Germany |

193,979.02 |

- |

|

France |

128,843.97 |

132,673,000 |

|

Italy |

26,032.44 |

37,995,100 |

|

Spain |

17,600.34 |

22,223,300 |

Source: WITS

Germany has significant refining capacity and large integrated chemical parks, particularly in industrial regions such as North Rhine-Westphalia. The petrochemical industry is vital to German sectors, including automotive, construction, and packaging. Due to their sustainability targets and legislation, German petrochemical producers are investing in new, innovative low-carbon processes, hydrogen-based technologies, and bio-feedstocks to meet EU climate performance goals and capitalize on competitive advantages in global trade.