Peripheral Interventions Market Outlook:

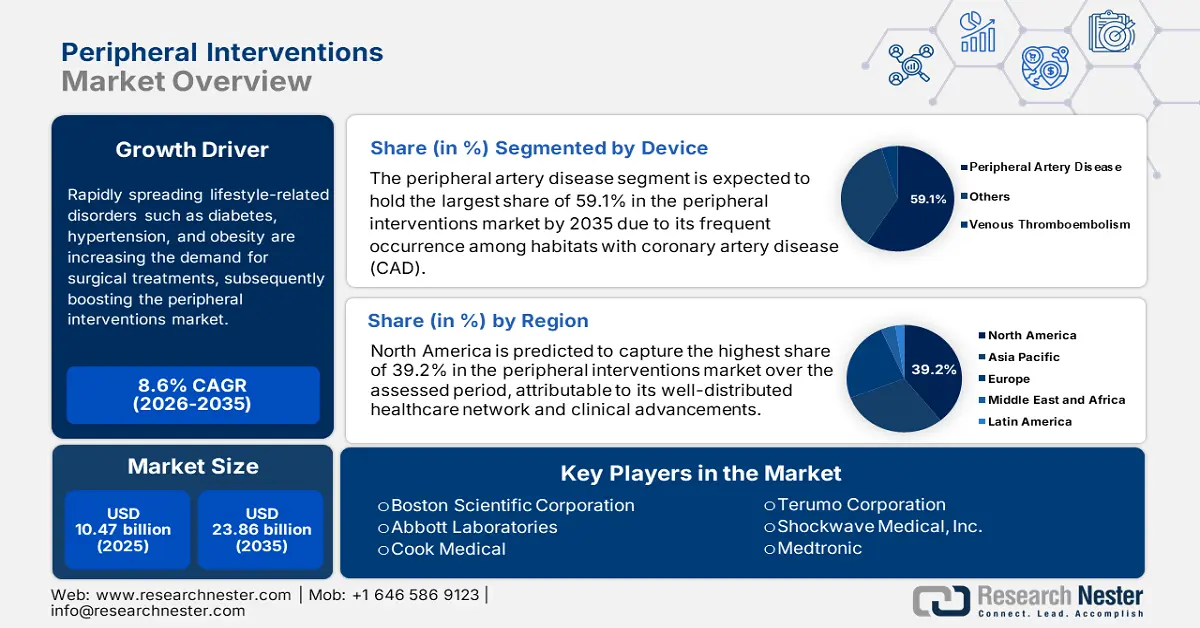

Peripheral Interventions Market size was over USD 10.47 billion in 2025 and is poised to exceed USD 23.89 billion by 2035, witnessing over 8.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of peripheral interventions is estimated at USD 11.28 billion.

Rapidly spreading lifestyle-related disorders such as diabetes, hypertension, and obesity are increasing the demand for surgical treatments, subsequently boosting the peripheral interventions market. As the volume of the patient pool of peripheral artery disease (PAD) enlarges, the requirement for procedures such as angioplasty and stenting inflates. According to the NLM article, published in April 2023, the worldwide prevalence of PAD in each 100,000 people showed an increment of 13.0%. It further mentioned that over 55.0% of this population was a result of risk factors such as tobacco use, diabetes, and hypertension. Thus, many healthcare authorities are focusing on cultivating sufficient supply for interventional processes.

As more governing bodies are proactively working to improve the accessibility of surgical services, investments in the peripheral interventions market rise. Many clinical studies classified the payers’ pricing for such procedures. For instance, in February 2024, a cost comparative review between catheter-directed thrombolysis (CDT) and mechanical thrombectomy (MT) was released in the Journal of the Society for Cardiovascular Angiography & Interventions (JSCAI). The study concluded that the adjusted difference in expenses for CDT and MT was USD 1351.0, where the incremental cost of USD 5120.0 was registered for CDT. In this regard, governments are allocating adequate reimbursement policies to increase availability and affordability of these surgeries.

Key Peripheral Interventions Market Insights Summary:

Regional Highlights:

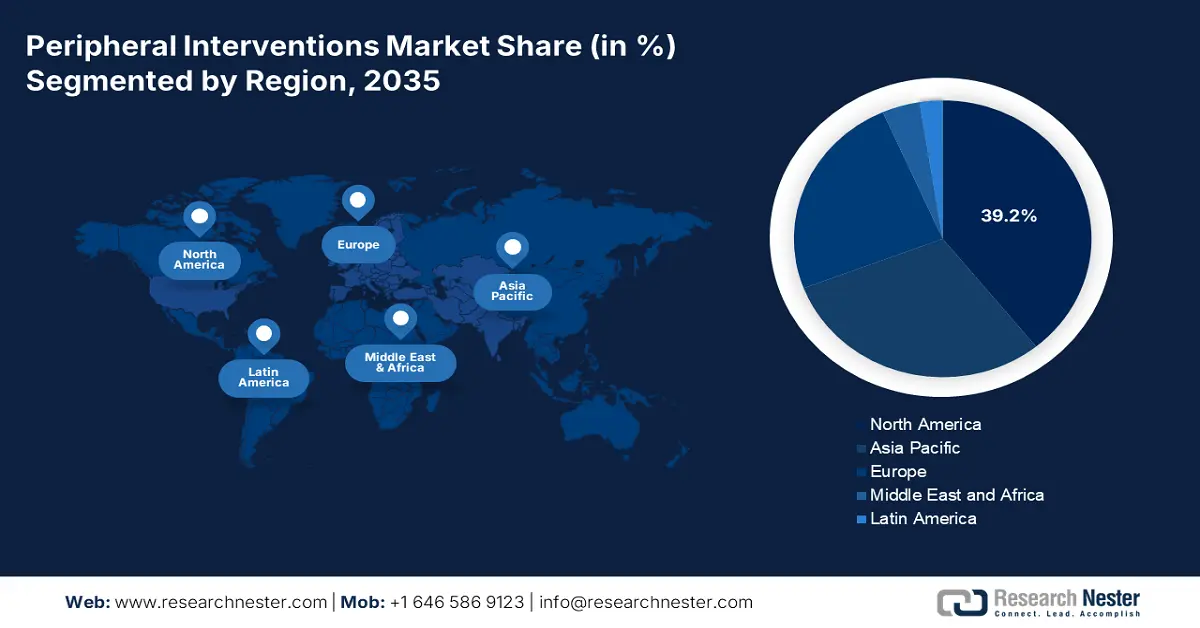

- North America leads the Peripheral Interventions Market with a 39.2% share, supported by a well-distributed healthcare network and increased availability of advanced treatments, ensuring strong growth through 2026–2035.

- Asia Pacific’s peripheral interventions market is expected to see rapid growth by 2035, driven by clinical R&D giants, larger capital influx in healthcare infrastructure, and supportive regulatory frameworks.

Segment Insights:

- The Peripheral Artery Disease segment is expected to hold 59.1% market share by 2035, fueled by the rising prevalence of coronary artery disease.

Key Growth Trends:

- Increasing awareness and investments in early diagnosis

- Innovations and expansion in the product range

Major Challenges:

- Economic burden and exhaustion in such patients

- Lack of standardized and strategic promotions

- Key Players: Boston Scientific Corporation, Abbott Laboratories, Medtronic, B. Braun Melsungen AG, Cook Medical.

Global Peripheral Interventions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.47 billion

- 2026 Market Size: USD 11.28 billion

- Projected Market Size: USD 23.89 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Peripheral Interventions Market Growth Drivers and Challenges:

Growth Drivers

- Increasing awareness and investments in early diagnosis: Growing international recognition for early diagnosis and intervention methods is improving patient outcomes, attracting more consumers to invest in the peripheral interventions market. As more people become aware of available options in this sector for treating a wide range of cardiovascular abnormalities, the scope of greater capital influx heightens. For instance, in October 2023, Evident Vascular raised a series A funding of USD 35.0 million for its newly developed intravascular ultrasound (IVUS) platform. This financial support was intended to spread the adoption of such AI-powered imaging systems, escalating the streamlined workflows in both coronary and peripheral interventions.

- Innovations and expansion in the product range: As a result of the healthy competition between pioneers in the peripheral interventions market, there are several clinical discoveries which enhance outcomes. For instance, in September 2024, Shockwave Medical extended its portfolio in the U.S. marketplace with the launch of Shockwave E8 Peripheral IVL Catheter. Following the previously gained success on regulatory clearance (the FDA), the company aimed at covering a wide spectrum of PAD conditions, including calcified femoro-popliteal and below-the-knee. These creations bring diversity and availability in this sector, encouraging more MedTech leaders to invest in this category.

Challenges

- Economic burden and exhaustion in such patients: The expenditure on patients undergoing these curative surgeries is a significant hurdle in the peripheral interventions market. The load of out-of-pocket expenses for enrolling under a specialized healthcare facility and professionals often discourages them from investing in this sector. Additionally, disparities in pricing for different products create confusion and hesitation among investors due to their limited knowledge about the effectiveness of different tools.

- Lack of standardized and strategic promotions: Residents from underserved regions are lagging in complete education about the efficacy of the offerings from the peripheral interventions market. Despite growing efforts to spread awareness, many people, particularly from rural areas, are still unaware of the available commodities. This shrinks the consumer base of this field, restricting the opportunities of wide adoption across the globe. Furthermore, the uncertainty in globalization discourages companies from participating.

Peripheral Interventions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 10.47 billion |

|

Forecast Year Market Size (2035) |

USD 23.89 billion |

|

Regional Scope |

|

Peripheral Interventions Market Segmentation:

Application (Peripheral Artery Disease, Venous Thromboembolism, Others)

Based on applications, the peripheral artery disease segment is set to capture peripheral interventions market share of around 59.1% by the end of 2035.This condition is a common occurrence among habitats with coronary artery disease (CAD). According to the American College of Cardiology, the count of people living with CAD reached 315.0 million in 2022 around the globe. Central Europe, Eastern Europe, and Central Asia were identified to have the highest prevalence of this disease. Subsequently, this type of arterial abnormality is also becoming a serious public health concern, inspiring leaders to engage their resources in this segment. For instance, in March 2024, BD commenced the investigational device exemption (IDE) study, AGILITY, to earn rights to commercialize its Vascular Covered Stent for treating PAD.

Product (Catheters, Sheath, Stents, Bare Metal Stents, Drug-eluting Stents, Guide Wires, Atherectomy Devices, Embolic Devices, IVC Filters)

In terms of product, the catheters segment is expected to dominate the peripheral interventions market throughout the forecasted timeframe. Recent innovations in this product line have significantly contributed to reducing mortality, severity, and recovery time. This is pushing more medical systems and professionals to adopt these tools. For instance, in March 2023, the FDA allowed Shockwave Medical to market its L6 Peripheral IVL Catheter, revolutionizing PAD interventions with lessened risk of rupture and dissection. This addition was intended to assist in large bore procedures, such as TAVR, TEVAR, and EVAR, widely performed for severe illness and increased complications. Such ground-breaking discoveries are influencing companies to invest more in this sub-type.

Our in-depth analysis of the global peripheral interventions market includes the following segments:

|

Application |

|

|

Product |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Peripheral Interventions Market Regional Analysis:

North America Market Analysis

North America peripheral interventions market is set to hold revenue share of over 39.2% by the end of 2035. This region has a well-distributed healthcare network, which signifies an increased availability of advanced treatments. This is influencing leaders in this sector to participate in this marketplace by introducing innovative surgical commodities. For instance, in June 2024, Boston Scientific purchased Silk Road Medical in a total transaction of USD 1.1 billion. This acquisition was aimed at possessing Silk Road’s revolutionary minimally invasive technologies, including transcarotid artery revascularization (TCAR), to leverage Boston’s vascular portfolio. Such commercial investments indicate a well-established atmosphere for this field.

Several driving factors are influencing the U.S. peripheral interventions market such as favorable regulatory framework, increased expenditure on healthcare, and notable incidences of related disorders. On this note, NLM reported a mean annual 10.6% prevalence for PAD and 1.3% for critical limb ischaemia (CLI) in this country, in an article from July 2022. Another June 2021 journal revealed that the population of PAD patients in the U.S. accounted for 8.5 million, exhibiting a prevalence rate of 7.0%. Further, regulatory ease is also boosting this field with accelerated approvals. For instance, in April 2024, Abbott received FDA clearance for its Esprit BTK Everolimus Eluting Resorbable Scaffold System for chronic limb-threatening ischemia (CLTI) patients.

Canada is augmenting the peripheral interventions market with the rising cases of heart-related conditions such as cardiac failure. A 2022 government database revealed that heart disease was identified to be the 2nd highest mortality cause in this nation. As a result, the focus on retrieving highly prone citizens from a deadly health condition is magnifying. Governing bodies of Canada are meticulously working and heavily investing in this field to avail sufficient resources. In this regard, in May 2022, the Ministry of Health in Canada allocated a USD 5.0 million grant to foster a strong nationwide network of prevention, diagnosis, treatment, and care for heart failure. This signifies the inflating need for innovative curative techniques, with faster recovery and less incisions, such as peripheral interventions.

APAC Market Statistics

Asia Pacific is projected to register the fastest CAGR in the peripheral interventions market during the forecasted timeline. This region is enriched with clinical R&D giants and larger capital influx in healthcare infrastructure. In addition, the participation from foreign forces is also elevating the reach and diversity in this field. For instance, in October 2020, Reflow Medical attained approval from the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan for its Wingman CTO Catheter. This also indicates a supportive regulatory framework, propelling expansion in this sector. Moreover, the progressive landscape and emerging healthcare industry is extending the reach of this region’s footprint in this field.

India is witnessing a strong presence of international excellence in minimally-invasive cardiovascular interventions. Their effort to establish a stable distribution channel across this country is escalating engagement. On this note, in March 2022, Boston Scientific founded a cutting-edge research and development facility in Pune, India, with a 45,000 square feet area and 170 employees. This move was intended to utilize the country’s academic excellence in accelerating its R&D capabilities in various medical disciplines, including technologies and tools for arterial surgeries. This is further encouraging more pioneers to participate in this cohort of development in the peripheral interventions market.

China is one of the leading producers of the crucial components of the offerings from the peripheral interventions market. The country serves the sector with both supplies and demand, making it an attractive base for business in this category. The rate of occurrence of PAD among general citizens in China ranges between 3.0% and 7.5%, as per the 2021 Journal of Vascular Surgery. The country is also highly influenced by the presence of the risk factors such as tobacco, obesity, and diabetes, pushing authorities in this country to accommodate the domestic medical system with advanced solutions.

Key Peripheral Interventions Market Players:

- Biotronik SE & Co. KG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teleflex Incorporated

- Abbott Laboratories

- Boston Scientific Corporation

- Cook Medical

- W. L. Gore & Associates Inc

- Cardinal Health Inc

- Angio Dynamics Inc

- Medtronic

- B. Braun Melsungen AG

- Becton Dickinson and Company

- Shockwave Medical, Inc.

- Royal Philips

- Elixir Medical

The current dynamics of the peripheral interventions market are prioritizing early diagnosis, besides the treatment methods. Additionally, the sector is revolutionizing the methods of incision through tech-based operations. This is enhancing patient outcomes and enabling seamless workflow. For instance, in September 2024, SpectraWave secured a series A funding of USD 50.0 million, led by Johnson & Johnson Innovation. With the financial support from the consortium of renowned capital ventures, the company aimed at commercializing its AI-based HyperVue imaging system, which recently gained FDA 510(k) clearance. These creations are inspiring others to engage in extensive R&D, bringing development in this field. Such key players are:

Recent Developments

- In March 2025, Shockwave Medical unveiled its novel intravascular lithotripsy (IVL) platform, Shockwave Javelin Peripheral IVL Catheter, in the U.S. market. The specially designed IVL platform is intended to modify calcium and cross extremely narrowed vessels in patients with peripheral artery disease (PAD).

- In November 2024, Royal Philips initiated the first U.S.-based THOR IDE clinical trials on its solely developed combination of laser atherectomy and intravascular lithotripsy catheter. The study aimed at evaluating the efficacy and safety of this tool in performing peripheral interventions in a single procedure.

- In March 2024, Elixir Medical gained Breakthrough Device Designation from the FDA for its novel adaptive implant, DynamX BTK System. This technology is designed to treat narrowed or blocked vessels below-the-knee (BTK) in patients with chronic limb-threatening ischemia (CLTI).

- Report ID: 7354

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Peripheral Interventions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.