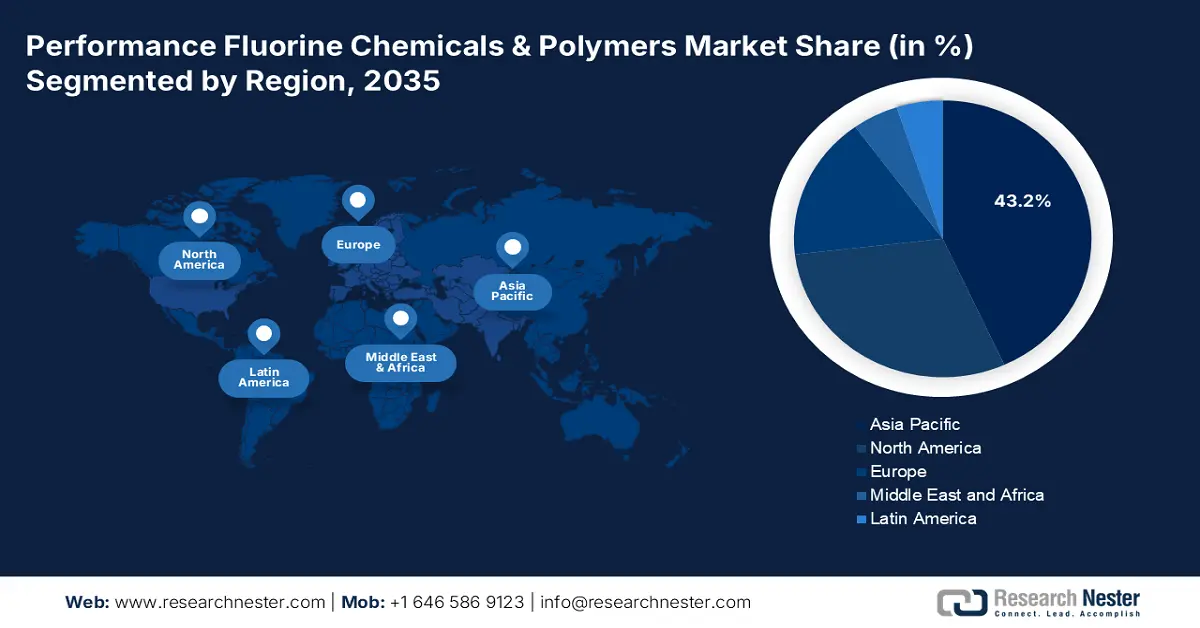

Performance Fluorine Chemicals & Polymers Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to dominate the market with the largest revenue share of 43.2% over the projected years from 2026 to 2035, due to growth in the automotive, electronics, and industrial sectors. In 2022, Japan sold 58,813 battery electric vehicles (BEVs), which is 2.7 times more than in 2021, contributing to the BEV market, with BEVs constituting 1.7% of passenger car sales. In fiscal year 2022, the government subsidized the adoption of EVs to the tune of about 70 billion Yen (USD 501 million).

Additionally, the growth of the market is very strong due to increasing industrial needs and environmental laws. In 2022, the output of the fluorine chemical products in China was about 3.984 million tons, and it is expected to be 4.028 million tons by 2023, and increase to 4.105 million tons in 2024. The market worth of the region is high, and China alone has a market worth of 58.556 billion yuan in 2022. In India, the government agencies, such as the Department of Chemicals and Petrochemicals, are actively involved in overseeing and assisting the industry in the form of statistics and policy programs. The developments have formed the basis of increasing use of high-performance fluorine polymers in the chemical industry, electronics industry, automobile industry, and renewable energy industry in the Asia Pacific.

By 2035, the market in China is expected to lead the Asia Pacific region with a significant share, driven by its semiconductor and automotive sectors. The Ministry of Ecology and Environment's increasing restrictions on perfluoroalkyl and polyfluoroalkyl substances (PFAS) have pushed low-global warming potential (GWP) alternatives like hydrofluoroolefins (HFOs). Additionally, the 14th Five-Year Plan of China (2021- 2025) requires that the chemical and petrochemical industries that should cut emissions of volatile organic compounds by more than 10% compared to 2016 and 2020, increase 70 green, smart, competitive chemical industrial parks producing more than 70% of the chemical products, and encourage clean technologies in synthesis.

Moreover, the Chinese filled fluoropolymer market, which is a very crucial sub-industry of the performance fluorine chemicals & polymers market, is estimated to be USD 6.3 billion in 2030. The demand by the automotive and electronic industries, as well as the chemical industries, to have better mechanical performance, chemical resistance, and lightweight materials, drives this growth. The growth is in line with the overall strategic orientation of China in the development of high-performance fluoropolymers in sustainable manufacturing, which is in line with the overall expansion drivers in the performance fluorine chemicals & polymers market internationally.

The Indian performance fluorine chemicals & polymers market is likely to grow steadily over the forecast period, attributed to the increasing demand in the automotive, electrical, electronics, and healthcare industries, where fluoropolymers are employed due to their chemical and thermal stability and durability. The domestic production and research in the field of fluoropolymer manufacture are being spurred by government programs such as the National Chemical and Petrochemical Policy and the Make in India campaign. For example, Gujarat Fluorochemicals Limited (GFL), which has now expanded its fluoropolymer line to include PFA, FEP, PVDF, as well as FKM, with its own research and development facility in Ranjit Nagar. This facility is based on sustainable technologies in its manufacturing and development of products that do not contain PFOA and non-fluorinated surfactants, which reduce the impact on the environment. Similarly, the emergence of the fluoropolymers in industrial coatings, seals, and electrical insulation is partly due to the environmental regulations of using environmentally friendly materials. The biggest revenue share goes to industrial processing, with the construction expected to exhibit the highest growth rate, driven by the development of infrastructure and smart cities.

North America Market Insights

The North American performance fluorine chemicals & polymers market is expected to grow with a notable revenue share of 31.5% over the forecast years, propelled by the growing demand in automotive, electronics, semiconductors, and HVAC markets. As of 2023, the U.S. Environmental Protection Agency (EPA) estimates that the greenhouse gas emissions of the U.S. chemical manufacturing industry reached 184.8 million metric tons of CO 2 equivalent (CO 2e), including the following gases: petrochemicals, fertilizers, and fluorochemicals. In this, 3.5 million metric tons of CO2e were assigned directly to the production of fluorinated gases, such as hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and other high-performance fluorinated substances. Moreover, the HFCs are being phased out by regulatory measures under the American Innovation and Manufacturing (AIM) Act, which has led to the industry developing low-global-warming fluoropolymers and refrigerants. The HFC Data Hub of the EPA allows monitoring this shift in detail, highlighting how policy affects the dynamics of the market.

The U.S. performance fluorine chemicals & polymers market is predicted to lead the North America region with the largest share by 2035, owing to the increasing semiconductor and EV demand. The EPA Green Chemistry Challenge Awards have honoured more than 133 technologies in the U.S that produce no 830 million pounds of hazardous chemicals and solvents, and save more than 20 billion gallons of water and 7.8 billion pounds of CO2e per year. These breakthroughs directly aid in the development of the performance fluorine chemicals & polymers market, where new technological innovation in low-emission fluoropolymers, non-PFOA surfactant, and more eco-friendly synthesis processes continue to accelerate, especially in the high-performance markets such as electronics, automotive, and aerospace, where sustainability is necessary along with thermal and chemical resistance. Semiconductor production is critical for 5G and is growing at 11% annually, and the NIST has a USD 52 million grant for research and development of GaAs wafers that will increase fluoropolymer applications. Furthermore, the DOE takes clean energy innovation seriously as the initiative is reflected in wider funding programs (i.e., the $150 million dedicated to mitigating the climate effects of energy technologies and manufacturing, and the $590 million dedicated to the expansion of bioenergy research). Such activities help in the creation of green materials and processes that are favorable to the performance fluorine chemicals & polymers market.

The performance fluorine chemicals & polymers market in Canada is projected to grow at the fastest CAGR within the North America region, mainly due to high demand in the medical, electronics, and automobile industries. Natural Resources Canada recorded a 13.5% growth in manufacturing shipments in the chemical manufacturing industry in 2022, which indicates the growing demand and investment in high-performance materials, such as high-performance fluoropolymers, in industrial applications. The sector employs around 90,800 people, highlighting the economic importance and ability of the industry to facilitate the specialized production of polymers. The increasing rate of manufacturing production and manpower growth is expanding the performance fluorine chemicals & polymers market growth in Canada based on the increasing rate of adoption in transport, airplane, electronic, and sustainable manufacturing industries. The federal focus on the use of green technology helps in the development of environmentally friendly fluoropolymers, which are essential in lightweight, durable parts in electric vehicles and electronic gadgets. Moreover, Environment and Climate Change Canada states a slow decline in industrial emissions, which implies the implementation of more sustainable chemical processes, which are beneficial to the market of fluorine chemicals.

Europe Market Insights

The European performance fluorine chemicals & polymers market is anticipated to expand notably, with a revenue share of 23.4% from 2026 to 2035, driven by high requirements in the automotive, aerospace, electronics, and medical industries. The European Chemicals Agency (ECHA) claims that fluoropolymers are essential in industries that demand chemical resistance and durability, and are finding more and more applications in environmentally controlled applications. In addition, according to the European Environment Agency (EEA), there has been a slow reduction of industrial emissions as a result of tougher regulations that have been adopted to promote the adoption of greener fluoropolymer production processes. The Green Deal will improve the growth potential of the market by funding and policy through sustainable chemistry, established by the EU. Government projects in the UK to promote sustainable manufacturing are promoting fluoropolymer innovation and net-zero emissions are with the goal of 2050. Germany focuses on the National Hydrogen Strategy for the modernization of the advanced chemical industry in favor of low-emission fluoropolymer technologies. These government initiatives and environmental regulations together are expected to drive the growth of the performance fluorine chemicals & polymers market in the region.