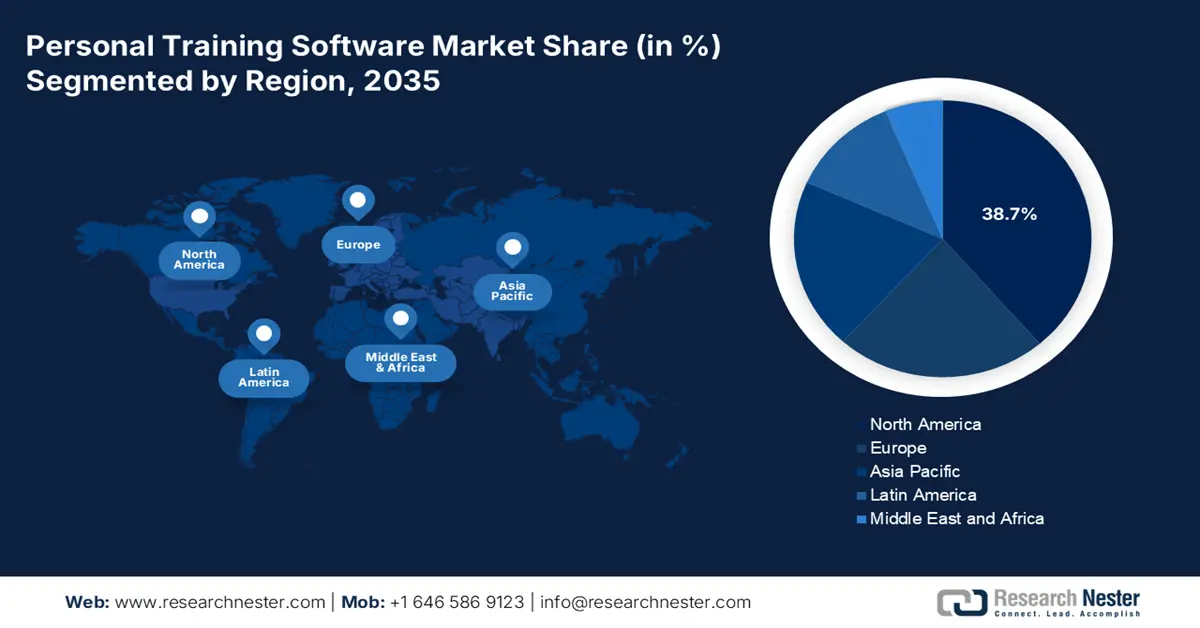

Personal Training Software Market - Regional Analysis

North America Market Insights

The North America personal training software market is projected to account for a leading share of 38.7% by the end of 2037. The region’s dominance in this sector is primarily empowered by the strong healthcare framework and supportive government initiatives. Particularly, dedicated agencies operating across the U.S. and Canada are prompting greater investment in these wellness technologies and services. Evidencing the same, the Health & Fitness Association reported that the number of overall fitness facility users rose by 8.1% in 2023 from 2022, totaling 82.7 million. On the other hand, the inclusion of PTS into standard health care plans and insurance coverage has further allowed the landscape to continue expanding.

With a strong emphasis on preventative healthcare maintenance and awareness, the U.S. has become the prominent contributor to the regional expansion in the market. As obesity and diabetes are a few of the most concerning nationwide clinical problems, the demand for real-time PTS solutions is earning financial advantages from the government. In this regard, a 2025 report from the Health Action Council revealed that more than 20% adults in 50 states of the country were living with obesity, whose monthly costs grew 2.3 times higher than those without this condition.

Recent Commercial Milestones in Key Landscapes

(August 2025)

|

Country |

Company Name |

Key Notes |

|

U.S. |

ABC Fitness |

Launched a powerful member retention tool for fitness operators, Click2Save, powered by DXFactor |

|

Canada |

TRAINERIZE |

Inaugurated ABC Trainerize Business to commercialize smarter ways to scale coaching businesses |

Source: Company Presss Relase

APAC Market Insights

Asia Pacific is emerging to become the fastest-growing region in the market over the timeline between 2026 and 2035. The rising personal health awareness, rapid urbanization, and disposable incomes are collectively fostering a lucrative business environment for the merchandise in the region. Developing economies, such as China and India, are seeing a robust surge in fitness app adoption and digital training platforms, fueled by growing smartphone penetration and internet access. Furthermore, the continuous enlargement of tech-savvy populations, combined with the amplifying demography of lifestyle-related ailments, is increasing demand for these personalized fitness and wellness solutions.

The rapid expansion of gyms, wellness centers, and corporate wellness initiatives across India is accelerating the uptake of tools and services available in the market. This attractive environment is further complemented by the 85.5% and 86.3% of households across the country possessing at least one smartphone and internet access, respectively, as unveiled by the 2025 PIB report. Besides, the growing digital economy of India is also propelling adoption rates in this sector, where it earned the second-largest position in the world in terms of smartphone unit volume in 2024, according to the IBEF findings.

Feasible Opportunities Present in Key Landscapes

|

Country |

Key Notes |

Timeline |

|

India |

690 million smartphone users within a total population of 1.4 billion |

2024 |

|

China |

Dominated both the global smartphone shipments and industry value with 22% and 31% shares, respectively |

2024 |

|

Australia |

The proportion of young people meeting the national physical activity guidelines doubled to 5.6% from 1.9% |

2018-2022 |

Source: IBEF and ABS Australia

Europe Market Insights

Europe is poised to hold the second-largest revenue share in the market by the end of 2035. The region’s consistency in growth is highly attributable to its robust healthcare digitalization and government initiatives that promote preventive measures. These organizations are also investing heavily in integrating software-based solutions for managing fitness, rehabilitation, and chronic disease into public health systems. Besides, the regulatory frameworks in Europe not only allow innovation but also assure safety and efficacy, building a strong foundation for this sector with greater consumer trust.

Cross-border collaboration and public funding, ramp up research and deployment of cutting-edge PTS systems in the mainstream medical practices, securing future progress in the UK market. Moreover, demographic changes, including an aging population, add to the demand for these technologies that promote remote health management and preventive care through lifestyle changes. Currently, being home to several pharma and tech pioneers, the country strongly expedites market expansion. Further, in August 2023, the government of the UK empowered this cohort by implementing a new strategy, Get Ready, for the future of sport and physical activity.